The Platform Cheatsheet to Mary MeekerŌĆÖs Internet Trends Deck

- 2. 31 Business Communications... Slack ŌĆō Stewart Butterfield Source: Slack, KPCB. Image: TVC Net support website (left), NY Times (right). THEN Email / Semi-Inflexible Messaging Tools NOW Slack Can reduce internal email traffic materially

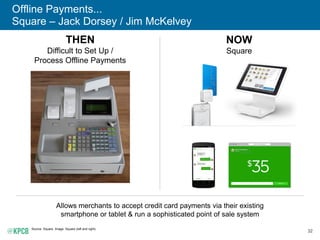

- 3. 32 Offline Payments... Square ŌĆō Jack Dorsey / Jim McKelvey Source: Square. Image: Square (left and right). THEN Difficult to Set Up / Process Offline Payments NOW Square Allows merchants to accept credit card payments via their existing smartphone or tablet & run a sophisticated point of sale system

- 4. 47 Messaging Apps = Top Global Apps in Usage + Sessions 6+ of Top 10 most used apps globally = Messaging Apps Messaging Apps significant app sessions Source: Quettra, Q1:15. Data ranked based on usage. Quettra analyzes 75MM+ Android users spread out in more than 150 countries, collecting install and usage statistics of every application present on the device. Q1:15 data analyzed three months of data starting from 1/1/15. Data excludes Google apps and other commonly pre-installed apps to remove biases. Only apps with 10K+ installs worldwide and 100+ DAU are counted.

- 5. 48 Communicating via Mobile Messaging = A Beautiful Thing Asynchronous yet Instant Expressive yet Fast Engaging yet User Controlled Easy yet Productive Simple yet 24x7 Real-Time yet Replayable* Current yet Evergreen Accessible yet Global Mobile yet Distributed Instant yet Secure Personal yet Mainstream Casual yet Professional FaceTime... *Up to 24 hours after original broadcast. Images: Company websites, Flickr (creative commons).

- 6. 49 Facebook Messenger (launched 2011) ŌĆó Messaging platform ŌĆó MAU = 600MM, +200% Y/Y, Q1:15 WhatsApp (launched 2009) ŌĆó Fast messaging ŌĆó MAU = 800MM, +60% Y/Y, Q1:15 ŌĆó Messages Sent / Day = 30B Snapchat (launched 2011) ŌĆó Ephemeral messages, pictures and videos ŌĆó DAU = 100MM, 5/15 ŌĆó Story Views / Day = 2B KakaoTalk (launched 2010, Korea) ŌĆó Messaging platform ŌĆó MAU = 48MM, flat Y/Y, Q1:15 ŌĆó Messages Sent / Day = 5.2B ŌĆó Revenue* = $853MM, +19% Y/Y LINE (launched 2011, Japan) ŌĆó Messaging platform ŌĆó MAU = 205MM, Q1:15 ŌĆó Messages Sent / Day = 13B, +30% Y/Y ŌĆó Revenue = $922MM, +70% Y/Y WeChat (launched 2011, China) ŌĆó Messaging platform ŌĆó MAU = 549MM, Q1:15, +39% Y/Y Messaging Leaders = Growing Fast... Building Expansive Platforms + Moats Selected Global Messaging Leaders Source: Company public filings, earnings transcripts, websites, statements to the press. Revenue figures are annualized as of most recent quarter. *Revenue of Daum Kakao.

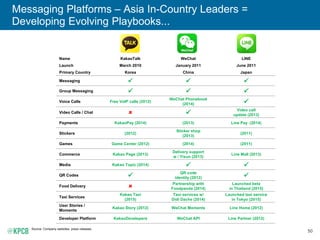

- 7. 50 Messaging Platforms ŌĆō Asia In-Country Leaders = Developing Evolving Playbooks... Source: Company websites, press releases. Name KakaoTalk WeChat LINE Launch March 2010 January 2011 June 2011 Primary Country Korea China Japan Messaging Group Messaging Voice Calls Free VoIP calls (2012) WeChat Phonebook (2014) Video Calls / Chat Video call update (2013) Payments KakaoPay (2014) (2013) Line Pay (2014) Stickers (2012) Sticker shop (2013) (2011) Games Game Center (2012) (2014) (2011) Commerce Kakao Page (2013) Delivery support w / Yixun (2013) Line Mall (2013) Media Kakao Topic (2014) QR Codes QR code identity (2012) Food Delivery Partnership with Foodpanda (2014) Launched beta in Thailand (2015) Taxi Services Kakao Taxi (2015) Taxi services w/ Didi Dache (2014) Launched taxi service in Tokyo (2015) User Stories / Moments Kakao Story (2012) WeChat Moments Line Home (2012) Developer Platform KakaoDevelopers WeChat API Line Partner (2012)

- 8. 51 ...Messaging Platforms ŌĆō Global Leaders = Implementing Playbooks & More Source: Company websites, press releases. Name Facebook Messenger Snapchat Launch August 2011 September 2011 Primary Country Global Global Messaging Separate messaging app (2014) Chat (2014) Group Messaging Voice Calls VoIP voice calls in US (2013) Video Calls / Chat Free VoIP video calls (2015) Video Chat (2014) Payments Messenger Payments (2015) Snapcash (2014) Stickers Sticker support (2013) Games Commerce Businesses on Messenger (2015) Media Discover (2015) QR Codes QR Codes to add friends (2015) Food Delivery Taxi Services User Stories / Moments Shared Stories (2013) Developer Platform Messenger Platform (2015)

- 9. 52 In Messaging, Not One-Size-Fits-All, For Now... Many People Use Different Messaging Apps for Various Purposes One User... (Illustrative) Image: Stratechery (right), BoumanBlog (left). ...Another User (Illustrative) KakaoTalk Snapchat Kik

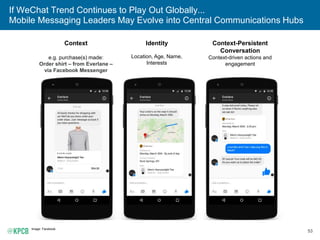

- 10. 53 If WeChat Trend Continues to Play Out Globally... Mobile Messaging Leaders May Evolve into Central Communications Hubs Image: Facebook. Context e.g. purchase(s) made: Order shirt ŌĆō from Everlane ŌĆō via Facebook Messenger Identity Location, Age, Name, Interests Context-Persistent Conversation Context-driven actions and engagement

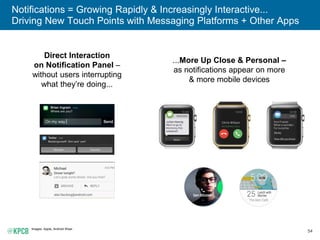

- 11. 54 Notifications = Growing Rapidly & Increasingly Interactive... Driving New Touch Points with Messaging Platforms + Other Apps Images: Apple, Android Wear. ...More Up Close & Personal ŌĆō as notifications appear on more & more mobile devices Direct Interaction on Notification Panel ŌĆō without users interrupting what theyŌĆÖre doing...

