Point Nine Transaction Reporting

- 1. Point Nine Limited 1 Strictly private and confidential Transaction Reporting Solution

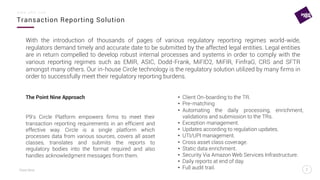

- 2. Point Nine Transaction Reporting Solution 2 w w w . p 9 f t . c o m 2 With the introduction of thousands of pages of various regulatory reporting regimes world-wide, regulators demand timely and accurate date to be submitted by the affected legal entities. Legal entities are in return compelled to develop robust internal processes and systems in order to comply with the various reporting regimes such as EMIR, ASIC, Dodd-Frank, MiFID2, MiFIR, FinfraG, CRS and SFTR amongst many others. Our in-house Circle technology is the regulatory solution utilized by many firms in order to successfully meet their regulatory reporting burdens. The Point Nine Approach P9ŌĆÖs Circle Platform empowers firms to meet their transaction reporting requirements in an efficient and effective way. Circle is a single platform which processes data from various sources, covers all asset classes, translates and submits the reports to regulatory bodies into the format required and also handles acknowledgment messages from them. ŌĆó Client On-boarding to the TR. ŌĆó Pre-matching ŌĆó Automating the daily processing, enrichment, validations and submission to the TRs. ŌĆó Exception management. ŌĆó Updates according to regulation updates. ŌĆó UTI/UPI management. ŌĆó Cross asset class coverage. ŌĆó Static data enrichment. ŌĆó Security Via Amazon Web Services Infrastructure. ŌĆó Daily reports at end of day. ŌĆó Full audit trail.

- 3. Point Nine Transaction Reporting Solution 3 w w w . p 9 f t . c o m 3

- 4. Point Nine Reporting Scenario EMIR A 4 w w w . p 9 f t . c o m 4 Cross Jurisdictional Regulatory Bodies (Trade Repositories, Swap Data Repositories) Client Bank Data Block Common Data Block Client Data Block Common Data Block Feature Bank Client P9 Pre-matching Y UTI Generation Y UTI Matching Y TR Validations Data Enrichment Y Multi TR Connectivity Y Collateral Data Y Y Valuation Data Y Y Bank

- 5. Point Nine Reporting Scenario EMIR B 5 w w w . p 9 f t . c o m 5 Cross Jurisdictional Regulatory Bodies (Trade Repositories, Swap Data Repositories) Client Bank Bank + Client Data Block Common Data Block Feature Bank Client P9 Pre-matching Y UTI Generation Y UTI Matching TR Validations Y Data Enrichment Y Multi TR Connectivity Y Collateral Data Y Valuation Data Y Client Accepts Report and Submits

- 6. Point Nine Get In Touch 6 w w w . p 9 f t . c o m 6 E info@p9ft.com +44 20 7193 5298 We are here to help you Working days 9am to 7pm BSG Valentine, Lynton House 7-12 Tavistock Square, WC1H 9BQ UK, London Chrysorrogiatissis 11, 3032 Cyprus, Limassol Sedyh 38-14, 220103 Belarus, Minsk Sales Office Head Office R&D Office P