NEGAS Presentation (06.19)

- 1. HEFFNER & ASSOCIATES ELDER LAW Mark B. Heffner, Esq. , CELA Heffner & Associates 615 Jefferson Boulevard Warwick, Rhode Island 401-737-1600 www.hefflaw.com Medicaid & Medicaid Planning: Stuff you will want to know & tell your clients

- 2. HEFFNER & ASSOCIATES ELDER LAW Disclaimer •Materials are for general education and should not be substituted for consultation with a competent elder law attorney in your jurisdiction •Materials presented from the perspective of Rhode Island Medicaid regulations and practice •Rules and practice vary significantly from State to State (and occasionally within the same State) and are subject to change

- 3. HEFFNER & ASSOCIATES ELDER LAW •Practicing elder law since 1988 •CELA (Certified Elder Law Attorney) by National Elder Law Foundation (accredited by ABA for specialization) •Served in Rhode Island House of Representatives for 10 years Who is this guy? •Harvard College; Boston College Law School •Adjunct Professor, Roger Williams University Law School •Friend of Tom Grennan’s

- 4. HEFFNER & ASSOCIATES ELDER LAW What is Medicaid? •It is not Medicare! •Medicaid: in addition to general criteria (age, blind, disabled) & needing a level of care, must also fall within financial criteria (assets, income, transfer restrictions) •Medicare: insurance model; no asset or income qualification requirements

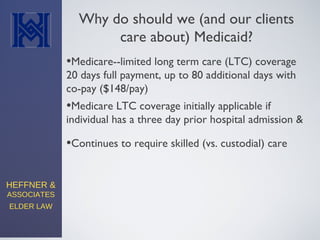

- 5. HEFFNER & ASSOCIATES ELDER LAW Why do should we (and our clients care about) Medicaid? •Medicare--limited long term care (LTC) coverage 20 days full payment, up to 80 additional days with co-pay ($148/pay) •Continues to require skilled (vs. custodial) care •Medicare LTC coverage initially applicable if individual has a three day prior hospital admission &

- 6. HEFFNER & ASSOCIATES ELDER LAW Why do should we (and our clients care about) Medicaid? •Once Medicare ends (if it began at all), absent long term care insurance, individual pays privately •Rhode Island: $8516/month • Genworth 2013 cost of care survey ( www.genworth.com/corporate/about-genworth/industry ) •Massachusetts: $10,493/month •Connecticut : $12,638/month

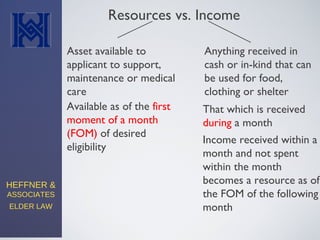

- 7. HEFFNER & ASSOCIATES ELDER LAW Resources vs. Income Asset available to applicant to support, maintenance or medical care Available as of the first moment of a month (FOM) of desired eligibility Anything received in cash or in-kind that can be used for food, clothing or shelter That which is received during a month Income received within a month and not spent within the month becomes a resource as of the FOM of the following month

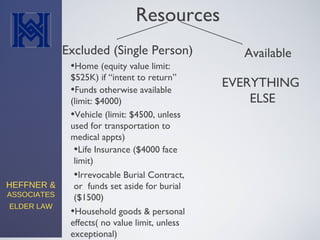

- 8. HEFFNER & ASSOCIATES ELDER LAW Resources Excluded (Single Person) •Home (equity value limit: $525K) if “intent to return” •Household goods & personal effects( no value limit, unless exceptional) •Vehicle (limit: $4500, unless used for transportation to medical appts) •Life Insurance ($4000 face limit) •Irrevocable Burial Contract, or funds set aside for burial ($1500) •Funds otherwise available (limit: $4000) Available EVERYTHING ELSE

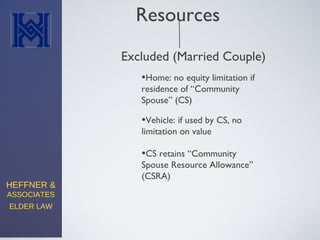

- 9. HEFFNER & ASSOCIATES ELDER LAW Resources Excluded (Married Couple) •Home: no equity limitation if residence of “Community Spouse” (CS) •Vehicle: if used by CS, no limitation on value •CS retains “Community Spouse Resource Allowance” (CSRA)