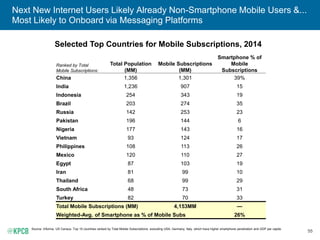

- 12. 55 Next New Internet Users Likely Already Non-Smartphone Mobile Users &... Most Likely to Onboard via Messaging Platforms Selected Top Countries for Mobile Subscriptions, 2014 Source: Informa, US Census. Top 15 countries ranked by Total Mobile Subscriptions, excluding USA, Germany, Italy, which have higher smartphone penetration and GDP per capita. Ranked by Total Mobile Subscriptions: Total Population (MM) Mobile Subscriptions (MM) Smartphone % of Mobile Subscriptions China 1,356 1,301 39% India 1,236 907 15 Indonesia 254 343 19 Brazil 203 274 35 Russia 142 253 23 Pakistan 196 144 6 Nigeria 177 143 16 Vietnam 93 124 17 Philippines 108 113 26 Mexico 120 110 27 Egypt 87 103 19 Iran 81 99 10 Thailand 68 99 29 South Africa 48 73 31 Turkey 82 70 33 Total Mobile Subscriptions (MM) 4,153MM ŌĆö Weighted-Avg. of Smartphone as % of Mobile Subs 26%

- 13. 56 Messaging + Notifications = Key Layers of Every Meaningful Mobile App Messaging Leaders Aiming to Create Cross-Platform Operating Systems that Are Context-Persistent Communications Hubs for More & More Services

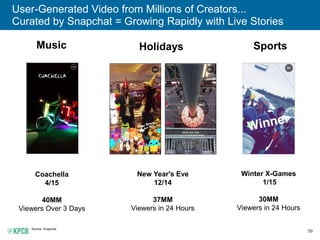

- 14. 59 User-Generated Video from Millions of Creators... Curated by Snapchat = Growing Rapidly with Live Stories Source: Snapchat. Winter X-Games 1/15 30MM Viewers in 24 Hours SportsMusic Holidays Coachella 4/15 40MM Viewers Over 3 Days New Year's Eve 12/14 37MM Viewers in 24 Hours

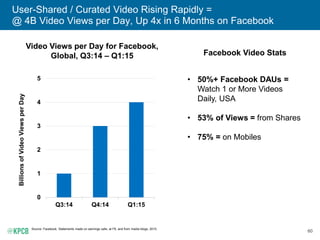

- 15. 60 User-Shared / Curated Video Rising Rapidly = @ 4B Video Views per Day, Up 4x in 6 Months on Facebook Source: Facebook. Statements made on earnings calls, at F8, and from media blogs, 2015. 0 1 2 3 4 5 Q3:14 Q4:14 Q1:15 BillionsofVideoViewsperDay Video Views per Day for Facebook, Global, Q3:14 ŌĆō Q1:15 Facebook Video Stats ŌĆó 50%+ Facebook DAUs = Watch 1 or More Videos Daily, USA ŌĆó 53% of Views = from Shares ŌĆó 75% = on Mobiles

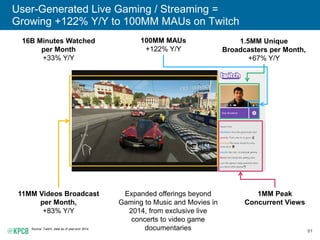

- 16. 61 User-Generated Live Gaming / Streaming = Growing +122% Y/Y to 100MM MAUs on Twitch Source: Twitch, data as of year-end 2014. 16B Minutes Watched per Month +33% Y/Y 1.5MM Unique Broadcasters per Month, +67% Y/Y 11MM Videos Broadcast per Month, +83% Y/Y 1MM Peak Concurrent Views Expanded offerings beyond Gaming to Music and Movies in 2014, from exclusive live concerts to video game documentaries 100MM MAUs +122% Y/Y

- 17. 62 User-Generated / Curated Audio Content (including Remixes) = @ 10MM Creators (+2x) Over 2 Years on SoundCloud Source: SoundCloud. 100MM Tracks +33% Y/Y Majority of content comes from creators not associated with known rights-holders

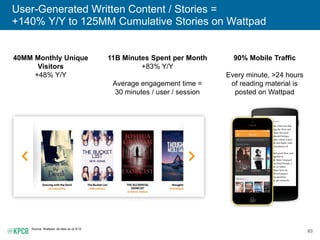

- 18. 63 User-Generated Written Content / Stories = +140% Y/Y to 125MM Cumulative Stories on Wattpad Source: Wattpad, all data as of 5/15. 11B Minutes Spent per Month +83% Y/Y Average engagement time = 30 minutes / user / session 40MM Monthly Unique Visitors +48% Y/Y 90% Mobile Traffic Every minute, >24 hours of reading material is posted on Wattpad

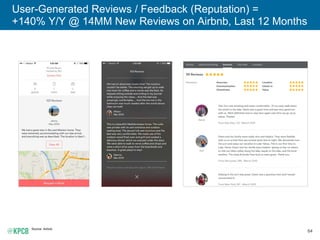

- 19. 64 User-Generated Reviews / Feedback (Reputation) = +140% Y/Y @ 14MM New Reviews on Airbnb, Last 12 Months Source: Airbnb.

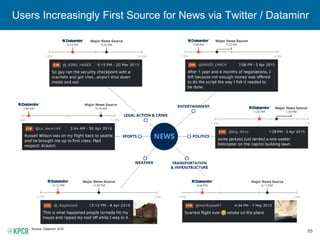

- 20. 65 Users Increasingly First Source for News via Twitter / Dataminr Source: Dataminr, 5/15.

