1 of 17

Download to read offline

Ad

Recommended

The Irish Economy Going Into 2011: Prospects of an Export Led Recovery

The Irish Economy Going Into 2011: Prospects of an Export Led Recoverys.coffey

╠²

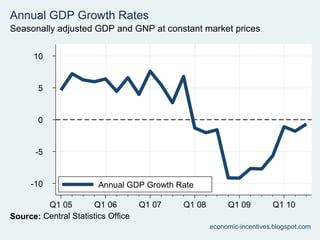

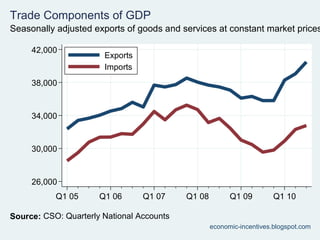

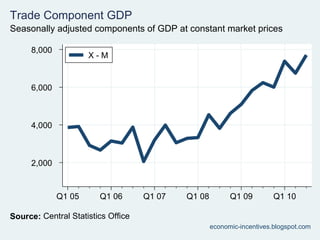

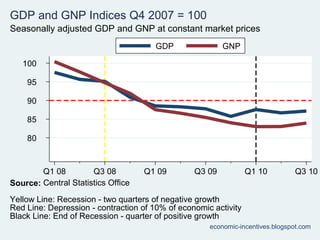

The Irish economy is turning the corner towards recovery in 2011 according to the Minister's statement on the 2010 Exchequer Returns. The public finances have stabilized and economic data from the third quarter of 2010 supports achieving the targets in Budget 2011. Export-led growth has been the government's strategy and it is working, with exports reaching an all-time high in 2010 and growing 6.2% over 2009, led by strong performances in manufacturing and agri-food. While the state continues to borrow more than sustainable, following the National Recovery Plan provides real grounds for optimism about the Irish economy entering 2011.CSO Quarterly National Accounts 2014 Q2

CSO Quarterly National Accounts 2014 Q2s.coffey

╠²

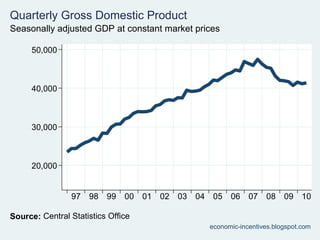

The document contains quarterly national accounts data from Ireland for 2005-2014. It includes time series charts and tables showing trends in key macroeconomic indicators such as GDP, GNP, consumption, investment, exports, imports and economic growth rates. Overall GDP growth was positive in 2014 Q2 according to the seasonally adjusted constant price data.CSO Data March 2010

CSO Data March 2010s.coffey

╠²

The document outlines the value of exports categorized by commodity types in millions of euros, indicating a total decrease of 2.6% from 2008. Notably, chemicals and related products constitute 57.3% of exports, showing an 8.4% increase, while food and live animals saw a significant 12.9% decline. Furthermore, the export performance by country shows varying changes, with the USA experiencing an 8.5% increase, while Great Britain and Germany faced declines of 14.3% and 21.2%, respectively.Business Planning Seminar

Business Planning Seminars.coffey

╠²

The macroeconomic environment in Ireland in 2009 presents challenges for business planning. Unemployment is high at 11% while inflation is low at -2.6%. Tax revenue has dropped significantly in just two years, falling over 30%. Further deterioration in the labor market is likely to increase social welfare spending and decrease tax revenue. In response, governments worldwide have announced massive stimulus spending packages totaling trillions of dollars, but there is uncertainty around where this money will come from and its effects.Budget 2011

Budget 2011s.coffey

╠²

The document discusses budget 2011 and government expenditure from the perspective of Seamus Coffey in the Department of Economics. It focuses on expenditure savings for central government spending. However, it notes that there is one little problem with the expenditure savings plans.Practice Day Presentation 2010

