Oppotus - Malaysians on Malaysia 4Q2019

- 1. 1 MALAYSIANS ON MALAYSIA 4Q 2 0 1 9 ESSEN TIAL IN SIGH TS IN TO C ON FID EN C E, MED IA TR U ST, BEH AVIOU R AL, TEC H & ESPORT TR EN D S IN MALAYSIA

- 2. 2 WELCOME TO MALAYSIANS ON MALAYSIA OVERALL INCREASE IN CONSUMER CONFIDENCE Coming into the last quarter of 2019, our Malaysians on Malaysia study is set to understand the trend and sentiments that has happened thus far during 2019. Since its inception in early 2018, this study has consistently reported on insights and sentiments amongst Malaysians. Malaysians are looking more confident than they were in 3Q19, with the overall Malaysian Confidence Index (MYCI) reaching the highest it’s been since the beginning of 2018 GLOBAL ECONOMY SEES GRADUAL DECLINE With continuous uncertainty proliferating throughout the world – BREXIT, US China Trade War, Persian Gulf crisis etc. – the current state of the global economy has seen better days. E-WALLET ADOPTION MOVING TOWARDS EARLY MAJORITY PHASE Usage of e-wallet as a technology and product has been steadily picking up, registering a 40% growth in 4Q19. We also saw the demise of the first notable e-wallet provider in Malaysia. As always, we continue to also cover interesting topics like tech trends, e- wallet insights and other key stats. If you like to dig deeper into the numbers, please do reach out to us on theteam@oppotus.com MALAYSIANS REMAIN OPTIMISTIC AMIDST SLOW ECONOMIC GROWTH Although some Malaysian’s are worried about their financial well-being in the upcoming year, most remain confident that the state of our economy will see improvements

- 3. 4 o Malaysia’s Confidence Index (MYCI) is at its highest index since the launch of our Malaysian’s on Malaysia report – ending 2019 with a high note o Despite the slowdown in both our domestic and the global economy, Malaysians remain confident and optimistic on the country’s economic growth as well as their current well-being 100 MALAYSIA CONFIDENCE INDEX (MYCI) 118 109 111 110 125 117 126 Q2'18 Q3'18 Q4'18 Q1'19 Q2'19 Q3'19 Q4'19 Source: Oppotus 4Q2019

- 4. 5 MALAYSIA CONFIDENCE INDEX (MYCI) COMPONENTS o Confidence index for most indicators seen to grow steadily this quarter – apart for consumer’s well-being in the next year which sees a 12pt drop since Q3’19 o Despite this, consumer’s purchase of major goods continues to increase, seeing it’s highest score of 111pts o This is not surprising, given the confidence towards the country’s economy in the next 12months and at the same time, most agree that the economy now is in a better position than it was in 2018 Source: Oppotus 4Q2019 Current state of financial well-being 126 106 113 133 152 139 147 0 50 100 150 200 2Q18 4Q18 2Q19 4Q19 Financial well-being next 12mths 142 140 129 136 149 155 143 2Q18 4Q18 2Q19 4Q19 Good time for major purchases 67 78 90 90 99 93 111 2Q18 4Q18 2Q19 4Q19 State of economy now vs. last year 93 95 105 91 109 98 114 0 50 100 150 200 2Q18 4Q18 2Q19 4Q19 State of economy next 12mths 161 125 115 98 119 100 116 2Q18 4Q18 2Q19 4Q19

- 5. 6 CURRENT FINANCIAL WELL-BEING Source: Oppotus 4Q2019 o Looking into current financial well-being, there is an 8pt increase in confidence vs last quarter o Headlines such as strong GDP growth rate and lower inflation in Q3’2019 likely to have contributed to this confidence level o This confidence is more apparent amongst mid to high income groups across all locations (with JB and Penang consumers leading indicators as opposed to Klang Valley) 140 137 167 135 134 154 156 149 0 50 100 150 200 Q4'18 Q2'19 Q4'19 Klang Valley Penang JB Kuantan Monthly Household Income Location Current state of financial well-being 126 106 113 133 152 139 147 0 50 100 150 200 2Q18 4Q18 2Q19 4Q19 135 153 157 0 50 100 150 200 Q4'18 Q2'19 Q4'19 RM4,501 - RM6,000 RM 6,001 - RM8,000 > RM8,000

