No frills airports

- 1. DESIGN AND CREATIVE IDEAS FOR NO-FRILLS (LOW COST) AIRPORTS INTIER II &TIER III CITIES BY, RAJIV BABU CHINTALA

- 2. INDUSTRY PROFILE ⊠By 2034, India is expected to be among the top five air domestic travel markets globally, in terms of additional passengers per year, according to the International AirTransport Association (IATA). ⊠The civil aviation industry in India has witnessed a new era of expansion driven by factors such as low-cost carriers (LCC), modern airports, foreign direct investments (FDI) in domestic airlines, cutting edge information technology (IT) interventions and a growing emphasis on regional connectivity. ⊠âThe world is focused on Indian aviation â from manufacturers, tourism boards, airlines, and global businesses to individual travelers, shippers and businessmen, etc. If we can find common purpose among all stakeholders in Indian aviation, a bright future is at hand.

- 3. COMPANY PROFILE ⊠AAI manages 125 airports, which include 18 International Airport, 07 Customs Airports, 78 Domestic Airports and 26 Civil Enclaves at Defense airfields. AAI provides air navigation services over 2.8 million square nautical miles of air space. During the year 2013-14, AAI handled aircraft movement of 1536.60 Thousand [International 335.95 & Domestic 1200.65], Passengers handled 168.91 Million [International 46.62 & Domestic 122.29] and the cargo handled 2279.14 thousand MT [International 1443.04 & Domestic 836.10].

- 4. OBJECTIVE ⊠To enable travelers to relax in a comfortable environment that is easy to use and to meet customer affordability. ⊠For LCC players, the low cost airports comes full of creative ideas that will allow them to operate efficiently at low cost. ⊠To design a model of no frill airport terminal building. ⊠To understand the airport revenues in all touch points of the organization. ⊠To study the level of customer expectations in no frill airports.

- 5. SCOPE ⊠Almost 70 percent of the population residing in smaller towns in the country does not have air connectivity.There is a large number of people who could afford to pay for air travel if the facility is made available. So this project will help the AAI and LCCâs to tap the current untapped air travel market. ⊠This project will help to increase the regional air connectivity. ⊠This project will help to reduce the passenger service fee and user development fee, which is burden to airlines as well as to passengers. ⊠This project design gives flexible model and easy for modification & up-gradation. ⊠This project will help to increase the revenue and employment opportunities in that particular states. 30 % 70 % AIR TRAVEL AIR TRAVEL IN INDIA TAPPED UNTAPPED

- 6. LIMITATIONS ï§ Time frame for the project is limited by two months. ⊠Access to direct customers inside security areas was not allowed and hence collecting data became tedious. ⊠Since the sample size is small and a simple random sample the facts revealed in this project may not be exact to consider. ⊠The researcher restrained to follow the rules of DGCA, BCAS and MoCA. ⊠The passenger survey was done only in theVijayawada airport.

- 7. RESEARCH METHODOLOGY ⊠As part of my project work I am dealing with four different research methods which gives clear ideas on how to proceed with the desired project.The four research methodologies are as follows: ïžLiterature Reviews ïžIndustry professional Inputs ïžPassenger Surveys ïžOn-siteVisits

- 8. PASSENGER SURVEY QUESTIONNAIRE (PERCENTAGE ANALYSIS) ⊠Respondents Details (Gender): INFERENCE: The sample consists of majority of male respondents. S.no Particulars No. of Respondents Percentage 1 Male 37 74 2 Female 13 26 Total 50 100 Male 74% Female 26% GENDER

- 9. PASSENGER SURVEY(ContiâĶ ⊠Respondent Details (Age): INFERENCE: The sample consists of mean age range of 36 to 45 and most of the respondents are in the age group of 26-35. S.no Particulars No. of Respondents Percentage 1 20 to 25 8 16 2 26 to 35 26 52 3 36 to 45 10 20 4 46 to 55 6 12 5 56 & above 0 0 Total 50 100 0 10 20 30 40 50 60 20 to 25 26 to 35 36 to 45 46 to 55 56 & above 16 52 20 12 0 Age