Practice Day Presentation 2010s.coffey

╠²

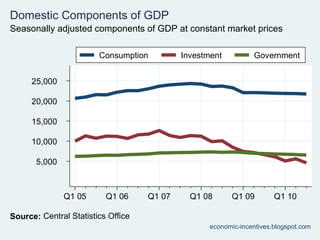

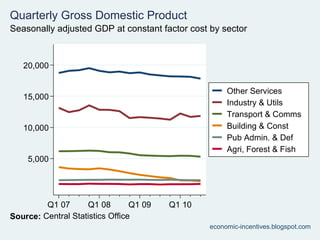

The document analyzes Ireland's economic performance in 2010. It shows that while consumption and investment continued declining in the first three quarters of 2009, exports remained relatively stable. The sectors hit hardest by the recession were building/construction and agriculture. The largest export markets were the US, Belgium, and UK, though exports declined to most countries. NAMA is expected to pay Ōé¼54 billion to acquire Ōé¼77 billion in bank loans now valued at Ōé¼47 billion, representing a 30% haircut. AIB estimates it will transfer Ōé¼23 billion in loans to NAMA and receive Ōé¼19 billion in return, an 18% discount.Six-Pack, Two-Pack and the Fiscal Compact

Six-Pack, Two-Pack and the Fiscal Compacts.coffey

╠²

The document discusses the Six-Pack, Two-Pack and Fiscal Compact which introduced stricter fiscal rules for EU countries. It outlines the key provisions including medium-term budgetary objectives of -1% to balance of GDP, annual improvements of 0.5% of GDP to structural balance, and reducing excess debt by 1/20th annually. It also examines macroeconomic indicators for Ireland like growth, deficits, debt levels, and concludes that increased monitoring and enforcement aims to prevent future crises but may not solve the ongoing crisis.The Continuing Constraints on Ireland's Public Finances

The Continuing Constraints on Ireland's Public Financess.coffey

╠²

Ireland still faces constraints on its public finances from deficits and high debt levels, though debt is falling. While expenditure remains high, approximately 80% of corporation tax revenue comes from multinational corporations, highlighting Ireland's vulnerability. To better prepare for economic downturns, fiscal policy should assess balances and debt levels based on GNP rather than GDP, set aside corporate tax revenues equivalent to half the tax rate in a stability fund, and allow withdrawals from this fund during periods of low growth.National Accounts 2015 Q2

National Accounts 2015 Q2s.coffey

╠²

This document contains quarterly national accounts data from Ireland for the years 2005-2015. It includes time series charts showing trends in GDP, GNP, consumption, investment, exports, imports and other economic indicators. GDP growth was positive in 2015 Q2 after a long period of recovery from the economic downturn. The data provides a statistical overview of Ireland's economic performance and the contributions of different components to economic growth.Presentation to Institute of Directors on Q2 economic data

Presentation to Institute of Directors on Q2 economic datas.coffey

╠²

This document analyzes Ireland's recent economic growth and whether it represents a true recovery or statistical anomaly. It provides statistics showing that Ireland's GDP and GNP have grown significantly in recent years, with GDP growth reaching 7.7% in 2014, the fastest pace since 2007. This growth has been driven by a rebound in domestic demand and a strong increase in exports. Economists and media outlets have reacted positively but some question if the strength of the recovery can be sustained.Presentation to Social Media Conference

Presentation to Social Media Conferences.coffey

╠²

The document discusses Ireland's growing public debt crisis. It estimates that Ireland's general government debt will reach approximately Ōé¼250 billion by 2014, up drastically from Ōé¼47 billion in 2007. This growth is primarily due to large budget deficits from 2008-2011, billions borrowed to recapitalize banks, and promissory notes issued to distressed financial institutions. While some assets may offset this debt, sustainability concerns remain due to risks of further bank losses, deficit overruns, and debt interest costs totaling billions annually. The outlook remains uncertain depending on maintaining deficit reduction and economic recovery.Fiscal treaty

Fiscal treatys.coffey

╠²

The document discusses the key fiscal rules and targets contained in the proposed Fiscal Stability Treaty, including:

- Limiting annual deficits to 3% of GDP and requiring debt levels not exceed 60% of GDP (Maastricht criteria)

- Requiring structural deficits be reduced by between 0.75-1.5% of GDP annually if above limits (Public Finances Correction Rule)

- Limiting expenditure growth to potential GDP growth in strong economic times (Sustainable Expenditure Growth Rule)

- Additional measures like macroeconomic imbalance scorecard and linking access to ESM funds on ratifying the treaty.MBA Presentation on The Irish Economy

MBA Presentation on The Irish Economys.coffey

╠²

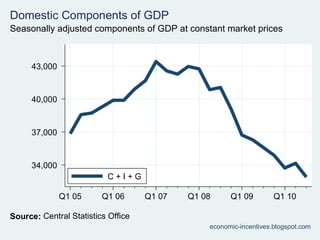

The document contains graphs and data on key Irish economic indicators such as GDP, components of GDP, trade balances, imports and exports from 2005-2011. It shows that after steady growth, GDP declined in 2008-2009 due to the financial crisis but resumed growing in 2010-2011. Exports initially drove growth but were later balanced by increasing domestic demand.Ireland's Public Debt Crisis

Ireland's Public Debt Crisiss.coffey

╠²

1) Professor Morgan Kelly warned in several Irish Times articles between 2006-2011 that Ireland's public debt crisis could result in national bankruptcy as property prices collapsed, unemployment rose, and bank losses mounted.

