National Bank of Belgium NBB Infosession for ERP

- 1. NBB SEPA ERP Day: Corporate requirements for a Customer Centric Solution Byron Soulopoulos Twitter: @Soulopoulos

- 2. The ┬ĀVOO ┬Āo’¼Ćering: ┬ĀTriple/Quadruple ┬ĀPlay ┬Ā TV ┬Ā Internet ┬Ā Tel ┬Ā Mobile ┬Ā ~25 analogue television channels The fastest internet in Wallonia Landlines In the course of 2013 : launch -> 100Mbps of mobile, voice and data ~150 digital, SD, HD, 3D television Unlimited packs, from landline to subscriptions channels ŌĆ£nŌĆØ standard wifi modem landline VOOcorder (PVR) and VOObox Wifi homespots (HD decoder) VOOmotion, TV on tablets, VOD smartphones and PC Exclusivity of Be tv pay-tv channels VOOfoot: Belgian division 1 championship Double Play, Triple Play and soon Quadruple Play Packs 2 ┬Ā

- 4. SDD Core Mandate Four corner model Debtor Creditor 1 2 3 1.ŌĆ» VOO sends the SDD Mandate to the customer 2.ŌĆ» The Customer signs and sends it back to VOO 3.ŌĆ» VOO Validates the Mandate (Signature, Date, IBAN, BIC, etc), creates mandate MRI & PDF and sends a confirmation letter back to the Debtor. CSM/CEC Debtor Bank Creditor Bank + Migration of existing Belgian Mandates (Dom80) via NBB 4

- 5. Mandate Management Paper Flow CREDITOR ID UMRef Contract ID IBAN BIC Date (sign) Location (sign) Signature 5

- 6. Migration existing Belgian Mandates (DOM80) -> SEPA Direct Debit Creditor SDD DOM80 DOM80 IBAN Active 3 BIC UMRef DOM80 1 2 Debtor Bank Creditor Bank 6

- 7. Customer CaTV TV NET TEL Mobile 7

- 8. Mandate Management Mandate changes SDD rulebook says for changes in: 1.ŌĆ» Unique Mandate Reference (UMRef) 2.ŌĆ» creditor identification 3.ŌĆ» creditor name 4.ŌĆ» debtorŌĆÖs account number (IBAN) A.ŌĆ» to another number within the same bank B.ŌĆ» to another number with another bank (BIC) The creditor must report the amendments to the Creditor bank as part of the next collection (as a ŌĆ£mandate amendmentŌĆØ). Additional attention point: in case 4.B, the creditor must send the next collection as a ŌĆ£FIRSTŌĆØ. ├Ā’āĀŌĆ» The paper mandate must be updated as well. Necessary to counter refund requests! ├Ā’āĀŌĆ» Creditor to evaluate if new mandate might not be more opportune instead of working with a mandate amendment 8

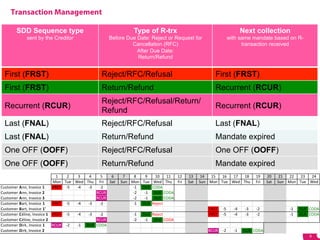

- 9. Transaction Management SDD Sequence type Type of R-trx Next collection sent by the Creditor Before Due Date: Reject or Request for with same mandate based on R- Cancellation (RFC) transaction received After Due Date: Return/Refund First (FRST) Reject/RFC/Refusal First (FRST) First (FRST) Return/Refund Recurrent (RCUR) Reject/RFC/Refusal/Return/ Recurrent (RCUR) Recurrent (RCUR) Refund Last (FNAL) Reject/RFC/Refusal Last (FNAL) Last (FNAL) Return/Refund Mandate expired One OFF (OOFF) Reject/RFC/Refusal One OFF (OOFF) One OFF (OOFF) Return/Refund Mandate expired 9

- 10. Combina=on ┬ĀDD ┬ĀType ┬Ā-┬ŁŌĆÉ ┬ĀR ┬ĀTransac=on ┬ĀType ┬Ā-┬ŁŌĆÉ ┬ĀMo=f ┬Ā(cfr ┬ĀCS ┬Ā127) ┬Ā source: ┬ĀBeno├«t ┬ĀHenrion, ┬ĀBeTV ┬Ā

- 11. eMandates 54% Ōé¼ = Stamps & Letters 11

- 12. Byron Soulopoulos Byron.Soulopoulos@sta’¼Ć.voo.be WebSite: www.voo.be Contact information at VOO: Business: Laurent Berti laurent.berti@wbcc.eu