Nike, The Innovation Machine

- 1. Helixa ┬Ā 16, ┬Ārue ┬ĀBrey ┬Ā-┬ŁŌĆÉ ┬Ā75017 ┬ĀParis ┬Ā Crea7ve ┬ĀCommons ┬ĀLicense ┬Ā August ┬Ā2012 ┬Ā v ┬Ā 1

- 2. Why Nike? ┬¦’é¦ŌĆ» Nike is the global largest athletic brand retailer The company has delivered a +19% CAGR in revenues over the last 33 yearsŌĆ”from 1978 to 2011; to reach $21b in 2012 ┬¦’é¦ŌĆ» Nike has developed a leadership strategy outperforming its competitors both in footwear and apparel ŌĆ£At Nike, we are leaders. When we fail is when we are followers.ŌĆØ Tinker Hatfield, VP of Innovation Nike has maintained a clear leadership position since the 1980s outrivaling top sportswear companies and fashion leaders ┬¦’é¦ŌĆ» Nike is consistently reinventing the way of retailing and branding thanks to innovation and resilience ŌĆ£Sports created Nike, but design and innovation made it grow.ŌĆØ Mark Parker, CEO Nike focuses on connecting with the consumer emotions and developing ways to turn transactional relationships into experiences: both online and offline, locally and globally. To achieve this ambition, Nike rests on a deep innovation pipeline 2

- 3. 1 INTRO: Nike at a glance 2 Nike, a top brand with outstanding results 3 Strengthening its leadership position consistently 4 ŌĆ” by being pioneer, innovative and resilient 5 Nike is facing multiple challenges 3

- 4. Nike Inc.ŌĆÖs History Timeline Net Sales top $21 billion Global expansion, including a strong growth in China, 2012 2006 Nike signs Brazilian football superstar Ronaldinho Nike sales top $3 billion 1991 Late Nike hit by allegations of sweatshop 1990 labour Niketown: the 1st home to a new 1990 retail-as-theatre experience, Nike signs basketball 1984 superstar Michael Jordan BRS officially changes its name to Nike and in 1980, Nike takes over from Adidas, capturing more than 50% of US 1979 market share 1973 Steve Prefontaine becomes NikeŌĆÖs first endorser BRS launches its own Nike shoe under the famous Knight and Johnson open the first BRS retail store in Santa ŌĆ£SwooshŌĆØ giving birth to Nike Brand 1971 1966 Monica, California. Knight approaches Jeff Johnson to sell shoes for BRS. Bill Bowerman and his University of Oregon runner Phil Johnson starts selling T-shirts as well 1965 1962 Knight form Blue Ribbon Sports (BRS) to distribute athletic shoes. 4

- 5. Nike Inc. Key Figures, The largest apparel & footwear company in the world HEADQUARTERS Beaverton, Oregon (The United States) ┬¦’é¦ŌĆ» Net sales: $20,9 bn ┬¦’é¦ŌĆ» Net profit: $2,1 bn 2011 KEY FIGURES ┬¦’é¦ŌĆ» Operating profit: $2,8 bn (10% of net sales) (13% of net sales) ┬¦’é¦ŌĆ» Employees: 38 000 ┬¦’é¦ŌĆ» The U.S: 36% of net revenues ┬¦’é¦ŌĆ» Asia Pacific: 14% GLOBAL PRESENCE ┬¦’é¦ŌĆ» Europe: 23% ┬¦’é¦ŌĆ» Others: 27% Nike, Inc. (Nike), incorporated in 1968, designs, develops and markets athletic footwear, apparel, equipment and accessories primarily under the Nike brand Sources: Nike Annual report / 2011 figures 5

- 6. The Acquisition Timeline: NikeŌĆÖs wholly-owned Affiliates Brands 2002 Acquires Hurley devoted to 2008 action sports and youth Sells Starter for $60 1994 lifestyle footwear, apparel million 2013 Acquires Canstar and accessories 2004 Nike to sell Umbro and (Bauer Parent) for $400 Acquires Starter for Cole Haan to focus on million $43 million its core brands 1985 2013 1988 1998 Acquires Cole Haan, a Nike Golf established 2007 NYC-based luxury shoes, Acquires Umbro for $630 2003 million, a Manchester- 2008 handbags, accessories & Acquires Converse, the based soccer brand Sells Bauer Hockey for coats brand, for $80 classic and retro-style shoe $200 million million brand (founded in 1908) for $305 million with sales growing 20% per year from $200 million to $1 billion in FY 2011 under NikeŌĆÖs ownership to date Sources: Jefferies / 2011 figures 6

