NYTLate

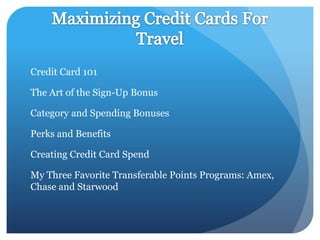

- 2. Credit Card 101 The Art of the Sign-Up Bonus Category and Spending Bonuses Perks and Benefits Creating Credit Card Spend My Three Favorite Transferable Points Programs: Amex, Chase and Starwood

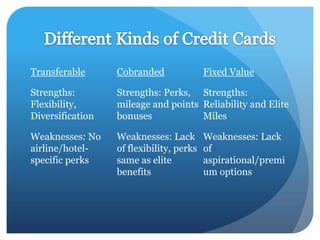

- 3. Transferable Cobranded Fixed Value Strengths: Strengths: Perks, Strengths: Flexibility, mileage and points Reliability and Elite Diversification bonuses Miles Weaknesses: No Weaknesses: Lack Weaknesses: Lack airline/hotel- of flexibility, perks of specific perks same as elite aspirational/premi benefits um options

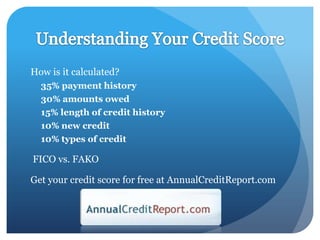

- 4. How is it calculated? 35% payment history 30% amounts owed 15% length of credit history 10% new credit 10% types of credit FICO vs. FAKO Get your credit score for free at AnnualCreditReport.com

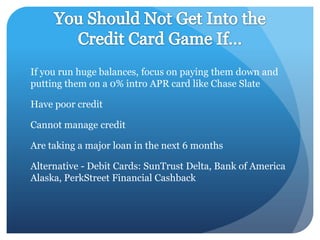

- 5. If you run huge balances, focus on paying them down and putting them on a 0% intro APR card like Chase Slate Have poor credit Cannot manage credit Are taking a major loan in the next 6 months Alternative - Debit Cards: SunTrust Delta, Bank of America Alaska, PerkStreet Financial Cashback

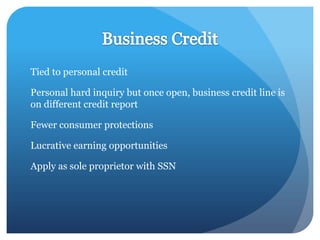

- 6. Tied to personal credit Personal hard inquiry but once open, business credit line is on different credit report Fewer consumer protections Lucrative earning opportunities Apply as sole proprietor with SSN

- 8.  Thepointsguy.com – Top Deals Page  Open your mail! You might be surprised  The forums/social media: FlyerTalk, MilePoint  Follow me on Twitter: @thepointsguy

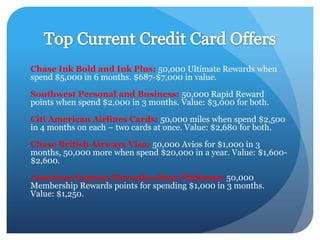

- 9. Chase Ink Bold and Ink Plus: 50,000 Ultimate Rewards when spend $5,000 in 6 months. $687-$7,000 in value. Southwest Personal and Business: 50,000 Rapid Reward points when spend $2,000 in 3 months. Value: $3,000 for both. Citi American Airlines Cards: 50,000 miles when spend $2,500 in 4 months on each – two cards at once. Value: $2,680 for both. Chase British Airways Visa: 50,000 Avios for $1,000 in 3 months, 50,000 more when spend $20,000 in a year. Value: $1,600- $2,600. American Express Mercedes-Benz Platinum: 50,000 Membership Rewards points for spending $1,000 in 3 months. Value: $1,250.

