Raise of complementary currencies and the possiblities for the financial industry

5 likes1,076 views

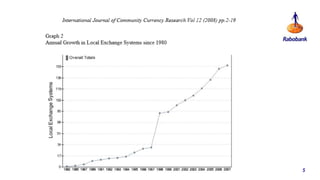

The document discusses the rise of alternative currencies and their implications for the financial industry. It outlines several reasons for a shift towards alternative currencies, including changes within society and technology. It then describes different types of currencies that currently exist or may exist in the future, including corporate barter systems, loyalty programs, cryptocurrencies, and time-based currencies. The rest of the document discusses the advantages of barter networks, including unlocking unused business capacities and improving profits. It concludes that while these innovations show potential, challenges remain in developing sustainable business models for banks to adopt complementary currencies.

1 of 27

Downloaded 17 times

Ad

Recommended

Central bank digital currencies - full reserve banks and Libra..?

Central bank digital currencies - full reserve banks and Libra..?Simon Lelieveldt

?

The document discusses central bank digital currencies (CBDCs) and their relationship with full reserve banking systems. It raises fundamental questions about the issuance, backing, and legal guarantees associated with CBDCs, particularly in the context of the Dutch central bank. The document also addresses the structure and implications of digital currencies like Facebook's Libra in comparison to traditional money and banking systems.Will Digital Currencies Break The Banking System?

Will Digital Currencies Break The Banking System? Harsh Chitroda

?

The document discusses the implications of digital currencies, particularly central bank digital currencies (CBDCs), on the banking system. It outlines the advantages and disadvantages of digital currencies, the potential benefits and risks associated with CBDCs, and their possible influence on monetary policy and financial stability. Additionally, it highlights the current state of CBDC development and its profound impact on the macroeconomy and the traditional banking structure.IMF Fintech report - cross board payment

IMF Fintech report - cross board paymentClement Hsieh

?

The document discusses the evolution and impact of fintech on financial services, emphasizing the technological innovations that foster new business models and address consumer needs. It highlights the challenges and opportunities fintech poses for regulatory authorities, as they balance efficiency, stability, and trust in an increasingly complex financial landscape. The IMF's framework suggests a cooperative international approach to adapt to these rapid changes while ensuring effective management of associated risks.Bacs Annual Review 2012

Bacs Annual Review 2012BacsUK

?

In 2012, Bacs reported significant growth in automated payments, achieving a record of 97.6 million transactions in a single day and an annual increase of 3.2% in direct debit volumes. The company also launched a successful cash ISA transfer service and engaged in various high-profile industry projects, despite small declines in direct credit volume due to migrations to faster payment schemes. Additionally, Bacs became carbon neutral and raised substantial funds for charities through various initiatives."Living a life on Ethereum" | TokenCard @ ETHLondon (May 2019)

"Living a life on Ethereum" | TokenCard @ ETHLondon (May 2019)Alan McAlpine

?

TokenCard is a crowd-funded Ethereum project based in London, aiming to provide a non-custodial, consumer-focused banking alternative through a Visa debit card that allows users to spend Ethereum and ERC-20 tokens globally. The company emphasizes decentralization, participation in the new economy, and a commitment to user privacy and security while developing solutions like the 0 balance card and self-sovereign identity. As they continue to innovate and fulfill their project goals, TokenCard seeks to empower individuals financially by challenging conventional banking structures.Deniss Fi?ipovs: Challenges in the age of new high-convenience Real-time paym...

Deniss Fi?ipovs: Challenges in the age of new high-convenience Real-time paym...Latvijas Banka

?

The document discusses the decline of cash usage in Latvia, exacerbated by the COVID-19 pandemic, with significant shifts towards cashless payment methods. In the euro area, cash transactions have decreased from 79% in 2016 to 73% in 2019, and projections indicate a continuing trend towards card payments. The paper emphasizes the need for European payment autonomy and the involvement of the private sector to maintain economic competitiveness amidst rising global technology influences.Ulrich Bindseil: Digital money in digital wallets

Ulrich Bindseil: Digital money in digital walletsLatvijas Banka

?

The document discusses the potential role of Central Bank Digital Currency (CBDC) in the context of declining cash usage and the evolution of electronic payments. It highlights various considerations, including privacy, market competitiveness, and the relationship between CBDC and private payment solutions. The ECB supports the coexistence of CBDC with private initiatives, emphasizing integration without replacing existing banking systems.Lecture at HWZ Z¨ąrich, 23rd of April 2019

Lecture at HWZ Z¨ąrich, 23rd of April 2019martinploom

?

The document outlines the concept of credit money in the cryptocurrency ecosystem, emphasizing the importance of a credit money system similar to traditional finance. It introduces smartcredit.io, a platform designed to facilitate decentralized credit creation and management through tokenized collateralized credit coins. The presentation highlights the shortcomings of existing crypto assets as base money while proposing a model for an elastic, programmable credit money system to enhance economic activities in the crypto sphere.M Mv MruIntroduction of the XO in Russia

M Mv MruIntroduction of the XO in RussiaHarrie Vollaard

?

§Ą§ŕ§Ü§ĺ§Ţ§Ö§ß§ä §ŕ§ă§Ó§Ö§ë§Ń§Ö§ä §á§â§ŕ§Ö§Ü§ä One Laptop Per Child (OLPC), §ß§Ń§á§â§Ń§Ó§Ý§Ö§ß§ß§í§Ű §ß§Ń §á§â§Ö§Ő§ŕ§ă§ä§Ń§Ó§Ý§Ö§ß§Ú§Ö §Ő§ŕ§ă§ä§ĺ§á§ß§ŕ§Ô§ŕ §ß§ŕ§ĺ§ä§Ň§ĺ§Ü§Ń §Ő§Ý§ń §Ő§Ö§ä§Ö§Ű §Ú§Ů §â§Ń§Ů§Ó§Ú§Ó§Ń§đ§ë§Ú§ç§ă§ń §ă§ä§â§Ń§ß §ă §č§Ö§Ý§î§đ §ĺ§Ý§ĺ§é§ę§Ö§ß§Ú§ń §ŕ§Ň§â§Ń§Ů§ŕ§Ó§Ń§ä§Ö§Ý§î§ß§í§ç §Ó§ŕ§Ů§Ţ§ŕ§Ř§ß§ŕ§ă§ä§Ö§Ű. OLPC §ă§ä§â§Ö§Ţ§Ú§ä§ă§ń §Ú§ă§á§ŕ§Ý§î§Ů§ŕ§Ó§Ń§ä§î §Ő§Ö§ę§Ö§Ó§ĺ§đ §Ú §Ü§Ń§é§Ö§ă§ä§Ó§Ö§ß§ß§ĺ§đ §ä§Ö§ç§ß§ŕ§Ý§ŕ§Ô§Ú§đ §Ő§Ý§ń §â§Ö§Ó§ŕ§Ý§đ§č§Ú§Ú §Ó §ŕ§Ň§ĺ§é§Ö§ß§Ú§Ú, §ă§Ó§ń§Ů§í§Ó§Ń§ń §Ő§Ö§ä§Ö§Ű, §ĺ§é§Ú§ä§Ö§Ý§Ö§Ű §Ú §Ú§ß§ä§Ö§â§ß§Ö§ä. §°§ă§ß§ŕ§Ó§ß§í§Ö §Ń§ă§á§Ö§Ü§ä§í §Ó§Ü§Ý§đ§é§Ń§đ§ä §ć§Ú§Ý§ŕ§ă§ŕ§ć§Ú§đ §á§â§ŕ§Ö§Ü§ä§Ń, §ă§ŕ§á§ŕ§ă§ä§Ń§Ó§Ý§Ö§ß§Ú§Ö §ă §Ü§ŕ§ß§Ü§ĺ§â§Ö§ß§ä§Ń§Ţ§Ú §Ú §â§Ö§Ń§Ý§Ú§Ů§Ń§č§Ú§đ §Ó §â§Ń§Ů§ß§í§ç §ă§ä§â§Ń§ß§Ń§ç, §á§ŕ§Ő§é§Ö§â§Ü§Ú§Ó§Ń§ń §Ó§Ń§Ř§ß§ŕ§ă§ä§î §Ň§ŕ§Ý§Ö§Ö §ß§Ú§Ů§Ü§ŕ§Ű §č§Ö§ß§í §Ú §Ő§ŕ§ă§ä§ĺ§á§ß§ŕ§ă§ä§Ú §ä§Ö§ç§ß§ŕ§Ý§ŕ§Ô§Ú§Ű.OLPC and Making Miles for Millennium

OLPC and Making Miles for MillenniumHarrie Vollaard

?