- 7. Nike Brand is the strongest brand of Nike Inc. brand portfolio 5475 M$ Footwear (55%) ┬¦’é¦ŌĆ» $18.0 b NikeŌĆÖs sales Apparel (26%) ┬¦’é¦ŌĆ» 86% of Nike Inc sales Equipment (5%) NIKE BRAND 1013 M$ 2881 M$ ┬¦’é¦ŌĆ» $2.9 b AffiliatesŌĆÖ sales ┬¦’é¦ŌĆ» 14% of Nike Inc sales Others 11 493 M$ ┬¦’é¦ŌĆ» $1.1 b ConverseŌĆÖs sales $20.9 B +19% CAGR 756 $343M 2011 SALES (1978-2011) STORES Web Sales (2%) Sources: Nike Annual report / 2011 figures 7

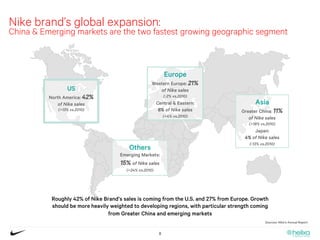

- 8. Nike brandŌĆÖs global expansion: China & Emerging markets are the two fastest growing geographic segment Europe Western Europe: 21% US of Nike sales North America: 42% (-2% vs.2010) of Nike sales Central & Eastern: Asia (+13% vs.2010) 6% of Nike sales Greater China: 11% (+4% vs.2010) of Nike sales (+18% vs.2010) Japan: 4% of Nike sales (-13% vs.2010) Others Emerging Markets: 15% of Nike sales (+24% vs.2010) Roughly 42% of Nike BrandŌĆÖs sales is coming from the U.S. and 27% from Europe. Growth should be more heavily weighted to developing regions, with particular strength coming from Greater China and emerging markets Sources: NikeŌĆÖs Annual Report 8

- 9. 1 INTRO: Nike at a glance 2 Nike, a top brand with outstanding results 3 Strengthening its leadership position consistently 4 ŌĆ” by being pioneer, innovative and resilient 5 Nike is facing multiple challenges 9

- 10. Nike Inc.ŌĆÖs exceptional growth in 33 years 25,0 10,0 Revenues (USD in billion) Net income (USD in billion) 9,0 Compound Annual Growth Rate CRISES 20,9 20,0 8,0 CAGR Revenue: 1978-2011: 19% 7,0 1990-2000: 15% Turnover (USD in billion) 1978-2002: 23% 15,0 2002-2011: 9% CAGR Revenue 6,0 Net income (USD in billion) 2007-2011: 6% 78-11: +19% BOYCOTT 5,0 10,0 10,0 4,0 CHILD LABOR & SWEATSHOP 3,0 2,1 5,0 2,0 3,0 0,7 1,0 1,2 0,3 0,7 0,0 0,0 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Nike, Inc. (Nike) has grown at a rate of 19% year-to-year over the past 33 years despite the strong impact of NikeŌĆÖs sweatshops controversy and the financial crises. NikeŌĆÖs net income represents 10% of net sales in 2011 Sources: NikeŌĆÖs Annual Report ŌĆō The Promise and Perils of Globalization: the case of Nike by Locke 10

- 11. 1 INTRO: Nike at a glance 2 Nike, a top brand with outstanding results 3 Strengthening its leadership position consistently 4 ŌĆ” by being pioneer, innovative and resilient 5 Nike is facing multiple challenges 11

- 12. In the late 1990s, Nike already dominated its competitorsŌĆ” GLOBAL ATHLETIC FOOTWEAR MARKET SHARE from 1991 to 1999 40% BOYCOTT 35% 35% 32% 30% 30% 27% 25% 24% 25% 23% 23% 20% 16% ┬Ā 14% ┬Ā 15% 10% ┬Ā 10% ┬Ā 10% ┬Ā 10% ┬Ā 10% ┬Ā 9% ┬Ā 10% 5% 0% 1991 1992 1993 1994 1995 1996 1997 1999 Since displacing Adidas in the early 1980s and Reebok in the early 1990s, Nike has become the largest and most important athletic shoe brand in the world. A clear soaring of Nike since 1994 Sources: HBS Case #9-299-084 "Nike, Inc.: Entering the Millennium, March 31,1999 and Footwear News, December 27, 1999 12