2) Kelly estimated that Ireland's total government debt could reach Ōé¼250 billion by 2014 due to annual deficits, bank bailouts, and promissory note interest. Others argued Kelly's estimate was too high by Ōé¼50-60 billion.

3) Breaking down potential debt sources, the author estimates Ireland's government debt could realistically reach Ōé¼210 billion by 2014, with bank-related debt accounting for 25% of the total and annual deficits contributing Ōé¼100 billion overall.Government spending

Government spendings.coffey

╠²

The government spends money on many programs and services each year. In 2009, the largest areas of central government spending were on healthcare at 24% of the budget, education at 15%, and social security benefits at 14%. Defense spending accounted for another 12% while interest on the national debt made up 7% of central government expenditures.From Ōé¼3 billion to Ōé¼6 billion

From Ōé¼3 billion to Ōé¼6 billions.coffey

╠²

The document discusses how Ireland's budget deficit projection increased from Ōé¼3 billion to Ōé¼6 billion between 2009 and 2010. This Ōé¼3 billion increase was due to several factors: Ōé¼1 billion from reductions to nominal GDP projections, Ōé¼1 billion from the continued deterioration of public finances, and Ōé¼1 billion from lowering the target for the general government balance (GGB) from 10% to 9.3% of GDP. Reduced growth forecasts did not contribute to the increased deficit projection.CSO Data September 2010

CSO Data September 2010s.coffey

╠²

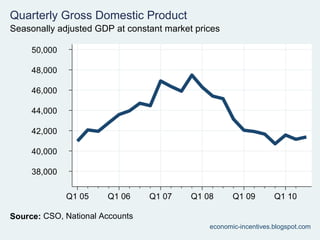

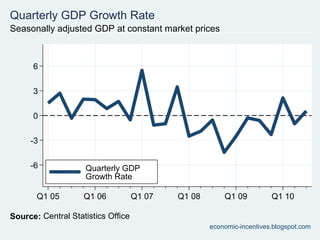

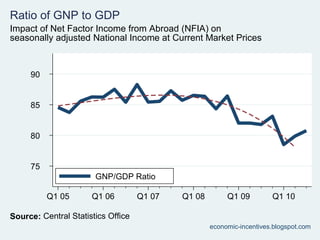

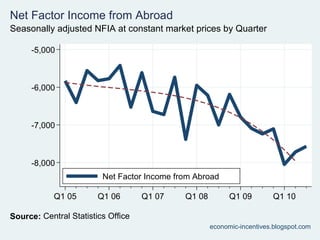

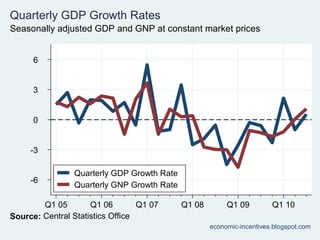

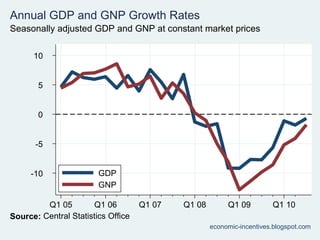

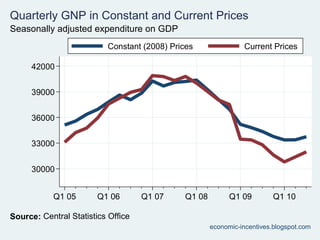

The document discusses quarterly GDP and GNP statistics from 2005 and 1997. It contains information on gross domestic product and gross national product for multiple quarters and years.CSO Data September 2010

CSO Data September 2010s.coffey

╠²

GDP and GNP figures for 2005 are presented on a quarterly basis. The document also contains quarterly GDP and GNP data from 1997. Overall, the document provides economic performance data from two different years broken down by quarter.The Black Economy In Ireland

