Partnership.pptx

- 1. James And Chloe Decide To Sell Lemonade At The School Fun Fair Hosted By The Grade 11 Learners. James And Chloe Will Each Contribute R100 To Start Their Business. Both Also Decided To Split The Profit 50:50. They Have Also Decided That James Will Serve The Lemonade To The Customers And Chloe Will Keep Record Of The Sales, Expenses And Income.

- 2. INTRODUCTION ïķ Up until now in accounting, we have only dealt with SOLE TRADERS ïķ Sole traders are businesses with only one owner. ïķ In this chapter, we will discuss the accounting records of PARTNERSHIPS ïķ Partnerships are businesses with more than one owner. ïķ The general day-to-day transactions of a partnership are the same as those of a sole trader. ïķ So how do these businesses differ from each other? One owner Sole traders the net profit generated by the business belongs to Partnerships More than one owner the net profit generated by the business belongs to

- 3. WHAT IS A PARTNERSHIP? ïķ A partnership is usually formed when: ï§ Two or more people want to start a business together, and ï§ They want to conduct business in a similar manner to a sole trader, ï§ Rather than forming a legal entity such as a close corporation or company. ïķ The partners contribute towards the partnership by providing: ï§ Capital (usually cash, but can also be fixed assets) ï§ Knowledge, skills and expertise ïķ Professionals, such as doctors, lawyers or architects usually form partnerships. ïķ According to the South African law, a partnership is not regarded as a legal person. This means that partners are jointly and separately liable and responsible for the assets and liabilities and of the partnership.

- 4. PARTNERSHIP AGREEMENT ïķ A partnership involves a legal agreement between two or more people. ïķ This agreement can be verbal but should preferably be in writing. ïķ A written agreement between partners is known as a partnership agreement. Contents Of Partnership Agreement âĒ The names of the partnership and partners involved. âĒ The aim of the business, and the product or service provided. âĒ The amount of capital, work or labour, knowledge and/or skills each partner will contribute to the business. âĒ The specific job description for each partner. âĒ The extent to which the partners will be liable for debts or losses. âĒ The ratio according to which the net profit is shared among partners. âĒ Any other stipulations with regards to changes in capital, drawings, retirement or withdrawal from the partnership.

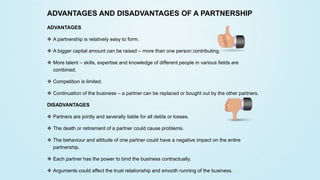

- 5. ADVANTAGES AND DISADVANTAGES OF A PARTNERSHIP ADVANTAGES ïķ A partnership is relatively easy to form. ïķ A bigger capital amount can be raised â more than one person contributing. ïķ More talent â skills, expertise and knowledge of different people in various fields are combined. ïķ Competition is limited. ïķ Continuation of the business â a partner can be replaced or bought out by the other partners. DISADVANTAGES ïķ Partners are jointly and severally liable for all debts or losses. ïķ The death or retirement of a partner could cause problems. ïķ The behaviour and attitude of one partner could have a negative impact on the entire partnership. ïķ Each partner has the power to bind the business contractually. ïķ Arguments could affect the trust relationship and smooth running of the business.

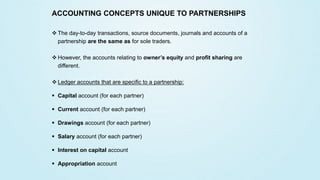

- 6. ACCOUNTING CONCEPTS UNIQUE TO PARTNERSHIPS ïķ The day-to-day transactions, source documents, journals and accounts of a partnership are the same as for sole traders. ïķ However, the accounts relating to ownerâs equity and profit sharing are different. ïķ Ledger accounts that are specific to a partnership: ï§ Capital account (for each partner) ï§ Current account (for each partner) ï§ Drawings account (for each partner) ï§ Salary account (for each partner) ï§ Interest on capital account ï§ Appropriation account

- 7. KNOWLEDGE CHECK Column A Column B 1. Has more than one partner a. Capital and Knowledge, skills 2. Partners contribute towards the business by providing b. Current account for each partner 3. States the specific job description for each partner c. Disadvantage of a partnership 4. Partners are jointly and severally liable for all debts or losses d. Partnership 5. Ledger account specific to a partnership e. Partnership Agreement