Merchant banking

- 2. Introduction MERCHANT BANKING Merchant Bankingis a combination of BANKING and CONSULTANCY SERVICES. It provides consultancy to its clientsfor financial,marketing, managerialand legal matters. Merchant Bankingprovides a wide range of services for starting until running a business. It acts as FINANCIAL ENGINEER for a business.

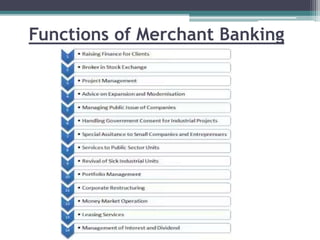

- 3. Functions of Merchant Banking

- 4. Merchant Bank Merchant Bankis a company that deals mostly in INTERNATIONAL FINANCE, Businessloans for companies and UNDERWRITING. These banksare experts in INTERNATIONAL TRADE, which makes them specialistsin dealing with multinationalcorporations. A Merchant Bankmay perform some of the same services as an INVESTMENT BANK, but it does not provide regular banking services to the general public.

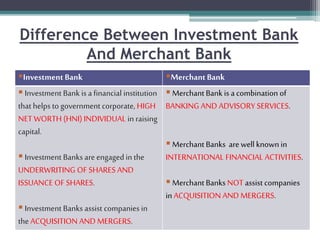

- 5. Difference Between Investment Bank And Merchant Bank ï§InvestmentBank ï§MerchantBank ï§ Investment Bank is a financial institution that helps to government corporate, HIGH NET WORTH (HNI)INDIVIDUAL in raising capital. ï§ Investment Banks areengaged in the UNDERWRITING OF SHARES AND ISSUANCE OF SHARES. ï§ Investment Banks assist companies in the ACQUISITION AND MERGERS. ï§ Merchant Bank is a combination of BANKING AND ADVISORY SERVICES. ï§ Merchant Banks are well known in INTERNATIONAL FINANCIAL ACTIVITIES. ï§ Merchant Banks NOT assist companies in ACQUISITION AND MERGERS.

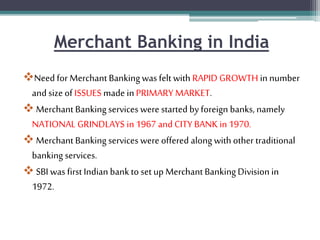

- 6. Merchant Banking in India ïķNeed for Merchant Bankingwas felt with RAPID GROWTH in number and size of ISSUES made in PRIMARY MARKET. ïķ Merchant Bankingservices were started by foreign banks, namely NATIONAL GRINDLAYS in 1967 and CITY BANK in 1970. ïķ Merchant Bankingservices were offered along with other traditional banking services. ïķ SBI was first Indian bank to set up Merchant BankingDivision in 1972.

- 7. Main Services Provided By Merchant Banks ïķ Project Counselling ïķ Underwriting ïķ Portfolio Management ïķManagers to issue ïķ Advising on Mergers and Take-Overs ïķArranging Offshore finance ïķ Corporate Reconstructing ïķNon-Resident Investment

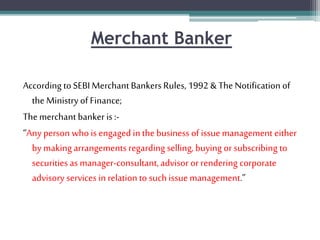

- 8. Merchant Banker According to SEBI Merchant BankersRules, 1992 & The Notification of the Ministry of Finance; The merchant banker is:- âAny person who is engaged in the business of issuemanagement either by making arrangements regarding selling, buying or subscribing to securities as manager-consultant,advisor or rendering corporate advisory services in relation to suchissue management.â

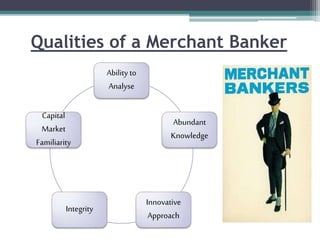

- 9. Qualities of a Merchant Banker Ability to Analyse Abundant Knowledge Innovative Approach Integrity Capital Market Familiarity

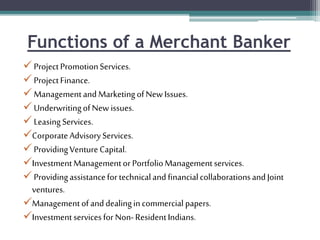

- 10. Functions of a Merchant Banker ïžProjectPromotionServices. ïžProjectFinance. ïžManagementandMarketingofNew Issues. ïžUnderwritingofNew issues. ïžLeasingServices. ïžCorporateAdvisoryServices. ïžProvidingVentureCapital. ïžInvestmentManagementor PortfolioManagementservices. ïžProvidingassistancefortechnicalandfinancialcollaborationsandJoint ventures. ïžManagementofanddealingincommercial papers. ïžInvestmentservicesfor Non-ResidentIndians.

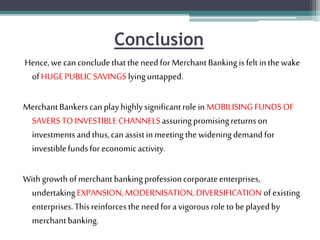

- 11. Conclusion Hence,wecanconcludethattheneedforMerchantBankingisfeltinthewake ofHUGEPUBLIC SAVINGS lyinguntapped. MerchantBankers canplayhighlysignificantrolein MOBILISING FUNDSOF SAVERSTO INVESTIBLE CHANNELSassuringpromisingreturnson investmentsandthus,canassistinmeetingthewideningdemandfor investiblefundsfor economicactivity. Withgrowthofmerchantbankingprofessioncorporateenterprises, undertakingEXPANSION,MODERNISATION,DIVERSIFICATION ofexisting enterprises.Thisreinforcestheneedfor a vigorousroletobeplayedby merchantbanking.

Editor's Notes

- #5: a