Point Nine Reporting

- 1. www.p9dt.com Trade & Transaction reporting Services

- 2. Contents 2 • Solution Overview • Onboarding • Reporting • Error Resolution • Reconciliation • Client Portal & Email Reports • Validations • Reporting Fines Powered and Secured By: Developed In:

- 3. 3 Reporting as a Service Solution Overview

- 4. 4 Point Nine Solution And Benefits 1/2 • Cross Asset & Contract Coverage Options / CFDs/ Warrants/ Commodities etc • Premier 9 Reporting Platform P9 proprietary technology • Reconciliation Engine Multiple Sources Pairing / Matching • UTI Management Generation / Shadow / Sharing • Data Mapping & Enrichment FIRDS, FIS Global, Bloomberg Symbology, ANNA-DSB • Validation Engine P9, ESMA/FCA, TR/ARM/NCA, Customers • Fully Automated Solution Take the pain away ● Connectivity SFTP, S3, Database, Email To Trade Repos, and/or ARMs • Flexibility Bespoke validation and business rules • Conversions As per NCAs / TRs / ARMs reporting requirements • Amazon & AWS Workspaces Reliable Encryption & Security • Python & ETL Complex Data Management, Performance Solution Overview

- 5. 5 Point Nine Solution And Benefits 2/2 • ISIN Eligibility Instrument routing • Job Based Solution ID for Easy Communication • Full Scope Reporting Trade/position/valuation/collateral reporting • Full Audit Trail Accepted / Pending / Rejected Records • Email Notification & Portal Access Accepted / Pending / Rejected Records TR reconciliation state (matched, unmatched, paired, unpaired ) Trade blotter (query specific transactions by UTI, TR state, Counterparty Id, Action) Exception / Data Quality Management • Exception /Data Quality Management Transparency • State Machine Historical Trade Statuses • Lifecycle Events Support Corporate Actions • Replay Features Replay pending records • CFI Management Validation and Construction • XML based ISO20022 Solution Overview

- 6. Easy Steps to Get Started Onboarding 6

- 7. 7 Reporting Premier 9 Reporting Platform

- 9. 9 Exception / Data Quality Management EM-1 Step 1: Error Identification by P9 Solution. Step 2: Customer Service Team contact customer to resolve. Exception Management Processes EM-2 Step 1: Error Identification by P9 Solution. Step 2: Customer Service Team contact customer to resolve. Step 3: End-of-Day Report sent to customer. EM-3 Step 1: Error Identification by End-Point. Step 2: Customer Service Team contact customer to resolve. Step 3: Email notification with feedback sent to customer. Error Resolution

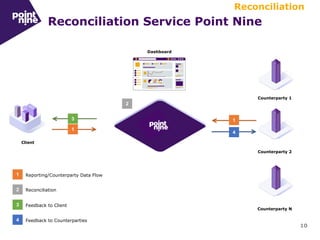

- 10. 10 Reconciliation Service Point Nine Client Feedback to Client Reconciliation 3 Reporting/Counterparty Data Flow 1 Reconciliation 2 Feedback to Counterparties 4 2 1 3 4 1 Counterparty 1 Counterparty 2 Counterparty N Dashboard

- 11. 11 P9 Recon RESULTS IN TWO FORMATS EMAIL SUMMARY WEB PORTAL Reconciliation INPUT PAIRING MATCHING VALIDATION SOURCES PROCESS PROCESS PROCESS

- 12. 12 Client Portal

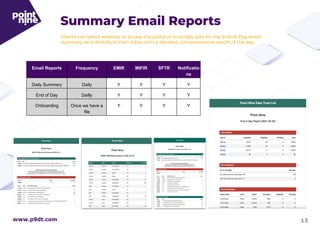

- 13. www.p9dt.com 13 Summary Email Reports Clients can select whether to access the portal or to simply wait for the End-of-Day email summary sent directly to their inbox with a detailed, comprehensive report of the day. Email Reports Frequency EMIR MIFIR SFTR Notificatio ns Daily Summary Daily Y Y Y Y End of Day Dailly Y Y Y Y Onboarding Once we have a file Y Y Y Y

