MeaWallet Company V3.11

- 1. MeaWallet Experts in cloud based mobile solutions Lars Sandtorv Founder & CEO +47 909 55 111 Lars.sandtorv@meawallet.com

- 2. Mobile Payments Mobile Access Mobile Wallet Be a part of the future of payments ÔÇô enable contactless and remote payments in your existing app Reduce your cost and improve your efficiency ÔÇô all your office cards in one app with cloud based access cards An all-in-one white label wallet solution, including app and backend End-to-end mobile wallet services and mobile solutions Center of excellence Expertise and in-depth knowledge about mobile solutions, wallet and cloud based security Adopt contactless payment with your app The future of payments in your app: HCE, tokenization and cloud-based payments

- 3. MeaWallet business idea Be the preferred technology provider in cloud based mobile solutions ÔÇó MeaWallet is a leading technology provider of end-to-end mobile wallet services and mobile solutions, enabling secure contactless and remote mobile services to banks, access control providers, mobile network operators and retailers. ÔÇó Using the MeaWalletÔÇÖs Mobile Services Platform and Mobile Business Components for payments, any application or mobile wallet can be enabled to perform contactless payments in-store as well as remote payments for m- and e-commerce. ÔÇó The cloud-based payments service includes support for tokenization and HCE based on the global standards from EMVCo and obtained licences from MasterCard and Visa.

- 4. MeaWallet - The company Experts in cloud based mobile solutions  Established in 2012  Strong management team  24 employees + external team in India  Experienced team with a track-record from the financial and the wireless industry, both from large corporations like IBM and Ericsson as well several VC-backed start-ups  Professional investors  External team in Bangalore  50.000 hours of development represent a large investment in new technology the fundamental investment in a service-oriented architecture coupled with a cloud-based service delivery model has enabled the company to capitalize on emerging market opportunities...

- 5. The MeaWallet management team Ove Teigen, (VP Sales) has been working in sales, both locally and internationally, in the IT industry for more than 20 years. He has experience from companies like Bull (Steria), BEA Systems (Oracle), IBM and CA Technologies. Steinar Svalesen, (COO) has more than 20 years experience from mobile-/digital business with a focus on business development and investments in start-ups and growth companies. He has built, managed and sold companies in Norway and USA. He is also a board member of several technology companies. Lars Sandtorv, (CEO & member of board) has been in the IT- industry for more than 20 years and done several start-upÔÇÖs. He has been working direct or indirect with Wifi, RFID and NFC technology for more than 10 years. He has also 5 years experience from international business development in IBM. Annely Aljas, (Member of the Board) has spent 6 years working for the British Embassy in Tallinn, with a focus on start-up investments in the UK and Baltic States, with specific focus on born-global technology startups and their financiers. She previously worked for the Estonian Police Board, including FBI support. John Longhurst, (Executive Chairman) has been an investment analyst and fund manager with global leaders such as Capital Group of Los Angeles and PIMCO. For 28 years he invested in global interactive media, industrial, and defence/aerospace industries, as well as broader geopolitical areas. He has invested in and led start ups for over a decade. The management team has extensive experience from the bank-, IT- and security ecosystem, as well as the mobile wallet ecosystem after working for leading companies such as IBM, Elavon, Europay, Luup Solutions, Telenor and Ericsson Geir Norlund, (CIO & member of board) has a long career within IT, financial services and mobile solutions. He has had leading roles in companies like Europay, Elavon, Luup Solutions and IBM, working with local and international customers worldwide. Morten Mansrud, (VP Business Development) has more than twenty yearsÔÇÖ experience from the IT-industry and financial services from the Nordics and globally. He has held senior positions in companies such as Tieto, Evry and IBM in sales and business development and has a strong track record from card payment, mobility and banking solutions. M─üris ─îakste, (Country Manager Latvia) has worked for Tieto in the payment cards area as a sales manager in Europe. Prior to that M─üris has gained knowledge of the IT industry in German IT solutions company servicing the E-commerce industry. M─üris holds a Master of Science degree in International Management at Flensburg University, Germany.

- 6. In October 2013, Google launched Android 4.4 (KitKat), introducing Host Card Emulation, which enables secure and virtual payment authentication, using the OS and NFC. This has made the SIM-based Secure Element obsolete for Android mobile phones, opening up the mobile payment ecosystem for new players. First generation mobile wallet-/payment solutions are designed with the Secure Element in a physical SIM-card. The Secure Element provides necessary transaction security for mobile payments and is an essential component of the mobile payment ecosystem. SIM-cards are controlled by mobile telecom operators in each local-/regional market, putting these companies at a privileged strategic position in the mobile wallet- /payment ecosystem. Retail banks world wide need to strengthen their strategic position relative to new entrants. New solutions for mobile payment- and wallet are key elements in retail banksÔÇÖ digital transformation. MeaWallet is positioned as a neutral and global provider of payment- and wallet services to retail banks, using a virtual Secure Element in the cloud. Reduced barriers to entry, new entrants and changing industry dynamics puts increasing pressure on retail banks to become digital. Significant new entrants include retailers (Tesco and Komplett), media companies (Schibsted), commercial airlines (Norwegian), infrastructure providers (PayPal) and digital ecosystems (Google, Facebook and Amazon.com) Key technology driver Business opportunity Key market driver The mobile payment market drivers

- 7. The mobile payments market Forecast - 1,5 billion active Mobile Wallets in 2017 Source: NFC Forum as the number of wallets continue to grow, we believe our strategic position supplying these wallets and apps with advanced modular payment functionality through our Mobile Business Components is a robust strategy enabling us to implement the ever evolving new global payment standards

