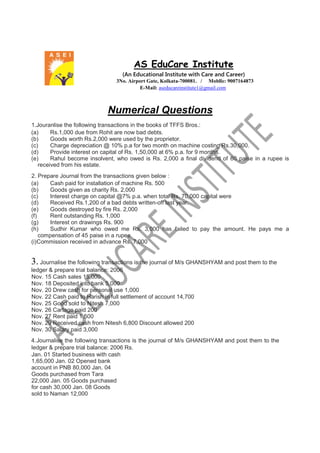

Numerical questions

- 1. AS EduCare Institute (An Educational Institute with Care and Career) 3No. Airport Gate, Kolkata-700081. / Moblle: 9007164873 E-Mail: aseducareinstitute1@gmail.com Numerical Questions 1.Jouranlise the following transactions in the books of TFFS Bros.: (a) Rs.1,000 due from Rohit are now bad debts. (b) Goods worth Rs.2,000 were used by the proprietor. (c) Charge depreciation @ 10% p.a for two month on machine costing Rs.30,000. (d) Provide interest on capital of Rs. 1,50,000 at 6% p.a. for 9 months. (e) Rahul become insolvent, who owed is Rs. 2,000 a final dividend of 60 paise in a rupee is received from his estate. 2. Prepare Journal from the transactions given below : (a) Cash paid for installation of machine Rs. 500 (b) Goods given as charity Rs. 2,000 (c) Interest charge on capital @7% p.a. when total Rs. 70,000 capital were (d) Received Rs.1,200 of a bad debts written-off last year. (e) Goods destroyed by fire Rs. 2,000 (f) Rent outstanding Rs. 1,000 (g) Interest on drawings Rs. 900 (h) Sudhir Kumar who owed me Rs. 3,000 has failed to pay the amount. He pays me a compensation of 45 paise in a rupee. (i) Commission received in advance Rs. 7,000 3. Journalise the following transactions is the journal of M/s GHANSHYAM and post them to the ledger & prepare trial balance: 2006 Nov. 15 Cash sales 15,000 Nov. 18 Deposited into bank 5,000 Nov. 20 Drew cash for personal use 1,000 Nov. 22 Cash paid to Harish in full settlement of account 14,700 Nov. 25 Good sold to Nitesh 7,000 Nov. 26 Cartage paid 200 Nov. 27 Rent paid 1,500 Nov. 29 Received cash from Nitesh 6,800 Discount allowed 200 Nov. 30 Salary paid 3,000 4. Journalise the following transactions is the journal of M/s GHANSHYAM and post them to the ledger & prepare trial balance: 2006 Rs. Jan. 01 Started business with cash 1,65,000 Jan. 02 Opened bank account in PNB 80,000 Jan. 04 Goods purchased from Tara 22,000 Jan. 05 Goods purchased for cash 30,000 Jan. 08 Goods sold to Naman 12,000

- 2. Jan. 10 Cash paid to tara 22,000 Jan. 15 Cash received from Naman 11,700 Discount allowed 300 Jan. 16 Paid wages 200 Jan. 18 Furniture purchased for office use 5,000 Jan. 20 withdrawn from bank for personal use 4,000 Jan. 22 Issued cheque for rent 3,000 Jan. 23 goods issued for house hold purpose 2,000 Jan. 24 drawn cash from bank for office use 6,000 Jan. 26 Commission received 1,000 Jan. 27 Bank charges 200 Jan. 28 Cheque given for insurance premium 3,000 Jan. 29 Paid salary 7,000 Jan. 30 Cash sales 10,000 5. Give journal entries of Rohit traders, Post them to the Ledger from the following transactions & prepare trial balance : August 2005 Rs. 1.Commenced business with cash 1,10,000 2.Opened bank account with H.D.F.C. 50,000 3.Purchased furniture 20,000 7.Bought goods for cash from M/s Rupa Traders 30,000 8.Purchased good from M/s Hema Traders 42,000 10. Sold goods for cash 30,000 14. Sold goods on credit to M/s. Gupta Traders 12,000 16. Rent paid 4,000 18. Paid trade expenses 1,000 20. Received cash from Gupta Traders 12,000 22. Goods return to Hema Traders 2,000 23. Cash paid to Hema Traders 40,000 25. Bought postage stamps 100 30. Paid salary to Rishabh 4,000 6. Journalise the following transaction in the Books of the Bhairav Traders and Post them into the Ledger & prepare trial balance : December, 2005 Rs. 1.Started business with cash 92,000 2.Deposited into bank 60,000 4.Bought goods on credit from Himani 40,000 6.Purchased goods from cash 20,000 8.Returned goods to Himani 4,000 10. Sold goods for cash 20,000 14. Cheque given to Himani 36,000 17. Goods sold to M/s Goyal Traders. 3,50,000 19. Drew cash from bank for personal use 2,000 21. Goyal traders returned goods 3,500