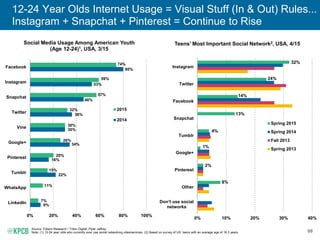

- 21. 68 12-24 Year Olds Internet Usage = Visual Stuff (In & Out) Rules... Instagram + Snapchat + Pinterest = Continue to Rise Source: Edison Research / Triton Digital, Piper Jaffray. Note: (1) 12-24 year olds who currently ever use social networking sites/services. (2) Based on survey of US teens with an average age of 16.3 years. 9% 22% 16% 34% 30% 36% 46% 53% 80% 7% 11% 15% 20% 26% 30% 32% 57% 59% 74% 0% 20% 40% 60% 80% 100% LinkedIn WhatsApp Tumblr Pinterest Google+ Vine Twitter Snapchat Instagram Facebook Social Media Usage Among American Youth (Age 12-24)1, USA, 3/15 2015 2014 8% 2% 1% 4% 13% 14% 24% 32% 0% 10% 20% 30% 40% DonŌĆÖt use social networks Other Pinterest Google+ Tumblr Snapchat Facebook Twitter Instagram TeensŌĆÖ Most Important Social Network2, USA, 4/15 Spring 2015 Spring 2014 Fall 2013 Spring 2013

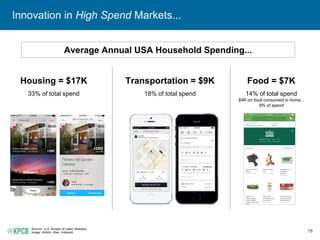

- 22. 78 Innovation in High Spend Markets... Source: U.S. Bureau of Labor Statistics. Image: Airbnb, Uber, Instacart. Transportation = $9K 18% of total spend Average Annual USA Household Spending... Housing = $17K 33% of total spend Food = $7K 14% of total spend $4K on food consumed in home... 8% of spend 32 min

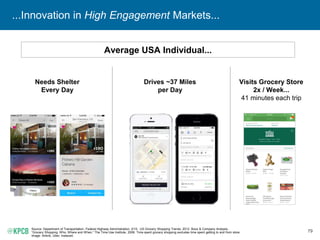

- 23. 79 ...Innovation in High Engagement Markets... Source: Department of Transportation, Federal Highway Administration, 2/15. US Grocery Shopping Trends, 2012. Booz & Company Analysis. ŌĆ£Grocery Shopping: Who, Where and When,ŌĆØ The Time Use Institute, 2008. Time spent grocery shopping excludes time spent getting to and from store. Image: Airbnb, Uber, Instacart. Drives ~37 Miles per Day Average USA Individual... Needs Shelter Every Day Visits Grocery Store 2x / Week... 41 minutes each trip 32 min

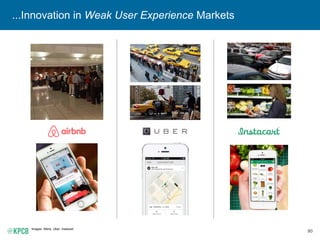

- 24. 80 ...Innovation in Weak User Experience Markets Images: iMore, Uber, Instacart.

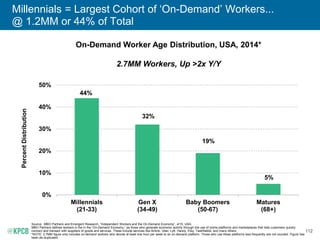

- 25. 112 Millennials = Largest Cohort of ŌĆśOn-DemandŌĆÖ Workers... @ 1.2MM or 44% of Total Source: MBO Partners and Emergent Research, ŌĆ£Independent Workers and the On-Demand EconomyŌĆØ, 4/15, USA. MBO Partners defines workers in the in the ŌĆ£On-Demand Economy,ŌĆØ as those who generate economic activity through the use of online platforms and marketplaces that help customers quickly connect and transact with suppliers of goods and services. These include services like Airbnb, Uber, Lyft, Handy, Etsy, TaskRabbit, and many others. *NOTE: 2.7MM figure only includes on-demand workers who devote at least one hour per week to an on-demand platform. Those who use these platforms less frequently are not counted. Figure has been de-duplicated. On-Demand Worker Age Distribution, USA, 2014* 2.7MM Workers, Up >2x Y/Y 44% 32% 19% 5% 0% 10% 20% 30% 40% 50% Millennials (21-33) Gen X (34-49) Baby Boomers (50-67) Matures (68+) PercentDistribution

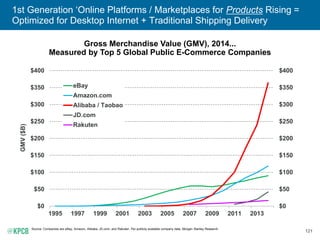

- 26. 121 1st Generation ŌĆśOnline Platforms / Marketplaces for Products Rising = Optimized for Desktop Internet + Traditional Shipping Delivery Gross Merchandise Value (GMV), 2014... Measured by Top 5 Global Public E-Commerce Companies Source: Companies are eBay, Amazon, Alibaba, JD.com, and Rakuten. Per publicly available company data, Morgan Stanley Research. $0 $50 $100 $150 $200 $250 $300 $350 $400 $0 $50 $100 $150 $200 $250 $300 $350 $400 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 GMV($B) eBay Amazon.com Alibaba / Taobao JD.com Rakuten

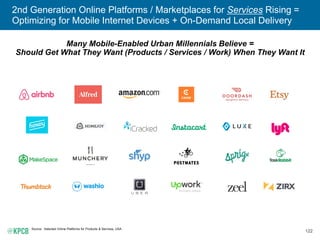

- 27. 122 2nd Generation Online Platforms / Marketplaces for Services Rising = Optimizing for Mobile Internet Devices + On-Demand Local Delivery Many Mobile-Enabled Urban Millennials Believe = Should Get What They Want (Products / Services / Work) When They Want It Source: Selected Online Platforms for Products & Services, USA

