Open House (W Timer)

- 1. 2004-2005 CFA ® Program A CFA Based Curriculum At the Master’s Level Master of Financial Economics Ohio University- Pickerington

- 2. Master’s of Financial Economics Objectives The Goal of the Master of Financial Economics (MFE) Program is to Train Students for the Financial Sector. The Program Contents are Based on the CFA Curriculum. No other designation within the investment management profession carries as much prestige as the CFA charter. The MFE is not a Prep Program, Rather it is a Degree Program. Although the Course Content is Based on the CFA Curriculum, the Topics Are Taught at the Graduate Level.

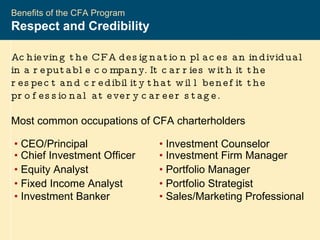

- 3. 2004-2005 CFA ® Program Benefits of the CFA Program Respect and Credibility Achieving the CFA designation places an individual in a reputable company. It carries with it the respect and credibility that will benefit the professional at every career stage. Most common occupations of CFA charterholders • CEO/Principal • Investment Counselor • Chief Investment Officer • Investment Firm Manager • Equity Analyst • Portfolio Manager • Fixed Income Analyst • Portfolio Strategist • Investment Banker • Sales/Marketing Professional

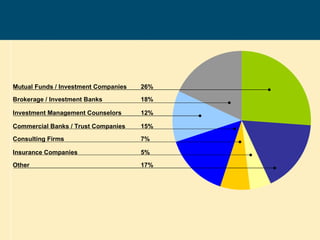

- 4. Benefits of the CFA Program Diverse Career Opportunities 2004-2005 CFA ® Program Mutual Funds / Investment Companies 26% Brokerage / Investment Banks 18% Investment Management Counselors 12% Commercial Banks / Trust Companies 15% Consulting Firms 7% Insurance Companies 5% Other 17%

- 5. 2004-2005 CFA ® Program Benefits of the CFA Program Opportunity – Top 22 Employers UBS Citigroup JP Morgan Chase & Co Merrill Lynch RBC Bank of America Credit Suisse HSBC Morgan Stanley Goldman Sachs Deutsche Bank TD Bank Financial Group Wachovia CIBC Barclays BMO Financial Group Allianz AG FMR Corporation PricewaterhouseCoopers Mellon Financial ABN AMRO Bank

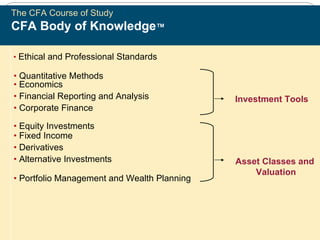

- 6. 2004-2005 CFA ® Program The CFA Course of Study CFA Body of Knowledge ™ • Ethical and Professional Standards • Quantitative Methods • Economics • Financial Reporting and Analysis • Corporate Finance • Equity Investments • Fixed Income • Derivatives • Alternative Investments • Portfolio Management and Wealth Planning Investment Tools Asset Classes and Valuation

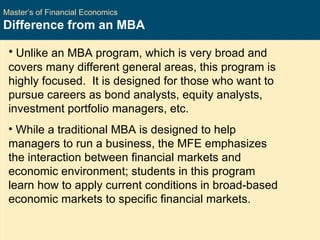

- 7. Master’s of Financial Economics Difference from an MBA Unlike an MBA program, which is very broad and covers many different general areas, this program is highly focused. It is designed for those who want to pursue careers as bond analysts, equity analysts, investment portfolio managers, etc. While a traditional MBA is designed to help managers to run a business, the MFE emphasizes the interaction between financial markets and economic environment; students in this program learn how to apply current conditions in broad-based economic markets to specific financial markets.

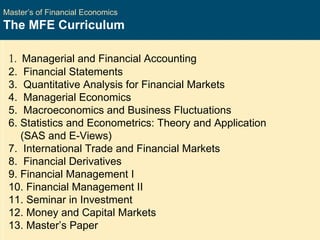

- 8. Master’s of Financial Economics The MFE Curriculum 1 . Managerial and Financial Accounting 2. Financial Statements 3. Quantitative Analysis for Financial Markets 4. Managerial Economics 5. Macroeconomics and Business Fluctuations 6. Statistics and Econometrics: Theory and Application (SAS and E-Views) 7. International Trade and Financial Markets 8. Financial Derivatives 9. Financial Management I 10. Financial Management II 11. Seminar in Investment 12. Money and Capital Markets 13. Master’s Paper

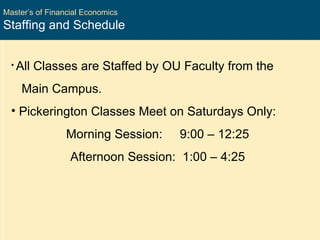

- 9. Master’s of Financial Economics Staffing and Schedule All Classes are Staffed by OU Faculty from the Main Campus. Pickerington Classes Meet on Saturdays Only: Morning Session: 9:00 – 12:25 Afternoon Session: 1:00 – 4:25

- 10. Master’s of Financial Economics Program Duration It Takes Seven Quarters to Finish the Program. Each Quarter Lasts for 11 Weeks, Followed by a Break. Students Take Two Courses Each Quarter for Six Consecutive Quarters. The Seventh Quarter is designed for Writing a Master’s Paper.

- 11. Master’s of Financial Economics Admission Requirements Since the Application Pool is Diverse, Students from All Disciplines are Admitted, Provided They have: Undergraduate Degree GPA of at Least 3.0 Strong Letters of Recommendation (optional) GMAT/GRE Score.

- 12. Master’s of Financial Economics Cost and Deadline Cost for 2011-2012 cohort is $2,393 per Course. It Includes the Instruction Fee, the General Fee, and Books, Computer software, the WSJ, The Economist, Meals, etc. This Cost is Fixed for 18 Months. Deadline: December 1. www.ohio.edu/economics

Editor's Notes

- #2: It is a common knowledge that no other designation within the investment management profession carries as much prestige as the CFA charter. The CFA designation carries with it the respect and credibility that will benefit the individual throughout his/her professional career.

- #5: Traditional employment in large financial institutions continues to be a primary career track for many CFA candidates and charterholders. However, growing numbers of charterholders are working in non-financial corporations and consulting firms. This slide is prepared by CFA Institute

- #6: The job listings in local newspapers and on the Internet contain a recurring requirement for investment–related positions: “CFA charter preferred or CFA candidate desired.” When hiring, promoting, and assigning additional responsibility, a large number of employers use the CFA charter as a benchmark for measuring capability and professionalism. Participation in the CFA Program is a clear signal to potential employers that a student or new employee is serious about a career in the investment profession . This slide is prepared by CFA Institute.

- #7: The material covered in the CFA Program’s curriculum is designed to reflect a Body of Knowledge that keeps pace with the ever-changing dynamics of the global investment industry. The CFA Program focuses on the principles of investment analysis and management. The Body of Knowledge is a systematic way of setting a framework for making investment decisions. The Body of Knowledge includes the 10 general topic areas listed here. Each of these topic areas is broken into sub-topics and serves as the framework on which the entire program is constructed. CFA Institute publishes the CFA Program Study Guides that candidates receive upon enrolling in each level of the program. The study guides contain the reading assignments to teach the Body of Knowledge and on which the examinations are based. This slide is prepared by CFA Institute