- 13. ŌĆ”And Today, Nike Inc. is still the No. 1 sportswear company Sales $20.9 bn FY11 EBIT (% sales) FY11: 13% Sales $17.3 bn FY11 Net income (% sales) FY11: 10% Sales $3.8 bn FY11 EBIT (% sales) FY11: 8% EBIT (% sales) FY11: 11% Net income (% sales) FY11: 5% Net income (% sales) FY11: 10% * In 2006, Adidas acquired┬ĀReebok for $3.8┬Ābillion 25,0 10,0 NikeŌĆÖs sales 20,9 9,0 CAGR 06-11: +7% EBIT 20,0 19,2 19,0 8,0 18,6 CAGR 06-11: +6% 17,3 Net income & EBIT (USD $billion) 16,3 7,0 Net income 16,0 15,2 15,0 CAGR 06-11: +9% 15,0 15,0 15,0 13,7 13,3 6,0 AdidasŌĆÖ sales CAGR 06-11: +5% Turnover (USD $billion) 5,0 EBIT 10,0 4,0 CAGR 06-11: +2% 7,8 2,8 2,5 Net income 2,4 3,0 2,1 2,1 2,1 CAGR 06-11: +6% 1,9 5,0 1,4 3,4 1,5 1,3 3,8 2,0 1,2 3,5 3,5 3,1 1,2 3,4 0,8 3,0 PumaŌĆÖs sales 0,7 CAGR 06-11: +2% 0,5 0,5 0,5 0,4 0,4 0,4 1,0 0,2 EBIT 0,0 0,0 CAGR 06-11: -2% NKE ADI PUM NKE ADI PUM NKE ADI PUM NKE ADI PUM NKE ADI PUM NKE ADI PUM NKE ADI PUM Net income 2005 2006 2007 2008 2009 2010 2011 CAGR 06-11: -3% 13

- 14. A Strong Marketing Spend: a distinct advantage in an industry that is heavily reliant on sports endorsements ANNUAL DEMAND CREATION PEER COMPARISON ($ AND % OF SALES FY11) Nike has entered into endor- 3,0 16% sement agreements with some of 2696 the most famous athletes in the 13,4% 14% world, such as basketball icon 2,5 Marketing %net sales (USD, million) 11,4% Michael Jordan, golf legend Tiger Marketing Spend (USD, million) 11,2% 12% Woods, Swiss tennis phe-nomenon 2,0 1771 Roger Federer, and Brazilian 10% soccer super-star Ronaldinho, etc. 1,5 6,5% 8% 5,7% 6% 1,0 3,4% 539 4% 0,5 384 231 168 2% 0,0 0% Nike Adidas VF Corp. PVH Ralph Under Lauren Amour Nike invests heavily in brand-building efforts by spending $2.7B on demand creation (marketing, sponsorshipŌĆ”) with help from its advertising partner, Wieden+Kennedy In FY11, Nike had $4.4 bn of endorsement obligations outstanding. Sources: Company data and Morgan Stanley Research 2012 14

- 15. 1 INTRO: Nike at a glance 2 Nike, a top brand with outstanding results 3 Strengthening its leadership position consistently 4 ŌĆ” by being pioneer, innovative and resilient 5 Nike is facing multiple challenges 15

- 16. Pioneer & Innovative 16

- 17. An historic product Innovation pipelineŌĆ” 2012 Flyknit upper technology is introduced 2012 NikeŌĆśs FuelBand is launched FLYKNIT FUELBAND PRO COMBAT 2009 Pro Combat performance apparel is launched 2008 NikeŌĆśs Lunar foam is launched and Nike Flywire technology LUNAR FLYWIRE 2006 Nike+ is launched (currently 6 million members) 2006 Air Max 360 (new method of creating Air-Sole units) 2005 Nike Free is launched NIKE + NIKE FREE 2002 Nike introduces its first golf clubs 2000 Nike unveils its Shox technology NIKE SHOX AIR TRAINER HIGH SHOE 1987 The Air Trainer High shoe and the Air Max shoe Air Force 1, the first Nike basketball shoe to incorporate Nike 1982 Air cushioning AIR FORCE 1 AIR MAX SHOE 1979 the Tailwind, the first running shoe with Nike Air 1978 The first Air-Sole units are created (Nike Air cushioning) NIKE TAILWIND WAFFLE TRAINER 1974 The Waffle trainer is introduced Sources: Company reports and JMS Research ŌĆō May 2012 17

