Optimizing Operating Working Capital (Felipe Florez-Arango)

- 1. Felipe A. Florez-Arango June 5 th , 2009 Felipe A. Florez-Arango Operating Working Capital Optimizing Operating Working Capital: An Increasingly Important Element of Change with an Exponential +$700Bn Cash Opportunity

- 2. Structure of Presentation Professional Background Optimizing Operating Working Capital: An Increasingly Important Element of Change with an Exponential +$700Bn Cash Opportunity Operating Working Capital (WoC): Facts Defining your Cash Conversion Cycle (CCC) Opportunities Pursuing your Cash Conversion Cycle (CCC) Opportunities Myths about Cash Conversion Cycle (CCC) Q&A References, Bibliography and Glossary Felipe A. Florez-Arango Operating Working Capital

- 3. Important Disclaimer The information contained in this presentation is provided for informational purposes only. While efforts were made to verify the completeness and accuracy of the information contained in this presentation, it is provided ŌĆ£as isŌĆØ, without warranty of any kind, expressed or implied. In addition, this information is based on my personal professional experience and I shall not be responsible for any damages arising out of the use of, or otherwise related to, this presentation or any other documentation. Felipe A. Florez-Arango Operating Working Capital

- 4. Professional Background Felipe A. Florez-Arango Operating Working Capital Innovative Finance Executive with a dynamic career providing business planning and decision support leadership in progressively responsible Finance and Accounting roles at the country, region and global levels for Procter & Gamble, General Electric and most recently Novartis Pharma. Extensive international experience in Latin America, USA, China and Europe. Degree in Business, Masters in Strategic Marketing and an MBA in Leadership and Finance. During my professional career, I have led key WoC projects including: Novartis Pharma: Currently leading since kick-off, a Global Project focused on Optimizing Operating Working Capital. GE Aero Energy: Lead a 6 Sigma Project focused on inventory optimization leading to the lowest inventory level: a) Without business disruptions, b) Improved processes and c) Improved Controls / visibility. P&G: Lead the Latin America WoC Team. Achievements include lowest regional DSO ever and significant operating and capital cost savings.

- 5. Felipe A. Florez-Arango Operating Working Capital Optimizing Operating Working Capital: An Increasingly Important Element of Change with an Exponential +$700Bn Cash Opportunity Credit: Is it available ? What is your cost ? What is your Business Operating WoC Opportunity ?

- 6. Operating WoC: Facts (1) Felipe A. Florez-Arango Operating Working Capital European Companies can potentially liberate from WoC : ~$610Bn Inventory: ~$220Bn Accounts Receivable: ~$210Bn Accounts Payable: ~$180Bn U.S.A. Companies can potentially liberate from WoC: ~$770Bn Inventory: ~$300Bn Accounts Receivable: ~$290Bn Accounts Payable: ~$180 Net Operating WoC as % of Sales: Regional View Canada: ~6% Australia/New Zealand: ~10% U.S.A.: ~11% Latin America: ~11% Europe: ~12% Asia: ~13%

- 7. Operating WoC: Facts (2) Cash Conversion Cycle (CCC): Top 25 Companies median at +29.5 days CCC #1: Apple with -45.2 days Accounts Receivable #1: Wal-Mart with +3.5 days Inventory #1: Apple with +8 days Accounts Payable #1: J&J with -142.1 days Cash Conversion Cycle (CCC): Regional View Canada: +21.9 days Australia/New Zealand: +35.0 days U.S.A.: +38.8 days Latin America: +38.8 days Asia: +44.6 days Europe: +47.3 days Felipe A. Florez-Arango Operating Working Capital

- 8. Defining Your CCC Opportunities: Size of the Prize (1) Felipe A. Florez-Arango Operating Working Capital Define your Operating WoC Team and Sponsors: Sponsors: CEO and CFO Team: Project Leader Finance: Head of Financial Planning and Analysis Treasury: Head of Treasury Accounting: Head of Accounting AR/AP Departments: Head of AR and Head of AP Sales: Head of Sales Sourcing: Head of Sourcing Product Supply: Head of Product Supply Critical Internal Customers (ie. Subsidiaries) Understand your CCC: Inventory: Days Inventory Outstanding (DIO) Accounts Receivable: Days Sales Outstanding (DSO) Accounts Payable: Days Payable Outstanding (DPO) Understand your CCC Dimensions / Levels: Top 15 Subsidiaries: CCC, DIO, DSO, DPO Top 15 Customers: DSO Top 15 Suppliers: DPO

- 9. Defining Your CCC Opportunities: Size of the Prize (2) Felipe A. Florez-Arango Operating Working Capital Understand your End-To-End Processes: DIO: Product Range Management -> Warehousing & Distribution DSO: Sales & Quote Management -> Cash Application DPO: Planning & Strategy -> Payment Identify what is the best possible CCC, DIO, DSO and DPO: Internal Trends (ie. where have we been; where are we today) Internal Benchmarks (Subsidiaries, Customers, Suppliers) Industry Benchmark Regional Benchmark Best-In-Class Companies Customer Receivable/Payable Performance Supplier Receivable/Payable Performance Quantify and Prioritize CCC, DIO, DSO, DPO Improvements in Ōé¼ and/or $ Set and align target levels for upcoming 5 Years (Granularity Yr 1 & 2) Operating WoC: Integral Part of your Strategic Plan

- 10. Pursuing your CCC Opportunities: Key Pillars Felipe A. Florez-Arango Operating Working Capital Leading Operating WoC Metrics Incremental Free Cash Flow Reporting / Tracking: KPIŌĆÖs Capability / Training Communication Change Management Leading Practice Processes Clear Roles, Responsibilities & Accountabilities Incentive System

