Paybl.hps.march2010.ver3.0

- 1. Transact Freely with One-Click Pay tm Presented to Heartland Payments Systems Mountain View, CA Apr 2010

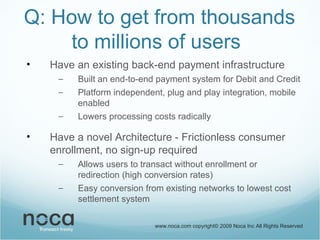

- 2. Q: How to get from thousands to millions of users Have an existing back-end payment infrastructure Built an end-to-end payment system for Debit and Credit Platform independent, plug and play integration, mobile enabled Lowers processing costs radically Have a novel Architecture - Frictionless consumer enrollment, no sign-up required Allows users to transact without enrollment or redirection (high conversion rates) Easy conversion from existing networks to lowest cost settlement system

- 3. Answer: Leverage a high growth segment Social gaming/Virtual Currencies have millions of users Exponentially high growth, marginal COGS zero Payments not their core competence Rate of conversion is key in Social networks gaming/Virtual Currencies Current rates saturated at 2-3% Barter offers extremely lucrative but will taper off

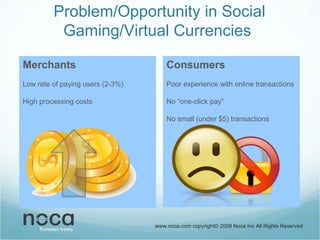

- 4. Problem/Opportunity in Social Gaming/Virtual Currencies Merchants Low rate of paying users (2-3%) High processing costs Consumers Poor experience with online transactions No âone-click payâ No small (under $5) transactions

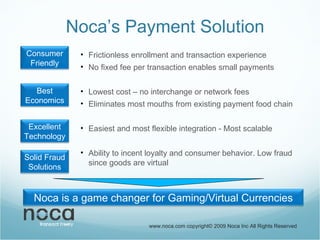

- 5. Nocaâs Payment Solution www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved Frictionless enrollment and transaction experience No fixed fee per transaction enables small payments Lowest cost â no interchange or network fees Eliminates most mouths from existing payment food chain Easiest and most flexible integration - Most scalable Ability to incent loyalty and consumer behavior. Low fraud since goods are virtual Consumer Friendly Solid Fraud Solutions Best Economics Excellent Technology Noca is a game changer for Gaming/Virtual Currencies

- 6. Increase Consumer Conversion SStart with greater convenience TTruly âOneClick Payâ increases conversion exponentially SSubsequent transactions using checks www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved NNo change in Consumer behavior needed PPay once inline, no redirection, auto enrollment with payment information pre-filled

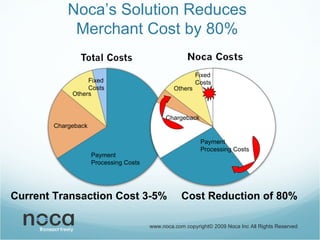

- 7. Nocaâs Solution Reduces Merchant Cost by 80% www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved Payment Processing Costs Chargeback Others Fixed Costs Fixed Costs Others Chargeback Payment Processing Costs Current Transaction Cost 3-5% Cost Reduction of 80%

- 8. Noca's âSecure Credit/Secure Checkâ tm Differentiators Nocaâs superior payment system will offer: Superior Chargebacks: merchant first right of refusal reduces chargebacks substantially Analytics: an API enabling rich analytics for merchants Real Time: provide real-time information regarding end-to-end payment experience SKU detail: deliver full SKU information and checkout âsnap shotsâ

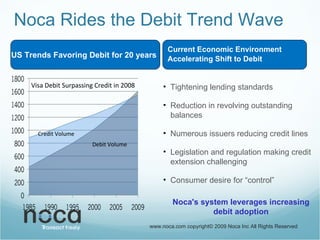

- 9. Noca Rides the Debit Trend Wave www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved Visa Debit Surpassing Credit in 2008 Tightening lending standards Reduction in revolving outstanding balances Numerous issuers reducing credit lines Legislation and regulation making credit extension challenging Consumer desire for âcontrolâ Noca's system leverages increasing debit adoption Credit Volume Debit Volume US Trends Favoring Debit for 20 years Current Economic Environment Accelerating Shift to Debit