This document discusses the One Laptop Per Child (OLPC) initiative and Gertie and Harrie's mission to support it. The key points are:

1. Gertie and Harrie aim to support OLPC through public relations, operational assistance, tactical consultancy, and fundraising for local projects.

2. OLPC designs and distributes a low-cost, rugged laptop for children in developing countries. The laptop is optimized for power efficiency, connectivity, and sustainability in challenging environments.

3. Implementing OLPC faces challenges regarding infrastructure, costs, distribution, and ensuring effective educational integration. Gertie and Harrie hope to help address these challenges and enable more children to benefit from the program.Mammoettankers en speedbootjes; Is banking heading towards its Spotify moment?

Mammoettankers en speedbootjes; Is banking heading towards its Spotify moment?Harrie Vollaard

?

Banking may be heading towards a disruption like Spotify brought to the music industry. There are over 3000 fintech startups that could challenge traditional banks, inspired by innovators like Bill Gates, Clayton Christensen, and Steven Sasson. The head of innovation at Rabobank discusses whether banks should try to beat fintech startups or partner with them.Making Miles for Millenniumgoals

Making Miles for MillenniumgoalsHarrie Vollaard

?

The document summarizes a trip being taken by Harrie Vollaard and Gertie Clabbers from OLPC The Netherlands from May 3rd to October 29th, 2008. The trip aims to raise awareness and funds for the Millennium Development Goals by promoting OLPC's work providing laptops to children. They will help local OLPC projects through public relations, operational support, tactical consultancy, and generating funds. Their goals are to enlarge children's chances in life through education and integrate modern tools into school systems in a sustainable but cheap way.MMvM OLPC NL 13-12-2008

MMvM OLPC NL 13-12-2008Harrie Vollaard

?

The document outlines the contributions and impact of the 'Meters Maken Voor Millennium' initiative, which involves deploying XO laptops in various countries such as India, Nepal, Russia, and Mongolia. It highlights the educational benefits of the XO laptops, their role in bridging the gap between developed and developing nations, and the challenges faced in implementing the program. Key learnings emphasize the importance of local collaboration, scaling projects effectively, and the need for professional project management and teacher training.IT: stimulating structural growth in developing countries

IT: stimulating structural growth in developing countriesHarrie Vollaard

?

The document discusses Rabobank's role as a cooperative bank focused on supporting financial service access in developing countries, particularly through technology innovation. It highlights a case study in Rwanda, addressing IT hurdles faced by savings and credit cooperatives (SACCOs) and outlining potential solutions to enhance operational efficiency. The conclusions emphasize the necessity of developing user-friendly management information systems to improve governance, transparency, and overall financial inclusion within these markets.Parikrma Foundation

Parikrma FoundationHarrie Vollaard

?

The document discusses the critical crisis of poverty and educational inequality in Bangalore, India, where only a small percentage of children receive quality education, resulting in a vast divide in employment opportunities. The Parikrma Humanity Foundation aims to address this issue through a comprehensive development model that provides underprivileged children with quality education, healthcare, and support, ensuring they can compete on equal terms. With a proven track record of high attendance and low dropout rates, Parikrma seeks to expand its impact by building a leadership training center to further educate teachers and administrators.Modern Bankieren Cooperatiebijeenkomst Breda

Modern Bankieren Cooperatiebijeenkomst BredaHarrie Vollaard

?

Presentatie workshop Modern Bankieren op Cooperatiebijeenkomst van Rabobank Breda op 14 maart 2011§±§ŕ§Ü§â§í§Ó§Ń§ń §Ţ§Ú§Ý§Ú §ß§Ń §á§ĺ§ä§Ú §Ü §®§Ú§Ý§Ý§Ö§ß§Ú§ĺ§Ţ§ĺ; Introduction of the XO in Russia

§±§ŕ§Ü§â§í§Ó§Ń§ń §Ţ§Ú§Ý§Ú §ß§Ń §á§ĺ§ä§Ú §Ü §®§Ú§Ý§Ý§Ö§ß§Ú§ĺ§Ţ§ĺ; Introduction of the XO in RussiaHarrie Vollaard

?

§±§ŕ§Ü§â§í§Ó§Ń§ń §Ţ§Ú§Ý§Ú §ß§Ń §á§ĺ§ä§Ú §Ü §®§Ú§Ý§Ý§Ö§ß§Ú§ĺ§Ţ§ĺ; Introduction of the XO in RussiaThe electronic payment systems

The electronic payment systemsVishal Singh

?

The document discusses various electronic payment systems used for e-commerce transactions. It describes advantages and disadvantages of different systems including electronic cash, electronic wallets, smart cards, and credit cards. It provides details on how each system works, examples of implementations, and considerations regarding their adoption and success.1.Internet Business Models in modern.pptx

1.Internet Business Models in modern.pptxThejuDaniel

?

This document discusses different types of business models and e-commerce. It defines e-commerce as digitally enabled commercial transactions between organizations and individuals. E-business refers to digital processes within a firm. Major types of e-commerce include business-to-consumer, business-to-business, consumer-to-consumer, and peer-to-peer. It also outlines various electronic payment systems used in e-commerce such as credit cards, digital wallets, stored value accounts, and digital checking.Part i

Part iOnkar Sule

?

E-commerce refers to business conducted over the Internet and World Wide Web. It involves the buying and selling of goods and services, as well as servicing customers and collaborating with business partners digitally. E-commerce lowers costs and product cycle times for businesses while allowing for faster customer response and improved service quality. It comes in various forms depending on whether transactions are business-to-business, business-to-consumer, etc. and whether aspects are purely digital or involve some physical elements.E-commerce System Technologies, Repository and Networking Technology

E-commerce System Technologies, Repository and Networking Technologyizan28

?

The document outlines an introduction to online payment systems and security. It discusses various payment methods including payment cards, electronic cash, electronic wallets, and stored-value cards. It also covers online payment processing, merchant accounts, and open and closed-loop payment systems. The document then discusses Internet technologies used by banks including check processing and mobile banking. It concludes by covering criminal activities like phishing and identity theft that target payment systems.E Volving Reciprocal Relationship E Conomies

E Volving Reciprocal Relationship E ConomiesLiezl Coetzee

?

This document summarizes Liezl Coetzee's presentation on how community currency networks and complementary "gift economies" can enhance local exchange through the use of global tools. It discusses concepts like reciprocal gifting, money as a social technology, and how online mutual credit systems and social features can help build community and promote reciprocity, while also addressing challenges around scale, scope, and bridging the digital divide.The Fintech Revolution

The Fintech Revolutioncurrencycloud

?