- 3. 22. Cash deposited into bank 20,000 26. Cheque received from Goyal Traders 31,500 28. Goods given as charity 2,000 29. Rent paid 3,000 30. Salary paid 7,000 31. Office machine purchased for cash 3,000 7. Journalise the following transaction in the Book of Sudha traders. Also post them in the ledger & prepare trial balance : Dec. 2005 Rs. 1.Started business with cash 2,00,000 2.Bought office furniture 30,000 3.Paid into bank to open an current account 1,00,000 5.Purchased a computer and paid by cheque 2,50,000 6.Bought goods on credit from Ritika 60,000 8.Cash sales 30,000 9.Sold goods to Karishna on credit 25,000 12. Cash paid to Mansi on account 30,000 14. Goods returned to Ritika 2,000 15. Stationery purchased for cash 3,000 16. Paid wages 1,000 18. Goods returned by Karishna 2,000 20. Cheque given to Ritika 28,000 22. Cash received from Karishna on account 15,000 24. Insurance premium paid by cheque 4,000 26. Cheque received from Karishna 8,000 28. Rent paid by cheque 3,000 29. Purchased goods on credit from Meena Traders 20,000 30. Cash sales 14,000 8. Journalise the following transaction in the books of Nand Kishor and post them into the ledger & prepare trial balance : January, 2006 Rs. 1. Cash in hand 6,000 Cash at bank 55,000 Stock of goods 40,000 Due to Rohan 6,000 Due from Tarun 10,000 3.Sold goods to Karuna 15,000 4.Cash sales 10,000 6. Goods sold to Heena 5,000 8. Purchased goods from Rupali 30,000 10. Goods returned from Karuna 2,000 14. Cash received from Karuna 13,000 15. Cheque given to Rohan 6,000 16. Cash received from Heena 3,000 20. Cheque received from Tarun 10.000 22. Cheque received from to Heena 2,000 25. Cash given to Rupali 18,000 26. Paid cartage 1,000 27. Paid salary 8,000 28. Cash sale 7,000 29. Cheque given to Rupali 12,000 30. Sanjana took goods for Personal use 4,000

- 4. 31. Paid General expense 500 Rectification of earrors 1.Rectify the following errors : Credit purchases from Raghu Rs. 20,000 (i) were not recorded. (ii)were recorded as Rs. 10,000. (iii) were recorded as Rs. 25,000. (iv) were not posted to his account.

- 5. (v) (vi) (vii) (viii) (ix) were posted to his account as Rs. 2,000. were posted to Reghav.s account. were posted to the debit of Raghu.s account. were posted to the debit of Raghav. were recorded through sales book. 2.Rectify the following errors : Cash sales Rs. 16,000 (i) were not posted to sales account. (ii)were posted as Rs. 6,000 in sales account. (iii) were posted to commission account. 3.Rectify the following earrors: Depreciation written-off as the machinery Rs. 2,000 (i) was not posted at all (ii)was not posted to machinery account (iii) was not posted to depreciation account 4.Trial balance of Anurag did not agree. It showed an excess credit Rs. 10,000. Anurag put the difference to suspense account. He located the following errors : (i) Sales return book over cast by Rs. 1,000. (ii)Purchases book was undercast by Rs. 600. (iii) In the sales book total of page no. 4 was carried forward to page 5 as Rs. 1,000 instead of Rs. 1,200 and total of page 8 was carried forward to page 9 as Rs. 5,600 instead of Rs. 5,000. (iv) Goods returned to Ram Rs. 1,000 were recorded through sales book. (v) Credit purchases from M & Co. Rs. 8,000 were recorded through sales book. (vi) Credit purchases from S & Co. Rs. 5,000 were recorded through sales book.However, S & Co. were correctly credited. (vii) Salary paid Rs. 2,000 was debited to employee.s personal account. 5.Trial balance of Rahul did not agree. Rahul put the difference to suspense account. Subsequently, he located the following errors: (i) Wages paid for installation of Machinery Rs. 600 was posted to wages account. (ii)Repairs to Machinery Rs. 400 debited to Machinery account. (iii) Repairs paid for the overhauling of second hand machinery purchased Rs. 1,000 was debited to Repairs account. (iv) Own business material Rs. 8,000 and wages Rs. 2,000 were used for construction of building. No adjustment was made in the books. (v) Furniture purchased for Rs. 5,000 was posted to purchase account as Rs. 500. (vi) Old machinery sold to Karim at its book value of Rs. 2,000 was recorded through sales book. (vii) Total of sales returns book Rs. 3,000 was not posted to the ledger. Rectify the above errors and prepare suspense account to ascertain the original difference in trial balance. 6.Trial balance of TFFS did not agree. It showed an excess credit of Rs. 16,000. He put the difference to suspense account. Subsequently the following errors were located:

- 6. (i) Cash received from Mohit Rs. 4,000 was posted to Mahesh as Rs. 1,000. (ii) Cheque for Rs. 5,800 received from Arnav in full settlement of his account of Rs. 6,000, was dishonoured. No entry was passed in the books on dishonour of the cheque. (iii) Rs. 800 received from Khanna, whose account had previously been written off as bad, was credited to his account. (iv) Credit sales to Manav for Rs. 5,000 was recorded through the purchases book as Rs. 2,000. (v) Purchases book undercast by Rs. 1,000. (vi) Repairs on machinery Rs. 1,600 wrongly debited to Machinery account as Rs. 1,000. (vii) Goods returned by Nathu Rs. 3,000 were taken into stock. No entry was recorded in the books. 7.Trial balance of TFFS did not agree. He put the difference to suspense account. The following errors were discovered : (i) Goods withdrawn by TFFS for personal use Rs. 500 were not recorded in the books. (ii)Discount allowed to Ramesh Rs.60 on receiving Rs. 2,040 from him was not recorded in the books. (iii) Discount received from Rohan Rs. 50 on paying Rs. 3,250 to him was not posted at all. (iv) Rs. 700 received from Khalil, a debtor, whose account had earlier been written-off as bad, were credited to his personal account. (v) Cash received from Govil, a debtor, Rs. 5,000 was posted to his account as Rs. 500. (vi) Goods returned to Mahesh Rs. 700 were posted to his account as Rs. 70. (vii) Bill receivable from Narayan Rs. 1,000 was dishonoured and wrongly debited to allowances account as Rs. 10,000. Give journal entries to rectify the above errors and prepare suspense account to ascertain the amount of difference in trial balance.