- 6. 7 OUTLOOK ON FINANCIAL WELL-BEING NEXT 12 MONTHS Source: Oppotus 4Q2019 o Despite the positive outlook of current well-being, Malaysians are somehow feeling worried about their well-being in the coming year – although overall, the index is still high at 143 o This drop is largely seen in Johor Bahru as news around the nation’s financial position, political stability, job security and increasing food prices raise concerns among consumers143 140 142 140 140 158 120 175 0 50 100 150 200 Q4'18 Q2'19 Q4'19 Klang Valley Penang JB Kuantan Monthly Household Income Location Financial well-being next 12 months 142 140 129 136 149 155 143 0 50 100 150 200 2Q18 4Q18 2Q19 4Q19 141 145 143 0 50 100 150 200 Q4'18 Q2'19 Q4'19 RM4,501 - RM6,000 RM 6,001 - RM8,000 > RM8,000

- 7. 8 SPEND ON MAJOR PURCHASES Source: Oppotus 4Q2019 o The confidence with current financial well-being is reflecting on consumers’ spending on major purchases o Growing steadily since Q2’2018, this quarter sees a big spike in consumer confidence on positivity to major purchases spending (up 18pts) o The jump is mainly contributed by the mid-income bracket o Looking at locations, consumers across agree Q4’2019 is a good time to spend on major purchases – but less so among Kuantan consumers where since Q1’2019, index has been depressed and continues to be 95 95 118 116 127 112 126 44 0 50 100 150 200 Q4'18 Q2'19 Q4'19 Klang Valley Penang JB Kuantan Monthly Household Income Location Good time for major purchases 67 78 90 90 99 93 111 0 50 100 150 200 2Q18 4Q18 2Q19 4Q19 87 122 133 0 50 100 150 200 Q4'18 Q2'19 Q4'19 RM4,501 - RM6,000 RM 6,001 - RM8,000 > RM8,000

- 8. 9 CURRENT STATE OF ECONOMY Source: Oppotus 4Q2019 o As for consumers’ outlook on the economy, Malaysians show confidence with our current economic position – highest score (114pts) seen since Q2’18 93 95 129 116 111 58 168 88 0 50 100 150 200 Q4'18 Q2'19 Q4'19 Klang Valley Penang JB Kuantan Monthly Household Income Location State of economy now vs. last year 93 95 105 91 109 98 114 0 50 100 150 200 2Q18 4Q18 2Q19 4Q19 107 113 122 0 50 100 150 200 Q4'18 Q2'19 Q4'19 RM4,501 - RM6,000 RM 6,001 - RM8,000 > RM8,000

- 9. 1 0 STATE OF ECONOMY NEXT 12 MONTHS Source: Oppotus 4Q2019 o There seems to be hope that there will be improvements in the country’s economy as Malaysians rated their confidence towards the country’s economy in the next 12 months o This increase in confidence is solely seen in JB as they remain optimistic towards the growth of the country’s economy, while other locations see a dip on this index 108 102 135 115 106 81 167 79 0 50 100 150 200 Q4'18 Q2'19 Q4'19 Klang Valley Penang JB Kuantan Monthly Household Income Location State of economy next 12 months 93 95 105 91 109 98 114 0 50 100 150 200 2Q18 4Q18 2Q19 4Q19 107 117 126 0 50 100 150 200 Q4'18 Q2'19 Q4'19 RM4,501 - RM6,000 RM 6,001 - RM8,000 > RM8,000

- 10. 1 1 NOTABLE ACTIVITIES PAST 3 MONTHS Online activities, % Making online purchases from e-commerce sites (e.g. Lazada, Shopee) Purchased insurance products online (e.g. car, fire, etc.) Apply for banking products online (e.g. credit card, loans, etc.) Travel, % Domestic travel (within Malaysia) International travel (outside Malaysia) Eating OOH, % Purchase meal takeaway from convenience stores/petrol marts Having a meal at convenience stores/petrol marts Used wearables (e.g smart watch, smart shoes, health, etc.) Wearables, % Making payments through e-wallet (digital wallet) E-wallet, % Source: Oppotus 4Q2019 11 22 14 9 8 10 10 2Q 4Q18 2Q 4Q19 14 29 16 14 10 10 13 2Q 4Q18 2Q 4Q19 21 39 36 35 31 4Q18 1Q 2Q 3Q 4Q19 12 22 15 22 27 38 3Q 4Q18 1Q 2Q 3Q 4Q19 12 21 20 17 13 15 29 2Q 4Q18 2Q 4Q19 29 40 26 48 47 46 50 2Q 4Q18 2Q 4Q19 15 18 11 15 18 17 17 2Q 4Q18 2Q 4Q19 46 57 32 26 61 66 58 2Q 4Q18 2Q 4Q19 40 61 30 56 22 38 25 2Q 4Q18 2Q 4Q19