- 18. ŌĆ”With (R)evolutionary Platforms that keep product pipeline full Nike Free Nike Air Max Nike Lunar Nike Flyknit Launched: 2005 2006 2008 2012 Innovative sole featuring siping Air platform that features Max Ultra-lightweight composite Revolutionary upper (deep slices) that allow for a Air ŌĆō a new design utilizing air foam ŌĆō 30% reduced weight construction made from a single more natural movement that throughout the midsole versus previous materials strand of yard (entire shoe resembles bare feet. weighs 5.6 oz) Estimated: $500M Business Estimated: $750M - $1B Estimated: $1B Business Estimated opportunity: $1B+ Sources: Company reports and JMS Research ŌĆō May 2012 18

- 19. ŌĆ”Even in Apparel, Nike is taking performance to another level Nike Dri-FIT Nike Pro Combat Nike HyperElite Launched: 1991 2009 2012 Lightweight, moisture wicking apparel Football-specific apparel featuring Lightweight (shorts weigh only 5 and accessories cooling, warmth, and/or built-in ounces) and breathable basketball (tops, bottoms, hats) protection technology apparel made of recycled materials Nike aims to serve athletes across apparel segments with compelling choices for competing (Elite), training (Everyday), and leisure (Lifestyle) Sources: Company reports and JMS Research ŌĆō May 2012 19

- 20. The first to use digital technology for products to elevate the brand Nike ID Nike + Nike FuelBrand Launched: 2000 2006 2012 Allows customers to design Sensor based technology and 3-axis gyroscopic wristband that personalized and custom-built integrated social ŌĆ£ecosystemŌĆØ that allows for real-time tracking of daily footwear, clothing, and gear allows for movement tracking movement Nike is positioning as a vanguard for premium athletic/consumer products. The Brand tries to establish deeper connections with the consumer Sources: Company reports and JMS Research ŌĆō May 2012 20

- 21. Focus: Nike, the pioneer of Mass Customization SPECIAL ORDERS MASS CUSTOMIZATION 1859 Nov. 1999 April 2000 2002 2006 2008 2008 2011 Mi Adidas was launched in April 2000 &Ms d ŌĆ£Design y ŌĆØ Bespoke d Burberr your Own ched My M E launche Shoe Barb an ecue Y launche n me nched Mo ngoli Monogram un nched Mo M&MŌĆÖs la CONVERS BURBERR ITTON lau Louis VuittonŌĆÖs Special Orders Department for PUMA lau unique cutomers Nike ID (web first, then in store) LOUIS VU NikeID co-creation platform brought in over $100 million in revenue for the fiscal year of 2009 Nike Inc. dedided to bring Mass Customization to the web in November 1999ŌĆ” Then accessed in select physical branches. Nike was the first to make substantial profits employing mass customization Sources: The ŌĆ£mi adidasŌĆØ Mass Customization Initiative by Pr. R.W. Seifert (IMD) 29.05.2006 21

- 22. The co-creation of value through customersŌĆÖ experiences ┬¦’é¦ŌĆ» Customers need no longer be mere passive recipients of value propositions offered by firms. They are now informed, connected and networkedŌĆ” ┬¦’é¦ŌĆ» ...Leading firms are then responding by engaging their customers in the co-creation of value ┬¦’é¦ŌĆ» Co-creative interactions are an emerging strategy for value creation. By engaging with informed, connected, and networked customers around the globe, the shoe company Nike has found a new source of value NikeŌĆÖs Co-creation Examples Joga.com was in effect a thematic community that enabled individuals to share personal and collective soccer experiences (videos downloaded over 32 million times). With over one million fans participating in this innovative brand building effort, Nike had a unique opportunity to learn directly from its customers NikeID provided software tools to co-design and customize the shoe. Nike can tap into the collective creativity of its customer base. NikeID co-creation platform brought in over $100 million in revenue for the fiscal year of 2009 The Nike+ co-creation platform capitalizes firstly on the connection between running and music. The combination of innovative, mobile technology, online communities (currently 6 million members) and athletic gear expands the field for co-creation Nike is Building a Co-creative Organization to Generate New Strategic Assets through Valuable Engagement Experiences 22