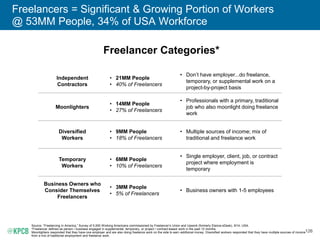

- 28. 126 Freelancers = Significant & Growing Portion of Workers @ 53MM People, 34% of USA Workforce Freelancer Categories* Source: ŌĆ£Freelancing in America,ŌĆØ Survey of 5,000 Working Americans commissioned by FreelancerŌĆÖs Union and Upwork (formerly Elance-oDesk), 9/14, USA. *Freelancer defined as person / business engaged in supplemental, temporary, or project / contract-based work in the past 12 months. Moonlighters responded that they have one employer and are also doing freelance work on the side to earn additional money. Diversified workers responded that they have multiple sources of income from a mix of traditional employment and freelance work. Independent Contractors ŌĆó 21MM People ŌĆó 40% of Freelancers ŌĆó DonŌĆÖt have employer...do freelance, temporary, or supplemental work on a project-by-project basis Moonlighters ŌĆó 14MM People ŌĆó 27% of Freelancers ŌĆó Professionals with a primary, traditional job who also moonlight doing freelance work Diversified Workers ŌĆó 9MM People ŌĆó 18% of Freelancers ŌĆó Multiple sources of income; mix of traditional and freelance work Temporary Workers ŌĆó 6MM People ŌĆó 10% of Freelancers ŌĆó Single employer, client, job, or contract project where employment is temporary Business Owners who Consider Themselves Freelancers ŌĆó 3MM People ŌĆó 5% of Freelancers ŌĆó Business owners with 1-5 employees

- 29. 128 Internet Enabling Commerce in Increasingly Efficient Ways Source: ŌĆ£2015 US Small Business Global Growth Report,ŌĆØ 2015. Published by eBay. ŌĆ£Redefining Entrepreneurship: Etsy SellersŌĆÖ Economic ImpactŌĆØ, 11/13. Published by Etsy. Survey measured 5,500 USA-based sellers on EtsyŌĆÖs marketplace. ŌĆ£Elance-oDesk Relaunches as Upwork, Debuts New Freelance Talent Platform,ŌĆØ 5/15. Airbnb, Thumbtack, Stripe. eBay SMBs = 95% engage in export vs. <5% of USA businesses Setting up export businesses historically required significant investment. Etsy sellers = 35% started business without much capital investment, compared to 21% for small business owners. Only a smartphone needed to set up a listing and become an Airbnb host. Hosts can get set up in minutes. Stripe Connect powers most marketplace businesses and enables coordination of transactions between buyers and sellers. Car + smartphone + quick onboarding to be UberX driver-partner vs. materially more to purchase medallion (or equivalent) to be a Taxi driver. SoundCloud Creators can use mobile devices to record / distribute audio content within minutes. Ability for businesses to access talent quickly ŌĆō time to hire averages 3 days on Upwork vs. longer time for traditional hiring. Thumbtack professionals pay $3-15 per introduction to services leads they are interested in vs. buying ads in directories monthly or yearly.

- 30. 129 Rise of Connectivity + Online Marketplaces / Platforms = Helping People Earn Income & Work on Own Terms

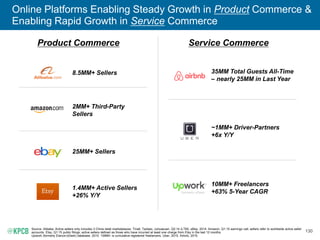

- 31. 130 Online Platforms Enabling Steady Growth in Product Commerce & Enabling Rapid Growth in Service Commerce 8.5MM+ Sellers 2MM+ Third-Party Sellers 25MM+ Sellers 1.4MM+ Active Sellers +26% Y/Y 10MM+ Freelancers +63% 5-Year CAGR ~1MM+ Driver-Partners +6x Y/Y 35MM Total Guests All-Time ŌĆō nearly 25MM in Last Year Product Commerce Service Commerce Source: Alibaba. Active sellers only includes 3 China retail marketplaces: Tmall, Taobao, Juhuasuan, Q2:14 (LTM). eBay, 2014. Amazon, Q1:15 earnings call; sellers refer to worldwide active seller accounts. Etsy, Q1:15 public filings; active sellers defined as those who have incurred at least one charge from Etsy in the last 12 months. Upwork (formerly Elance-oDesk) database, 2015. 10MM+ is cumulative registered freelancers. Uber, 2015. Airbnb, 2015.

- 32. 131 People Typically Use Online Platforms to Find Extra Income & Flexibility

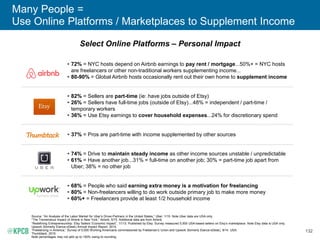

- 33. 132 Many People = Use Online Platforms / Marketplaces to Supplement Income Select Online Platforms ŌĆō Personal Impact Source: ŌĆ£An Analysis of the Labor Market for UberŌĆÖs Driver-Partners in the United States,ŌĆØ Uber, 1/15. Note Uber data are USA only. ŌĆ£The Tremendous Impact of Airbnb in New York,ŌĆØ Airbnb, 5/15. Additional data are from Airbnb. ŌĆ£Redefining Entrepreneurship: Etsy SellersŌĆÖ Economic ImpactŌĆØ, 11/13. Published by Etsy. Survey measured 5,500 USA-based sellers on EtsyŌĆÖs marketplace. Note Etsy data is USA only. Upwork (formerly Elance-oDesk) Annual Impact Report, 2014. ŌĆ£Freelancing in America,ŌĆØ Survey of 5,000 Working Americans commissioned by FreelancerŌĆÖs Union and Upwork (formerly Elance-oDesk), 9/14. USA. Thumbtack, 2015. Note percentages may not add up to 100% owing to rounding. ŌĆó 72% = NYC hosts depend on Airbnb earnings to pay rent / mortgage...50%+ = NYC hosts are freelancers or other non-traditional workers supplementing income... ŌĆó 80-90% = Global Airbnb hosts occasionally rent out their own home to supplement income ŌĆó 82% = Sellers are part-time (ie: have jobs outside of Etsy) ŌĆó 26% = Sellers have full-time jobs (outside of Etsy)...48% = independent / part-time / temporary workers ŌĆó 36% = Use Etsy earnings to cover household expenses...24% for discretionary spend ŌĆó 37% = Pros are part-time with income supplemented by other sources ŌĆó 74% = Drive to maintain steady income as other income sources unstable / unpredictable ŌĆó 61% = Have another job...31% = full-time on another job; 30% = part-time job apart from Uber; 38% = no other job ŌĆó 68% = People who said earning extra money is a motivation for freelancing ŌĆó 80% = Non-freelancers willing to do work outside primary job to make more money ŌĆó 60%+ = Freelancers provide at least 1/2 household income

