Phs brochure en

- 1. Personal Health Insurance 4 Perfect Health Solution Krungthai-AXA Life has received numerous awards and recognitions nationally and internationally such as. ; 2014- Asia Disability Matters honoree in workforce category by Springboard Consultant LLC (USA) - Asia Responsible Entrepreneurship Award in Health Promotion category by Enterprise Asia - The Annual Best Employer Award in Employee Skill Development, 2013 - The Best Development Life Insurance company from Office of Insurance Commission, second place for Corporate Responsibility for the AXA Group, 2011 - Social Contribution for People with Disabilities Award and Diversity & Inclusiveness with regards to People with Disabilities. The AXA Group works closely with the United Nations International Strategy for Disaster Reduction (UNISDR) and the United Nations Environment Protection (UNEP) on the Principles for Sustainable Insurance (PSI). Krungthai-AXA Life is also closely involved with these UN initiatives and has taken the lead in Thailand on the PSI. Krungthai-AXA Life Insurance Public Company Limited 2034/116-123, 136-143 Italthai Tower, Floor 27-28, 32-33 New Phetchaburi Road, Bangkapi, Huai Khwang, Bangkok 10310, Thailand Tel. 0 2723 4000 Fax. 0 2723 4032 0 2689 4800 www.krungthai-axa.co.th Customer Call Center Perfect Health Solution ................................................................................... ................................................................................... ................................................................................... ................................................................................... ................................................................................... ................................................................................... ................................................................................... ................................................................................... Live a worry-free life from critical illness with Coverage for Radiotherapy, chemotherapy and Kidney dialysis Welcome Mommy to-be with coverage for pregnancy, childbirth, pre and post natal complications and newborn accommodation Support proactive healthcare with coverage for annual health screen, routine dental care, routine optical care and vaccination Receive coverage in every perspective of your health with alternative therapies including acupuncture and chiropractics as per suggestion from qualified practitioner Access to world-class healthcare treatment with worldwide coverage, as per coverage plan of choice Medical second opinion to provide you free access to world-class medical practitionerFree Provide lump-sum coverage for in-patient treatments of up to maximum Bt100 million per year 2 3 4 5 6 Because we are unique 1) In-patient and daycare treatment 2) Out-patient treatment 4) Physical Therapy 3) Radiotherapy, chemotherapy and Kidney dialysis Maximum as per coverage plan Maximum 180,000 Baht per year 8) Alternative therapies 9) Routine dental care 10) Routine optical care 11) Annual Health screen 12) Vaccination 13) Domestic Health treatment 14) International treatment (for in-patient treatment) No pre-payment is required in case early notice by insured with sufficient coverage Pre-payment is required and paid based on benefit table, mostly insufficient coverage for international hospitals 15) 24-hour International Emergency Medical Assistance 16) Concierge service 17) Medical second opinion Perfect Health Solution Other health plan Benefits Lump-sum payment Based on benefit table Lump-sum payment Maximum limit imposed Covered Not coverage Covered Not coverage Covered Not coverage Covered Not coverage Covered Not coverage Covered Not coverage Covered Not coverage Covered Not coverage Covered Not coverage Covered Not coverage Covered Not coverage Covered Not coverage 7) Pregnancy and childbirth 5) Pre and post natal complications 6) Newborn accommodation No pre-payment is required in case admitted to in network hospitals Note : Benefit No.7 - No. 12 depend on chosen coverage plan 1 Worldwide Healthcare that meets all your needs Worldwide Healthcare that meets all your needs