The document discusses the evolution of financial technology (fin-tech) and how it impacts banking, emphasizing the importance of innovative technology and efficiency in international payments. It highlights the historical context of the term 'lorem ipsum' and its relevance in design and publishing, while also showcasing the Currency Cloud's role in simplifying payments. The document stresses the need for more control, lower costs, and improved efficiency in financial services.Digital Payment-Revolution in India

Digital Payment-Revolution in IndiaBinod Sinha

?

The document discusses the evolution of payment systems, highlighting the shift from traditional barter methods to digital payments, including mobile commerce and e-wallets. It emphasizes the benefits of a cashless economy in India, such as increased financial inclusion, tracking of transactions, and job creation, while also addressing challenges like cyber security and fraud. Additionally, it outlines initiatives and government programs aimed at promoting digital financial literacy and usage among citizens.BarterCard

BarterCardLiam Moore

?

BarterCard has introduced a platform that allows over 25,000 businesses across 10 countries to exchange goods and services using a proprietary digital currency. Since 1991, BarterCard has grown to become the world's largest trade exchange, facilitating over $600 million in trades annually. Their currency ensures both parties in a trade feel satisfied, even if they don't have a direct match of goods or services to exchange. Members represent over 700 industries and can use trade dollars to increase working capital, access interest-free credit, network with other businesses, and avoid discounting unsold inventory. While successful, some businesses find the model difficult and BarterCard currency lacks value outside its network.Internet technology and the digital firm.

Internet technology and the digital firm.Prof. Othman Alsalloum

?

The document discusses key topics around digital firms and e-commerce including internet business models, benefits of internet technology for organizations, and management challenges of digital transformation. It provides examples of how intranets support collaboration and supply chain management. Electronic payment systems and the flow of information in business-to-business and business-to-consumer e-commerce are also examined.Thoroughly Modern Money - How to Design a Currency

Thoroughly Modern Money - How to Design a CurrencyPhoebe Bright

?

Phoebe Bright discusses the design considerations for creating a new local currency aimed at increasing liquidity and promoting local economic resilience. Key aspects include managing money supply, ensuring security and trust, and understanding the needs of different user groups, while presenting strategies for implementation and potential scenarios for success or failure. The document emphasizes the need for a thorough assessment of local economic circuits and user engagement to determine the viability of such a currency.Chapter 15: GETTING THE MONEY

Chapter 15: GETTING THE MONEY Syeda Tabia

?

The document discusses various topics related to electronic payments, including:

1) Different types of electronic money and key requirements for internet-based payment systems.

2) Methods of electronic payment such as credit cards, debit cards, smart cards, and digital cash/e-cash.

3) Issues and implications regarding the regulation, economics, and social impacts of electronic payment methods.Welcome to the ecosystem of the collaborative economy

Welcome to the ecosystem of the collaborative economyshareNL

?

The document explains the collaborative economy, defined as decentralized networks and marketplaces that optimize the use of underused assets by connecting providers and consumers, bypassing traditional institutions. It categorizes organizations within this economy into peer-to-peer, peer-to-business-to-peer, and business-to-peer, highlighting various markets such as transportation, space, and food. The text also contrasts the collaborative economy with traditional economic models, emphasizing its reliance on modern technology to facilitate peer interactions and transactions on a larger scale.Elecrtonic payment system

Elecrtonic payment systemMukesh Lal Karn

?

This document discusses electronic payment systems. It defines electronic payment as a financial exchange that occurs online between buyers and sellers using digital payment methods like encrypted credit card numbers or digital cash. The document outlines requirements for electronic payments like acceptability, anonymity, and usability. It describes different types of electronic payment systems including digital token-based systems like electronic cash and cheques, and retail payment methods like credit cards and debit cards. The advantages and disadvantages of electronic cash are also summarized.More Related Content

Viewers also liked (9)

M Mv MruIntroduction of the XO in Russia

M Mv MruIntroduction of the XO in RussiaHarrie Vollaard

?

§Ą§ŕ§Ü§ĺ§Ţ§Ö§ß§ä §ŕ§ă§Ó§Ö§ë§Ń§Ö§ä §á§â§ŕ§Ö§Ü§ä One Laptop Per Child (OLPC), §ß§Ń§á§â§Ń§Ó§Ý§Ö§ß§ß§í§Ű §ß§Ń §á§â§Ö§Ő§ŕ§ă§ä§Ń§Ó§Ý§Ö§ß§Ú§Ö §Ő§ŕ§ă§ä§ĺ§á§ß§ŕ§Ô§ŕ §ß§ŕ§ĺ§ä§Ň§ĺ§Ü§Ń §Ő§Ý§ń §Ő§Ö§ä§Ö§Ű §Ú§Ů §â§Ń§Ů§Ó§Ú§Ó§Ń§đ§ë§Ú§ç§ă§ń §ă§ä§â§Ń§ß §ă §č§Ö§Ý§î§đ §ĺ§Ý§ĺ§é§ę§Ö§ß§Ú§ń §ŕ§Ň§â§Ń§Ů§ŕ§Ó§Ń§ä§Ö§Ý§î§ß§í§ç §Ó§ŕ§Ů§Ţ§ŕ§Ř§ß§ŕ§ă§ä§Ö§Ű. OLPC §ă§ä§â§Ö§Ţ§Ú§ä§ă§ń §Ú§ă§á§ŕ§Ý§î§Ů§ŕ§Ó§Ń§ä§î §Ő§Ö§ę§Ö§Ó§ĺ§đ §Ú §Ü§Ń§é§Ö§ă§ä§Ó§Ö§ß§ß§ĺ§đ §ä§Ö§ç§ß§ŕ§Ý§ŕ§Ô§Ú§đ §Ő§Ý§ń §â§Ö§Ó§ŕ§Ý§đ§č§Ú§Ú §Ó §ŕ§Ň§ĺ§é§Ö§ß§Ú§Ú, §ă§Ó§ń§Ů§í§Ó§Ń§ń §Ő§Ö§ä§Ö§Ű, §ĺ§é§Ú§ä§Ö§Ý§Ö§Ű §Ú §Ú§ß§ä§Ö§â§ß§Ö§ä. §°§ă§ß§ŕ§Ó§ß§í§Ö §Ń§ă§á§Ö§Ü§ä§í §Ó§Ü§Ý§đ§é§Ń§đ§ä §ć§Ú§Ý§ŕ§ă§ŕ§ć§Ú§đ §á§â§ŕ§Ö§Ü§ä§Ń, §ă§ŕ§á§ŕ§ă§ä§Ń§Ó§Ý§Ö§ß§Ú§Ö §ă §Ü§ŕ§ß§Ü§ĺ§â§Ö§ß§ä§Ń§Ţ§Ú §Ú §â§Ö§Ń§Ý§Ú§Ů§Ń§č§Ú§đ §Ó §â§Ń§Ů§ß§í§ç §ă§ä§â§Ń§ß§Ń§ç, §á§ŕ§Ő§é§Ö§â§Ü§Ú§Ó§Ń§ń §Ó§Ń§Ř§ß§ŕ§ă§ä§î §Ň§ŕ§Ý§Ö§Ö §ß§Ú§Ů§Ü§ŕ§Ű §č§Ö§ß§í §Ú §Ő§ŕ§ă§ä§ĺ§á§ß§ŕ§ă§ä§Ú §ä§Ö§ç§ß§ŕ§Ý§ŕ§Ô§Ú§Ű.OLPC and Making Miles for Millennium

OLPC and Making Miles for MillenniumHarrie Vollaard

?

This document discusses the One Laptop Per Child (OLPC) initiative and Gertie and Harrie's mission to support it. The key points are:

1. Gertie and Harrie aim to support OLPC through public relations, operational assistance, tactical consultancy, and fundraising for local projects.

