Pay Easy Solutions International

- 1. We are committed to Your success.

- 2. About usSimple, Secure, Low Cost Payment Solutions…PayEasy is a global provider of electronic payments solutions for financial institutions, retailers and payment processors. Customers rely on PayEasy solutions to deliver reliable, scalable and secure payment services and to have money on the move. PayEasy’s objective is to become the leading electronic payment services company in the Middle East and North Africa, Europe, Central and South East Asia and North America.We work with web developers, shopping cart providers and all the major banks to offer the best in internet payment processing services - PayEasy means industry leading reliability, security and value

- 3. About usGlobal Operations Centre Headquartered in Metro Manila, Philippines,

- 4. Branches : Asia Pacific, North America, Europe, United Kingdom

- 5. Partner Offices: Middle East (Manama, Bahrain), Australia, Hong Kong

- 7. Privately held and funded by regional investors

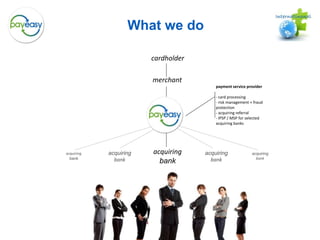

- 8. Operations in US, UK, Monaco, Hong Kong, Manila, Bahrain, Lebanon and Germanycardholdermerchantpayment service provider- card processing- risk management + fraud protection- acquiring referral- IPSP / MSP for selected acquiring banksacquiringbankacquiringbankacquiringbankacquiringbankacquiringbankWhat we do

- 9. What makes a payment solution successfulEasy to use, Convenient& PortableElectronicTransactionSolutionsLow Cost to Deploy& MaintainRobust & Dynamic SecurityLeverages Existing Systems & Behaviors

- 10. Our SolutionsCredit Card AcquiringWe provide multicurrency credit card acquiring services in collaboration with regional and international banks.Direct Acquiring RelationshipsMerchant enters into direct contractual relationship with acquiring bank

- 11. Multiple referral partnerships in the region and internationallyMerchant Service Provider (IPSP/MSP)Merchant enters into contractual relationship with PayEasybut gets dedicated merchant account from sponsoring bankLink-up various payment methods through a Payment Service Provider (only one Interface)Payment Service ProviderE-ShopDebitDebit CardAdditionalPayment methods

- 12. Our SolutionsPayment ProcessingEasy integration for merchants using secure web-services

- 13. Payment page enables merchants to avoid pci/dss certification

- 14. Extensive risk management and fraud protection functionality

- 15. Full support for verified by visa and MasterCard secure code

- 16. Dynamic routing of transactions to local acquiring bank to optimize acceptance ratios

- 17. Online refund and credit functionalityOur SolutionsRisk management and Fraud PreventionLess Fraud. Decreased Costs. Optimized Revenue

- 18. Fraud PreventionMaxMind LLC ….Fraudster techniques becoming more advancedTechniques used in online card-not-present fraud are becoming more and more sophisticated. Traditional fraud screening tools can only determine if a credit card is legitimate or if the user-entered account information matches those on record. Today, fraudsters can obtain personal credit card information, pose as the legitimate card holder, and bypass standard fraud checks.Looking at fraud from a different angleAt MaxMind, we approach fraud screening in a different way. We examine an online transaction from various angles. Our tools are not geared towards verifying the authenticity of the credit card details used for the purchase, but rather, identifying if the purchaser is the legitimate card holder. Through our analysis, we have been able to identify traits and patterns that are associated with fraudulent orders. By asking the right questions, we can provide e-commerce businesses with the necessary information to detect fraudulent orders before the payment is processed.

- 19. Fraud PreventionMaxMind LLC ….We provide multicurrency credit card acquiring services in collaboration with regional and international banks.Key features include: Geographical IP address location checking

- 20. High risk IP address and e-mail checking

- 21. Issuing bank BIN Number country matching*

- 22. minFraud Network

- 23. Proxy server detection (both open and closed)

- 24. Post query analysis Fraud PreventionElastic Payment Gateway FeaturesWithin our own Gateway we have established several basic parameters that help both the Gateway Operator and the merchant reduce the risk of fraud before the transaction is passed to our third party Fraud Prevention Service Provider (MaxMind) and then the acquirer. These features include : Specifying the maximum number of times a credit card can be used within a specified period. If this is exceeded the Payment Gateway automatically locks that credit card number out for the specified period. If the customer attempts to use the card number with that merchant during this lock out period the lock out period is then extended from the time that the last attempt was made using that card number.

