Modern portfolio theory

- 2. EFFICIENT PORTFOLIO âĒ An efficient portfolio is a portfolio maximize the expected return with a certain level of risk that is willing underwritten, or portfolio that offers the lowest risk with a certain rate of return. âĒ Smallest portfolio risk for a given level of expected return âĒ Largest expected return for a given level of portfolio risk âĒ From the set of all possible portfolios âĒ Only locate and analyze the subset known as the efficient set âĒ Lowest risk for given level of return

- 3. âĒ All other portfolios in attainable set are dominated by efficient set âĒ Global minimum variance portfolio âĒ Smallest risk of the efficient set of portfolios âĒ Efficient set âĒ Part of the efficient frontier with greater risk than the global minimum variance portfolio

- 4. 7-4 x B A C y Risk = ïģ E(R) âĒ Efficient frontier or Efficient set (curved line from A to B) âĒ Global minimum variance portfolio (represented by point A)

- 5. OPTIMUM PORTFOLIO âĒ The optimal portfolio is a portfolio chosen by investors from many the choices that are in the collection efficient portfolio. âĒ The portfolio chosen by investors is portfolio according to preference the investor is concerned with return and against willing risks bear.

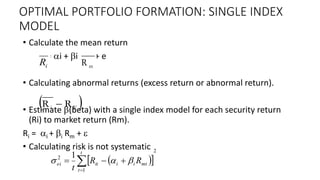

- 6. OPTIMAL PORTFOLIO FORMATION: SINGLE INDEX MODEL âĒ Calculate the mean return = ïĄi + ïĒi + e âĒ Calculating abnormal returns (excess return or abnormal return). âĒ Estimate ïĒ(beta) with a single index model for each security return (Ri) to market return (Rm). Ri = ïĄi + ïĒi Rm + ïĨ âĒ Calculating risk is not systematic iR mR ïĻ ïĐFi RR ï ïĻ ïĐï ï 2 1 2 1 ïĨï― ïŦïï― t t mtiiitei RR t ïĒïĄïģ

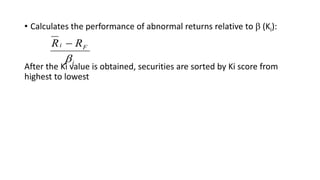

- 7. âĒ Calculates the performance of abnormal returns relative to ïĒ (Ki): After the Ki value is obtained, securities are sorted by Ki score from highest to lowest i Fi RR ïĒ ï

- 8. MARKOWITZ PORTFOLIO MODEL âĒ Portfolio theory with the Markowitz model based on three assumptions, namely: âĒ Single investment period, for example 1 year. âĒ There are no transaction fees. âĒ Investor preferences are just based on expected returns and risks. âĒ Markowitz Diversification âĒ Non-random diversification âĒ Active measurement and management of portfolio risk âĒ Investigate relationships between portfolio securities before making a decision to invest âĒ Takes advantage of expected return and risk for individual securities and how security returns move together

- 9. âĒ Simplifying Markowitz Calculations âĒ Markowitz full-covariance model âĒ Requires a covariance between the returns of all securities in order to calculate portfolio variance âĒ n(n-1)/2 set of covariances for n securities âĒ Markowitz suggests using an index to which all securities are related to simplify

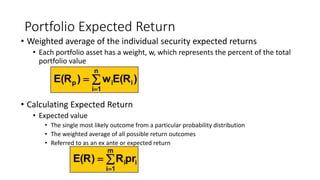

- 10. Portfolio Expected Return âĒ Weighted average of the individual security expected returns âĒ Each portfolio asset has a weight, w, which represents the percent of the total portfolio value âĒ Calculating Expected Return âĒ Expected value âĒ The single most likely outcome from a particular probability distribution âĒ The weighted average of all possible return outcomes âĒ Referred to as an ex ante or expected return ïĨ ï― ï― n 1i iip )R(Ew)R(E i m 1i iprR)R(E ïĨ ï― ï―

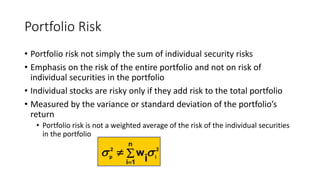

- 11. Portfolio Risk âĒ Portfolio risk not simply the sum of individual security risks âĒ Emphasis on the risk of the entire portfolio and not on risk of individual securities in the portfolio âĒ Individual stocks are risky only if they add risk to the total portfolio âĒ Measured by the variance or standard deviation of the portfolioâs return âĒ Portfolio risk is not a weighted average of the risk of the individual securities in the portfolio 2 i 2 p n 1i i w ïģïģ ïĨ ï― ïđ

- 12. Risk Reduction in Portfolios âĒ Assume all risk sources for a portfolio of securities are independent âĒ The larger the number of securities the smaller the exposure to any particular risk âĒ âInsurance principleâ âĒ Only issue is how many securities to hold âĒ Random diversification âĒ Diversifying without looking at relevant investment characteristics âĒ Marginal risk reduction gets smaller and smaller as more securities are added âĒ A large number of securities is not required for significant risk reduction âĒ International diversification benefits

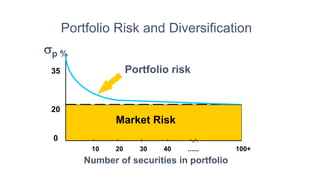

- 13. Portfolio Risk and Diversification ïģp % 35 20 0 Number of securities in portfolio 10 20 30 40 ...... 100+ Portfolio risk Market Risk

- 14. Calculating Portfolio Risk âĒ Encompasses three factors âĒ Variance (risk) of each security âĒ Covariance between each pair of securities âĒ Portfolio weights for each security âĒ Goal: select weights to determine the minimum variance combination for a given level of expected return âĒ Generalizations âĒ the smaller the positive correlation between securities, the better âĒ Covariance calculations grow quickly âĒ n(n-1) for n securities âĒ As the number of securities increases: âĒ The importance of covariance relationships increases âĒ The importance of each individual securityâs risk decreases

- 15. Measuring Portfolio Risk âĒ Needed to calculate risk of a portfolio: âĒ Weighted individual security risks âĒ Calculated by a weighted variance using the proportion of funds in each security âĒ For security i: (wi à ïģi)2 âĒ Weighted comovements between returns âĒ Return covariances are weighted using the proportion of funds in each security âĒ For securities i, j: 2wiwj à ïģij