- 10. PASSENGER SURVEY(ContiâĶ ⊠Respondents Details (Place): INFERENCE: The sample consists of most of respondents fromTier â 3 cities. S.no Particulars No. of Respondents Percentage 1 Tier â 1 10 20 2 Tier â 2 17 34 3 Tier â 3 23 46 Total 50 100 0 10 20 30 40 50 Tier â 1 Tier â 2 Tier â 3 20 34 46 Place

- 11. PASSENGER SURVEY(ContiâĶ ⊠Respondents Details (Occupation): INFERENCE: The sample shows that most of the respondents work in business. S.no Particulars No. of Respondents Percentage 1 Government Employee 9 18 2 Business 18 36 3 Student 6 12 4 Private Employee 17 34 Total 50 100 0 5 10 15 20 25 30 35 40 Government Employee Business Student Private Employee 18 36 12 34 OCCUPATION

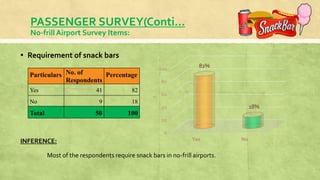

- 12. PASSENGER SURVEY(ContiâĶ No-frill Airport Survey Items: ⊠Requirement of snack bars INFERENCE: Most of the respondents require snack bars in no-frill airports. Particulars No. of Respondents Percentage Yes 41 82 No 9 18 Total 50 100 0 20 40 60 80 100 Yes No 82% 18%

- 13. PASSENGER SURVEY(ContiâĶ ⊠Need for Wi-Fi INFERENCE: More than half percentage of respondents needWi-Fi in no-frill airports. Particulars No. of Respondents Percentage Yes 29 58 No 21 42 Total 50 100 Yes 58% No 42% NEED FOR WI-FI

- 14. PASSENGER SURVEY(ContiâĶ ⊠Need for cell phone/laptop charging slots INFERENCE: Most of the survey respondents need cell phone/laptop charging slots in no-frill airports. Particulars No. of Respondents Percentage Yes 34 68 No 16 32 Total 50 100 0 10 20 30 40 50 60 70 Y e s N o 68% 32%

- 15. PASSENGER SURVEY(ContiâĶ ⊠Requirement of flight information display systems INFERENCE: Almost all the respondents require flight information display systems in no-frill airports. Particulars No. of Respondents Percentage Yes 46 92 No 4 8 Total 50 100 0 50 100 Yes No 92% 8%

- 16. PASSENGER SURVEY(ContiâĶ ⊠Need of ATM machines INFERENCE: Most of the respondents not require ATM machines in no-frill airports. Particulars No. of Respondents Percentage Yes 3 6 No 47 94 Total 50 100 6% 94% Yes No

- 17. PASSENGER SURVEY(ContiâĶ ⊠Do you require air conditioning in check-in area? INFERENCE: Many of the respondents not require air conditioning in check-in area of no-frill airports. Particulars No. of Respondents Percentage Yes 9 18 No 41 82 Total 50 100 0 10 20 30 40 50 60 70 80 90 Yes No 18% 82%

- 18. PASSENGER SURVEY(ContiâĶ ⊠Do you require air conditioning in security check area? INFERENCE: The survey shows that many of the respondents require air conditioning in security check area of no-frill airports. Particulars No. of Respondents Percentage Yes 36 72 No 14 28 Total 50 100 72% 28% Yes No

- 19. PASSENGER SURVEY(ContiâĶ ⊠Would you like to have parking facilities in the airport? INFERENCE: The survey shows that more than half the respondents not require parking facilities in the no-frill airports. Particulars No. of Respondents Percentage Yes 19 38 No 31 62 Total 50 100 0 20 40 60 80 Yes No 38% 62%