- 25. Specifying the maximum number of times transactions can be sent from an IP Address within a specified period of time. If this is exceeded the Payment Gateway automatically locks all transactions out coming from that IP Address for the specified period. If transactions are attempted from that IP Address within the lock out period the lock out period is automatically extended from the time of the last attempt.

- 26. Specifying the maximum number of different credit card transactions (numbers) that can be sent from the same email address within a specified period of time.

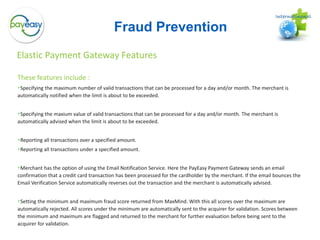

- 27. Specifying the maximum number of email addresses that can be associated with a specific credit card number within a specified period of time. Fraud PreventionElastic Payment Gateway FeaturesThese features include : Specifying the maximum number of valid transactions that can be processed for a day and/or month. The merchant is automatically notified when the limit is about to be exceeded.

- 28. Specifying the maxium value of valid transactions that can be processed for a day and/or month. The merchant is automatically advised when the limit is about to be exceeded.

- 29. Reporting all transactions over a specified amount.

- 30. Reporting all transactions under a specified amount.

- 31. Merchant has the option of using the Email Notification Service. Here the PayEasy Payment Gateway sends an email confirmation that a credit card transaction has been processed for the cardholder by the merchant. If the email bounces the Email Verification Service automatically reverses out the transaction and the merchant is automatically advised.

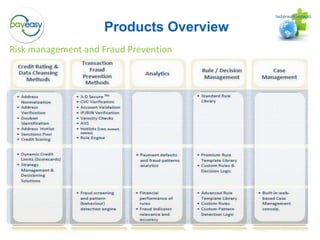

- 32. Setting the minimum and maximum fraud score returned from MaxMind. With this all scores over the maximum are automatically rejected. All scores under the minimum are automatically sent to the acquirer for validation. Scores between the minimum and maximum are flagged and returned to the merchant for further evaluation before being sent to the acquirer for validation. Products OverviewRisk management and Fraud Prevention

- 33. BenefitsRisk management and Fraud PreventionReduce your Fraud by... Detecting fraudulent behavior (patterns) automatically,

- 34. Incorporating market specific data into the fraud decision process, including itinerary information such as departures, stopovers, arrivals and airport information.Decrease your Costs by.... Reducing chargebacks, safeguarding against surcharges and fines

- 35. Reducing the number of transactions being queued for manual review,

- 36. Decreasing time spent on processing exceptions (chargeback notifications, etc.).Optimize your Revenue by... Accepting more genuine business,

- 37. Identifying and protecting your good customers.Thus optimizing sales conversion, while minimizing fraud risk and manual review and associated costs.

- 38. Security and InfrastructureCompliant with payment card industry data security standard

- 39. Support for verified by Visa and MasterCard secure code

- 40. Secure data center facilities in Germany(PCI/DSS)

- 41. Reporting and ManagementWeb-based administrative interface

- 42. Extensive transaction search and management functionality

- 43. Business intelligence and reporting dashboard

- 45. Online refund and credit capabilityMerchant SupportKeeping you connected online….We offer a range of support facilities to online merchants – via email and/or telephone. Technical expertise is also available ‘in the flesh’ where required. The level of support does, of course, depend on which PayEasyOnline payment solution you have chosen. Support facilities available: Online Support

- 46. Merchant support (via phone and email)

- 47. Technical support (via phone and email)Contact Christopher R. Bauer CEO / Chief Executive Officer PayEasy Solutions Inc. InternationalDDI: +63 (0) 2 577 4680 Cell: +63 (0) 917 892 0016 E-mail: chris.ba@me.comJames E BergmanGlobal COO / Chief Operational OfficerPayEasy Solutions Inc. InternationalTel UK (M): +44(0)7791171680Tel UK (W): +44(0)2078732022Email: James.Bergman@me.com http://www.payeasy-solutions.com/