Mutual fund

- 2.  Mutual funds are a type of investment that takes money from many investors and uses it to make investments based on a stated investment objective. Each shareholder in the mutual fund participates proportionally (based upon the number of shares owned) in the gain or loss of the fund.

- 5.  Mutual funds offer investors an affordable way to diversify their investment portfolios.  Mutual funds allow investors the opportunity to have a financial stake in many different types of investments.  These investments include: stocks, bonds, money markets, real estate, commodities, etc…  Individually, an investor may be able to own stock in a few companies, a few bonds, and have money in a money market account. Participation in a mutual fund, however, allows the investor to have much greater exposure to each of these asset classes.

- 6. ď‚ž Professional Management ď‚ž Diversification ď‚ž Convenient Administration ď‚ž Return Potential ď‚ž Low Costs ď‚ž Liquidity ď‚ž Transparency ď‚ž Flexibility ď‚ž Choice of schemes ď‚ž Tax benefits ď‚ž Well regulated

- 7.  No control over costs: The investor pays investment management fees as long as he remains with the fund, even while the value of his investments are declining. He also pays for funds distribution charges which he would not incur in direct investments.  No tailor-made portfolios: The very high net-worth individuals or large corporate investors may find this to be a constraint as they will not be able to build their own portfolio of shares, bonds and other securities.  Managing a portfolio of funds: Availability of a large number of funds can actually mean too much choice for the investor. So, he may again need advice on how to select a fund to achieve his objectives.  Delay in redemption: It takes 3-6 days for redemption of the units and the money to flow back into the investor’s account.

- 8. ď‚ž 1. Equity Instruments like shares form only a part of the securities held by mutual funds. Mutual funds also invest in debt securities which are relatively much safer. ď‚ž 2. The biggest advantage of Mutual Funds is their ability to diversify the risk. ď‚ž 3. Mutual Funds are their in India since 1964. Mutual Funds market is very evolved in U.S.A and is there for the last 60 years. ď‚ž 4. Mutual Funds are the best solution for people who want to manage risks and get good returns. ď‚ž 5. The truth is as an investor you should always pay attention to your mutual funds and continuously monitor them. There are various funds to suit investor needs, both as a long term investment vehicle or as a very short term cash management vehicle.

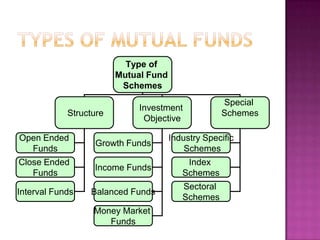

- 9. Type of Mutual Fund Schemes Special Investment Structure Schemes Objective Open Ended Industry Specific Growth Funds Funds Schemes Close Ended Index Income Funds Funds Schemes Sectoral Interval Funds Balanced Funds Schemes Money Market Funds

- 10. ď‚ž Limited risk: Mutual funds are diversification in action and hence do not rely on the performance of a single entity. ď‚ž Convenience: You can invest directly with a fund house, or through your bank or financial adviser, or even over the internet. ď‚ž Investor protection: A mutual fund in India is registered with SEBI, which also monitor the operations of the fund to protect your interests. ď‚ž Quick access to your money: It's good to know that should you need your money at short notice, you can usually get it in four working days. ď‚ž Transparency: As an investor, you get updates on the value of your units, information on specific investments made by the mutual fund and the fund manager's strategy and outlook. ď‚ž Low transaction costs: A mutual fund, by sheer scale of its investments is able to carry out cost-effective brokerage transactions. ď‚ž Tax benefits: Over the years, tax policies on mutual funds have been favorable to investors and continue to be so.