2. OLPC designs and distributes a low-cost, rugged laptop for children in developing countries. The laptop is optimized for power efficiency, connectivity, and sustainability in challenging environments.

3. Implementing OLPC faces challenges regarding infrastructure, costs, distribution, and ensuring effective educational integration. Gertie and Harrie hope to help address these challenges and enable more children to benefit from the program.Mammoettankers en speedbootjes; Is banking heading towards its Spotify moment?

Mammoettankers en speedbootjes; Is banking heading towards its Spotify moment?Harrie Vollaard

?

Banking may be heading towards a disruption like Spotify brought to the music industry. There are over 3000 fintech startups that could challenge traditional banks, inspired by innovators like Bill Gates, Clayton Christensen, and Steven Sasson. The head of innovation at Rabobank discusses whether banks should try to beat fintech startups or partner with them.Making Miles for Millenniumgoals

Making Miles for MillenniumgoalsHarrie Vollaard

?

The document summarizes a trip being taken by Harrie Vollaard and Gertie Clabbers from OLPC The Netherlands from May 3rd to October 29th, 2008. The trip aims to raise awareness and funds for the Millennium Development Goals by promoting OLPC's work providing laptops to children. They will help local OLPC projects through public relations, operational support, tactical consultancy, and generating funds. Their goals are to enlarge children's chances in life through education and integrate modern tools into school systems in a sustainable but cheap way.MMvM OLPC NL 13-12-2008

MMvM OLPC NL 13-12-2008Harrie Vollaard

?

The document outlines the contributions and impact of the 'Meters Maken Voor Millennium' initiative, which involves deploying XO laptops in various countries such as India, Nepal, Russia, and Mongolia. It highlights the educational benefits of the XO laptops, their role in bridging the gap between developed and developing nations, and the challenges faced in implementing the program. Key learnings emphasize the importance of local collaboration, scaling projects effectively, and the need for professional project management and teacher training.IT: stimulating structural growth in developing countries

IT: stimulating structural growth in developing countriesHarrie Vollaard

?

The document discusses Rabobank's role as a cooperative bank focused on supporting financial service access in developing countries, particularly through technology innovation. It highlights a case study in Rwanda, addressing IT hurdles faced by savings and credit cooperatives (SACCOs) and outlining potential solutions to enhance operational efficiency. The conclusions emphasize the necessity of developing user-friendly management information systems to improve governance, transparency, and overall financial inclusion within these markets.Parikrma Foundation

Parikrma FoundationHarrie Vollaard

?

The document discusses the critical crisis of poverty and educational inequality in Bangalore, India, where only a small percentage of children receive quality education, resulting in a vast divide in employment opportunities. The Parikrma Humanity Foundation aims to address this issue through a comprehensive development model that provides underprivileged children with quality education, healthcare, and support, ensuring they can compete on equal terms. With a proven track record of high attendance and low dropout rates, Parikrma seeks to expand its impact by building a leadership training center to further educate teachers and administrators.Modern Bankieren Cooperatiebijeenkomst Breda

Modern Bankieren Cooperatiebijeenkomst BredaHarrie Vollaard

?

Presentatie workshop Modern Bankieren op Cooperatiebijeenkomst van Rabobank Breda op 14 maart 2011§±§ŕ§Ü§â§í§Ó§Ń§ń §Ţ§Ú§Ý§Ú §ß§Ń §á§ĺ§ä§Ú §Ü §®§Ú§Ý§Ý§Ö§ß§Ú§ĺ§Ţ§ĺ; Introduction of the XO in Russia

§±§ŕ§Ü§â§í§Ó§Ń§ń §Ţ§Ú§Ý§Ú §ß§Ń §á§ĺ§ä§Ú §Ü §®§Ú§Ý§Ý§Ö§ß§Ú§ĺ§Ţ§ĺ; Introduction of the XO in RussiaHarrie Vollaard

?

§±§ŕ§Ü§â§í§Ó§Ń§ń §Ţ§Ú§Ý§Ú §ß§Ń §á§ĺ§ä§Ú §Ü §®§Ú§Ý§Ý§Ö§ß§Ú§ĺ§Ţ§ĺ; Introduction of the XO in Russia§±§ŕ§Ü§â§í§Ó§Ń§ń §Ţ§Ú§Ý§Ú §ß§Ń §á§ĺ§ä§Ú §Ü §®§Ú§Ý§Ý§Ö§ß§Ú§ĺ§Ţ§ĺ; Introduction of the XO in Russia

§±§ŕ§Ü§â§í§Ó§Ń§ń §Ţ§Ú§Ý§Ú §ß§Ń §á§ĺ§ä§Ú §Ü §®§Ú§Ý§Ý§Ö§ß§Ú§ĺ§Ţ§ĺ; Introduction of the XO in RussiaHarrie Vollaard

?

Similar to Raise of complementary currencies and the possiblities for the financial industry (20)

The electronic payment systems

The electronic payment systemsVishal Singh

?

The document discusses various electronic payment systems used for e-commerce transactions. It describes advantages and disadvantages of different systems including electronic cash, electronic wallets, smart cards, and credit cards. It provides details on how each system works, examples of implementations, and considerations regarding their adoption and success.1.Internet Business Models in modern.pptx

1.Internet Business Models in modern.pptxThejuDaniel

?

This document discusses different types of business models and e-commerce. It defines e-commerce as digitally enabled commercial transactions between organizations and individuals. E-business refers to digital processes within a firm. Major types of e-commerce include business-to-consumer, business-to-business, consumer-to-consumer, and peer-to-peer. It also outlines various electronic payment systems used in e-commerce such as credit cards, digital wallets, stored value accounts, and digital checking.Part i

Part iOnkar Sule

?

E-commerce refers to business conducted over the Internet and World Wide Web. It involves the buying and selling of goods and services, as well as servicing customers and collaborating with business partners digitally. E-commerce lowers costs and product cycle times for businesses while allowing for faster customer response and improved service quality. It comes in various forms depending on whether transactions are business-to-business, business-to-consumer, etc. and whether aspects are purely digital or involve some physical elements.E-commerce System Technologies, Repository and Networking Technology

E-commerce System Technologies, Repository and Networking Technologyizan28

?

The document outlines an introduction to online payment systems and security. It discusses various payment methods including payment cards, electronic cash, electronic wallets, and stored-value cards. It also covers online payment processing, merchant accounts, and open and closed-loop payment systems. The document then discusses Internet technologies used by banks including check processing and mobile banking. It concludes by covering criminal activities like phishing and identity theft that target payment systems.E Volving Reciprocal Relationship E Conomies

E Volving Reciprocal Relationship E ConomiesLiezl Coetzee

?

This document summarizes Liezl Coetzee's presentation on how community currency networks and complementary "gift economies" can enhance local exchange through the use of global tools. It discusses concepts like reciprocal gifting, money as a social technology, and how online mutual credit systems and social features can help build community and promote reciprocity, while also addressing challenges around scale, scope, and bridging the digital divide.The Fintech Revolution

The Fintech Revolutioncurrencycloud

?

The document discusses the evolution of financial technology (fin-tech) and how it impacts banking, emphasizing the importance of innovative technology and efficiency in international payments. It highlights the historical context of the term 'lorem ipsum' and its relevance in design and publishing, while also showcasing the Currency Cloud's role in simplifying payments. The document stresses the need for more control, lower costs, and improved efficiency in financial services.Digital Payment-Revolution in India

Digital Payment-Revolution in IndiaBinod Sinha

?

The document discusses the evolution of payment systems, highlighting the shift from traditional barter methods to digital payments, including mobile commerce and e-wallets. It emphasizes the benefits of a cashless economy in India, such as increased financial inclusion, tracking of transactions, and job creation, while also addressing challenges like cyber security and fraud. Additionally, it outlines initiatives and government programs aimed at promoting digital financial literacy and usage among citizens.BarterCard

BarterCardLiam Moore

?