- 20. PASSENGER SURVEY(ContiâĶ ⊠Need for car rental services in the no-frill airports INFERENCE: Most of the respondents need car rental services in the no-frill airports. Particulars No. of Respondents Percentage Yes 35 70 No 15 30 Total 50 100 70% 30% Yes No

- 21. PASSENGER SURVEY(ContiâĶ ⊠Need for the availability of medical/health assistance INFERENCE: The survey shows that the respondents need medical/health assistance in no-frill airports. Particulars No. of Respondents Percentage Yes 43 86 No 7 14 Total 50 100 YES NO 86% 14%

- 22. PASSENGER SURVEY(ContiâĶ ⊠Do you think, there is a need for prayer/meditation room in the no-frill terminal building? INFERENCE: Almost all the respondents not require meditation/prayer room in the no-frill airports. Particulars No. of Respondents Percentage Yes 1 2 No 49 98 Total 50 100 2% 98% Yes No

- 23. PASSENGER SURVEY(ContiâĶ ⊠Do you need conveyor belts for baggage handling in the terminal building? INFERENCE: Most of the respondents not require conveyor belts for baggage handling in no-frill terminal building. Particulars No. of Respondents Percentage Yes 17 34 No 33 66 Total 50 100 YES NO 34% 66%

- 24. PASSENGER SURVEY(ContiâĶ ⊠Do you require televisions for entertainment purpose in the waiting hall? INFERENCE: This shows that half of the respondents require televisions and almost half of the respondents not require televisions for entertainment purpose in the waiting hall. Particulars No. of Respondents Percentage Yes 28 56 No 22 44 Total 50 100 0 10 20 30 40 50 60 Yes No 56% 44%

- 25. PASSENGER SURVEY(ContiâĶ ⊠Do you like to have your luggage check manually? INFERENCE: This survey shows that almost all the respondents are not interested to check their luggage manually. Particulars No. of Respondents Percentage Yes 4 8 No 46 92 Total 50 100 Yes 8% No 92%

- 26. PASSENGER SURVEY(ContiâĶ ⊠How often do you travel through air? INFERENCE: The survey shows that most of the respondents travel monthly once through air. Particulars No. of Respondents Percentage Weekly 1 2 Monthly 29 58 Six months 17 34 Yearly 3 6 Total 50 100 0 10 20 30 40 50 60 Weekly Monthly Six months Yearly 2% 58% 34% 6%

- 27. PASSENGER SURVEY(ContiâĶ ⊠What makes you feel good when you come to an airport? INFERENCE: The survey shows that many of the respondents feel good with customer service and infrastructure while comes to an airport. Particulars No. of Respondents Percentage Airport Ambience 4 8 Infrastructure 17 34 Aircrafts 9 18 Customer Service 20 40 Total 50 100 0 5 10 15 20 25 30 35 40 Airport Ambience Infrastructure Aircrafts Customer Service 8% 34% 18% 40%

- 28. PASSENGER SURVEY(ContiâĶ ⊠Which airlines you prefer the most for your travel? INFERENCE: The survey shows the respondents prefer mostly low cost carriers for their air travel. Particulars No. of Respondents Percentage Leisure 6 12 Business 7 14 Legacy 4 8 LCC 33 66 Total 50 100 0 10 20 30 40 50 60 70 Leisure Business Legacy LCC 12% 14% 8% 66%

- 29. STEP BY STEP DESIGN PROCESS

- 33. REVENUE THROUGH PSF AND UDF CHARGES: S.NO PSF + UDF CHARGE (RS) 50 PAX (RS) 60 PAX (RS) 70 PAX (RS) 1 50 2737500 3285000 3832500 2 60 3285000 3942000 4599000 3 70 3832500 4599000 5365500 4 80 4380000 5256000 6132000 5 90 4927500 5913000 6898500 6 100 5475000 6570000 7665000 Assumptions: No. of flights per day: 3 No. of days calculated: 365 days (1 year) S.NO PSF + UDF CHARGES (RS) 50 PAX (RS) 60 PAX (RS) 70 PAX (RS) 1 50 1825000 2190000 2555000 2 60 2190000 2628000 3066000 3 70 2555000 3066000 3577000 4 80 2920000 3504000 4088000 5 90 3285000 3942000 4599000 6 100 3650000 4380000 5110000 Assumptions: No. of flights per day: 2 No. of days calculated: 365 days (1 year)