- 11. 1 2 E-WALLET LANDSCAPE IN MALAYSIA JAN SEPT APR 2018 NOV DEC JAN MAR APR JULY AUGMAY 2017 2018 NOVAPR MAR FEB JAN DEC OCT 2019 NOV OCT AUG JULYDEC Source: Oppotus 4Q2019 E X I T

- 12. 1 3 E-WALLET USAGE 12% 22% 15% 22% 27% 38% 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 Used e-wallet in last 3 months? On average, how many e-wallets do each person use? 1.9 2.6 4Q18 AVE 1Q19 AVE e e e e e e 3.32Q19 AVE e e e e Source: Oppotus 4Q2019 +11% 2.63Q19 AVE e e e 3.04Q19 AVE e e e e

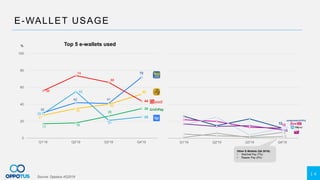

- 13. 1 4 1212 12 10 7 2 Q1'19 Q2'19 Q3'19 Q4'19 E-WALLET USAGE Source: Oppotus 4Q2019 % 30 42 41 72 27 35 40 5256 74 66 44 17 18 26 35 29 55 21 25 0 20 40 60 80 100 Q1'19 Q2'19 Q3'19 Q4'19 Top 5 e-wallets used Other E-Wallets (Q4 2019): ? WeChat Pay (7%) ? Raazer Pay (2%)

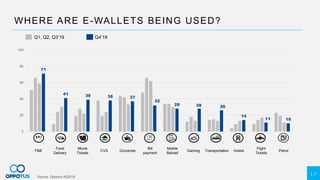

- 14. 1 7 Q1, Q2, Q3’19 WHERE ARE E-WALLETS BEING USED? Source: Oppotus 4Q2019 71 41 39 38 37 32 28 28 26 14 11 10 0 20 40 60 80 100 F&B Food Delivery Movie Tickets CVS Groceries Bill payment Mobile Reload Gaming Transportation Hotels Petrol Flight Tickets Q4’19

- 15. 2 5 Source: Oppotus 4Q2019 WOULD YOU CONTINUE TO USE E-WALLETS IF THERE ARE NO INCENTIVES? Incentives include: Cash back, rebates, promotions & discounts offered 77 10 13 0% 20% 40% 60% 80% 100% 4Q2019 YES MAYBE NO

- 16. 2 7 22 51 53 59 39 44 59 64 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 Q419 27 56 54 57 39 53 70 72 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 34 61 68 60 73 85 79 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 19 41 40 56 27 42 56 61 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 21 50 51 47 27 44 51 57 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 TECH TRENDS 31 75 64 51 56 57 66 75 0 25 50 75 100 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 Cryptocurrency (e.g. Bitcoin, Ethereum, etc.) FinTech EsportsBlockchain % 29 60 66 63 61 61 69 75 0 25 50 75 100 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 Virtual Reality (VR) Artificial Intelligence (AI) Augmented Reality (AR) % Source: Oppotus 4Q2019

- 17. 2 8 35 28 22 30 23 26 0 10 20 30 40 50 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 OWN ANY CRYPTOCURRENCY? +3% Source: Oppotus 4Q2019 %

- 18. 2 9 Q1, Q2, Q3’19 Source: Oppotus 4Q2019 20 17 6 4 4 3 3 2 0 10 20 30 40 50 Q4’19 TYPES OF CRYPTOCURRENCY OWNED Bitcoin Bitcoin Cash Litecoin Dash Ripple NEO Ethereum NEM %

- 19. 3 0 35 20 30 15 26 27 21 26 50 50 56 37 8 44 56 59 20 21 ESPORTS ATTENDANCE TRENDS AND PROFILE 12 27 13 15 13 19 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 Have physically ever been to an Esports event? Klang Valley Penang Johor Bahru Kuantan 18-24 years old 25-34 years old 35-44 years old 45 years old & above Male Female Malay Chinese Indian PMEB Non-PMEB RM4,500-RM7,000 RM7,001-RM9,000 RM9,001 and above LOCATION AGE GENDER RACE MHI WORKING STATUS Source: Oppotus 4Q2019 29 43 27 1 41 36 14 9 58 42 44 52 3 50 50 52 17 30 E-SPORTS ATTENDEES AVE. 29.3 YO AVE. RM7484.82 % % TOTAL AVE. 34.7 YO AVE. RM8,311.90 %

- 20. 3 2 OPPOTUS RESEARCH GROUP SDN BHD Level 40 Mercu 2, No.3 Jalan Bangsar KL ECO CITY, 59200 Kuala Lumpur, Malaysia www.oppotus.com theteam@oppotus.com