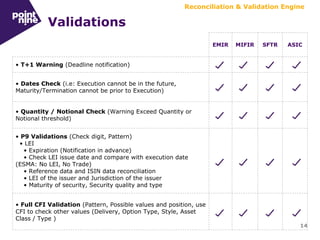

- 14. 14 Validations EMIR MIFIR SFTR ASIC • T+1 Warning (Deadline notification) • Dates Check (i.e: Execution cannot be in the future, Maturity/Termination cannot be prior to Execution) • Quantity / Notional Check (Warning Exceed Quantity or Notional threshold) • P9 Validations (Check digit, Pattern) • LEI • Expiration (Notification in advance) • Check LEI issue date and compare with execution date (ESMA: No LEI, No Trade) • Reference data and ISIN data reconciliation • LEI of the issuer and Jurisdiction of the issuer • Maturity of security, Security quality and type • Full CFI Validation (Pattern, Possible values and position, use CFI to check other values (Delivery, Option Type, Style, Asset Class / Type ) Reconciliation & Validation Engine

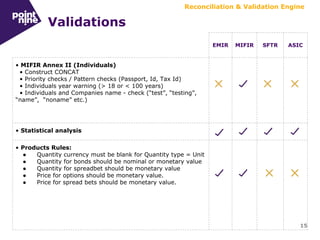

- 15. Validations EMIR MIFIR SFTR ASIC • MIFIR Annex II (Individuals) • Construct CONCAT • Priority checks / Pattern checks (Passport, Id, Tax Id) • Individuals year warning (> 18 or < 100 years) • Individuals and Companies name - check (“test”, “testing”, “name”, “noname” etc.) • Statistical analysis • Products Rules: ● Quantity currency must be blank for Quantity type = Unit ● Quantity for bonds should be nominal or monetary value ● Quantity for spreadbet should be monetary value ● Price for options should be monetary value. ● Price for spread bets should be monetary value. 15 Reconciliation & Validation Engine

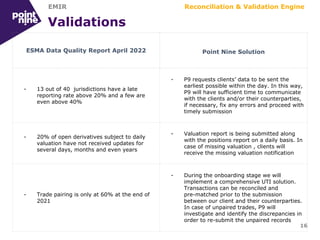

- 16. Validations ESMA Data Quality Report April 2022 Point Nine Solution - 13 out of 40 jurisdictions have a late reporting rate above 20% and a few are even above 40% - P9 requests clients’ data to be sent the earliest possible within the day. In this way, P9 will have sufficient time to communicate with the clients and/or their counterparties, if necessary, fix any errors and proceed with timely submission - 20% of open derivatives subject to daily valuation have not received updates for several days, months and even years - Valuation report is being submitted along with the positions report on a daily basis. In case of missing valuation , clients will receive the missing valuation notification - Trade pairing is only at 60% at the end of 2021 - During the onboarding stage we will implement a comprehensive UTI solution. Transactions can be reconciled and pre-matched prior to the submission between our client and their counterparties. In case of unpaired trades, P9 will investigate and identify the discrepancies in order to re-submit the unpaired records 16 Reconciliation & Validation Engine EMIR

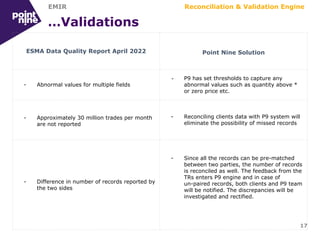

- 17. …Validations ESMA Data Quality Report April 2022 Point Nine Solution - Abnormal values for multiple fields - P9 has set thresholds to capture any abnormal values such as quantity above * or zero price etc. - Approximately 30 million trades per month are not reported - Reconciling clients data with P9 system will eliminate the possibility of missed records - Difference in number of records reported by the two sides - Since all the records can be pre-matched between two parties, the number of records is reconciled as well. The feedback from the TRs enters P9 engine and in case of un-paired records, both clients and P9 team will be notified. The discrepancies will be investigated and rectified. 17 Reconciliation & Validation Engine EMIR

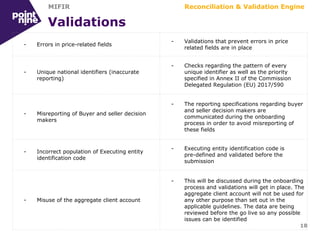

- 18. Validations 18 - Errors in price-related fields - Validations that prevent errors in price related fields are in place - Unique national identifiers (inaccurate reporting) - Checks regarding the pattern of every unique identifier as well as the priority specified in Annex II of the Commission Delegated Regulation (EU) 2017/590 - Misreporting of Buyer and seller decision makers - The reporting specifications regarding buyer and seller decision makers are communicated during the onboarding process in order to avoid misreporting of these fields - Incorrect population of Executing entity identification code - Executing entity identification code is pre-defined and validated before the submission - Misuse of the aggregate client account - This will be discussed during the onboarding process and validations will get in place. The aggregate client account will not be used for any other purpose than set out in the applicable guidelines. The data are being reviewed before the go live so any possible issues can be identified Reconciliation & Validation Engine MIFIR