BarterCard has introduced a platform that allows over 25,000 businesses across 10 countries to exchange goods and services using a proprietary digital currency. Since 1991, BarterCard has grown to become the world's largest trade exchange, facilitating over $600 million in trades annually. Their currency ensures both parties in a trade feel satisfied, even if they don't have a direct match of goods or services to exchange. Members represent over 700 industries and can use trade dollars to increase working capital, access interest-free credit, network with other businesses, and avoid discounting unsold inventory. While successful, some businesses find the model difficult and BarterCard currency lacks value outside its network.Internet technology and the digital firm.

Internet technology and the digital firm.Prof. Othman Alsalloum

?

The document discusses key topics around digital firms and e-commerce including internet business models, benefits of internet technology for organizations, and management challenges of digital transformation. It provides examples of how intranets support collaboration and supply chain management. Electronic payment systems and the flow of information in business-to-business and business-to-consumer e-commerce are also examined.Thoroughly Modern Money - How to Design a Currency

Thoroughly Modern Money - How to Design a CurrencyPhoebe Bright

?

Phoebe Bright discusses the design considerations for creating a new local currency aimed at increasing liquidity and promoting local economic resilience. Key aspects include managing money supply, ensuring security and trust, and understanding the needs of different user groups, while presenting strategies for implementation and potential scenarios for success or failure. The document emphasizes the need for a thorough assessment of local economic circuits and user engagement to determine the viability of such a currency.Chapter 15: GETTING THE MONEY

Chapter 15: GETTING THE MONEY Syeda Tabia

?

The document discusses various topics related to electronic payments, including:

1) Different types of electronic money and key requirements for internet-based payment systems.

2) Methods of electronic payment such as credit cards, debit cards, smart cards, and digital cash/e-cash.

3) Issues and implications regarding the regulation, economics, and social impacts of electronic payment methods.Welcome to the ecosystem of the collaborative economy

Welcome to the ecosystem of the collaborative economyshareNL

?

The document explains the collaborative economy, defined as decentralized networks and marketplaces that optimize the use of underused assets by connecting providers and consumers, bypassing traditional institutions. It categorizes organizations within this economy into peer-to-peer, peer-to-business-to-peer, and business-to-peer, highlighting various markets such as transportation, space, and food. The text also contrasts the collaborative economy with traditional economic models, emphasizing its reliance on modern technology to facilitate peer interactions and transactions on a larger scale.Elecrtonic payment system

Elecrtonic payment systemMukesh Lal Karn

?

This document discusses electronic payment systems. It defines electronic payment as a financial exchange that occurs online between buyers and sellers using digital payment methods like encrypted credit card numbers or digital cash. The document outlines requirements for electronic payments like acceptability, anonymity, and usability. It describes different types of electronic payment systems including digital token-based systems like electronic cash and cheques, and retail payment methods like credit cards and debit cards. The advantages and disadvantages of electronic cash are also summarized.Social Currencies and Crowdfunding

Social Currencies and CrowdfundingWerner Keil

?

The document discusses social currencies, local money systems, and the history and evolution of crowdfunding. It highlights various forms of digital currencies such as Facebook Credits and Amazon Coins, as well as notable crowdfunding projects and the impact of legislation like the JOBS Act in the U.S. It also introduces JSR 354, a Java API that supports currency operations and is designed for enterprise applications dealing with monetary values.Money

Money Ashutosh Goel

?

1) Money refers to anything that is generally accepted as payment for goods and services or debt repayment. The document defines related terms like wealth, income, stock, and flow.

2) The functions of money are discussed - as a medium of exchange, unit of account, store of value, and standard of deferred payment. The history and evolution of money is also outlined, from barter systems to modern digital payments.

3) The advantages and disadvantages of barter systems are compared. Characteristics of good forms of money are defined as portable, acceptable, durable, divisible, scarce, recognizable, and uniform. Works cited in MLA format are listed at the end.Social Gold: How to Launch your own Currency

Social Gold: How to Launch your own CurrencySocial Gold

?

The document outlines the essentials of launching a virtual currency, emphasizing that currency is a means to an end and not the ultimate goal. It discusses the importance of user experience, the need to optimize for engagement before monetization, and the creation of a sustainable economy through user-generated content. Key areas covered include building the currency infrastructure, methods for making money, and utilizing actionable metrics for success.Overview of Electronic Commerce

Overview of Electronic CommerceAndrey Andoko

?

This document provides an overview of electronic commerce (EC), including definitions, frameworks, classifications of different types of EC transactions, drivers of EC such as the digital revolution and business environment, EC business models, and benefits and limitations of EC. It describes key concepts such as business-to-business, business-to-consumer, and mobile commerce models. The document also discusses social and business networks, the future of EC including Web 2.0, and issues for managers to consider regarding EC strategy and challenges.Electronic payments ystem

Electronic payments ystem Aditya Kumar

?

The document discusses a manufacturer business model and electronic payment systems presented by a group of students. It defines business models and e-commerce business models. It then covers the key components of a business model including value proposition, revenue model, market opportunity, and competitive advantage. The document also discusses electronic payment systems including e-cash, e-wallets, smart cards, and credit cards. It covers the capabilities of a B2C e-commerce model and the advantages and risks of different electronic payment methods.Tradesbay-Online cashless trading system

Tradesbay-Online cashless trading systemIRJET Journal

?

1) The document proposes an online cashless trading system called Tradesbay that uses a proprietary compatibility algorithm and virtual currency to facilitate trading goods online without cash.

2) It aims to address issues with traditional online trading sites like high fees, limited product variety, and privacy concerns by allowing users to trade goods for virtual currency points assigned based on the good's quality and condition.

3) The system would verify goods, evaluate them, assign trading points, then make goods available for trade using those points to minimize costs for users and promote more accessible online trading.Vaishnavi e commerce

Vaishnavi e commerceVaishnaviVaishnavi17

?

This document provides an introduction to electronic payments and e-commerce. It discusses various modes of electronic payment such as payment cards, electronic cash, check free payments, electronic wallets, and smart cards. The advantages and disadvantages of these methods are outlined. Emerging trends in electronic payments are also examined, including growing smartphone adoption and mobile payment technologies like near-field communication. The future of payments is predicted to be increasingly mobile-centric.Ad

Recently uploaded (20)

Ô°ćÎ÷°ŕŃŔάżË´óѧ-ĽÓĚ©ÂŢÄáŃÇÖĐŃë´óѧ±Ďҵ֤(±«łŐ±ő°ä±Ďҵ֤Ęé)ČçşÎ°ěŔí

Ô°ćÎ÷°ŕŃŔάżË´óѧ-ĽÓĚ©ÂŢÄáŃÇÖĐŃë´óѧ±Ďҵ֤(±«łŐ±ő°ä±Ďҵ֤Ęé)ČçşÎ°ěŔítaqyed

?

