NPA

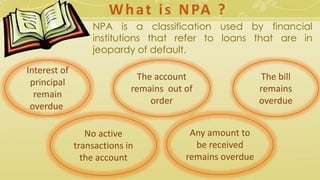

- 2. What is NPA ? NPA is a classification used by financial institutions that refer to loans that are in jeopardy of default. Interest of principal remain overdue The account remains out of order The bill remains overdue No active transactions in the account Any amount to be received remains overdue

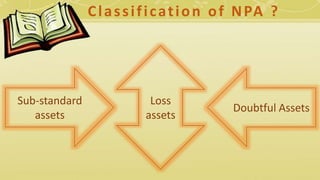

- 3. Classification of NPA ? Sub-standard assets Doubtful Assets Loss assets

- 4. Example of NPA Grace Period Bank’s balance sheet Recovery

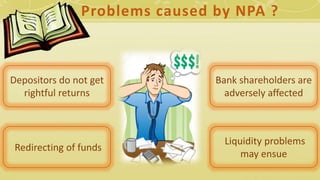

- 5. Problems caused by NPA ? Depositors do not get rightful returns Bank shareholders are adversely affected Redirecting of funds Liquidity problems may ensue

- 6. NPA Solutions Restructuring of finance Debt Recovery Tribunal Legal Issues Winding up proceedings Regular Training Programs