- 11. Put every expense possible on your card – as long as you’re not paying fees Charity donations Buy Gift Cards Advanced: Payment Services like ChargeSmart and WilliamPaid (generally 3%), Amazon Payments $1,000 per month to another person with no fee

- 13. ď‚— Airfare: ď‚— Gas: ď‚— Grocery: ď‚— Dining: Hilton Citi Hilton Hilton Citi Forward Reserve 5x, Reserve 5x, Amexes 6x, 5x, Chase Premier Premier Premier Sapphire Rewards Rewards 2x, Rewards 2x Preferred Gold 3x, Chase Ink 2x, Chase Chase Bold 2x Hyatt Visa Sapphire 2x Preferred, Airline Co- Branded Cards

- 14. In addition to sign-up bonuses, many credit cards offer additional perks for hitting certain spend thresholds such as: Bonus Points: American Express Premier Rewards Airline Elite Miles: American Express Delta Reserve Hotel Elite Status: Citi Hilton HHonors Reserve Companion Tickets: Chase British Airways Visa

- 15. Keep cards open at least 6 months to avoid red flags Transfer or use points before closing an account To renew or not to renew? Do the math. Example: Chase Hyatt Visa gives you a free night at a Category 1- 4 hotel each year – more than makes up for the $75 annual fee What it means for your credit when you cancel? Call and ask them to waive annual fee – it never hurts to ask! Don’t cancel, downgrade so you can use as bargaining tool for future cards Keep a couple no-fee cards around. Best: Chase Freedom

- 17. Pros: 16 airline partners 4 hotel partners Transfer bonuses – Delta, British Airways, Virgin America Transfers post instantaneously (mostly) Has added some partners like British Airways, Virgin America (bad ratio) Cons: Losing transfer partners – Continental, Southwest, Airtran, Priority Club 6/100 cents per point for transfers to US airlines Earning portal shut down Pay With Points Dropping to 1 cent on all cards, except Business Platinum

- 18. Star Alliance OneWorld • Aeroplan 1:1 • British Airways 1:1 • All Nippon Airways 1:1 • Iberia 1:1 • Singapore Airlines 1:1 • Asia Miles 1:1 Airline Transfer Partners Skyteam Other • Aeromexico 1:1 • El Al 50:1 JetBlue 1.25:1 • Alitalia Airlines 1:1 • Frontier 1:1 Virgin America 2:1 • Delta 1:1 • Hawaiian 1:1 Virgin Atlantic 1:1 • Air France/KLM 1:1

- 19. • Positives: Instant transfers, transfer bonuses, some great values from distance-based awards, no last-minute booking fees British • Negatives: High fuel surcharges, Airways segment pricing on awards, hard to search for some awards • Good awards: Expensive short- and mid-haul flights. Ex: New York to Toronto

- 20. • Best Western 1:1 • Choice Privileges 1:1 Hotel Transfer • Hilton HHonors 1:1.5 Partners • Jumeirah Hotels and Resorts 23:1 • Starwood 3:1 Tip: Transfer points to Virgin Atlantic at 1:1 and then Virgin Atlantic to Hilton at 2:1- better than the standard direct transfer ratio of 1: 1.5

- 21. Earn 1 point per dollar spent (Premier Rewards is 3x on airfare and 2x on gas & groceries, 4x per dollar with Amex Travel) Points go into pending status for a month after statement close (can be expedited) Cannot combine Membership Rewards points Transfer to anyone! - Link (not enroll!) their account to your account membershiprewards.com -> Points Summary -> Bottom right - Advance points for free, just earn them back - Up to 60,000 for Platinum - 15,000 for most other cards (not corporate) - Buy points at 2.5 cents each, up to 500,000 a year!

- 22. Pay With Points Easy, but fixed value: 1 cent (1.25 for Business Platinum) - A $5,000 business class ticket would require 500,000 points! - Could be an okay decision for cheap domestic tickets Earns elite status just like a purchased ticket

- 23. Pros: Adding partners Most transfers instantaneous No transfer fees Transfer points to anyone else, combine points with anyone else Points post right after statement closes Good customer service Cons: Limited number of partners No transfer bonuses yet

- 24. • British Airways 1:1 • Korean Air 1:1 Airline • Southwest 1:1 • United 1:1 • Hyatt 1:1 • Priority Club 1:1 Hotel • Marriott 1:1 • The Ritz Carlton 1:1 Other • Amtrak 1:1