ĽřÓÚ´ËŁ¬°ěŔíUVIC´óѧ±Ďҵ֤άżË´óѧ-ĽÓĚ©ÂŢÄáŃÇÖĐŃë´óѧ±Ďҵ֤Ę顾qޱ1954292140ˇżÁôѧһվʽ°ěŔíѧŔúÎÄƾֱͨłµŁ¨Î¬żË´óѧ-ĽÓĚ©ÂŢÄáŃÇÖĐŃë´óѧ±Ďҵ֤UVICłÉĽ¨µĄÔ°ćάżË´óѧ-ĽÓĚ©ÂŢÄáŃÇÖĐŃë´óѧѧλ֤ĽŮÎÄĆľŁ©Î´ÄÜŐýłŁ±ĎҵŁżˇľqޱ1954292140ˇż°ěŔíάżË´óѧ-ĽÓĚ©ÂŢÄáŃÇÖĐŃë´óѧ±Ďҵ֤łÉĽ¨µĄ/ÁôĐĹѧŔúČĎÖ¤/ѧŔúÎÄĆľ/ĘąąÝČĎÖ¤/Áôѧ»ŘąúČËÔ±Ö¤Ă÷/¼ȡ֪ͨĘé/Offer/ÔÚ¶ÁÖ¤Ă÷/łÉĽ¨µĄ/ÍřÉĎ´ćµµÓŔľĂżÉ˛éŁˇ

ČçąűÄú´¦ÓÚŇÔĎÂĽ¸ÖÖÇéżöŁş

ˇóÔÚĐŁĆڼ䣬Ňň¸÷ÖÖÔŇňδÄÜËłŔű±ĎҵˇˇÄò»µ˝ąŮ·˝±Ďҵ֤

ˇóĂć¶Ô¸¸Ä¸µÄŃąÁ¦Ł¬ĎŁÍűľˇżěÄõ˝Ł»

ˇó˛»ÇĺłţČĎÖ¤Á÷łĚŇÔĽ°˛ÄÁϸĂČçşÎ׼±¸Ł»

ˇó»ŘąúʱĽäşÜł¤Ł¬ÍüĽÇ°ěŔíŁ»

ˇó»ŘąúÂíÉĎľÍŇŞŐŇą¤×÷Ł¬°ě¸řÓĂČ˵ĄÎ»ż´Ł»

ˇóĆóĘÂҵµĄÎ»±ŘĐëŇŞÇó°ěŔíµÄ

ˇóĐčŇŞ±¨żĽą«ÎńÔ±ˇ˘ąşÂňĂâË°łµˇ˘Âäת»§żÚ

ˇóÉęÇëÁôѧÉú´´Ňµ»ů˝đ

ˇľ°ěŔíάżË´óѧ-ĽÓĚ©ÂŢÄáŃÇÖĐŃë´óѧłÉĽ¨µĄBuy Universitat de Vic-Universitat Central de Catalunya Transcriptsˇż

ąşÂňČŐş«łÉĽ¨µĄˇ˘Ó˘ąú´óѧłÉĽ¨µĄˇ˘ĂŔąú´óѧłÉĽ¨µĄˇ˘°ÄÖŢ´óѧłÉĽ¨µĄˇ˘ĽÓÄĂ´ó´óѧłÉĽ¨µĄŁ¨q΢1954292140Ł©ĐÂĽÓĆ´óѧłÉĽ¨µĄˇ˘ĐÂÎ÷ŔĽ´óѧłÉĽ¨µĄˇ˘°®¶űŔĽłÉĽ¨µĄˇ˘Î÷°ŕŃŔłÉĽ¨µĄˇ˘µÂąúłÉĽ¨µĄˇŁłÉĽ¨µĄµÄŇâŇĺÖ÷ŇŞĚĺĎÖÔÚÖ¤Ă÷ѧϰÄÜÁ¦ˇ˘ĆŔąŔѧĘő±łľ°ˇ˘ŐąĘľ×ŰşĎËŘÖʡ˘Ěá¸ß¼ȡÂĘŁ¬ŇÔĽ°ĘÇ×÷ÎŞÁôĐĹČĎÖ¤ÉęÇë˛ÄÁϵÄŇ»˛ż·ÖˇŁ

άżË´óѧ-ĽÓĚ©ÂŢÄáŃÇÖĐŃë´óѧłÉĽ¨µĄÄÜą»ĚĺĎÖÄúµÄµÄѧϰÄÜÁ¦Ł¬°üŔ¨Î¬żË´óѧ-ĽÓĚ©ÂŢÄáŃÇÖĐŃë´óѧżÎłĚłÉĽ¨ˇ˘×¨ŇµÄÜÁ¦ˇ˘ŃĐľżÄÜÁ¦ˇŁŁ¨q΢1954292140Ł©ľßĚĺŔ´ËµŁ¬łÉĽ¨±¨¸ćµĄÍ¨łŁ°üş¬Ń§ÉúµÄѧϰĽĽÄÜÓëĎ°ąßˇ˘¸÷żĆłÉĽ¨ŇÔĽ°ŔĎʦĆŔÓďµČ˛ż·ÖŁ¬Ňň´ËŁ¬łÉĽ¨µĄ˛»˝öĘÇѧÉúѧĘőÄÜÁ¦µÄÖ¤Ă÷Ł¬Ň˛ĘÇĆŔąŔѧÉúĘÇ·ńĘĘşĎÄł¸ö˝ĚÓýĎîÄżµÄÖŘŇŞŇŔľÝŁˇThe Impact of Blockchain Technology on IndiaˇŻs Financial Sector

The Impact of Blockchain Technology on IndiaˇŻs Financial Sectorrealtaxindia07

?

Introduction

IndiaˇŻs financial sector is on the brink of a digital revolution, with blockchain technology emerging as a key disruptor. Once considered a buzzword linked only to cryptocurrencies, blockchain has now evolved into a powerful tool with real-world applications in banking, finance, and even government services. But what does this mean for IndiaˇŻs economy and its people?

LetˇŻs explore how blockchain is reshaping IndiaˇŻs financial landscape and what the future might hold.Panel 2 - Panel discussion - Demystifying key critical & practical issues und...

Panel 2 - Panel discussion - Demystifying key critical & practical issues und...imccci

?

Panel 2 - Panel discussion - Demystifying key critical & practical issues under VSV 2.0

Shakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24

Shakti Pumps India - Business Analysis | NSE:SHAKTIPUMP | FY 24Business Analysis

?

Qualitative Fundamental Analysis of Shakti Pumps (India) share for its future growth potential (based on the Annual Report FY2024)

Get a sense of the Shakti Pumps (India)'s business activities, by understanding its values, business and risks.

YouTube video: https://youtu.be/lx5SxXcu90g

Order a printed copy of this presentation: BusinessAnalysis.BA.info@gmail.com

--

Disclaimer:

We are not SEBI RIAs. This presentation is not an investment advice. It is only for study and reference purposes.Pieter Stalenhoef Leadership in Finance, Lifestyle Balance, and the Value of ...

Pieter Stalenhoef Leadership in Finance, Lifestyle Balance, and the Value of ...WilliamClack2

?

Pieter Stalenhoef Leadership in Finance, Lifestyle Balance, and the Value of CFA Society EngagementSTOCK TRADING COURSE BY FINANCEWORLD.IO (PDF)

STOCK TRADING COURSE BY FINANCEWORLD.IO (PDF)AndrewBorisenko3

?

Unlock the Power of the Stock Market ¨C Stock Trading Course by FinanceWorld.io (PDF)

Take your first step towards financial independence with FinanceWorld.ioˇŻs in-depth Stock Trading Course. This easy-to-follow PDF guide demystifies the stock market, providing you with all the essential tools and knowledge to begin trading with confidence.

WhatˇŻs Included in This Course:

Introduction to stocks and the stock market ecosystem

Understanding shares, indices, and different market sectors

How to open a brokerage account and place your first trades

Fundamental analysis: reading financial statements and news

Technical analysis: chart patterns, trends, and indicators

Time-tested strategies for beginners and experienced traders

Essential risk management techniques to protect your capital

Trading psychology: mastering emotions and staying disciplined

Real-world examples, practice exercises, and actionable tips

Who Is This PDF For?

New investors looking to enter the world of stock trading

Current traders wanting to refine their approach and strategy

Anyone seeking to build wealth through the stock market

Why Choose FinanceWorld.io?

