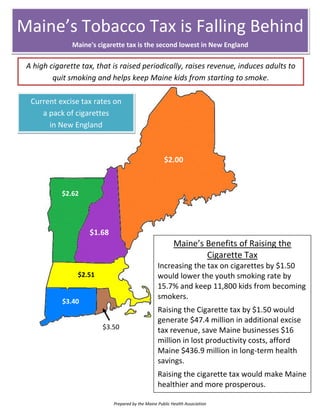

Northeast cigarette tax rates map 2013 02-21

- 1. Maine’s Tobacco Tax is Falling Behind Maine's cigarette tax is the second lowest in New England A high cigarette tax, that is raised periodically, raises revenue, induces adults to quit smoking and helps keep Maine kids from starting to smoke. Current excise tax rates on a pack of cigarettes in New England $2.00 $2.62 $1.68 Maine’s Benefits of Raising the Cigarette Tax Increasing the tax on cigarettes by $1.50 $2.51 would lower the youth smoking rate by 15.7% and keep 11,800 kids from becoming smokers. $3.40 Raising the Cigarette tax by $1.50 would generate $47.4 million in additional excise $3.50 tax revenue, save Maine businesses $16 million in lost productivity costs, afford Maine $436.9 million in long-term health savings. Raising the cigarette tax would make Maine healthier and more prosperous. Prepared by the Maine Public Health Association