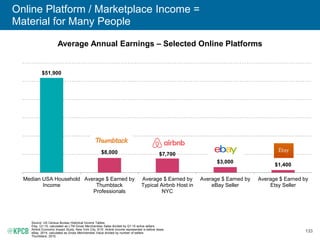

- 34. 133 Online Platform / Marketplace Income = Material for Many People Average Annual Earnings ŌĆō Selected Online Platforms $51,900 $8,000 $7,700 $3,000 $1,400 Median USA Household Income Average $ Earned by Thumbtack Professionals Average $ Earned by Typical Airbnb Host in NYC Average $ Earned by eBay Seller Average $ Earned by Etsy Seller Source: US Census Bureau Historical Income Tables. Etsy, Q1:15; calculated as LTM Gross Merchandise Sales divided by Q1:15 active sellers. Airbnb Economic Impact Study, New York City, 5/15. Airbnb income represented is before taxes. eBay, 2014; calculated as Gross Merchandise Value divided by number of sellers. Thumbtack, 2015.

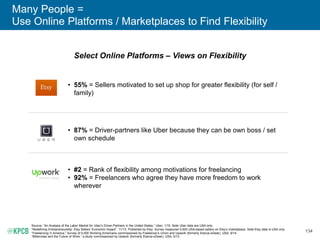

- 35. 134 Many People = Use Online Platforms / Marketplaces to Find Flexibility Select Online Platforms ŌĆō Views on Flexibility Source: ŌĆ£An Analysis of the Labor Market for UberŌĆÖs Driver-Partners in the United States,ŌĆØ Uber, 1/15. Note Uber data are USA only. ŌĆ£Redefining Entrepreneurship: Etsy SellersŌĆÖ Economic ImpactŌĆØ, 11/13. Published by Etsy. Survey measured 5,500 USA-based sellers on EtsyŌĆÖs marketplace. Note Etsy data is USA only. ŌĆ£Freelancing in America,ŌĆØ Survey of 5,000 Working Americans commissioned by FreelancerŌĆÖs Union and Upwork (formerly Elance-oDesk), USA, 9/14. ŌĆ£Millennials and the Future of Work,ŌĆØ a study commissioned by Upwork (formerly Elance-oDesk), USA, 5/13. ŌĆó 55% = Sellers motivated to set up shop for greater flexibility (for self / family) ŌĆó 87% = Driver-partners like Uber because they can be own boss / set own schedule ŌĆó #2 = Rank of flexibility among motivations for freelancing ŌĆó 92% = Freelancers who agree they have more freedom to work wherever

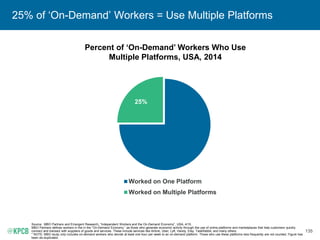

- 36. 135 25% of ŌĆśOn-DemandŌĆÖ Workers = Use Multiple Platforms Source: MBO Partners and Emergent Research, ŌĆ£Independent Workers and the On-Demand EconomyŌĆØ, USA, 4/15. MBO Partners defines workers in the in the ŌĆ£On-Demand Economy,ŌĆØ as those who generate economic activity through the use of online platforms and marketplaces that help customers quickly connect and transact with suppliers of goods and services. These include services like Airbnb, Uber, Lyft, Handy, Etsy, TaskRabbit, and many others. * NOTE: MBO study only includes on-demand workers who devote at least one hour per week to an on-demand platform. Those who use these platforms less frequently are not counted. Figure has been de-duplicated. 75% 25% Worked on One Platform Worked on Multiple Platforms Percent of ŌĆśOn-DemandŌĆÖ Workers Who Use Multiple Platforms, USA, 2014

- 37. 136 Growth in Online Platforms / Marketplaces = Creates Benefits & Challenges

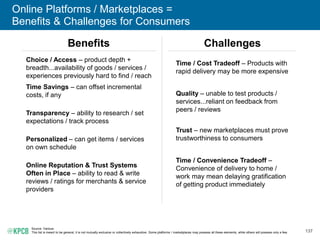

- 38. 137 Online Platforms / Marketplaces = Benefits & Challenges for Consumers Source: Various. This list is meant to be general, it is not mutually exclusive or collectively exhaustive. Some platforms / marketplaces may possess all these elements, while others will possess only a few. Time / Cost Tradeoff ŌĆō Products with rapid delivery may be more expensive Quality ŌĆō unable to test products / services...reliant on feedback from peers / reviews Trust ŌĆō new marketplaces must prove trustworthiness to consumers Time / Convenience Tradeoff ŌĆō Convenience of delivery to home / work may mean delaying gratification of getting product immediately Choice / Access ŌĆō product depth + breadth...availability of goods / services / experiences previously hard to find / reach Time Savings ŌĆō can offset incremental costs, if any Transparency ŌĆō ability to research / set expectations / track process Personalized ŌĆō can get items / services on own schedule Online Reputation & Trust Systems Often in Place ŌĆō ability to read & write reviews / ratings for merchants & service providers Benefits Challenges

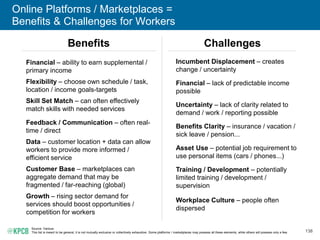

- 39. 138 Online Platforms / Marketplaces = Benefits & Challenges for Workers Financial ŌĆō ability to earn supplemental / primary income Flexibility ŌĆō choose own schedule / task, location / income goals-targets Skill Set Match ŌĆō can often effectively match skills with needed services Feedback / Communication ŌĆō often real- time / direct Data ŌĆō customer location + data can allow workers to provide more informed / efficient service Customer Base ŌĆō marketplaces can aggregate demand that may be fragmented / far-reaching (global) Growth ŌĆō rising sector demand for services should boost opportunities / competition for workers Incumbent Displacement ŌĆō creates change / uncertainty Financial ŌĆō lack of predictable income possible Uncertainty ŌĆō lack of clarity related to demand / work / reporting possible Benefits Clarity ŌĆō insurance / vacation / sick leave / pension... Asset Use ŌĆō potential job requirement to use personal items (cars / phones...) Training / Development ŌĆō potentially limited training / development / supervision Workplace Culture ŌĆō people often dispersed Benefits Challenges Source: Various. This list is meant to be general, it is not mutually exclusive or collectively exhaustive. Some platforms / marketplaces may possess all these elements, while others will possess only a few.