Our expert-written guides strip away the jargon and focus on practical, real-world trading skills. With FinanceWorld.io, you gain clarity, confidence, and a proven roadmap to succeed in the markets.Prospects & Challenges of Doing Business in Nepal: Investment Opportunities, ...

Prospects & Challenges of Doing Business in Nepal: Investment Opportunities, ...Kshitiz Parajuli

?

Overview:

This comprehensive presentation analyzes Nepal's evolving business landscape, highlighting high-potential investment sectors, critical challenges, and actionable recommendations for sustainable growth. Prepared by Alosh Lama, Kshitiz Parajuli, Saurav Shrestha, and Suraj Chapagain, it combines data-driven insights with policy analysis for investors, policymakers, and entrepreneurs.

Key Opportunities Explored:

- Hydropower: Only 4.2% of 50,000 MW potential harnessed; 40% FDI surge (2022) and export prospects to India.

- Tourism: 2025 declared "Special Tourism Year"; 1.2M tourists (2023) spending $40.5/day.

- Agriculture: 24.09% GDP contribution, govt subsidies for processing, and crop insurance.

- Digital Economy: Rapid adoption of e-commerce and fintech.

- Demographic Advantage: Youth-dominated workforce and strategic India-China location.

Critical Challenges:

?? Infrastructure Gaps:

- 72% roads unpaved; 200km transport takes 2-3 days

- 8-10 hour daily power cuts; 15-20% firms face equipment damage from voltage fluctuations

?? Regulatory Hurdles:

- 37+ approvals for hydropower projects; 5-year delays

- FDI bans in retail/media; 5% expat hiring cap

?? Economic Volatility:

- 9.2% food inflation; NPR depreciated 4% vs USD (2024)

- Forex reserves cover only 14 months of imports

?? Legal Burdens:

- 35% effective corporate tax; 6-9 month VAT refund delays

- 45-day minimum profit repatriation

?? Socio-Political Risks:

- 147 major strikes (2024); 5 industrial policy shifts since 2010

Data Highlights:

- ? Hydropower: 97.7% electricity access (2019)

- ?? Tourism: 2% GDP contribution despite growth

- ? Agriculture: 59% cultivable land lacks irrigation

- ? Strike Losses: NPR 850M (15 days for Surya Nepal)

Recommendations for Growth:

1. Streamline Bureaucracy: Adopt Singapore-like business registration

2. Infrastructure Investment: Follow BangladeshˇŻs model

3. Legal Framework Strengthening: New Zealand-inspired trust-building

4. Workforce Development: GermanyˇŻs vocational training system

Conclusion:

Nepal offers significant untapped potential in energy, agribusiness, and tourism but requires urgent reforms in infrastructure, policy stability, and ease of doing business to attract FDI. Sustainable growth hinges on implementing these data-backed solutions.

Relevant For:

Investors, policymakers, entrepreneurs, economists, international trade analysts, and development agencies exploring South Asian markets.

2025 RWA Report: When Crypto Gets Real | CoinGecko

2025 RWA Report: When Crypto Gets Real | CoinGeckoCoinGecko Research

?

The revival of real world assets (RWA) in crypto marked one of 2024ˇŻs most quietly transformative narratives. While attention remained fixated on memecoins, Layer 2 ecosystems, and political betting markets, RWA steadily evolved from a niche experiment into one of the most credible and capitalized sectors in crypto.

So, how far have the core RWA verticals come since the start of 2024?

WeˇŻve summarized the key highlights, but be sure to dig into the full 18 slides below.INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptx

INVESTMENT ANALYSIS AND PORTFOLIO MANAGEMENT-1.pptxAnkush Upadhyay

?

This presentation analyzes investment strategies for a 30-year-old risk-averse investor with ?50 lakhs. Based on a 35:65 equity-debt allocation, it recommends equity investments in HAL, BEL, and Bajaj Auto due to their strong financials and low debt, and debt investments in government and tax-free bonds with stable yields. The analysis balances risk and return for long-term portfolio growth in the defense sector and public sector bonds.Shocks and Inequality An Empirical Exploration

Shocks and Inequality An Empirical ExplorationGRAPE

?

We study the contribution of supply and demand shocks to income inequality in a panel setting. In particular, we exploit the newly created Global Repository of Income Dynamics to study how unanticipated supply and demand shocks identified using long-run restrictions affect income inequality as measured by Gini. We find that demand shocks originating in the United States, on average, increase income dispersion, which we interpret as the impact of changes to US consumption of foreign goods and services. Supply shocks also tend to increase income dispersion, but have a much weaker and short-lived impact. A comparison with responses to domestic shocks reveals that demand shocks exhibit a similar dynamic. Domestic supply shocks are linked to declines in income dispersion. Middle East Conflict Sparks Oil Price Surge ¨C Global Markets on Alert

Middle East Conflict Sparks Oil Price Surge ¨C Global Markets on Alert Swiss International University SIU

?

Tensions between Israel and Iran have intensified, with recent strikes on key oil and gas facilities sending shockwaves through global markets. Making Heritage Inclusive at Shivsrushti - How a single donation made cultura...

Making Heritage Inclusive at Shivsrushti - How a single donation made cultura...Raj Kumble

?

Learn how Shivsrushti, with support from the Abhay Bhutada Foundation, is blending storytelling and technology for inclusive cultural education.

Optimal taxation of human capital and the role of family

Optimal taxation of human capital and the role of familysradomska

?

Optimal taxation of human capital and the role of family2025 RWA Report: When Crypto Gets Real | CoinGecko

2025 RWA Report: When Crypto Gets Real | CoinGeckoCoinGecko Research

?

The revival of real world assets (RWA) in crypto marked one of 2024ˇŻs most quietly transformative narratives. While attention remained fixated on memecoins, Layer 2 ecosystems, and political betting markets, RWA steadily evolved from a niche experiment into one of the most credible and capitalized sectors in crypto.

So, how far have the core RWA verticals come since the start of 2024?

WeˇŻve summarized the key highlights, but be sure to dig into the full 18 slides below.Moore Organizations Insurance Company Overview

Moore Organizations Insurance Company OverviewMoore Organizations

?

Moore Organizations is a licensed life insurance agency

Family Governance Presentation by Dinesh Kanabar

Family Governance Presentation by Dinesh Kanabarimccci

?

Family Governance Presentation by Dinesh Kanabar 15 2024Middle East Conflict Sparks Oil Price Surge ¨C Global Markets on Alert

Middle East Conflict Sparks Oil Price Surge ¨C Global Markets on Alert Swiss International University SIU

?

Ad

Raise of complementary currencies and the possiblities for the financial industry

- 1. Raise of virtual currencies and the possibilities for the financial industry NetFinance Conference, London Harrie Vollaard, Innovation, November 19. 2013

- 2. The raise of alternative currencies (C2C) 2

- 3. The raise of alternative currencies (B2B) 3

- 5. 5

- 6. Why 1. Change within the financial industry: a. The financial crisis has changed the playing field; banks seen as part of the problem; public seeking fair solutions. b. Shift from financed by banks to financed by the capital market 2. Change within society: Raise of sharing economy 3. Change of technology: Technology means business models for financial services will change; financial institutions need innovations.

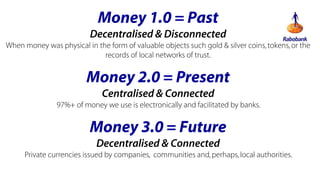

- 7. Money 1.0 = Past Decentralised & Disconnected When money was physical in the form of valuable objects such gold & silver coins, tokens, or the records of local networks of trust. Money 2.0 = Present Centralised & Connected 97%+ of money we use is electronically and facilitated by banks. Money 3.0 = Future Decentralised & Connected Private currencies issued by companies, communities and, perhaps, local authorities.