- 10. Easy Implementation of Mobile Payments www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved

- 11. Social Media Payments www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved Actual facebook screen

- 12. Noca Value Proposition Good Consumer acceptance - Frictionless consumer experience Good Merchant acceptance - Ability to steer consumer from credit or debit option Lower cost transactions - Order of magnitude cost difference Lower regulatory hurdles - No PCI compliance Increased efficiency for recurring payments - Bank accounts do not expire

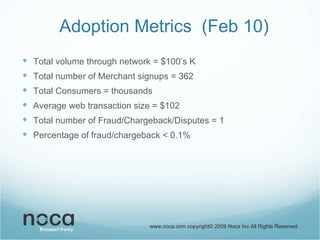

- 13. Adoption Metrics (Feb 10) Total volume through network = $100âs K Total number of Merchant signups = 362 Total Consumers = thousands Average web transaction size = $102 Total number of Fraud/Chargeback/Disputes = 1 Percentage of fraud/chargeback < 0.1% www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved

- 14. www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved Competitive Assessment Customer Friendly: No Registration or Redirection Registration or Redirection Low Merchant Fees (0.75%) High Merchant Fees 1-3% +$0.10-0.30

- 15. Current status 1M+ users signed 4M+ users discussion/LOI 80M+ users discussion/LOI 15M+ users discussion 20M+ users contact

- 16. Current status â Discussion/LOI Homeaway - RFP/RFI â LOI

- 17. The Founding Team Pankaj Gupta [Founder, President] Chief Network Architect at VISA 15+ years industry experience in financial services MS and BS in Computer and Information Science from Ohio State University S. Randy Nott [Chief Architect] Lead developer at VISA 15+ years Industry experience. BS in Computer Science from Western Michigan University www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved

- 18. Team Glenn Poppe [Biz. Dev] Harvard Business School, cum laude Ex Boston Consulting Group Entrepreneurial experience, International Experience Tony DeGangi [Lead, Security and Risk Engineer ] Ex MIT Engineer Extensive risk operations experience BS, MS in Computer Science, Entrepreneurial experience www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved

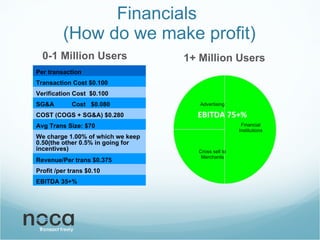

- 19. Financials (How do we make profit) 0-1 Million Users 1+ Million Users Cross sell to Merchants Advertising Financial Institutions EBITDA 75+% Per transaction Transaction Cost $0.100 Verification Cost $0.100 SG&A Cost $0.080 COST (COGS + SG&A) $0.280 Avg Trans Size: $70 We charge 1.00% of which we keep 0.50(the other 0.5% in going for incentives) Revenue/Per trans $0.375 Profit /per trans $0.10 EBITDA 35+%

- 20. Financial Summary Current Capital Raised = 350K, Individual Angel investors Terms = Convertibles with discount Pre-money Valuation = under discussion Looking to raise $3.5Million Use of funds = growth through infrastructure and staff augmentation In 4 years, 50M users and 200+M in revenues

![The Founding Team Pankaj Gupta [Founder, President] Chief Network Architect at VISA 15+ years industry experience in financial services MS and BS in Computer and Information Science from Ohio State University S. Randy Nott [Chief Architect] Lead developer at VISA 15+ years Industry experience. BS in Computer Science from Western Michigan University www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved](https://image.slidesharecdn.com/paybl-hps-march2010-ver3-0-100413110748-phpapp02/85/Paybl-hps-march2010-ver3-0-17-320.jpg)

![Team Glenn Poppe [Biz. Dev] Harvard Business School, cum laude Ex Boston Consulting Group Entrepreneurial experience, International Experience Tony DeGangi [Lead, Security and Risk Engineer ] Ex MIT Engineer Extensive risk operations experience BS, MS in Computer Science, Entrepreneurial experience www.noca.com copyrightÂĐ 2009 Noca Inc All Rights Reserved](https://image.slidesharecdn.com/paybl-hps-march2010-ver3-0-100413110748-phpapp02/85/Paybl-hps-march2010-ver3-0-18-320.jpg)