The Black Economy In Irelands.coffey

╠²

The document provides an overview of methods used to estimate the size of the black economy in Ireland. It summarizes international estimates that range from 2-28% of GDP depending on the method. A monetary method is then applied to Ireland which estimates the black economy was around 11% of GNP in 1995, equivalent to ┬Ż3.6 billion. The estimate suggests the black economy has increased over time from low levels in the 1960s, rising steadily to 5.5% of GNP in 1979 and then more rapidly in the 1980s due to rising tax burden.A Natural Experiment in the Prisoner's Dilemma

A Natural Experiment in the Prisoner's Dilemmas.coffey

╠²

This document analyzes data from the TV game show Goldenballs to study how participants make choices in prisoner's dilemma situations. In the final round, two contestants split or steal a jackpot. Players cooperated (split) 48% of the time, with males cooperating more than females and young players cooperating more than mature players. There was more cooperation between genders than within genders. Players in the same age category cooperated more than those of different ages. Mature players were most efficient at converting jackpots into winnings.Compulsory Savings and the Singapore Health System

Compulsory Savings and the Singapore Health Systems.coffey

╠²

The document discusses Singapore's healthcare system and whether aspects of it could be applied in Ireland. It outlines Singapore's Central Provident Fund program which requires compulsory healthcare savings contributions. These contributions fund the "3Ms" of the Singapore system - Medisave medical savings accounts, Medishield catastrophic insurance, and Medifund for the needy. Surveys show Singaporeans support personal responsibility for healthcare costs and view the system as generally affordable and high quality despite relying on less than 4% of GDP. However, implementing such a system may require prerequisites like willingness to save that differ between countries.No Man Is An Island

No Man Is An Islands.coffey

╠²

1. Driving a car can negatively impact others through traffic congestion, pollution, and increased chances of accidents. These unintended impacts are called externalities.

2. Economists propose addressing externalities through mechanisms like taxes and regulations that make individuals consider the full social costs of their actions. For driving, examples include gas taxes, emissions regulations, and traffic laws.

3. Congestion is a major externality from driving that remains largely unaddressed. Proposals like congestion pricing charge drivers variable fees based on road usage levels, encouraging more efficient driving behaviors. Singapore has implemented this successfully, reducing peak traffic by 13%.The Irish Economy going into 2010

The Irish Economy going into 2010s.coffey

╠²

The document provides an overview of key metrics of the Irish economy in January 2010, including the components of GDP (consumption, investment, government spending, exports minus imports), and quarterly growth rates by sector from 2008 to 2009 Q3, which show a decline across most sectors during the recession. National debt is also mentioned.Basic Striking 2 Weighting & Placing

Basic Striking 2 Weighting & Placings.coffey

╠²

Players practice striking and catching drills at different distances on the field. Drill A has partners strike balls directly to each other from blue bollards to work on striking, judging flight, and catching. Drill B has one player lob a pass from a blue bollard to outside a yellow or red bollard for their partner to work on placement and giving their teammate an advantage. The purpose of both drills is to improve striking, catching, placement, and visualizing opponents on the field.Basic Striking 1 Scoring

Basic Striking 1 Scorings.coffey

╠²

The document provides instructions for basic striking drills in hurling. It describes running drills where players strike the ball from different positions, making sure their weight is on the correct foot when striking left or right. Players are told to visualize the defender being on their outside shoulder and to imagine having time and space when taking their shot.The Irish Economy: October 2009

The Irish Economy: October 2009s.coffey

╠²

The document provides an overview of the state of the Irish economy in October 2009 by comparing economic indicators from 1984 and 2009. Unemployment and inflation rates had declined but interest rates, government deficit as a percentage of GDP, and forecasts for declines in consumer spending, investment and GDP in 2009-2010 had increased compared to 1984. Tax revenues were also projected to decline significantly in 2009 compared to previous years.More Related Content

More from s.coffey (20)

The Continuing Constraints on Ireland's Public Finances

The Continuing Constraints on Ireland's Public Financess.coffey

╠²

Ireland still faces constraints on its public finances from deficits and high debt levels, though debt is falling. While expenditure remains high, approximately 80% of corporation tax revenue comes from multinational corporations, highlighting Ireland's vulnerability. To better prepare for economic downturns, fiscal policy should assess balances and debt levels based on GNP rather than GDP, set aside corporate tax revenues equivalent to half the tax rate in a stability fund, and allow withdrawals from this fund during periods of low growth.National Accounts 2015 Q2