- 8. Diversity of Currencies 1. Trade Exchange B2B - mutual credit Business 2 Business, unit = trade credits/dollars 2. Corporate Barter B2B- central credit Issuing, unit = trade credits/dollars 3. Corporate Trade Exchange B2B - hybrid Corporate/ Trade Exchange, unit = trade credits/dollars 4. Loyalty Exchange B2C - hybrid Trade Exchange business 2 citizen , unit = points 5. Air miles rewards - propriety, coalition operated by airlines unit = air miles 6. Loyalty programs - propriety, coalition consumer rewards, unit = points 7. Time bank - social exchange, unit = hours 8. Time bank - professional exchange, unit = (multiple) hours 9. Local Exchange Trading System C2C - mutual credit citizen 2 citizen, unit = LETS credits 10.Local paper currency - discount shopping, = paper currency/scrip 11.Local fiat currency - paper and digital 12.Social media currency - Facebook, QQ, unit =points 13.Games consoles currency - Wii, Xbox, play station etc, unit =points 14.Gamer currency - e.g. Second Life, unit = points 15.Charity exchange - mailing list exchange for fund raising, unit = points 16.Media exchange - discount shopping = paper currency/scrip/points 17.Incentive exchange - employee or citizen rewards program, unit = points 18.Metal based - gold, silver and copper coins or digital, Liberty Dollar etc. 19.Commodity based ¨C baskets of commodies like Ven or energy-backed currencies 20.Cryptographic - encrypted files created by CPU power e.g Bitcoin, units = depends 21. Reputation ¨C based upon social media reputation e.g. Flattr, Mobbr, units = points

- 10. Trade currency within Barter network

- 11. Barter network (Mutual Credit Systems) ? ? ? A group of businesses create a group credit for their goods & services Each business in the group is given an amount of credit that is backed by the commitment of the other businesses. Either electronic database, or even coupons act as a currency that is backed by excess capacity of the business community. Worldwide, more than 400,000 companies are members of one or more of the hundreds of Trade (ˇ°Barterˇ±) Exchanges. Various sources estimate the volume of non-monetary trade worldwide to be between 15% to 25% of the total.

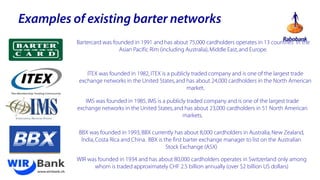

- 12. Examples of existing barter networks Bartercard was founded in 1991 and has about 75,000 cardholders operates in 13 countries in the Asian Pacific Rim (including Australia), Middle East, and Europe. ITEX was founded in 1982, ITEX is a publicly traded company and is one of the largest trade exchange networks in the United States, and has about 24,000 cardholders in the North American market. IMS was founded in 1985, IMS is a publicly traded company and is one of the largest trade exchange networks in the United States, and has about 23,000 cardholders in 51 North American markets. BBX was founded in 1993, BBX currently has about 8,000 cardholders in Australia, New Zealand, India, Costa Rica and China. BBX is the first barter exchange manager to list on the Australian Stock Exchange (ASX) WIR was founded in 1934 and has about 80,000 cardholders operates in Switzerland only among whom is traded approximately CHF 2.5 billion annually (over $2 billion US dollars)

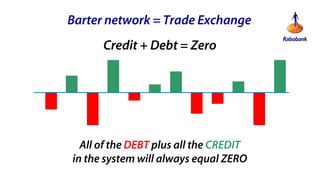

- 13. Barter network = Trade Exchange Credit + Debt = Zero All of the DEBT plus all the CREDIT in the system will always equal ZERO

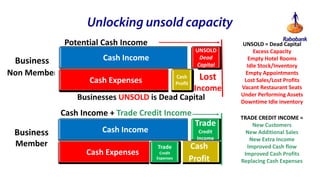

- 14. Unlocking unsold capacity Potential Cash Income Business Non Member UNSOLD Dead Capital Cash Income Lost Cash Profit Cash Expenses Income Businesses UNSOLD is Dead Capital Cash Income + Trade Credit Income Business Member Trade Cash Income Cash Expenses Credit Income Trade Credit Expenses Cash Profit UNSOLD = Dead Capital Excess Capacity Empty Hotel Rooms Idle Stock/Inventory Empty Appointments Lost Sales/Lost Profits Vacant Restaurant Seats Under Performing Assets Downtime Idle inventory TRADE CREDIT INCOME = New Customers New Additional Sales New Extra Income Improved Cash flow Improved Cash Profits Replacing Cash Expenses Trade Credit income REPLACES cash expenses which in return increases profits

- 15. Why Popular? Unsold Capacities ADVERTISING AIRLINE HOTELS LABOUR MANUFACTURER PRINTER RETAILER RESTAURANT SERVICES All Businesses Have UNSOLD UNSOLD UNSOLD UNSOLD UNSOLD UNSOLD UNSOLD UNSOLD UNSOLD Advertising space and slots UNSOLD Capacity Or Inventory Tickets empty seats Rooms seasonal business Jobs unbilled hours Production and idle inventory Down time on printing presses Stock and end of line goods Table seats quiet mid-week Time unfilled appointments

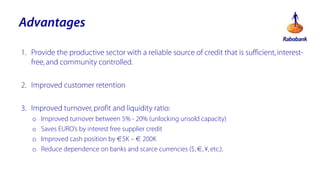

- 16. Advantages 1. Provide the productive sector with a reliable source of credit that is sufficient, interestfree, and community controlled. 2. Improved customer retention 3. Improved turnover, profit and liquidity ratio: o o o o Improved turnover between 5% - 20% (unlocking unsold capacity) Saves EUROˇŻs by interest free supplier credit Improved cash position by €5K ¨C € 200K Reduce dependence on banks and scarce currencies ($, €, ?, etc.).

- 17. Time currency within WeHelpen

- 19. 2-12-2013

- 20. 2-12-2013

- 21. 21

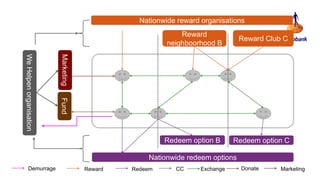

- 23. Nationwide reward organisations Redeem option C Marketing Reward Club C Redeem option B Fund We Helpen organisation Reward neighboorhood B Nationwide redeem options Demurrage Reward Redeem CC Exchange Donate Marketing

- 24. Demurrage ? 1% per month ? < 50 credits: no interest ? > 50: 1 credit per month

- 25. Future of Banking Services? ? ? ? ? ? ? ? Being part of the system Accounting and credit clearing services Financial analysis and determination of creditworthiness Safe storage of various currencies and digital assets Payment systems Sales of financial products (cross sell), like insurance Revenues derived from: o service fees (transaction fees, evaluation fees, brokerage fees) o data analysis, advertising and sales of additional services *

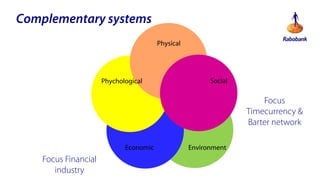

- 26. Complementary systems Physical Phychological Wellbeing customer Economic Focus Financial industry Social Environment Focus Timecurrency & Barter network

- 27. Summary; it is just the beginning ? There is potential from these innovations in terms of their wider effect on society. ? As a cooperative bank needs fair and sustainable innovations. The challenge is to find fair business models for the bank using complementary currencies. ? Learning by doing: be active in a number of ways where Rabobank enhances its co-operative approach to monetary innovation, and has horses in the race and shapes the rules of the game.