Cr├®dit Agricole 2016 - Financial objectives of Cr├®dit Agricole Group and Cr├®dit Agricole SA

1 like973 views

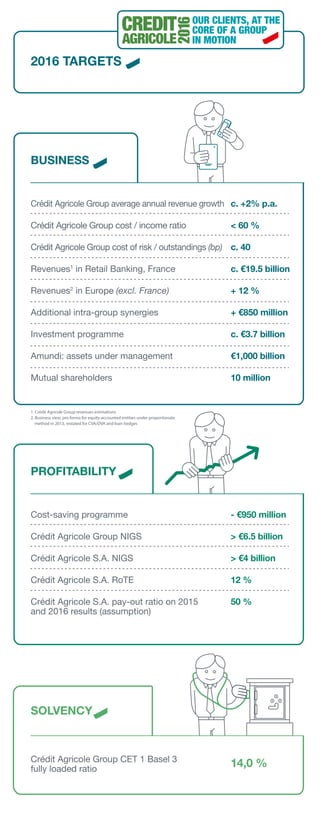

The document discusses Cr├®dit Agricole Group's financial performance, highlighting an average annual revenue growth, a cost/income ratio of under 60%, and a significant investment program with revenues reaching Ōé¼19.5 billion in retail banking. It also mentions the group's cost-saving measures and solvency metrics, such as a CET1 ratio of 14.0% and profitability targets for 2016. Additional details include mutual shareholders' growth, asset management figures, and pay-out ratios for previous years.

1 of 1

Download to read offline

More Related Content

Viewers also liked (10)

PPTX

ąæą░čÅąĮ-ė©ą╗ą│ąĖą╣ ą░ą╣ą╝ą│ąĖą╣ąĮ ąźčāą┤ą░ą╗ą┤ą░ąĮ ą░ą▓ą░čģ ą░ąČąĖą╗ą╗ą░ą│ą░ą░ąĮčŗ ą░ą╗ą▒ą░ąĮčŗ 2014 ąŠąĮčŗ 껹╣ą╗ ą░ąČąĖą╗ą╗ą░ą│ą░ą░ąĮčŗ ...Makhanbyet Adai╠²

ąæą░čÅąĮ-ė©ą╗ą│ąĖą╣ ą░ą╣ą╝ą│ąĖą╣ąĮ ąźčāą┤ą░ą╗ą┤ą░ąĮ ą░ą▓ą░čģ ą░ąČąĖą╗ą╗ą░ą│ą░ą░ąĮčŗ ą░ą╗ą▒ą░ąĮčŗ 2014 ąŠąĮčŗ 껹╣ą╗ ą░ąČąĖą╗ą╗ą░ą│ą░ą░ąĮčŗ ...Makhanbyet Adai

╠²

Similar to Cr├®dit Agricole 2016 - Financial objectives of Cr├®dit Agricole Group and Cr├®dit Agricole SA (20)

PDF

Banco Santander delivers on its targets and earns EUR 5.966 million (+3%), wi...BANCO SANTANDER╠²

PDF

SantanderŌĆÖs 2012 attributable net profit was EUR 2.205 billion (-59%), after ...BANCO SANTANDER╠²

Ad

More from Groupe Cr├®dit Agricole (20)

PDF

R├®sultats du 1er semestre et du 2├©me trimestre 2014 du groupe Cr├®dit AgricoleGroupe Cr├®dit Agricole╠²

PDF

Une nouvelle fa├¦on de travailler dans les entreprises : l'intrapreneuriatGroupe Cr├®dit Agricole╠²

PDF

Cr├®dit Agricole Immobilier : acheter un logement neuf, un parcours tr├©s connect├®Groupe Cr├®dit Agricole╠²

PDF

Cr├®dit Agricole 2016 - Objectifs financiers du Groupe et de Cr├®dit Agricole SAGroupe Cr├®dit Agricole╠²

PDF

Cr├®dit Agricole SA - Rapport de responsabilit├® sociale dŌĆÖentreprise 2012-2013Groupe Cr├®dit Agricole╠²

PDF

Nouvelle solution de paiement du groupe Cr├®dit Agricole : Smart TPE et Monem ...Groupe Cr├®dit Agricole╠²

PDF

Motivation et m├®morisation : comment rendre une formation plus efficace ?Groupe Cr├®dit Agricole╠²

R├®sultats du 1er semestre et du 2├©me trimestre 2014 du groupe Cr├®dit AgricoleGroupe Cr├®dit Agricole

╠²

Cr├®dit Agricole Immobilier : acheter un logement neuf, un parcours tr├©s connect├®Groupe Cr├®dit Agricole

╠²

Cr├®dit Agricole 2016 - Objectifs financiers du Groupe et de Cr├®dit Agricole SAGroupe Cr├®dit Agricole

╠²

Cr├®dit Agricole SA - Rapport de responsabilit├® sociale dŌĆÖentreprise 2012-2013Groupe Cr├®dit Agricole

╠²

Nouvelle solution de paiement du groupe Cr├®dit Agricole : Smart TPE et Monem ...Groupe Cr├®dit Agricole

╠²

Ad

Cr├®dit Agricole 2016 - Financial objectives of Cr├®dit Agricole Group and Cr├®dit Agricole SA

- 1. Cr├®dit Agricole Group average annual revenue growth Cr├®dit Agricole Group cost / income ratio Cr├®dit Agricole Group cost of risk / outstandings (bp) Revenues1 in Retail Banking, France Revenues2 in Europe (excl. France) Additional intra-group synergies Investment programme Amundi: assets under management Mutual shareholders c. +2% p.a. < 60 % c. 40 c. Ōé¼19.5 billion + 12 % + Ōé¼850 million c. Ōé¼3.7 billion Ōé¼1,000 billion 10 million BUSINESS Cost-saving programme Cr├®dit Agricole Group NIGS Cr├®dit Agricole S.A. NIGS Cr├®dit Agricole S.A. RoTE Cr├®dit Agricole S.A. pay-out ratio on 2015 and 2016 results (assumption) - Ōé¼950 million > Ōé¼6.5 billion > Ōé¼4 billion 12 % 50 % PROFITABILITY Cr├®dit Agricole Group CET 1 Basel 3 fully loaded ratio 14,0 % SOLVENCY 2016 TARGETS CREDIT AGRICOLE OUR CLIENTS, AT THE CORE OF A GROUP IN MOTION 2016 1. Cr├®dit Agricole Group revenues estimations 2. Business view, pro forma for equity-accounted entities under proportionate method in 2013, restated for CVA/DVA and loan hedges