Options Trader Series - Iron Butterfly

- 1. Options Trader Series Short Iron Butterfly Strategy 1

- 2. When to use Iron Butterfly ŌĆóBest used when prices are in a sideways trend or rangebound. ŌĆóPresence of strong Support & Resistance levels. ŌĆóWhen there are no major events, news or earnings. ŌĆóPreferably used in shorter expiry time frames ex., weekly expiry. 2

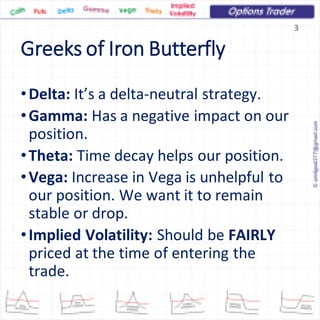

- 3. Greeks of Iron Butterfly ŌĆóDelta: ItŌĆÖs a delta-neutral strategy. ŌĆóGamma: Has a negative impact on our position. ŌĆóTheta: Time decay helps our position. ŌĆóVega: Increase in Vega is unhelpful to our position. We want it to remain stable or drop. ŌĆóImplied Volatility: Should be FAIRLY priced at the time of entering the trade. 3

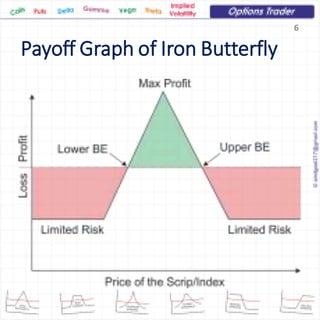

- 4. Reward & Risk Profile of Iron Butterfly ŌĆóReward : Limited to the net credit received. ŌĆóRisk : Limited to the difference in adjacent strikes minus net credit. ŌĆóBreakeven Up: Middle strike minus net credit. ŌĆóBreakeven Down: Middle strike plus net credit 4

- 5. Entry & Exit Rules of Iron Butterfly ŌĆóEntry ŌĆóClose to midpoint of the range. ŌĆóIV should be FAIR. ŌĆóTrend should be sideways. ŌĆóExit ŌĆóIf 90% potential profit is achieved. ŌĆóIf Stop Loss @Breakeven is hit on either side. 5

- 6. Payoff Graph of Iron Butterfly 6

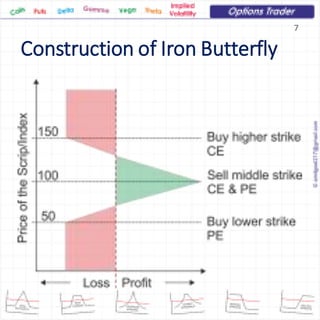

- 7. Construction of Iron Butterfly 7

- 8. Thank You ┬® Amit Goel Email: amitgoel217@gmail.com 8