- 11. Pursuing your CCC Opportunities: Suggested Approach Inventory of Opportunities Aligned Detailed Action Plan Action Items Responsible Due Date Timing Impact (Q.Win/L.Term) Resources/Costs Benefit/Costs: Cash Flow, P/L Scoping, Analysis & Action Plan Delivery of the aligned detailed action plan & benefits Lessons Learned Results Implementation Cash Conversion Cycle Improvement Approach CONTINUOUS Processes Data Tools Know How R & Roles Deliverables Deliverables TARGET CCC, DIO, DSO, DPO: Ōé¼ and / or $ Cash Flow Released IMPROVEMENT RCA Solution Track

- 12. Pursuing your CCC Opportunities: Tracking (Example) Felipe A. Florez-Arango Operating Working Capital

- 13. Myths About CCC It is what it is. The benchmark is not reliable. Accounts Receivable: We cannot improve or influence DSOŌĆ” we will lose sales. We can improve terms but it will cost us a lot of money. Our processes are perfect. Zero Overdue as % of Sales is not achievableŌĆ” cost of doing business. Accounts Payable: We cannot improve itŌĆ” we are already paying late all the time. Our suppliers will increase prices if we extend terms. Inventory: Reducing Inventory will increase Out of Stocks and impact sales. If we have issues, the problem is at the factory. Felipe A. Florez-Arango Operating Working Capital

- 14. Thank you for your time Q&A Felipe A. Florez-Arango Operating Working Capital

- 15. References Felipe A. Florez-Arango Operating Working Capital Felipe Flore-Arango CFO Mature Products, Global Business Unit Cash Flow Optimization, Global Project Leader Novartis Pharma AG [email_address] Bernhard Wenders Director REL [email_address] Robert Smid Director Ernst & Young [email_address] Gordon Bivens Director, eLearning The Accounts Payable Network / The Accounts Receivable Network [email_address]

- 16. Bibliography Felipe A. Florez-Arango Operating Working Capital E&Y: All Tied Up ? Annual Working Capital Survey 2008 The Accounts Payable Network: www.TAPN.com The Accounts Receivable Network: www.TARN.com REL/CFO: Global Working Capital Insight 2007 Cash Flow Metric, Cash Conversion Efficiency Europe - 2008 Cash Masters Scorecard Europe - 2008: Working Capital Survey Europe - 2008: Working Capital Scorecard Europe - 2007: Working Capital Scorecard U.S.A.ŌĆō 2008 Cash Masters Scorecard Canada - 2008: Working Capital Survey Latin America - 2008: Working Capital Survey Asia ŌĆō 2008 APAC: Working Capital Survey Asia ŌĆō 2007 Cash Masters Scorecard Asia ŌĆō 2008 Cash Masters Scorecard Australia/New Zealand ŌĆō 2008 Working Capital Survey

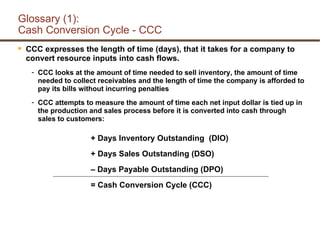

- 17. Glossary (1): Cash Conversion Cycle - CCC CCC expresses the length of time (days), that it takes for a company to convert resource inputs into cash flows. CCC looks at the amount of time needed to sell inventory, the amount of time needed to collect receivables and the length of time the company is afforded to pay its bills without incurring penalties CCC attempts to measure the amount of time each net input dollar is tied up in the production and sales process before it is converted into cash through sales to customers: + Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) ŌĆō Days Payable Outstanding (DPO) = Cash Conversion Cycle (CCC) Felipe A. Florez-Arango Operating Working Capital

- 18. Glossary (2): Days Inventory Outstanding; Days Sales Outstanding Days Inventory Outstanding (DIO) is a measure of the average number of days that a company has in inventory including raw materials, work in progress and finished goods High DIO number shows that a company has significant amount of inventoryŌĆ” usually negative trend. Low DIO number shows that a company has a low amount of inventoryŌĆ” usually positive trend. Best-in-class DIO is achieved when just-in-time is in place. Days Sales Outstanding (DSO) is a measure of the average number of days that a company takes to collect revenue after a sale has been made. Low DSO number means that it takes a company fewer days to collect its accounts receivableŌĆ” usually very positive trend. High DSO number shows that a company is selling its product to customers on credit and taking longer to collect moneyŌĆ” usually very negative trend. Felipe A. Florez-Arango Operating Working Capital

- 19. Glossary (3): Days Payable Outstanding Days Payable Outstanding (DPO) is a measure of the average number of days that a company takes to pay itŌĆÖs trade creditors. High DPO number shows that a company is taking longer time to pay itŌĆÖs creditorsŌĆ” usually positive trend. Low DPO number means that it takes a company few days to pay itŌĆÖs trade creditorsŌĆ” usually negative trend. Felipe A. Florez-Arango Operating Working Capital

![References Felipe A. Florez-Arango Operating Working Capital Felipe Flore-Arango CFO Mature Products, Global Business Unit Cash Flow Optimization, Global Project Leader Novartis Pharma AG [email_address] Bernhard Wenders Director REL [email_address] Robert Smid Director Ernst & Young [email_address] Gordon Bivens Director, eLearning The Accounts Payable Network / The Accounts Receivable Network [email_address]](https://image.slidesharecdn.com/optimizingoperatingworkingcapitalfelipeflorezarango-12559710017396-phpapp02/85/Optimizing-Operating-Working-Capital-Felipe-Florez-Arango-15-320.jpg)