- 25. • Positives: Low points requirements for free nights, great elite perks • Negatives: Just over 400 properties worldwide Hyatt • Good awards: Top-tier redemptions for 22,000 points like Park Hyatt Paris Vendome, only 6,000 points to upgrade paid stays for up to 4 nights

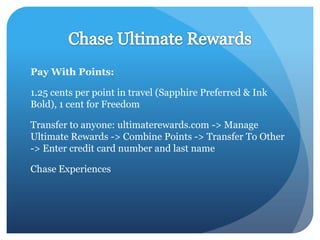

- 26. Pay With Points: 1.25 cents per point in travel (Sapphire Preferred & Ink Bold), 1 cent for Freedom Transfer to anyone: ultimaterewards.com -> Manage Ultimate Rewards -> Combine Points -> Transfer To Other -> Enter credit card number and last name Chase Experiences

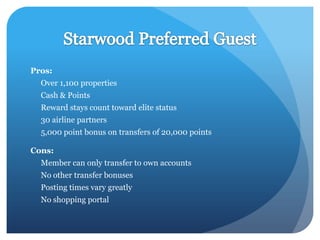

- 27. Pros: Over 1,100 properties Cash & Points Reward stays count toward elite status 30 airline partners 5,000 point bonus on transfers of 20,000 points Cons: Member can only transfer to own accounts No other transfer bonuses Posting times vary greatly No shopping portal

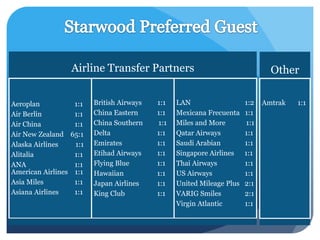

- 28. Airline Transfer Partners Other Aeroplan 1:1 British Airways 1:1 LAN 1:2 Amtrak 1:1 Air Berlin 1:1 China Eastern 1:1 Mexicana Frecuenta 1:1 Air China 1:1 China Southern 1:1 Miles and More 1:1 Air New Zealand 65:1 Delta 1:1 Qatar Airways 1:1 Alaska Airlines 1:1 Emirates 1:1 Saudi Arabian 1:1 Alitalia 1:1 Etihad Airways 1:1 Singapore Airlines 1:1 ANA 1:1 Flying Blue 1:1 Thai Airways 1:1 American Airlines 1:1 Hawaiian 1:1 US Airways 1:1 Asia Miles 1:1 Japan Airlines 1:1 United Mileage Plus 2:1 Asiana Airlines 1:1 King Club 1:1 VARIG Smiles 2:1 Virgin Atlantic 1:1

- 29. Airline Transfer Time In Days Delta 1 Aeroplan 3 Air Berlin 4 ANA 4 Virgin Atlantic 6 American Airlines 8 US Airways 8 Alaska Airlines 8 British Airways 9 LAN 9 United 11 Asia Miles 15 Asiana N/A Flying Blue N/A

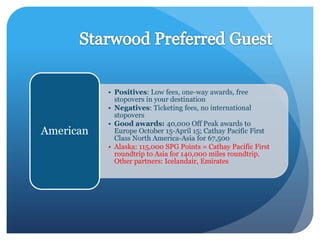

- 30. • Positives: Low fees, one-way awards, free stopovers in your destination • Negatives: Ticketing fees, no international stopovers • Good awards: 40,000 Off Peak awards to American Europe October 15-April 15; Cathay Pacific First Class North America-Asia for 67,500 • Alaska: 115,000 SPG Points = Cathay Pacific First roundtrip to Asia for 140,000 miles roundtrip. Other partners: Icelandair, Emirates

- 32. Your credit score is an asset. It is critical and you can leverage it to earn hundreds of thousands of points and miles a year Think long-term: It’s not just about sign-up miles and points – perks, status, bonuses Hop on deals when they come – they don’t last long Don’t bite off more than you can chew Always set auto-payments – make sure you don’t miss a payment Strategize Your Spend