OAG Analytics Solution Overview

- 1. ┬® 2014 OAG Analytics Predict production for any well, anywhere and reduce underperforming wells by over 25% Revolutionary Sub-Surface Insights

- 2. Shale Revolution ŌĆö’éŚŌĆ» Resource plays have fundamentally revolutionized the US oil industry ŌĆö’éŚŌĆ» Onshore reservoirs are much more complex than they were a decade ago ŌĆö’éŚŌĆ» Currently an estimated 25% of wells underperform ŌĆö’éŚŌĆ» OAG Analytics is a revolutionary solution to modeling resource plays and reducing underperforming wells 2 Massive Increase in Production, Reserves, Wells, and Capital Expenditures ┬® 2014 OAG Analytics

- 3. OAGŌĆÖs Big Data Analytics ŌĆö’éŚŌĆ» Big Data is going to impact your organization whether you like it or not ŌĆö’éŚŌĆ» OAG Analytics makes this seamless and painless ŌĆóŌĆ» You provide your data in its current form ŌĆóŌĆ» We produce a state-of-the-art Reservoir Model ŌĆóŌĆ» Users access OAG Analytics with a web browser or TIBCO Spotfire ŌĆö’éŚŌĆ» OAG Analytics is a high-value business solution, not an IT project ŌĆö’éŚŌĆ» OAG seamlessly delivers insights to business users, making us the ideal next step on your Big Data journey 3 Seamlessly Integrate into Existing Operations ┬® 2014 OAG Analytics

- 4. Strategic Value From the Wellhead to the Boardroom in Under 30 Days ┬® 2014 OAG Analytics 4

- 5. Type Curves 5 * Accuracy measured by root mean squared error (RMSE). Each Underperforming Well Costs ~$5MM to $10MM A 5% Production Improvement is Worth ~$1MM per Well 2 7 5 Predict Average Production for a Large Acreage Position ŌĆö’éŚŌĆ» Type curve standard deviation (risk) is often over 35% ŌĆö’éŚŌĆ» Type curves often miss average production by 10% Type Curve Predict Production for Any Well, Anywhere OAG Models Capture Unconventional Oilfield Complexity Developed for Conventional Oilfields - Resource Plays are MUCH More Complex OAG Analytics Uniquely Explains Our ModelŌĆÖs Predictions ŌĆö’éŚŌĆ» OAG Analytics standard deviation is consistently less than 20% ŌĆö’éŚŌĆ» OAG is consistently over 40% more accurate than type curves* OAG Analytics VS ┬® 2014 OAG Analytics

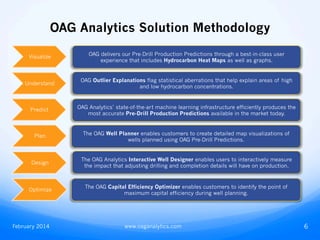

- 6. The Virtuous Cycle www.OAGanalytics.com 6┬® 2014 OAG Analytics Monthly Updates OAG Big Data Analytics Engine Oilfield Data OAG Oilfield Model

- 7. Regional Coverage ŌĆö’éŚŌĆ» Bakken ŌĆö’éŚŌĆ» Barnett ŌĆö’éŚŌĆ» Eagle Ford ŌĆö’éŚŌĆ» Marcellus ŌĆö’éŚŌĆ» Permian Bakken ŌĆö’éŚŌĆ» $15B on Drilling and Completions in 2014 ŌĆö’éŚŌĆ» Production is projected to increase 70% by 2020 OAG Covers the Most Active Domestic Onshore Plays ┬® 2014 OAG Analytics 7

- 8. 8 info@OAGanalytics.com 844-OAG-WELL www.OAGanalytics.com Contact us to start reducing underperforming wells today! Revolutionary Oilfield Models ┬® 2014 OAG Analytics