- 23. A revolution in its relationship with customers (1/2) ┬½┬ĀNike is becoming a company that isn't just focused on productsŌĆ” ŌĆ”but is focused on products and services┬Ā┬╗ Stefan OLANDER, Nike's VP of Digital Sport PRODUCT SERVICES 23

- 24. A revolution in its relationship with customers (2/2) ┬½┬ĀBefore the product was the end point of the consumer experienceŌĆ” ŌĆ”now it is the starting point┬Ā┬╗ Stefan OLANDER, Nike's VP of Digital Sport PRODUCT SERVICES EXPERIENCES 24

- 25. Nike is always one step ahead, including on the Internet Nike Foot Locker Adidas Launched: 1999 2000 2006 Nike.com FootLocker / LadyFootLocker.com ShopAdidas.com NikeStore.com KidsFootLocker.com Miadidas.com NikeID.com Eastbay.com / Footaction.com Reebok.com ChampsSports.com / CCS.com Shop.adidasGolf.com ┬¦’é¦ŌĆ» 2011 Web Sales: $343M ┬¦’é¦ŌĆ» 2011 Web Sales: $457M ┬¦’é¦ŌĆ» 2011 Web Sales: $78M (2% of Nike brandŌĆÖs net sales) (8% of groupŌĆÖs net sales) (1% of Adidas groupŌĆÖs net sales) ┬¦’é¦ŌĆ» CAGR 2004-2011: +28% ┬¦’é¦ŌĆ» CAGR 2004-2011: +12% ┬¦’é¦ŌĆ» CAGR 2004-2011: +21% ┬¦’é¦ŌĆ» Monthly Unique Visitors: 4,1M ┬¦’é¦ŌĆ» Monthly Unique Visitors: 2,6M ┬¦’é¦ŌĆ» Monthly Unique Visitors: 0,9M ┬¦’é¦ŌĆ» Monthly Visits: 7,5M ┬¦’é¦ŌĆ» Monthly Visits: 8,0M ┬¦’é¦ŌĆ» Monthly Visits: 2,6M ┬¦’é¦ŌĆ» Total SKUs on Web: 30 000 ┬¦’é¦ŌĆ» Total SKUs on Web: 80 000 ┬¦’é¦ŌĆ» Total SKUs on Web: 6 000 Sources: Internet Retailer ŌĆō June 2012 25

- 26. Among the first of the major sportswear brands to embrace Social Media 9,3M fans 458 665 Followers 8,0M 279 216 1 7,4M 1 245 766 1,1M 64 077 0,6M 58 358 SOCIAL PRESENCE IN CHINA SOCIAL PRESENCE IN RUSSIA Nike uses social media with the most relevant ones in each country: Facebook and Twitter in the US, in China with Weibo, Ren Ren, QQ, and in Russia Vkontakte..which supports NikeŌĆÖs position as tech-led, early adopting and youthful Sources: Facebook and Twitter data 06/2012 26

- 27. Distribution channel: One of the first owned retail stores within Sport industryŌĆ” ┬Ā U.S. stores non-U.S. Total Nike factory stores 150 243 393 Nike stores 16 50 66 NIKETOWNs 9 3 12 57% of 43% total revenues OWNED RETAIL STORES ┬¦’é¦ŌĆ» 1966: The first Blue Ribbon Sports retail store opened in California ┬¦’é¦ŌĆ» 1990: The first Flagship NIKETOWN store opened in downtown┬ĀPortland Compared to ┬¦’é¦ŌĆ» 1986: First Flagship Ralph Lauren shop in NYC ┬¦’é¦ŌĆ» 1999: First Flagship Foot Locker store in NYC ┬¦’é¦ŌĆ» 2001: First Adidas Originals store BRANDED RETAIL COLLABORATIONS In FY15, Nike expects to exceed $5,5 billion in DTC sales, on 850 owned stores for the Nike brand across concepts and more than 300 affiliate stores. DTC= $3,2B in revenue in FY11 (in-line stores (+12%), factory stores (+15%) and e-commerce (+25%) Sources: Business week Nike: It's Not A Shoe, It's A Community ŌĆō july 2006 27

