Non Traditional ETFs - Frequently Asked Questions

- 1. Frequently Asked Questions www.securitieslitigators.com brought to you by Attorney advertising. For information purposes only. Visit www.securitieslitigators.com and the last page of this presentation for important information and disclaimers.

- 2. The shares of an ETF commonly represent an interest in a portfolio of securities that track an underlying benchmark or index. A leveraged ETF generally seeks to deliver multiples of the daily performance of the index or benchmark that it tracks. An inverse ETF generally seeks to deliver the opposite of the daily performance of the index or benchmark that it tracks. Inverse ETFs often are marketed as a way for investors to profit from, or at least leverage their exposure to downward-moving markets. Some ETFs are a combination of both such that they seek a return which is a multiple of the inverse performance of the underlying index. In order to achieve these objectives, leveraged and inverse ETFs use a range of investments strategies like swaps, futures contracts and other forms of derivative instruments. Attorney advertising. See last page and www.securitieslitigators.com for important disclosures

- 3. Most leveraged ETFs and inverse ETFs reset everyday this means that they are meant to achieve their stated objective on a daily basis. Due to the effects of compounding overtime the results can differ significantly from their stated objective. As they reset each day, leveraged and inverse ETFs are generally inappropriate for those investors with intermediate or long-term investment horizons. They may be appropriate if they are a part of a sophisticated trading or hedging strategy that will be closely monitored by a financial professional. At times such strategies might justify a decision to hold a leveraged or inverse ETFs longer than one day. However, a registered representative should carefully address the question of how to engage in these strategies in a manner that confirms to the suitability rule. Attorney advertising. See last page and www.securitieslitigators.com for important disclosures

- 4. NASD Rule 2310 requires that prior to recommending the purchase, sale or exchange of a security, a brokerage firm must have a reasonable basis for believing that the transaction is suitable to the customer to whom it is being recommended. This determination requires two steps. The first step requires a determination if the product is suitable for any customer. The firm offering the investment must fully understand the products and transactions that it will recommend. It must understand all the terms and features of the investment. For leveraged ETFs or inverse ETFs, these questions include considerations of how the fund is designed to perform, how it achieves that objective, the impact on performance from market volatility, the use of leverage and the appropriate holding period. Attorney advertising. See last page and www.securitieslitigators.com for important disclosures

- 5. Once a firm is satisfied that a product is generally suited for at least some investors, a customer suitability analysis must be done. With it a firm must determine if the product is suitable for specific customers to whom it may be recommended. Such analysis includes making reasonable efforts to get information on the customerâs financial and tax status as well as his investment objectives and other information which may assist in determining his suitability. Attorney advertising. See last page and www.securitieslitigators.com for important disclosures

- 6. The securities industry regulators have taken the position that leveraged and inverse ETFs are likely unsuitable for retail customers, and firms that choose to recommend them must carefully consider their suitability for each customer. Given the peculiar properties of the reset feature it is important that these ETFs are offered as a part of an intermediate or long-term investment rather than as part of a closely monitored trading or hedging strategy. Attorney advertising. See last page and www.securitieslitigators.com for important disclosures

- 7. Some mutual funds are leveraged or inverse â they are made to deliver multiples or the inverse of the performance of the index or the benchmark that they track. Funds like these reset daily and may present many of the same issues present in leveraged and inverse ETFs, and should thus be also subject to the same level of scrutiny. Attorney advertising. See last page and www.securitieslitigators.com for important disclosures

- 8. Investors may call (888-998-0520) or email us for a free evaluation of their case. You can learn more about ETF sales practices by visiting our website www.securitieslitigators.com Attorney advertising. See last page and www.securitieslitigators.com for important disclosures

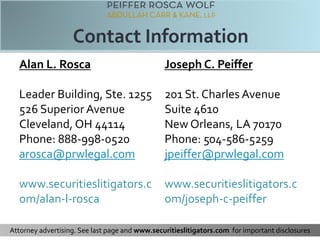

- 9. Alan L. Rosca Leader Building, Ste. 1255 526 Superior Avenue Cleveland, OH 44114 Phone: 888-998-0520 arosca@prwlegal.com www.securitieslitigators.c om/alan-l-rosca Joseph C. Peiffer 201 St. Charles Avenue Suite 4610 New Orleans, LA 70170 Phone: 504-586-5259 jpeiffer@prwlegal.com www.securitieslitigators.c om/joseph-c-peiffer Attorney advertising. See last page and www.securitieslitigators.com for important disclosures

- 10. Important Disclosures This disclaimer contains important information about this presentation. Please read it carefully. This presentation has general information about FINRA arbitration process and our firm, but it is not legal advice. We are not offering to provide you with legal representation through this presentation. Neither your use of this presentation, nor any e-mail you send to us, will create an attorney-client relationship with us. Such a relationship can be formed only through a personal conversation between you and one of our lawyers, after a thorough screening for potential conflicts that we might have. You should not take any action or decline to take any action concerning a legal matter based upon the information in this presentation without first obtaining the advice of a lawyer. Do not send us any information or materials you consider to be confidential without first obtaining a statement from us in writing that we represent you, and the authorization by one of our lawyers to send us the information. We will not treat any information you send us without that written statement and authorization as confidential. Attorney Joe Peifferâs office is in New Orleans. He is licensed to practice law in Louisiana. Alan Rosca's office is in Cleveland. He is licensed to practice law in Ohio. We handle financial fraud cases in most states. However, our firm's lawyers are not admitted to practice law in every state. In those jurisdictions in which we are not admitted to practice, we will associate with local co-counsel to assist with the matter, at no additional cost to our clients, whenever permitted or required by the respective jurisdiction. We are not certified or recognized as specialists or experts in any area of law. The descriptions of our lawyers` and our firm's areas of practice do not state or imply that our lawyers hold certifications or are specialists or experts in any particular areas of law. In cases in which we associate with local co-counsel, we will typically act as primary counsel. Occasionally, it is possible that our co-counsel will take the leading role. Whenever that is the case, we will obtain the client's advance, written permission. Copyright ©2014. All rights reserved. You may download and print out any part of this presentation for your own personal, non-commercial use. Any other reproduction or retransmission of this presentation without our prior written consent is prohibited. This presentation includes attorney advertising.