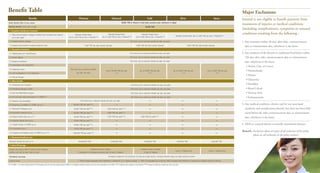

- 2. Benefit Table ................................................................................... ................................................................................... ................................................................................... ................................................................................... ................................................................................... Insured can choose ONE (1) Area of cover; however, premium will vary for each Area of cover. Death Benefit (Due to any cause) Maturity Benefit (at 85 years of age) Benefits Platinum Diamond Gold Silver Smart 50,000 THB or Return of total basic premium paid, whichever is higher 50,000 THB 1. In-patient and daycare treatment 2. Out-patient treatment 3. Other benefits 4. Maximum benefit per year 5. Areas of Coverage 1.1 Daily accommodation charges including Room & Board and meals of up to (per night) 1.2 Hospital General charges 1.3 Hospital Cash benefit (In-patient treatment only) 2.1 Radiotherapy and chemotherapy 2.2 Kidney dialysis 2.3 Surgical procedures 2.4 Consultation and prescription 2.5 Diagnostic scans 2.6 Lab investigations, X ray, Ultrasound 2.7 Phycial Therapy 3.1 Ambulance and Transport 3.2 Accidental damage to teeth 3.3 Oral and Maxillofacial Surgery 3.4 Pre and post natal complications (12 MWP) (*) 3.5 Newborn accommodation 3.6 Pregnancy & childbirth (12 MWP) up to (*) 3.7 Alternative Therapies up to 3.8 Psychiatric treatment up to 3.9 Routine Dental Care up to (**) 3.10 Routine Optical Care up to 3.11 Health Screen (12 MWP) up to 3.12 Vaccination up to Maximum benefit per year up to Worldwide Coverage Level of cover 3.13 Hospice and Palliative Care (12 MWP) up to (***) 1. 100% of actual expenses when treatment is received at an in-network hospital 2. 100% of reasonable and customary (R&C) charges when treatment is received at hospitals outside of network Standard Single Room (Up to 21,000 THB per day in Thailand)(****) Standard Single Room (Up to 15,000 THB per day in Thailand)(****) Standard Single Room (Up to 9,000 THB per day in Thailand)(****) Standard Single Room (Up to 5,200 THB per day in Thailand)(****) Full Cover (up to maximum benefit per plan, per year) 7,000 THB (No other benefit claimed) 4,500 THB (No other benefit claimed) 3,500 THB (No other benefit claimed) Full Cover (up to maximum benefit per plan, per year) Full Cover (up to maximum benefit per plan, per year) Full Cover (up to maximum benefit per plan, per year) Full Cover (up to maximum benefit per plan, per year) Full Cover (up to maximum benefit per plan, per year) Full Cover (up to maximum benefit per plan, per year) Full Cover (up to maximum benefit per plan, per year) Full Cover (up to maximum benefit per plan, per year) Up to 100,000 THB per year (****) Up to 50,000 THB per year (****) Up to 35,000 THB per year (****) Up to 12,000 THB per year (****) Full Cover (up to maximum benefit per plan, per year) 400,000 THB per year(****) 35,000 THB per year(****) 5,000 THB per year(****) 5,000 THB per year(****) 7,500 THB per year(****) 4,000 THB per year(****) 200,000 THB per year(****) 36,000 THB per year(****) 25,000 THB per year(****) 30,000 THB per year(****) 45,000 THB per year(****) 1,000,000 THB per year(****) 100,000,000 THB 70,000,000 THB 10,000,000 THB 6,000,000 THB 3,000,000 THB 4 areas of cover to choose 1) Worldwide 2) Worldwide excluding USA 3) Asia 4) Thailand 2 areas of cover to choose 1) Asia 2) Thailand Cover in Thailand Only Cover in Thailand Only Emergency treatment only (maximum 45 days per single journey, including treatment days, for areas outside of cover) (*) 12 MWP : 12-month waiting period. (**) Krungthai-AXA Life will pay eighty percent (80%) of all eligible treatment shown up to the limit specified in the table. (***) A lifetime limit applies to this benefit (****) Limited to maximum benefit per plan, per year. Major Exclusions Insured is not eligible to benefit payment from treatments of injuries or medical conditions (including complications), symptoms or unusual conditions resulting from the following : 1. Any treatment within 30 days after rider commencement date or reinstatement date, whichever is the latest. 2. Any treatment of the diseases or conditions listed below within 120 days after rider commencement date or reinstatement date, whichever is the latest. ? Tumor, Cyst, or Cancer ? Hemorrhoids ? Hernia ? Glaucoma ? Tonsillitis ? Renal Calculi ? Varicose Vein ? Endometriosis 3. Any medical condition, chronic and for any associated condition and complications thereof, that have not been fully cured before the rider commencement date or reinstatement date, whichever is the latest. 4. AIDS or venereal disease or sexually transmitted diseases. Remark : Exclusions above are parts of all exclusions of the policy, please see all exclusions in the policy contract.