Overview Of University Budget And Planning Process

- 1. ╠²

- 2. State of Michigan Higher Education Appropriations Wayne State University Budget Highlights Economic Impacts to Enrollment Wayne State University Budget Planning Process

- 4. National Average: 63% Michigan: 16%

- 5. Annual Change in Resources FY 2001 to FY 2007: (State Appropriations & Tuition/FYES)

- 6. FY 2001 ($9.740 billion) FY 2009 ($9.701 billion)

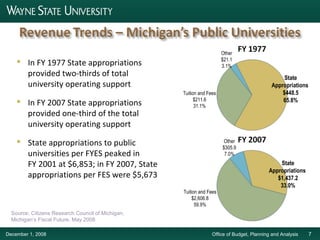

- 7. Source: Citizens Research Council of Michigan, MichiganŌĆÖs Fiscal Future, May 2008 State Appropriations $448.5 65.8% State Appropriations $1,437.2 33.0% Other $21.1 3.1% Tuition and Fees $211.6 31.1% Other $305.9 7.0% Tuition and Fees $2,606.8 59.9% In FY 1977 State appropriations provided two-thirds of total university operating support In FY 2007 State appropriations provided one-third of the total university operating support State appropriations to public universities per FYES peaked in FY 2001 at $6,853; in FY 2007, State appropriations per FES were $5,673

- 8. Average change for MPU institutions = 2.0% Average tuition rate increase = 7.2%

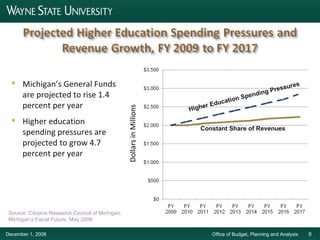

- 9. Dollars in Millions Higher Education Spending Pressures Constant Share of Revenues Source: Citizens Research Council of Michigan, MichiganŌĆÖs Fiscal Future, May 2008 MichiganŌĆÖs General Funds are projected to rise 1.4 percent per year Higher education spending pressures are projected to grow 4.7 percent per year

- 11. General Fund Budget: $535 M Sources: Tuition, fees, ICR and State Uses: Faculty / staff compensation, utilities, insurance Designated Fund Budget: $91 M Sources: Gifts and Non-Governmental contracts Uses: Funding for specific purposes that have been designated to schools, colleges or divisions Auxiliary Fund Budget: $37 M Sources: Housing, Parking, University Press, Bookstore, Student Center, etc. Uses: Salaries, operations and debt service of auxiliary entities Restricted Budget: $157 M Sources: Federal grants, contracts, and gift Uses: GrantsŌĆösupport the universityŌĆÖs research activities Uses: GiftsŌĆödedicated components of the educational budget such as scholarships, endowed chairs, and capital improvements Pre-Allocated Available for Allocation

- 12. Primary Mission 58% Instruction/Public Service: $341M Expenditures associated with faculty compensation Research: $132 M Expenditures associated with sponsored award activity Support Programs 31% Scholarships: $67 M Expenditures associated with financial aid for the University Institutional Support: $57 M Expenditures associated with administrative operations Academic Support: $72M Expenditures associated with supporting academic mission such as Libraries Student Services: $34 M Plant Operations 7% Operations and Maintenance: $62 M Transfers 4% Debt Service/ Plant Improvement: $33 M Auxiliary Enterprises $22M 3%

- 14. FY 2001 - $381 M FY 2009 - $535 M Since FY 2001, Wayne State University has had to become more reliant on tuition and fees and less reliant on State Appropriations.

- 15. Funding Gap $79.4 M State appropriations if increased by CPI each year. Actual State Appropriations

- 16. ╠²

- 19. Unemployment Rates Income Changes Market Share

- 20. Chart compares the Michigan unemployment rate to changes in enrollment at EMU, U of M, MSU, and WSU over time.

- 21. MSU UM WSU CMU GVSU OU

- 22. Census population grew 0.8% between 2000 ŌĆō 2006 Enrollment in MPUs grew 10% (or 11,762) from fall 1998 ŌĆō 2007 OU & GVSU accounted for 52% or 6,113 of the growth Enrollment in community colleges increased 16.7% between 1998 - 2007 Total Enrollment Market Share Changes between Fall 1998 - Fall 2007

- 23. Livingston Macomb Monroe Oakland St. Clair Washten. Wayne 2006 Census 185,000 830,000 155,000 1,215,000 172,000 345,000 1,850,000 WSU Enroll 158 5,001 140 7,051 318 566 14,565

- 25. Board of Governors Budget and Finance Committee President Cabinet Faculty Senate Policy Committee Budget and Finance Committee Council of Deans Student Council Office of Budget, Planning and Analysis

- 26. State Budget Finalized WSU Financial Report and Year End Budget 2 nd Michigan Revenue Conference WSU 2 nd Quarter Report WSU Tuition and Budget Approved 1 st Michigan Revenue Conference End of Fiscal Year Sept. 30th Start of Fiscal Year Oct. 1st BOG Meeting BOG Meeting BOG Meeting BOG Meeting BOG Meeting BOG Meeting BOG Meeting Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sept