Monnaie Money Newsletter - May 2013

- 1. MONNAIEMONEY FINANCIAL LITERACY PROJECT Newsletter My ┬ĀPriorities! ┬ĀMy ┬Ā Future! ┬Ā May 10th , 2013 Financial literacy provides the foundation of saving and investing wisely. It is the basics for the responsible use of credit and money and the making informed financial decisions that can affect our families and our future. The MonnaieMoney Financial Literacy Project will provide fundamental tools for youth. The objective of the project is to bridge the gap between what people know and what they need to know with respect to personal financial skills and provide opportunities for personal empowerment and enhanced self-sufficiency. For the past four years the Carrefour jeunesse-emploi de C├┤te-des-Neiges and the Jamaican Canadian Community WomenŌĆÖs League of Montreal Inc. have been very active in promoting financial literacy to the wider community in the city of Montreal. Content 1 2 3 4

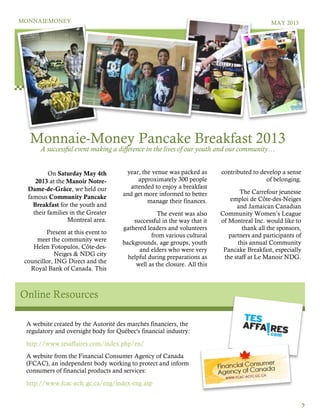

- 2. MONNAIEMONEY MAY 2013 2 Monnaie-Money Pancake Breakfast 2013 1 On Saturday May 4th 2013 at the Manoir Notre- Dame-de-Gr├óce, we held our famous Community Pancake Breakfast for the youth and their families in the Greater Montreal area. Present at this event to meet the community were Helen Fotopulos, C├┤te-des- Neiges & NDG city councillor, ING Direct and the Royal Bank of Canada. This A successful event making a difference in the lives of our youth and our communityŌĆ” 2 year, the venue was packed as approximately 300 people attended to enjoy a breakfast and get more informed to better manage their finances. The event was also successful in the way that it gathered leaders and volunteers from various cultural backgrounds, age groups, youth and elders who were very helpful during preparations as well as the closure. All this 3 contributed to develop a sense of belonging. The Carrefour jeunesse emploi de C├┤te-des-Neiges and Jamaican Canadian Community WomenŌĆÖs League of Montreal Inc. would like to thank all the sponsors, partners and participants of this annual Community Pancake Breakfast, especially the staff at Le Manoir NDG. Online Resources A website created by the Autorit├® des march├®s financiers, the regulatory and oversight body for Qu├®bec's financial industry: http://www.tesaffaires.com/index.php/en/ A website from the Financial Consumer Agency of Canada (FCAC), an independent body working to protect and inform consumers of financial products and services: http://www.fcac-acfc.gc.ca/eng/index-eng.asp