- 40. ONLINE MARKETPLACE / PLATFORMS = REGULATORY FOCUS EVOLVING

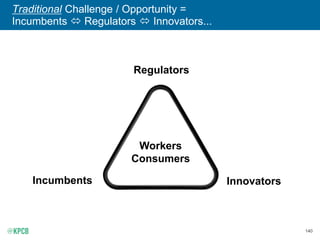

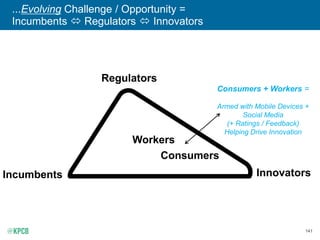

- 41. 140 Traditional Challenge / Opportunity = Incumbents Regulators Innovators... Regulators Incumbents Innovators Workers Consumers

- 42. 141 ...Evolving Challenge / Opportunity = Incumbents Regulators Innovators Regulators Incumbents Innovators Consumers + Workers = Armed with Mobile Devices + Social Media (+ Ratings / Feedback) Helping Drive Innovation Consumers Workers

- 43. 142 Innovative Online Platform / Marketplace Business Models = Capturing Attention of Incumbents + Regulators + Policy Makers + Plaintiffs Lawyers ŌĆó Airbnb Emerges Victorious as New York City Regulators Overturn Host's $2,400 Fine ŌĆō The Verge, 9/13 ŌĆó Artist Sued for 'Subletting' Loft on Airbnb ŌĆō New York Post, 6/14 ŌĆó Sharing Economy Faces Patchwork of Guidelines in European Countries ŌĆō NY Times, 9/14 ŌĆó State Regulator Says Uber meets Florida Insurance Requirement ŌĆō Tampa Bay Times, 10/14 ŌĆó Handy.com HousecleanersŌĆÖ Lawsuit Could Rock On-Demand Companies ŌĆō SF Gate, 11/14 ŌĆó Uber, Lyft Lawsuits Could Spell Trouble For the On-Demand Economy ŌĆō CNN, 3/15

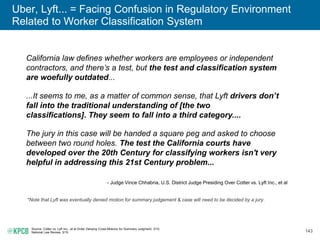

- 44. 143 Uber, Lyft... = Facing Confusion in Regulatory Environment Related to Worker Classification System Source: Cotter vs. Lyft Inc., et al Order Denying Cross-Motions for Summary Judgment, 3/15. National Law Review, 3/15 California law defines whether workers are employees or independent contractors, and thereŌĆÖs a test, but the test and classification system are woefully outdated... ...It seems to me, as a matter of common sense, that Lyft drivers donŌĆÖt fall into the traditional understanding of [the two classifications]. They seem to fall into a third category.... The jury in this case will be handed a square peg and asked to choose between two round holes. The test the California courts have developed over the 20th Century for classifying workers isn't very helpful in addressing this 21st Century problem... - Judge Vince Chhabria, U.S. District Judge Presiding Over Cotter vs. Lyft Inc., et al *Note that Lyft was eventually denied motion for summary judgement & case will need to be decided by a jury.

- 45. 144 Airbnb = Facing Confusion in Regulatory Environment Related to Myriad of Local Laws on Hotels / Short-Term Rentals Source: ŌĆ£The Future of Airbnb in Cities,ŌĆØ McKinsey & Company Interview with Brian Chesky (Cofounder and CEO of Airbnb), 11/14. ...this is amazing, but itŌĆÖs also complicated because there are laws that were written many decades ago ŌĆō sometimes a century ago ŌĆō that said, ŌĆśThere are laws for people and there are laws for business.ŌĆÖ What happens when a person becomes a business? Suddenly these laws feel a little bit outdated. TheyŌĆÖre really 20th-century laws, and weŌĆÖre in a 21st-century economy. - Brian Chesky, Co-founder and CEO of Airbnb, 11/14

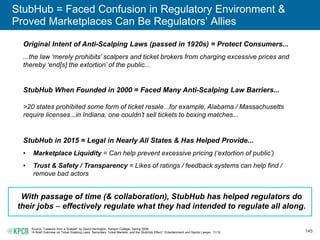

- 46. 145 StubHub = Faced Confusion in Regulatory Environment & Proved Marketplaces Can Be RegulatorsŌĆÖ Allies Source: ŌĆ£Lessons from a ScalperŌĆØ by David Harrington, Kenyon College, Spring 2009. ŌĆ£A Brief Overview on Ticket Scalping Laws, Secondary Ticket Markets, and the StubHub Effect,ŌĆØ Entertainment and Sports Lawyer, 11/12. Original Intent of Anti-Scalping Laws (passed in 1920s) = Protect Consumers... ...the law ŌĆśmerely prohibitsŌĆÖ scalpers and ticket brokers from charging excessive prices and thereby ŌĆśend[s] the extortionŌĆÖ of the public... StubHub When Founded in 2000 = Faced Many Anti-Scalping Law Barriers... >20 states prohibited some form of ticket resale...for example, Alabama / Massachusetts require licenses...in Indiana, one couldnŌĆÖt sell tickets to boxing matches... StubHub in 2015 = Legal in Nearly All States & Has Helped Provide... ŌĆó Marketplace Liquidity = Can help prevent excessive pricing (ŌĆśextortion of publicŌĆÖ) ŌĆó Trust & Safety / Transparency = Likes of ratings / feedback systems can help find / remove bad actors With passage of time (& collaboration), StubHub has helped regulators do their jobs ŌĆō effectively regulate what they had intended to regulate all along.

