Opportunities for the U.S. Medical Equipment Sector

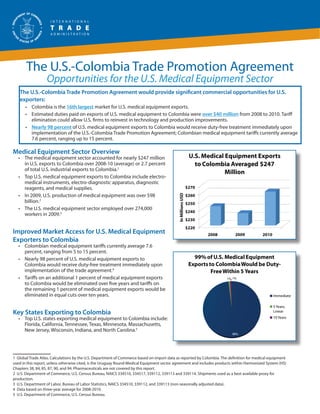

- 1. The U.S.-Colombia Trade Promotion Agreement Opportunities for the U.S. Medical Equipment Sector The U.S.-Colombia Trade Promotion Agreement would provide significant commercial opportunities for U.S. exporters: • Colombia is the 16th largest market for U.S. medical equipment exports. • Estimated duties paid on exports of U.S. medical equipment to Colombia were over $40 million from 2008 to 2010. Tariff elimination could allow U.S. firms to reinvest in technology and production improvements. • Nearly 98 percent of U.S. medical equipment exports to Colombia would receive duty-free treatment immediately upon implementation of the U.S.-Colombia Trade Promotion Agreement; Colombian medical equipment tariffs currently average 7.6 percent, ranging up to 15 percent. Medical Equipment Sector Overview • The medical equipment sector accounted for nearly $247 million U.S. Medical Equipment Exports in U.S. exports to Colombia over 2008-10 (average) or 2.7 percent to Colombia Averaged $247 of total U.S. industrial exports to Colombia.1 Million • Top U.S. medical equipment exports to Colombia include electro- medical instruments, electro-diagnostic apparatus, diagnostic reagents, and medical supplies. $270 • In 2009, U.S. production of medical equipment was over $98 $260 In Millions USD billion.2 $250 • The U.S. medical equipment sector employed over 274,000 $240 workers in 2009.3 $230 $220 Improved Market Access for U.S. Medical Equipment 2008 2009 2010 Exporters to Colombia • Colombian medical equipment tariffs currently average 7.6 percent, ranging from 5 to 15 percent. • Nearly 98 percent of U.S. medical equipment exports to 99% of U.S. Medical Equipment Colombia would receive duty-free treatment immediately upon Exports to Colombia Would be Duty- implementation of the trade agreement.4 Free Within 5 Years • Tariffs on an additional 1 percent of medical equipment exports 1% 1% to Colombia would be eliminated over five years and tariffs on the remaining 1 percent of medical equipment exports would be eliminated in equal cuts over ten years. Immediate 5 Years, Key States Exporting to Colombia Linear • Top U.S. states exporting medical equipment to Colombia include: 10 Years Florida, California, Tennessee, Texas, Minnesota, Massachusetts, New Jersey, Wisconsin, Indiana, and North Carolina.5 98% 1 Global Trade Atlas. Calculations by the U.S. Department of Commerce based on import data as reported by Colombia. The definition for medical equipment used in this report, unless otherwise cited, is the Uruguay Round Medical Equipment sector agreement and includes products within Harmonized System (HS) Chapters 38, 84, 85, 87, 90, and 94. Pharmaceuticals are not covered by this report. 2 U.S. Department of Commerce, U.S. Census Bureau, NAICS 334510, 334517, 339112, 339113 and 339114. Shipments used as a best available proxy for production. 3 U.S. Department of Labor, Bureau of Labor Statistics, NAICS 334510, 339112, and 339113 (non-seasonally adjusted data). 4 Data based on three-year average for 2008-2010. 5 U.S. Department of Commerce, U.S. Census Bureau.

- 2. Foreign Competition in Colombian Market • Colombia signed trade agreements with both the EU and Canada in November, 2008. Additionally, Colombia has FTAs in force with EU Could Gain a Tariff Advantage the rest of the Andean Community, Chile, Mexico, El Salvador, In the Colombian Medical Guatemala, and Honduras. Colombia grants some preferential access to MERCOSUR, CARICOM, Costa Rica, Nicaragua, and Equipment Market Panama. 9 8 • Upon implementation of its agreement, EU medical equipment 7 exporters would enjoy a 4.5 percent average tariff advantage over Average Tariff 6 U.S. exports. However, if the U.S.-Colombia TPA is implemented at 5 EU the same time, U.S. exports would have an immediate 0.9 percent 4 US average tariff advantage over the EU.6 3 MFN 2 1 Other Key Commitments by Colombia for the 0 Medical Equipment Sector Intellectual Property Rights: The U.S.-Colombia Trade Promotion Agreement requires high levels of intellectual property protection and enforcement, consistent with U.S. and international standards, and will support the growth of trade in valuable digital and other intellectual property-based products. The Agreement will provide for enhanced protections for trademarks, copyrights, and patents, such as the implementation a Colombian electronic trademark application system and on-line database, prohibitions on the circumvention of technological protection measures used by copyright holders, as well as ensuring that the parties will provide robust patent and test data protection. Remanufactured Goods: Colombia will eliminate its prohibition on the importation of remanufactured goods upon entry into force of the Agreement. Most Colombian tariffs on remanufactured goods will be eliminated immediately upon entry into force of the agreement, while tariffs on a small number of remanufactured goods will phase out over ten years. April 2011 6 U.S. Department of Commerce calculations based on EU-Colombia FTA and U.S.-Colombia Trade Agreement tariff commitments and Colombian 2010 Tariff Schedule.