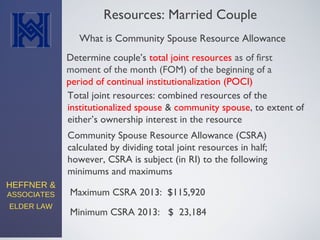

- 10. HEFFNER & ASSOCIATES ELDER LAW Resources: Married Couple What is Community Spouse Resource Allowance Determine couple’s total joint resources as of first moment of the month (FOM) of the beginning of a period of continual institutionalization (POCI) Total joint resources: combined resources of the institutionalized spouse & community spouse, to extent of either’s ownership interest in the resource Maximum CSRA 2013: $115,920 Minimum CSRA 2013: $ 23,184 Community Spouse Resource Allowance (CSRA) calculated by dividing total joint resources in half; however, CSRA is subject (in RI) to the following minimums and maximums

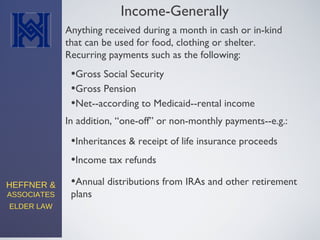

- 11. HEFFNER & ASSOCIATES ELDER LAW Income-Generally Anything received during a month in cash or in-kind that can be used for food, clothing or shelter. Recurring payments such as the following: •Gross Social Security •Gross Pension •Net--according to Medicaid--rental income In addition, “one-off” or non-monthly payments--e.g.: •Inheritances & receipt of life insurance proceeds •Income tax refunds •Annual distributions from IRAs and other retirement plans

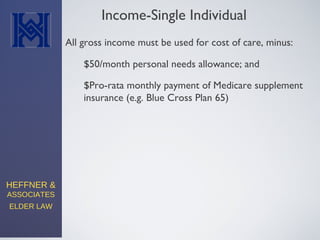

- 12. HEFFNER & ASSOCIATES ELDER LAW Income-Single Individual All gross income must be used for cost of care, minus: $50/month personal needs allowance; and $Pro-rata monthly payment of Medicare supplement insurance (e.g. Blue Cross Plan 65)

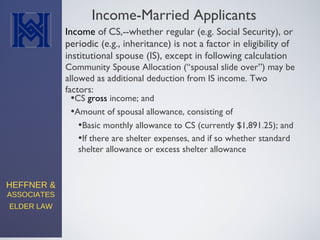

- 13. HEFFNER & ASSOCIATES ELDER LAW Income-Married Applicants Community Spouse Allocation (“spousal slide over”) may be allowed as additional deduction from IS income. Two factors: •CS gross income; and •Amount of spousal allowance, consisting of Income of CS,--whether regular (e.g. Social Security), or periodic (e.g., inheritance) is not a factor in eligibility of institutional spouse (IS), except in following calculation •Basic monthly allowance to CS (currently $1,891.25); and •If there are shelter expenses, and if so whether standard shelter allowance or excess shelter allowance

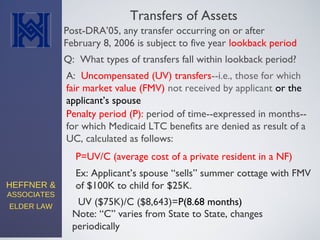

- 14. HEFFNER & ASSOCIATES ELDER LAW Transfers of Assets Post-DRA’05, any transfer occurring on or after February 8, 2006 is subject to five year lookback period Q: What types of transfers fall within lookback period? A: Uncompensated (UV) transfers--i.e., those for which fair market value (FMV) not received by applicant or the applicant’s spouse Penalty period (P): period of time--expressed in months-- for which Medicaid LTC benefits are denied as result of a UC, calculated as follows: P=UV/C (average cost of a private resident in a NF) Ex: Applicant’s spouse “sells” summer cottage with FMV of $100K to child for $25K. UV ($75K)/C ($8,643)=P(8.68 months) Note: “C” varies from State to State, changes periodically

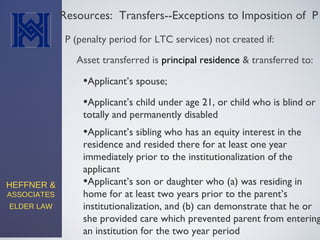

- 15. HEFFNER & ASSOCIATES ELDER LAW Resources: Transfers--Exceptions to Imposition of P •Applicant’s spouse; P (penalty period for LTC services) not created if: •Applicant’s son or daughter who (a) was residing in home for at least two years prior to the parent’s institutionalization, and (b) can demonstrate that he or she provided care which prevented parent from entering an institution for the two year period Asset transferred is principal residence & transferred to: •Applicant’s child under age 21, or child who is blind or totally and permanently disabled •Applicant’s sibling who has an equity interest in the residence and resided there for at least one year immediately prior to the institutionalization of the applicant

