How P2P Finance Models Work: Risks, Controls and Regulatory Barriers

- 1. PEER-TO-PEER FINANCE POLICY SUMMIT 2012 How P2P Finance Models Work: Risks, Controls And Regulatory Barriers Simon Deane-Johns 7 December 2012 Keystone Law

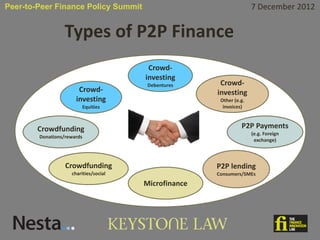

- 2. Peer-to-Peer Finance Policy Summit 7 December 2012 Types of P2P Finance Crowd- investing Debentures Crowd- Crowd- investing investing Other (e.g. Equities invoices) Crowdfunding P2P Payments (e.g. Foreign Donations/rewards exchange) Crowdfunding P2P lending charities/social Consumers/SMEs Microfinance

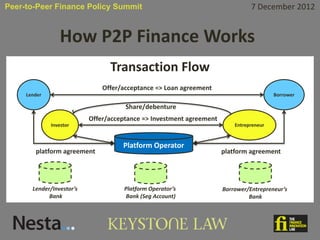

- 3. Peer-to-Peer Finance Policy Summit 7 December 2012 How P2P Finance Works Transaction Flow Offer/acceptance => Loan agreement Lender Borrower Share/debenture Offer/acceptance => Investment agreement Investor Entrepreneur Platform Operator platform agreement platform agreement Lender/InvestorŌĆÖs Platform OperatorŌĆÖs Borrower/EntrepreneurŌĆÖs Bank Bank (Seg Account) Bank

- 4. Peer-to-Peer Finance Policy Summit 7 December 2012 How P2P Finance Works Funds Flow Loan agreement Lender Borrower Share/debenture Investment agreement Transfer request Investor Entrepreneur Transfer request Platform Operator platform agreement platform agreement Funds Transfer Disburse Loan/Investment Funds Transfer Repayment/dividend Lender/InvestorŌĆÖs Platform OperatorŌĆÖs Borrower/EntrepreneurŌĆÖs Bank Bank (Seg Account) Bank

- 5. Peer-to-Peer Finance Policy Summit 7 December 2012 Common Features ŌĆó Platform operator is not a party to instrument agreed between participants ŌĆō Segregates participantsŌĆÖ funds rather than treating them as own assets; ŌĆō Margin stays with the participants; ŌĆó Online only ŌĆō> low cost ŌĆō> lower fees ŌĆó Low minimum commitment ŌĆō accessible to ordinary people ŌĆō Aids diversification of small investment amounts; ŌĆō Finance from many in small amounts at outset ŌĆō> no need to securitise; ŌĆó Data centralised to aid risk assessment, performance analysis, collections, enforcement ŌĆó Transparency and funds segregation removes ŌĆśmoral hazardŌĆÖ

- 6. Peer-to-Peer Finance Policy Summit 7 December 2012 Standard Operational Risks ŌĆó Lack of adequate internal controls, governance ŌĆō Financial mismanagement, operator insolvency; ŌĆō Internal fraud; ŌĆō lack of system integrity/availability; ŌĆō lack of business continuity; ŌĆō failure to manage/respond appropriately to customer complaints; ŌĆō Unclear, unfair or misleading promotions/communications. ŌĆó Basic credit or investment risk ŌĆó Money laundering, external Fraud

- 7. Peer-to-Peer Finance Policy Summit 7 December 2012 Common Operational Controls ŌĆó Senior management systems and controls; ŌĆó Minimum working capital; ŌĆó Segregation of participantsŌĆÖ funds; ŌĆó Clear, fair and not misleading service terms/communications/promotions; ŌĆó Secure and reliable IT systems; ŌĆó Fair complaints handling; ŌĆó Orderly administration if platform ceases to operate; ŌĆó Appropriate risk assessment, AML and anti-fraud measures ŌĆó Extra measures appropriate to specific instruments available

- 8. Peer-to-Peer Finance Policy Summit 7 December 2012 Regulatory Barriers ŌĆó Confusion as to whether you can lawfully participate on platforms; ŌĆó Tiny differences have seismic implications in permission or licence needed; ŌĆó Regulatory ŌĆścreepŌĆÖ: uncertainty/ risk aversion leads to unnecessary complexity; ŌĆó Regulatory overlap/conflict (e.g. FSMA/MiFID, Prospectus Directive/CoŌĆÖs Act); ŌĆó Different ŌĆśbusiness testŌĆÖ criteria for different activities; ŌĆó Unclear when participants might be acting in the course of a business; ŌĆó Different rules for ŌĆśpromotingŌĆÖ vs ŌĆśofferingŌĆÖ a security; ŌĆó Unregulated operators may still face rules on public offers and promotions; ŌĆó Regulators can only look inside the regulated markets to foster competition; ŌĆó Regulation (coupled with perverse tax incentives) discourages diversifying beyond regulated cash/investment products, limiting innovation and competition.