National Accounts 2015 Q2s.coffey

╠²

This document contains quarterly national accounts data from Ireland for the years 2005-2015. It includes time series charts showing trends in GDP, GNP, consumption, investment, exports, imports and other economic indicators. GDP growth was positive in 2015 Q2 after a long period of recovery from the economic downturn. The data provides a statistical overview of Ireland's economic performance and the contributions of different components to economic growth.Presentation to Institute of Directors on Q2 economic data

Presentation to Institute of Directors on Q2 economic datas.coffey

╠²

This document analyzes Ireland's recent economic growth and whether it represents a true recovery or statistical anomaly. It provides statistics showing that Ireland's GDP and GNP have grown significantly in recent years, with GDP growth reaching 7.7% in 2014, the fastest pace since 2007. This growth has been driven by a rebound in domestic demand and a strong increase in exports. Economists and media outlets have reacted positively but some question if the strength of the recovery can be sustained.Presentation to Social Media Conference

Presentation to Social Media Conferences.coffey

╠²

The document discusses Ireland's growing public debt crisis. It estimates that Ireland's general government debt will reach approximately Ōé¼250 billion by 2014, up drastically from Ōé¼47 billion in 2007. This growth is primarily due to large budget deficits from 2008-2011, billions borrowed to recapitalize banks, and promissory notes issued to distressed financial institutions. While some assets may offset this debt, sustainability concerns remain due to risks of further bank losses, deficit overruns, and debt interest costs totaling billions annually. The outlook remains uncertain depending on maintaining deficit reduction and economic recovery.Fiscal treaty

Fiscal treatys.coffey

╠²

The document discusses the key fiscal rules and targets contained in the proposed Fiscal Stability Treaty, including:

- Limiting annual deficits to 3% of GDP and requiring debt levels not exceed 60% of GDP (Maastricht criteria)

- Requiring structural deficits be reduced by between 0.75-1.5% of GDP annually if above limits (Public Finances Correction Rule)

- Limiting expenditure growth to potential GDP growth in strong economic times (Sustainable Expenditure Growth Rule)

- Additional measures like macroeconomic imbalance scorecard and linking access to ESM funds on ratifying the treaty.MBA Presentation on The Irish Economy

MBA Presentation on The Irish Economys.coffey

╠²

The document contains graphs and data on key Irish economic indicators such as GDP, components of GDP, trade balances, imports and exports from 2005-2011. It shows that after steady growth, GDP declined in 2008-2009 due to the financial crisis but resumed growing in 2010-2011. Exports initially drove growth but were later balanced by increasing domestic demand.Ireland's Public Debt Crisis

Ireland's Public Debt Crisiss.coffey

╠²

1) Professor Morgan Kelly warned in several Irish Times articles between 2006-2011 that Ireland's public debt crisis could result in national bankruptcy as property prices collapsed, unemployment rose, and bank losses mounted.

2) Kelly estimated that Ireland's total government debt could reach Ōé¼250 billion by 2014 due to annual deficits, bank bailouts, and promissory note interest. Others argued Kelly's estimate was too high by Ōé¼50-60 billion.

3) Breaking down potential debt sources, the author estimates Ireland's government debt could realistically reach Ōé¼210 billion by 2014, with bank-related debt accounting for 25% of the total and annual deficits contributing Ōé¼100 billion overall.Government spending

Government spendings.coffey

╠²

The government spends money on many programs and services each year. In 2009, the largest areas of central government spending were on healthcare at 24% of the budget, education at 15%, and social security benefits at 14%. Defense spending accounted for another 12% while interest on the national debt made up 7% of central government expenditures.From Ōé¼3 billion to Ōé¼6 billion

From Ōé¼3 billion to Ōé¼6 billions.coffey

╠²

The document discusses how Ireland's budget deficit projection increased from Ōé¼3 billion to Ōé¼6 billion between 2009 and 2010. This Ōé¼3 billion increase was due to several factors: Ōé¼1 billion from reductions to nominal GDP projections, Ōé¼1 billion from the continued deterioration of public finances, and Ōé¼1 billion from lowering the target for the general government balance (GGB) from 10% to 9.3% of GDP. Reduced growth forecasts did not contribute to the increased deficit projection.CSO Data September 2010