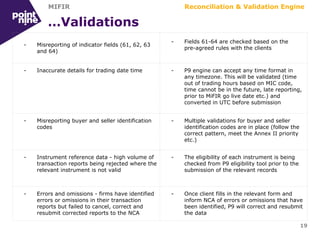

- 19. …Validations 19 - Misreporting of indicator fields (61, 62, 63 and 64) - Fields 61-64 are checked based on the pre-agreed rules with the clients - Inaccurate details for trading date time - P9 engine can accept any time format in any timezone. This will be validated (time out of trading hours based on MIC code, time cannot be in the future, late reporting, prior to MiFIR go live date etc.) and converted in UTC before submission - Misreporting buyer and seller identification codes - Multiple validations for buyer and seller identification codes are in place (follow the correct pattern, meet the Annex II priority etc.) - Instrument reference data - high volume of transaction reports being rejected where the relevant instrument is not valid - The eligibility of each instrument is being checked from P9 eligibility tool prior to the submission of the relevant records - Errors and omissions - firms have identified errors or omissions in their transaction reports but failed to cancel, correct and resubmit corrected reports to the NCA - Once client fills in the relevant form and inform NCA of errors or omissions that have been identified, P9 will correct and resubmit the data Reconciliation & Validation Engine MIFIR

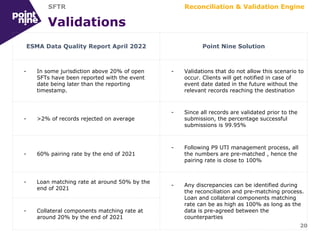

- 20. Validations 20 ESMA Data Quality Report April 2022 Point Nine Solution - In some jurisdiction above 20% of open SFTs have been reported with the event date being later than the reporting timestamp. - Validations that do not allow this scenario to occur. Clients will get notified in case of event date dated in the future without the relevant records reaching the destination - >2% of records rejected on average - Since all records are validated prior to the submission, the percentage successful submissions is 99.95% - 60% pairing rate by the end of 2021 - Following P9 UTI management process, all the numbers are pre-matched , hence the pairing rate is close to 100% - Loan matching rate at around 50% by the end of 2021 - Any discrepancies can be identified during the reconciliation and pre-matching process. Loan and collateral components matching rate can be as high as 100% as long as the data is pre-agreed between the counterparties - Collateral components matching rate at around 20% by the end of 2021 Reconciliation & Validation Engine SFTR

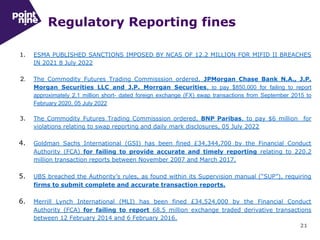

- 21. Regulatory Reporting fines 21 1. ESMA PUBLISHED SANCTIONS IMPOSED BY NCAS OF 12.2 MILLION FOR MIFID II BREACHES IN 2021 8 July 2022 2. The Commodity Futures Trading Commisssion ordered, JPMorgan Chase Bank N.A., J.P. Morgan Securities LLC and J.P. Morrgan Securities, to pay $850,000 for failing to report approximately 2.1 million short- dated foreign exchange (FX) swap transactions from September 2015 to February 2020, 05 July 2022 3. The Commodity Futures Trading Commisssion ordered, BNP Paribas, to pay $6 million for violations relating to swap reporting and daily mark disclosures, 05 July 2022 4. Goldman Sachs International (GSI) has been fined £34,344,700 by the Financial Conduct Authority (FCA) for failing to provide accurate and timely reporting relating to 220.2 million transaction reports between November 2007 and March 2017. 5. UBS breached the Authority’s rules, as found within its Supervision manual (“SUP”), requiring firms to submit complete and accurate transaction reports. 6. Merrill Lynch International (MLI) has been fined £34,524,000 by the Financial Conduct Authority (FCA) for failing to report 68.5 million exchange traded derivative transactions between 12 February 2014 and 6 February 2016.