- 3. MONNAIEMONEY MAY 2013 3 ┬Ā 1 ┬Ā ┬Ā On ┬ĀApril ┬Ā25th, ┬Ā2013, ┬Āwe ┬Ā presented ┬Āof ┬Āour ┬Āfinancial ┬Ā education ┬Āproject ┬ĀMonnaie ┬Ā Money ┬Āby ┬Āaddressing ┬Āstatistics ┬Ā regarding ┬Āthe ┬Āfinancial ┬Āhealth ┬Ā of ┬Āthe ┬ĀCanadian ┬Āyouth ┬Ā population ┬Āas ┬Āwell ┬Āas ┬Ātopics ┬Ā discussed ┬Āwith ┬Āyoung ┬Āpeople ┬Ā targeted ┬Āby ┬Āthis ┬Āproject ┬Ā through ┬Āour ┬Āworkshops ┬Ā(need, ┬Ā desire, ┬Ābudget, ┬Āconsumption, ┬Ā savings, ┬Āetc.). ┬Ā ┬Ā The ┬Āpresentation ┬Āwas ┬Āgiven ┬Āat ┬Ā the ┬ĀUniversit├® ┬Ādu ┬ĀQu├®bec ┬Āde ┬Ā Montr├®al ┬Ā(UQ├ĆM), ┬Āby ┬ĀMaleesa ┬Ā Phommavongsay, ┬Ā administrative ┬Āassistant ┬Āand ┬Ā Monnaie ┬ĀMoney ┬Āproject ┬Ā facilitator ┬Āas ┬Āwell ┬Āas ┬Āa ┬Ā2008 ┬Ā graduate ┬Āof ┬ĀUQ├ĆM. ┬Ā ┬Ā The ┬Āpresentation ┬Āwas ┬Ā requested ┬Āfrom ┬Āthe ┬ĀAssociation ┬Ā des ┬Āresponsables ┬ĀdŌĆÖaide ┬Ā financi├©re ┬Ādes ┬Āuniversit├®s ┬Ādu ┬Ā Quebec, ┬Āa ┬Āgroup ┬Āof ┬Ā professionals ┬Āfrom ┬Ā17 ┬Ādifferent ┬Ā universities ┬Āthat ┬Āis ┬Āalso ┬Ā concerned ┬Āabout ┬Āthe ┬Ādebt ┬Āof ┬Ā local ┬Āas ┬Āwell ┬Āas ┬Āforeign ┬Āstudent ┬Ā leaders. ┬Ā 2 ┬Ā ┬Ā ┬ĀIt ┬Āshowed ┬Āresults ┬Āfrom ┬Āa ┬Āstudy ┬Ā of ┬Āthe ┬ĀFinancial ┬ĀConsumer ┬Ā Agency ┬Āof ┬ĀCanada ┬Ā(FCAC) ┬Ā which ┬Āhad ┬Āstatistics ┬Āabout ┬Ā debt, ┬Āincluding ┬Āoverall ┬Āstudent ┬Ā debts, ┬Āusage ┬Āof ┬Āfinancial ┬Ā products ┬Āand ┬Āservices. ┬Ā ┬Ā ┬Ā Most ┬Āstudents ┬Āare ┬Āhaving ┬Āa ┬Ā hard ┬Ātime ┬Āto ┬Āpay ┬Āoff ┬Ātheir ┬Ā credit ┬Ācards ┬Āas ┬Āwell ┬Āas ┬Ātheir ┬Ā school ┬Āloans. ┬Ā36% ┬Āof ┬Āyoung ┬Ā Canadians ┬Āhave ┬Āa ┬Ādebt ┬Āof ┬Āover ┬Ā 10 ┬Ā000$ ┬Āand ┬Āmore ┬Āand ┬Ā1 ┬Āout ┬Āof ┬Ā 5 ┬Āreported ┬Āa ┬Ādebt ┬Āof ┬Ā20 ┬Ā000$ ┬Ā and ┬Āmore.1 ┬Ā ┬Ā ┬Ā Also, ┬Āabout ┬Āfour ┬Āin ┬Āten ┬Āyoung ┬Ā Canadians ┬Ā(37%) ┬Āreport ┬Āthat ┬Ā there ┬Āhas ┬Ābeen ┬Āat ┬Āleast ┬Āone ┬Ā month ┬Āin ┬Āthe ┬Āpast ┬Āyear ┬Āwhen ┬Ā they ┬Ādid ┬Ānot ┬Āhave ┬Āenough ┬Ā money ┬Āto ┬Ācover ┬Ātheir ┬Āexpenses. ┬Ā 3 ┬Ā In ┬Āconclusion, ┬Āthere ┬Āneeds ┬Āto ┬Ā be ┬Āmore ┬Āpartnerships ┬Ā between ┬Ācommunity ┬Ā organizations ┬Āworking ┬Āin ┬Ā financial ┬Āliteracy ┬Āand ┬Āthe ┬Ā school ┬Āsystem. ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā ┬Ā 1Source: ┬ĀFinancial ┬ĀConsumer ┬Ā Agency ┬Āof ┬ĀCanada ┬Ā(FCAC), ┬Ā http://www.fcac-┬ŁŌĆÉ acfc.gc.ca/eng/resources/surveyst udies/youthfinlit2008/youthfinlit2 008_04-┬ŁŌĆÉeng.asp ┬Ā UQ├ĆM Monnaie Money Special presentation

- 4. MONNAIEMONEY MAY 2013 4 5 Money saving tips for the summer! Spend your summer wiselyŌĆ” Cook out. Using the stove or baking in the oven creates a lot of excess heat in your house and uses a lot of electricity. Consider taking time to light up the barbecue, grill outside so that you can keep your house cooler. Dry laundry outside. If you have the ability to hang up laundry outside, let the sun and warm summer breeze do the drying for you. Even if you canŌĆÖt hang up clothes outside, try partially drying your clothes and letting the air dry the rest. Garden up. As the summer begins, it is a perfect time to be on the lookout for plant sales. Growing up your own vegetables and fruits is not only healthier for the body, but it can also save you money. Enjoy the great outdoors. Try camping instead of booking a resort. It can cost a fraction of the cost of a traditional vacation and it will be a unique experience you will remember. Check the National Park Services and look for a safe campsite near you. Ditch Your Car. With rising gas prices and nice weather, how much money could you save if you walk, bike or carpool to work? This may take some adjustment, plan ahead to change habits and you will save money as well as getting some exercise. Nothing like doing groceries by bike! Last but not leastŌĆ”Prepare your summer budget in advance! Need some help? Check out the online budget calculator of the AMF's site: http://www.tesaffaires.com/index.php/en/calculators/monthly-budget

- 5. Carrefour Jeunesse-Emploi de C├┤te-des-Neiges 6555, C├┤te-des-Neiges, # 240 Montreal, Quebec, H3S 2A6 Jamaican Canadian Community WomenŌĆÖs League of Montreal, Inc. 5465 Queen Mary Rd, # 300 Montreal, Quebec, H3X 1V5 UPCOMING COMMUNITY EVENTŌĆ” Join us for a free barbecue and some financial knowledge! Brian Smith, MonnaieMoney Project Coordinator (514) 342-5678 ext. 228 / (514) 817-3941 From 10 am to 1pm! DATE: July 1st , 2013