- 28. China : a first mover Represents 10% of Nike IncŌĆÖs Sales & 15% of Profits CHINA REVENUES ($ BILLION): NIKE & ADIDAS VS. CHINESE BRANDS 0,0 2 0,0 2010E China Revenues ($B) 1,4 0,0 1,3 0,9 Kobe endorsement Nike in 0,0 0,5 0,0 0,3 ┬¦’é¦ŌĆ» Nike is the market leader in China, home to 1.3 billion people, 0,0 300 million basketball fans Nike Adidas Li Ning Anta Peak Puma ┬¦’é¦ŌĆ» Having been in China since the 1980s, its first-mover advantage has allowed the company to dominate its competition, generating $2.3B in sales in FY11 (11% of Nike IncŌĆÖs revenue; +18% vs. 2010), vs $1.3B at adidas and less than $500M at Puma ┬¦’é¦ŌĆ» Given its position and strength in sports relevant to the Chinese consumer (particularly golf and basketball), Nike will continue to capitalize on growth potential ┬¦’é¦ŌĆ» Nike has Kobe Bryant, the most popular basketball player in China Nike is far and away the largest athletic brand in the Chinese market. Sources: AlphaWise (July 2011), Morgan Stanley Research 2012 ŌĆō Jefferies Estimates and company data 28

- 29. ŌĆ”and also Resilient Nike finally took the lead to become sustainable 29

- 30. A Heavy BurdenŌĆ” 1970 Mid 1980s 1990s ┬¦’é¦ŌĆ» Nike opened up its own shoe ┬¦’é¦ŌĆ» Rising of US wages, closing of Nike ┬¦’é¦ŌĆ» A series of public relations factories in Maine and New US Factory and outsourcing nightmares, involving: Hampshire manufacturing to Asia ├╝’ā╝ŌĆ» Underpaid workers in Indonesia ┬¦’é¦ŌĆ» At the same time, it also began to ┬¦’é¦ŌĆ» 1982: 86% of NikeŌĆÖs athletic footwear ├╝’ā╝ŌĆ» Child labor in Cambodia and cultivate potential suppliers in came from Korea and Taiwan Pakistan Korea, Thailand, China and Taiwan. ┬¦’é¦ŌĆ» Then, it opened up manufacturing ├╝’ā╝ŌĆ» Poor working conditions in plants in Indonesia, China and China and Vietnam Vietnam ┬¦’é¦ŌĆ» Anti-Nike campaign and the film of ┬¦’é¦ŌĆ» Already in the early 1980s, Nike had Michael Moore The Big One (1998) been criticized for sourcing its revealed the deplorable conditions products in factories/countries of NikeŌĆÖs suppliers where low wages, poor working conditions and human rights ┬¦’é¦ŌĆ» Nike described as ŌĆ£sweatshopsŌĆØ problems Sources: Richard M. Locke (2001) The Promise and Perils of Globalization: The Case of Nike 30

- 31. ŌĆ”Many Challenges to Face CONSUMER ┬Ā BOYCOTT ┬Ā LEGISLATION ┬Ā COMPANY ┬Ā PRESSURES ┬Ā IMAGE ┬Ā NGOs ┬ĀATTACK ┬Ā COMPETITORS ┬Ā NIKE ┬Ā 31