- 8. The payments industry is being transformed by new standards and technology Fundamental changes world wide USA introduce EMV (Chip & PIN) 2015 ÔÇó All US bank cards will be replaced with chip & PIN ÔÇó New payment terminals will support NFC ÔÇó 8.000% increased sales of NFC terminals in Q3-14 Apple - iPhone 6 with NFC & Apple Pay ÔÇó The NFC ecosystem is now expected to grow much faster ÔÇó All smartphones manufacturers support NFC Changes in EMV standards ÔÇó Tokenization (cloud) approved ÔÇô The TSM is less important ÔÇó Mobile operators are disrupted ÔÇô no need for SIM cards ÔÇó Interchange fees have been reduced from 1,5% to 0,3% +500 million smart phones with NFC in the market today ÔÇó Mainly Android smartphones ÔÇó New low-end (EUR 50) smart phones with NFC Payment

- 9. Market position The mobile wallet and mobile payment market Leading edge technology solutions for mobile wallet and cloud based payments

- 10. Mobile payments - what the analysts say The market starts now - reaching tipping point in 2015 MeaWallet is ready and certified to serve the market now! Finextra, 13 January 2015 NRK, 2 January 2015 Forbes, 2 January 2015 Why Is The Starbucks Mobile Payments App So Successful? Starbucks is a clear leader in mobile payments and we are encouraged by how consumers have embraced mobile apps as a way to pay.ÔÇØ- Howard Schultz.

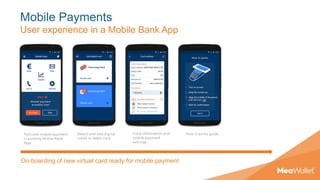

- 11. Mobile Payments User experience in a Mobile Bank App On-boarding of new virtual card ready for mobile payment

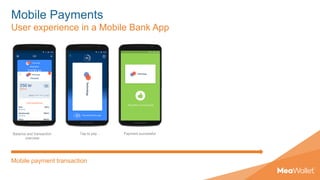

- 12. Mobile Payments User experience in a Mobile Bank App Mobile payment transaction Balance and transaction overview Tap to pay Payment successful

- 13. Complete Mobile Wallet framework ÔÇô White label Turnkey Mobile wallet with 6 verticals ÔÇô hosted as a service Turn key Mobile Wallet solution Ready for 6 verticals, including payment Support NFC, HCE, QR, more Offer all your customers a Mobile Wallet White Label Mobile Wallet - Brand your own Mobile Wallet - HCE-enabling, using tokenization security - Support of open and closed loop payment card schemes - Supports EMV Cloud based payment standard - Flexible integration layer through ESB/SOA - Payment, Loyalty, Coupons, ID, Tickets, more.. - PCI Certified - Reduce total cost by 60-80% Delivery models ÔÇó Managed services ÔÇó Customer/externally installed and operated datacenter ÔÇó Customer/externally installed solution with MeaWallet remote operations

- 14. Be a part of the future of mobile payments Enable contactless and remote payments in your existing bank app Cloud based mobile payment - Adopt contactless NFC mobile payments in any app - HCE-enabling your app, using tokenization security - Support of open and closed loop payment card schemes - Supports EMVCo cloud based payment standard - Flexible integration layer through ESB/SOA - PCI Certified Delivery models ÔÇó Managed services ÔÇó Customer/externally installed and operated datacenter ÔÇó Customer/externally installed solution with MeaWallet remote operations Reduced time-to-market by 60% Reduced cost with cloud based solution No need for SIM or embedded secure elements Go mobile with your credit or debit cards!

- 15. Cloud based payments for retail / card issuer Enable contactless payments in your existing retailer app Cloud based mobile payment - Adopt contactless NFC mobile payments in any retailer app - HCE-enabling your app, using tokenization security - No need for SIM or embedded secure elements - Support of open and closed loop payment card schemes - Supports EMV Cloud based payment standard - Flexible integration layer through ESB/SOA - PCI Certified Delivery models ÔÇó Managed services ÔÇó Customer/externally installed and operated datacenter ÔÇó Customer/externally installed solution with MeaWallet remote operations Go mobile with your credit or debit cards! Reduced time-to-market by 60% Reduced cost with cloud based solution No need for SIM or embedded secure elements

- 16. Cloud based Mobile Access Reduce cost and improve efficiency Cloud based access - Contactless NFC / BLE mobile access - Cloud SE-enabling your app, using tokenization security - FG standard++ - Flexible integration layer through ESB/SOA - Your access card instantly available in the one device you always bring Delivery models ÔÇó Managed services ÔÇó Customer/externally installed and operated datacenter ÔÇó Customer/externally installed solution with MeaWallet remote operations Your access card instantly available in the one device you always bring Reduced time-to-market Reduced cost with cloud based security Embedded secure elements

- 17. MeaWallet Mobile Business Components and Services Enable secure contactless services in your existing app Value proposition - The MBC work as a layer of components between device OS APIÔÇÖs and the mobile application. - MBC is connected to MeaWallet Mobile Service Platform for handling of mobile card services. - Any card can be provisioned, distributed and activated using the MeaWallet Mobile Service Platform. - Complex features provided as easily integrated APIs and SDKs Delivery models ÔÇó Managed services ÔÇó Customer/externally installed and operated datacenter ÔÇó Customer/externally installed solution with MeaWallet remote operations Mobile business components Reduced time-to-market Reduced integration cost R&D Mobile expertise and know how

- 18. Contact us today If you want to be a part of the mobile wallet platform or add cloud based payment DonÔÇÖt hesitate to ask us about our products and services Email post@meawallet.com Call +47 920 37 333