- 34. REVENUE THROUGH AIRLINE COUNTERS AND BACKUP OFFICES: S.NO PARTICULARS AIRLINES PER MONTH PER YEAR 1 Ticket counters 3 Rs 6000/- Rs 72000/- 2 Airline Backup office 3 Rs 9000/- Rs 108000/- PARTICULARS AIRCRAFTS PER DAY COST PER COUNTER PER AIRCRAFT TOTAL COST PER YEAR Check-in counters 3 Rs 300/- Rs 328500/- Check-in counters 2 Rs 300/- Rs 219000/-

- 35. REVENUE THROUGH PARKING & ENTRY CHARGES: Entry Fee: Bike : Rs 10/- Car : Rs 25/- Bus : Rs 50/- HOURS TWO WHEELER FOUR WHEELER 0-2 Hours Rs 15/- Rs 35/- 2-5 Hours Rs 30/- Rs 75/- 5-10 Hours Rs 50/- Rs 100/- 10-15 Hours Rs 60/- Rs 150/- 15-24 Hours Rs 75/- Rs 200/- PARKING CHARGES:

- 36. DIMENSIONS OF TERMINAL BUILDING: DEPARTURE Ticket counters 5ft x 5ft (each) Airlines backup offices 8ft x 8ft (each) V.I.P Room 10ft x 8ft Entrance door 7ft height x 5ft length Grill gate 4ft x 4ft Baggage scanning area 8ft x 4ft Check-in counters 6ft x 8ft (each) Total area for check-in counters 20ft x 8ft Total check-in area 30ft x 60ft Security check entry & out door 7ft height x 5ft length Security check cabin for ladies 4ft x 5ft Rest rooms (security check area) 10ft x16ft (each) Total security check area 60ft x 50ft A&D common waiting hall 60ft x 30ft Total Departure Area: 90ft x 80ft ARRIVAL ATC & Navigation offices 30ft x 20ft ATC communication center 20ft x 20ft Arrival entry & exit doors 7ft ht x 5ft l Baggage arrival area(total) 30ft x 40ft Snack bar/Restaurant 20ft x 20ft Total Arrival Area: 30ft x 80ft TOTAL TERMINAL BUILDING: 120ft x 80ft

- 37. CONCLUSION: ïžIndia being an aviation hub has many untapped markets i.e. (Tier-II andTier-III cities) where the air travel is not in reach for travelers. But then, there are potential passengers who can afford air travel. Also, the business is increasing with much industrialization and IT sector popping up in India there could be an added advantage for the development of airports in those areas.Therefore an attempt has been made to give a creative ideas for these No-Frills Airport planning where all the limitations for cost and space is reduced (within the estimated budget) thus making the decision cost effective by using effective and flexible systems for the development of No- Frills Airports.

![COMPANY PROFILE

⊠AAI manages 125 airports, which include 18

International Airport, 07 Customs Airports, 78

Domestic Airports and 26 Civil Enclaves at

Defense airfields. AAI provides air navigation

services over 2.8 million square nautical miles

of air space. During the year 2013-14, AAI

handled aircraft movement of 1536.60

Thousand [International 335.95 & Domestic

1200.65], Passengers handled 168.91 Million

[International 46.62 & Domestic 122.29] and

the cargo handled 2279.14 thousand MT

[International 1443.04 & Domestic 836.10].](https://image.slidesharecdn.com/no-frillsairports-150818151254-lva1-app6892/85/No-frills-airports-3-320.jpg)