CSO Data September 2010s.coffey

╠²

The document discusses quarterly GDP and GNP statistics from 2005 and 1997. It contains information on gross domestic product and gross national product for multiple quarters and years.CSO Data September 2010

CSO Data September 2010s.coffey

╠²

GDP and GNP figures for 2005 are presented on a quarterly basis. The document also contains quarterly GDP and GNP data from 1997. Overall, the document provides economic performance data from two different years broken down by quarter.The Black Economy In Ireland

The Black Economy In Irelands.coffey

╠²

The document provides an overview of methods used to estimate the size of the black economy in Ireland. It summarizes international estimates that range from 2-28% of GDP depending on the method. A monetary method is then applied to Ireland which estimates the black economy was around 11% of GNP in 1995, equivalent to ┬Ż3.6 billion. The estimate suggests the black economy has increased over time from low levels in the 1960s, rising steadily to 5.5% of GNP in 1979 and then more rapidly in the 1980s due to rising tax burden.A Natural Experiment in the Prisoner's Dilemma

A Natural Experiment in the Prisoner's Dilemmas.coffey

╠²

This document analyzes data from the TV game show Goldenballs to study how participants make choices in prisoner's dilemma situations. In the final round, two contestants split or steal a jackpot. Players cooperated (split) 48% of the time, with males cooperating more than females and young players cooperating more than mature players. There was more cooperation between genders than within genders. Players in the same age category cooperated more than those of different ages. Mature players were most efficient at converting jackpots into winnings.Compulsory Savings and the Singapore Health System

Compulsory Savings and the Singapore Health Systems.coffey

╠²

The document discusses Singapore's healthcare system and whether aspects of it could be applied in Ireland. It outlines Singapore's Central Provident Fund program which requires compulsory healthcare savings contributions. These contributions fund the "3Ms" of the Singapore system - Medisave medical savings accounts, Medishield catastrophic insurance, and Medifund for the needy. Surveys show Singaporeans support personal responsibility for healthcare costs and view the system as generally affordable and high quality despite relying on less than 4% of GDP. However, implementing such a system may require prerequisites like willingness to save that differ between countries.No Man Is An Island

No Man Is An Islands.coffey

╠²

1. Driving a car can negatively impact others through traffic congestion, pollution, and increased chances of accidents. These unintended impacts are called externalities.

2. Economists propose addressing externalities through mechanisms like taxes and regulations that make individuals consider the full social costs of their actions. For driving, examples include gas taxes, emissions regulations, and traffic laws.

3. Congestion is a major externality from driving that remains largely unaddressed. Proposals like congestion pricing charge drivers variable fees based on road usage levels, encouraging more efficient driving behaviors. Singapore has implemented this successfully, reducing peak traffic by 13%.The Irish Economy going into 2010

The Irish Economy going into 2010s.coffey

╠²

The document provides an overview of key metrics of the Irish economy in January 2010, including the components of GDP (consumption, investment, government spending, exports minus imports), and quarterly growth rates by sector from 2008 to 2009 Q3, which show a decline across most sectors during the recession. National debt is also mentioned.Basic Striking 2 Weighting & Placing

Basic Striking 2 Weighting & Placings.coffey

╠²

Players practice striking and catching drills at different distances on the field. Drill A has partners strike balls directly to each other from blue bollards to work on striking, judging flight, and catching. Drill B has one player lob a pass from a blue bollard to outside a yellow or red bollard for their partner to work on placement and giving their teammate an advantage. The purpose of both drills is to improve striking, catching, placement, and visualizing opponents on the field.Basic Striking 1 Scoring

Basic Striking 1 Scorings.coffey

╠²

The document provides instructions for basic striking drills in hurling. It describes running drills where players strike the ball from different positions, making sure their weight is on the correct foot when striking left or right. Players are told to visualize the defender being on their outside shoulder and to imagine having time and space when taking their shot.The Irish Economy: October 2009

The Irish Economy: October 2009s.coffey

╠²

The document provides an overview of the state of the Irish economy in October 2009 by comparing economic indicators from 1984 and 2009. Unemployment and inflation rates had declined but interest rates, government deficit as a percentage of GDP, and forecasts for declines in consumer spending, investment and GDP in 2009-2010 had increased compared to 1984. Tax revenues were also projected to decline significantly in 2009 compared to previous years.