- 32. NikeŌĆÖs ResponseŌĆ” forced to be the first- mover Mid 1980s 1990s Late 1990s BLIND SPOTS COMPLIANCE TRANSPARENCY ┬¦’é¦ŌĆ» At first, Nike managers refused to ┬¦’é¦ŌĆ» 1992: Nike formulated a Code of ┬¦’é¦ŌĆ» Nike has increased monitoring of its accept any responsibility for the conduct for its suppliers (minimalist suppliers : SHAPE inspection various labor and environmental/ and not fully enforced) ┬¦’é¦ŌĆ» Nike suppliers are regularly audited health problems found at their ┬¦’é¦ŌĆ» Introduction of the Safety, Health, by external firms like Ernst and suppliersŌĆÖ plants Attitudes of management, People Young, PWC,ŌĆ” ┬¦’é¦ŌĆ» According to NikeŌĆ” Workers at Investment and Environment ┬¦’é¦ŌĆ» Relations with international and these factories were not Nike program (SHAPE) Non-Profit Organizations employees, and thus Nike had no ┬¦’é¦ŌĆ» Nike has increased the minimum age ├╝’ā╝ŌĆ» Involved in the UN Global responsibility towards them of footwear factory workers to 18 Impact and to 16 in apparel, equipment ├╝’ā╝ŌĆ» Founded Global Alliance for (1998) Workers and Communities ├╝’ā╝ŌĆ» Active in the Fair Labor ┬¦’é¦ŌĆ» New staff and Training by creating Association several new departments: ├╝’ā╝ŌĆ» Labor Practices (1996) ┬¦’é¦ŌĆ» ┬½┬ĀTransparency 101┬Ā┬╗ program ├╝’ā╝ŌĆ» Nike Environmental Action Team (1993) Sources: Richard M. Locke (2001) The Promise and Perils of Globalization: The Case of Nike 32

- 33. ...Reflected in Its offering: Nike sustainable innovations Recycle shoes┬Āwith Nike Trash Talk, Nike┬Ā ┬½┬ĀReuse a shoe┬Ā┬╗ a basketball shoe made from manufacturing waste Sources: Nikeinc.com 33

- 34. Some of its latest remarkable sustainable initiativesŌĆ” 2012 The 2012 National Team Kit NikeŌĆÖs most Flyknit: a revolutionary upper A strategic partnership with DyeCoo environmentally-friendly construction made from a single strand Textile Systems B.V., a Netherlands- of yarn that is extremely lightweight based company that has developed and Kits are made with made with at least built the first commercially available 96% recycled polyester, each jersey is FlyknitŌĆÖs aim: waterless textile dyeing machines. made using an average of 7 plastic - To cut labor costs and production time bottles. Each short is made using an (less waste, reduced labor) average of 6 recycled plastic bottlesŌĆö To increasing profit margins and adding up to 13 plastic bottles per kit opportunities for personalization 34

- 35. Integrating Sustainability into its Game Plan ...Nike rethinks its Value Chain NIKE INC. CURRENT VALUE CHAIN FINAL GOAL: FULLY CLOSED-LOOP Plan, Design, Make, Move, Sell, Use, Reuse Cradle-to-Cradle model 1. ┬ĀUsing ┬Āthe ┬Āfewest ┬Ā possible ┬Āmaterials ┬Ā 3. ┬ĀAllowing ┬Āthem ┬Āto ┬Ābe ┬Ā recycled ┬Āinto ┬Ānew ┬Ā product ┬Āor ┬Āsafely ┬Ā 2. ┬ĀDesigned ┬Āfor ┬Āeasy ┬Ā disassembly ┬Ā SUSTAINABILITY PILLARS returned ┬Āto ┬Ānature ┬Āat ┬Ā ├╝’ā╝ŌĆ» Creating a portfolio of sustainable materials the ┬Āend ┬Āof ┬Ātheir ┬Ālife ┬Ā ├╝’ā╝ŌĆ» Prototyping and scaling sustainable sourcing and┬Āmanufacturing models┬Ā ├╝’ā╝ŌĆ» Igniting and driving market transformation┬Ā ├╝’ā╝ŌĆ» Creating digital services revenue┬Ā Sources: Nikeinc.com ŌĆō Cradle-to-Cradle 35

- 36. Strategic Innovation to reinvent businesses In a constantly changing world, To build such strategies, Helixa has companies can no longer do business devised a series of new tools and in the same way as in the past. Indeed, proceeds by combining creativity companies now have to steer a course with analysis to imagine for its through a world where everything is clients what has as yet never seen changing at a high speed . It is forcing light of day. them to rethink their strategic choices With its wealth of experience in such along completely different lines. Those sectors as luxury goods, media, firms able to rapidly identify disruptive retailing, chemistry, energy and innovation and take up adequate internet and given its design thinking strategies can gain the upper hand inspiration, Helixa can offer highly on competitors and become the next effective tailor-made solutions. winners. HelixaŌĆÖs team mixes engineers, strategists and designers. 36

- 37. For more information, contact us: 16, rue Brey Paris 17├©me development@helixa.com (+33)1 45 72 55 89 This document is under Creative Commons License 37