- 47. 150 China = Digital Innovation Alive & Well Hillhouse Capital* Created / Provided China Section of Internet Trends, 2015 *Disclaimer ŌĆō The information provided in the following slides is for informational and illustrative purposes only. No representation or warranty, express or implied, is given and no responsibility or liability is accepted by any person with respect to the accuracy, reliability, correctness or completeness of this Information or its contents or any oral or written communication in connection with it. A business relationship, arrangement, or contract by or among any of the businesses described herein may not exist at all and should not be implied or assumed from the information provided. The information provided herein by Hillhouse Capital does not constitute an offer to sell or a solicitation of an offer to buy, and may not be relied upon in connection with the purchase or sale of, any security or interest offered, sponsored, or managed by Hillhouse Capital or its affiliates.

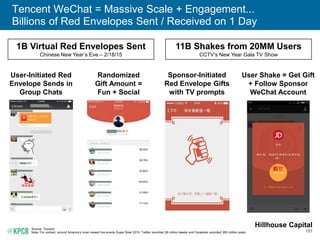

- 48. 151 Tencent WeChat = Massive Scale + Engagement... Billions of Red Envelopes Sent / Received on 1 Day Source: Tencent. Note: For context, around AmericaŌĆÖs most viewed live events Super Bowl 2015, Twitter recorded 28 million tweets and Facebook recorded 265 million posts. User-Initiated Red Envelope Sends in Group Chats Randomized Gift Amount = Fun + Social Sponsor-Initiated Red Envelope Gifts with TV prompts User Shake = Get Gift + Follow Sponsor WeChat Account 1B Virtual Red Envelopes Sent Chinese New YearŌĆÖs Eve ŌĆō 2/18/15 11B Shakes from 20MM Users CCTVŌĆÖs New Year Gala TV Show Hillhouse Capital

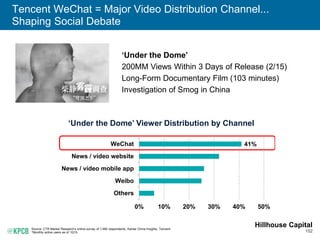

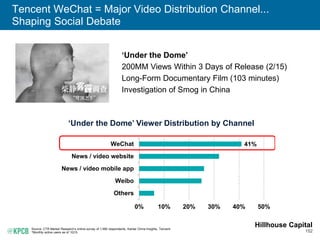

- 49. 152 Tencent WeChat = Major Video Distribution Channel... Shaping Social Debate Source: CTR Market ResearchŌĆÖs online survey of 1,580 respondents, Kantar China Insights, Tencent. *Monthly active users as of 1Q15. ŌĆśUnder the DomeŌĆÖ 200MM Views Within 3 Days of Release (2/15) Long-Form Documentary Film (103 minutes) Investigation of Smog in China ŌĆśUnder the DomeŌĆÖ Viewer Distribution by Channel 41% Others Weibo News / video mobile app News / video website WeChat 0% 10% 20% 30% 40% 50% Hillhouse Capital

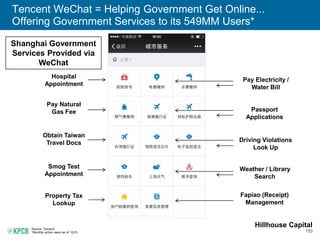

- 50. 153 Tencent WeChat = Helping Government Get Online... Offering Government Services to its 549MM Users* Source: Tencent. *Monthly active users as of 1Q15. Shanghai Government Services Provided via WeChat Hospital Appointment Pay Natural Gas Fee Obtain Taiwan Travel Docs Smog Test Appointment Property Tax Lookup Pay Electricity / Water Bill Passport Applications Driving Violations Look Up Weather / Library Search Fapiao (Receipt) Management Hillhouse Capital

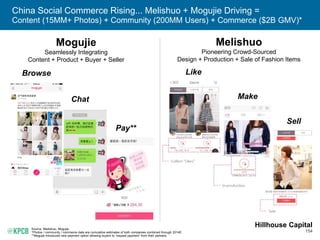

- 51. 154 China Social Commerce Rising... Melishuo + Mogujie Driving = Content (15MM+ Photos) + Community (200MM Users) + Commerce ($2B GMV)* Source: Meilishuo, Mogujie. *Photos / community / commerce data are cumulative estimates of both companies combined through 2014E. **Mogujie introduced new payment option allowing buyers to ŌĆśrequest paymentŌĆÖ from their partners. Melishuo Pioneering Crowd-Sourced Design + Production + Sale of Fashion Items Mogujie Seamlessly Integrating Content + Product + Buyer + Seller Browse Chat Pay** Like Make Sell Hillhouse Capital

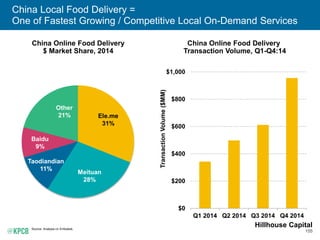

- 52. 155 China Local Food Delivery = One of Fastest Growing / Competitive Local On-Demand Services China Online Food Delivery Transaction Volume, Q1-Q4:14 Source: Analysis.cn Enfodesk. $0 $200 $400 $600 $800 $1,000 Q1 2014 Q2 2014 Q3 2014 Q4 2014 TransactionVolume($MM) Ele.me 31% Meituan 28% Taodiandian 11% Baidu 9% Other 21% China Online Food Delivery $ Market Share, 2014 Hillhouse Capital

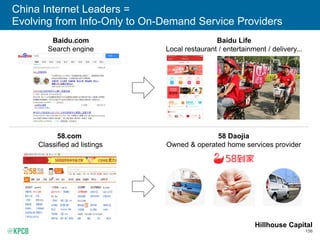

- 53. 156 China Internet Leaders = Evolving from Info-Only to On-Demand Service Providers Search engine Baidu Life Local restaurant / entertainment / delivery... 58.com Classified ad listings 58 Daojia Owned & operated home services provider Hillhouse Capital

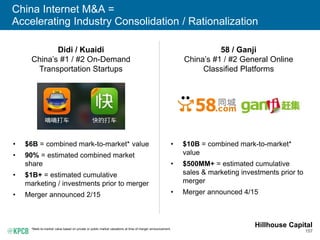

- 54. 157 China Internet M&A = Accelerating Industry Consolidation / Rationalization *Mark-to-market value based on private or public market valuations at time of merger announcement. Didi / Kuaidi ChinaŌĆÖs #1 / #2 On-Demand Transportation Startups ŌĆó $6B = combined mark-to-market* value ŌĆó 90% = estimated combined market share ŌĆó $1B+ = estimated cumulative marketing / investments prior to merger ŌĆó Merger announced 2/15 58 / Ganji ChinaŌĆÖs #1 / #2 General Online Classified Platforms ŌĆó $10B = combined mark-to-market* value ŌĆó $500MM+ = estimated cumulative sales & marketing investments prior to merger ŌĆó Merger announced 4/15 Hillhouse Capital