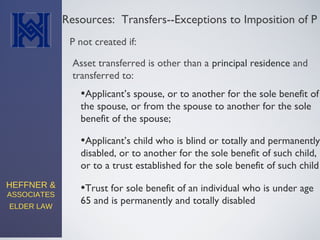

- 16. HEFFNER & ASSOCIATES ELDER LAW Resources: Transfers--Exceptions to Imposition of P •Applicant’s spouse, or to another for the sole benefit of the spouse, or from the spouse to another for the sole benefit of the spouse; P not created if: Asset transferred is other than a principal residence and transferred to: •Applicant’s child who is blind or totally and permanently disabled, or to another for the sole benefit of such child, or to a trust established for the sole benefit of such child •Trust for sole benefit of an individual who is under age 65 and is permanently and totally disabled

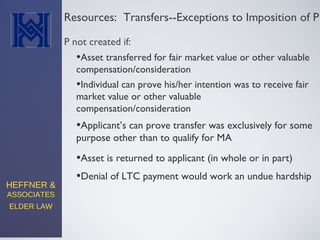

- 17. HEFFNER & ASSOCIATES ELDER LAW Resources: Transfers--Exceptions to Imposition of P •Individual can prove his/her intention was to receive fair market value or other valuable compensation/consideration P not created if: •Applicant’s can prove transfer was exclusively for some purpose other than to qualify for MA •Asset is returned to applicant (in whole or in part) •Asset transferred for fair market value or other valuable compensation/consideration •Denial of LTC payment would work an undue hardship

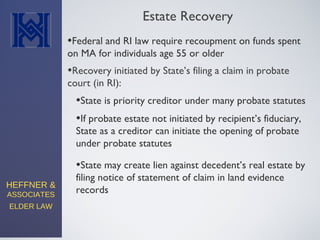

- 18. HEFFNER & ASSOCIATES ELDER LAW Estate Recovery •Federal and RI law require recoupment on funds spent on MA for individuals age 55 or older •Recovery initiated by State’s filing a claim in probate court (in RI): •State may create lien against decedent’s real estate by filing notice of statement of claim in land evidence records •State is priority creditor under many probate statutes •If probate estate not initiated by recipient’s fiduciary, State as a creditor can initiate the opening of probate under probate statutes

- 19. HEFFNER & ASSOCIATES ELDER LAW Mark B. Heffner, Esq. , CELA Heffner & Associates 615 Jefferson Boulevard Warwick, Rhode Island 401-737-1600 mheffner@hefflaw.com www.hefflaw.com National Elder Law Foundation www.nelf.org Provides interactive state map of Certified Elder Law Attorneys (CELA) in each state

Editor's Notes

- #3: Refer to OMR tool Practice pointer: don’t assume, as in past, that just because client in nh, will qualify for Medicaid LTC benefits in nh

- #4: Refer to OMR tool Practice pointer: don’t assume, as in past, that just because client in nh, will qualify for Medicaid LTC benefits in nh

- #5: Refer to OMR tool Practice pointer: don’t assume, as in past, that just because client in nh, will qualify for Medicaid LTC benefits in nh

- #6: Refer to OMR tool Practice pointer: don’t assume, as in past, that just because client in nh, will qualify for Medicaid LTC benefits in nh

- #7: Refer to OMR tool Practice pointer: don’t assume, as in past, that just because client in nh, will qualify for Medicaid LTC benefits in nh

- #8: Highlight FOM concept

- #9: Illustration of “legal ability to make resource available” and a resource not subject to “a legal impediment which precludes applicant from making resource available. Gship or conservatorship--evidence inability to make resource available. Asset unavailable to to refusal of joint tenant to sell, and hence partition suit (ask JK + law school case)

- #10: Illustration of “legal ability to make resource available” and a resource not subject to “a legal impediment which precludes applicant from making resource available. Gship or conservatorship--evidence inability to make resource available. Asset unavailable to to refusal of joint tenant to sell, and hence partition suit (ask JK + law school case)

- #11: no notes

- #12: Highlight FOM concept

- #13: Highlight FOM concept

- #15: no notes

- #16: no notes

- #17: no notes

- #18: no notes