Niinue MSME Investments Exchange Pitch Deck

- 1. NIINUE Turning Diaspora Remittances Into Investments 123 Anywhere St., Any City, ST 12345 hello@niinue.com +254799086727

- 2. Kenyans abroad lose a staggering US$200 million annually to misguided investments back home. This sum is just the tip of the iceberg, as fear of further losses keeps potential investments back home at bay. This means that only 5% of the US$4 billion diaspora remittances into the country go into investments largely because there is a lack of transparency and trust, lack of regulation and little Return On these Investments. The Problem Diaspora funds are in an investment money trap *SOURCE: Kenya Diaspora Remittances Survey, 2021

- 3. The physical separation between sender and recipient leads to a lack of visibility. This often results in investment funds not being utilized for their intended purpose. Misappropriation of funds meant for investments is common, leading to mistrust between sender and recipient. No Transparency & Trust Root Problem Those in diaspora are averse to investing back home Most investment funds go towards real estate, which is highly unregulated. There’s no recourse for anyone sending money to an investment that doesn’t materialize, leading to stories of investors pumping money into failed real estate development projects. Lack of Regulation If you have little visibility on your investment, and there’s no regulation protecting your cash, it is very likely that you will not get any returns on your investment. Most remittances allocated to investment rarely deliver on ROI. Lack of ROI

- 4. What’s needed is a regulated platform that not only guarantees visibility on investments but also delivers attractive returns for investors in the diaspora. Safeguarding a US$4B Investment Pool Remedy So much money, such little regulation

- 5. Solution We’ve developed Niinue, a regulated online crowdfunding platform that securely connects investors with entrepreneurs running high-growth MSME’s thus ensuring a robust return on investment.

- 6. It’s a crowdfunding platform that gives investors constant visibility on their investment. Niinue serves two core functions it’s an online platform that allows one to invest in a host of small businesses a. it provides ERP services for these high-growth small businesses b. The platform offers investors exclusive access to curated MSME business information e.g. company & business owner profile, business model, balance sheet, income statement and cash flow projections. Through the ERP, investors also get select visibility to monthly business data such as sales, sales projections, invoice reports and profit margins. Delivers Transparency and Investor Trust; How Niinue Resolves The Root Problem Root problems - No transparency & trust, Lack of regulation and little RoI

- 7. How Niinue Resolves The Root Problem Root problems - No transparency & trust, Lack of regulation and little RoI Niinue is regulated by the Capital Markets Authority, SASRA and the CBK. Entrepreneurs wanting to get funding on Niinue must also be members of a SACCO registered by SASRA. It’s Highly Regulated It provides investors with unique opportunities to invest in high-growth MSME’s businesses that deliver robust return on investments. These MSME’s are vetted through a rigorous on-boarding process that allows for the identify of the following; a. Businesses that demonstrate potential for rapid growth b. Businesses with owners who demonstrate acceptable management & financial knowledge capacity c. Businesses with acceptable KPI’s and KYC’s that allow for smooth operation & management Attractive Returns

- 8. how niinue attracts funders Content Marketing - informative and engaging content i.e. videos, blogs, podcasts, etc. 1. Social media marketing - Advertising, events, videos, podcasts, interviews, etc. 2. Ministry of Foreign and Diaspora Affairs - partnerships & collaborations 3. Influencer marketing - through individuals both abroad and in Kenya who are held in high esteem 4. Conferences and events abroad - both virtual and physical 5. Incentives and Referral Programs: Encourage investors to join by offering exclusive investment opportunities, discounts on fees, or referral bonuses for referring friends 6.

- 9. How Niinue Works How investments are approved and funded

- 12. Business Vetting MSME’s are vetted through a rigorous on-boarding process that allows for the identify of the following; a. Businesses that demonstrate potential for rapid growth b. Businesses with owners who demonstrate acceptable management & financial knowledge capacity c. Businesses with acceptable KPI’s and KYC’s that allow for smooth operation & management This information is gathered online via the Niinue platform, where business owners are required to fill in an application form, and also follow up with an online video interview. Here's a breakdown of the KYCs required in the application process:

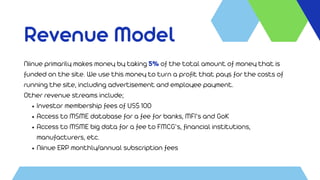

- 15. How Niinue Monetizes How this platform will make money

- 16. Revenue Model Niinue primarily makes money by taking 5% of the total amount of money that is funded on the site. We use this money to turn a profit that pays for the costs of running the site, including advertisement and employee payment. Other revenue streams include; Investor membership fees of US$ 100 Access to MSME database for a fee for banks, MFI’s and GoK Access to MSME big data for a fee to FMCG’s, financial institutions, manufacturers, etc. Niinue ERP monthly/annual subscription fees

- 17. Revenue Model We’re looking at investments within the range of US$5,000 - 100,000 per investment These investments can be individual or groups (an investment group or SACCO can decide to invest in a business) Loan tenors will last between 12 months - 36 months We’re looking at loan returns ranging between 16% - 24% P.A.

- 18. MSME Loans Value There were 1.18 million active MSME loan accounts in the banking industry as at December 2022, with a total value of Ksh.783.3 billion

- 20. Chief Executive Officer Ngaruiya Thuku General Manager John Kabaa Credit Control Director Eva Githuku Meet our Team Chief Tech Officer Eric Wanyoike