- 55. 158 China E-Commerce = Low Take Rates* Helped China Marketplace Leaders Pass USA Peers Source: Meituan gross billings data are estimates by Tuan800.com, eBay, Groupon, Alibaba GMV data per company. Note: Take rate defined as net revenue divided by gross merchandise value or gross billings. eBay marketplace take rate excludes PayPal (~3%), eBay, Alibaba GMV data per company. Meituan take rate is estimate per media report. Gross Merchandise Value, 2004 ŌĆō 2014 eBay vs. Alibaba (Taobao / Tmall) Gross Billings, 2009 ŌĆō 2014 Groupon N. America vs. Meituan $0 $100 $200 $300 $400 2004 2006 2008 2010 2012 2014 GrossMerchandiseVolume($B) eBay Global Marketplace Take Rate = ~8% Taobao / Tmall Take Rate = ~3% $0 $2 $4 $6 $8 2009 2010 2011 2012 2013 2014 GrossBillings($B) Groupon North America Take Rate = ~35% Meituan Take Rate = ~5% Hillhouse Capital

- 56. 151 Tencent WeChat = Massive Scale + Engagement... Billions of Red Envelopes Sent / Received on 1 Day Source: Tencent. Note: For context, around AmericaŌĆÖs most viewed live events Super Bowl 2015, Twitter recorded 28 million tweets and Facebook recorded 265 million posts. User-Initiated Red Envelope Sends in Group Chats Randomized Gift Amount = Fun + Social Sponsor-Initiated Red Envelope Gifts with TV prompts User Shake = Get Gift + Follow Sponsor WeChat Account 1B Virtual Red Envelopes Sent Chinese New YearŌĆÖs Eve ŌĆō 2/18/15 11B Shakes from 20MM Users CCTVŌĆÖs New Year Gala TV Show Hillhouse Capital

- 57. 152 Tencent WeChat = Major Video Distribution Channel... Shaping Social Debate Source: CTR Market ResearchŌĆÖs online survey of 1,580 respondents, Kantar China Insights, Tencent. *Monthly active users as of 1Q15. ŌĆśUnder the DomeŌĆÖ 200MM Views Within 3 Days of Release (2/15) Long-Form Documentary Film (103 minutes) Investigation of Smog in China ŌĆśUnder the DomeŌĆÖ Viewer Distribution by Channel 41% Others Weibo News / video mobile app News / video website WeChat 0% 10% 20% 30% 40% 50% Hillhouse Capital

- 58. 176 Technology-Related Company Investing Observations ŌĆó Booms / Busts ŌĆō In periods of material business disruption ŌĆō like those brought about by the evolutions of the Internet ŌĆō company creation typically goes through a boom bust boom-let cycle while wealth creation typically goes through a boom-let bust boom cycle. ŌĆó Valuations ŌĆō There are pockets of Internet company overvaluation but there are also pockets of undervaluation ŌĆō the one rule is that very few companies will win ŌĆō those that do ŌĆō can win big. ŌĆó Platforms ŌĆō Race is won by those that build platforms & drive free cash flow over long-term (a decade or more). ŌĆó Free Cash Flow ŌĆō Value of a business, over time, is the present value of its future cash flows.

![143

Uber, Lyft... = Facing Confusion in Regulatory Environment

Related to Worker Classification System

Source: Cotter vs. Lyft Inc., et al Order Denying Cross-Motions for Summary Judgment, 3/15.

National Law Review, 3/15

California law defines whether workers are employees or independent

contractors, and thereŌĆÖs a test, but the test and classification system

are woefully outdated...

...It seems to me, as a matter of common sense, that Lyft drivers donŌĆÖt

fall into the traditional understanding of [the two

classifications]. They seem to fall into a third category....

The jury in this case will be handed a square peg and asked to choose

between two round holes. The test the California courts have

developed over the 20th Century for classifying workers isn't very

helpful in addressing this 21st Century problem...

- Judge Vince Chhabria, U.S. District Judge Presiding Over Cotter vs. Lyft Inc., et al

*Note that Lyft was eventually denied motion for summary judgement & case will need to be decided by a jury.](https://image.slidesharecdn.com/mergeddocument-150601200417-lva1-app6891/85/The-Platform-Cheatsheet-to-Mary-Meeker-s-Internet-Trends-Deck-44-320.jpg)

![145

StubHub = Faced Confusion in Regulatory Environment &

Proved Marketplaces Can Be RegulatorsŌĆÖ Allies

Source: ŌĆ£Lessons from a ScalperŌĆØ by David Harrington, Kenyon College, Spring 2009.

ŌĆ£A Brief Overview on Ticket Scalping Laws, Secondary Ticket Markets, and the StubHub Effect,ŌĆØ Entertainment and Sports Lawyer, 11/12.

Original Intent of Anti-Scalping Laws (passed in 1920s) = Protect Consumers...

...the law ŌĆśmerely prohibitsŌĆÖ scalpers and ticket brokers from charging excessive prices and

thereby ŌĆśend[s] the extortionŌĆÖ of the public...

StubHub When Founded in 2000 = Faced Many Anti-Scalping Law Barriers...

>20 states prohibited some form of ticket resale...for example, Alabama / Massachusetts

require licenses...in Indiana, one couldnŌĆÖt sell tickets to boxing matches...

StubHub in 2015 = Legal in Nearly All States & Has Helped Provide...

ŌĆó Marketplace Liquidity = Can help prevent excessive pricing (ŌĆśextortion of publicŌĆÖ)

ŌĆó Trust & Safety / Transparency = Likes of ratings / feedback systems can help find /

remove bad actors

With passage of time (& collaboration), StubHub has helped regulators do

their jobs ŌĆō effectively regulate what they had intended to regulate all along.](https://image.slidesharecdn.com/mergeddocument-150601200417-lva1-app6891/85/The-Platform-Cheatsheet-to-Mary-Meeker-s-Internet-Trends-Deck-46-320.jpg)