PointNine_Company_Overview.v1.9

- 1. Point Nine 1 Strictly private and confidential Post Trade Excellency

- 2. Point Nine Introducing Point Nine 2 w w w . p 9 f t . c o m 2 ŌĆóŌĆ»Founded in 2002, Point Nine is one of the industry leaders in post trade execution, operation, processing and reporting. ŌĆóŌĆ»We collaborate with both buy and sell side ’¼ünancial ’¼ürms and corporates to help them meet the ever-expanding challenges of post-trade processing. ŌĆóŌĆ»Circle, our in-house proprietary technology, provides a real-time solution to all our customers and their trading relationships

- 3. Point Nine Circle Network - Financial Service Providers 3 w w w . p 9 f t . c o m 3

- 4. Point Nine Circle Network - Independent Software Vendors 4 w w w . p 9 f t . c o m 4 investone AXYSGeneva

- 5. Point Nine Point Nine Overview 5 w w w . p 9 f t . c o m 5 !ŌĆ»Circle has been operational since 2004 !ŌĆ»Real-time, end-to-end automation of post trade execution work-flow !ŌĆ»Integrated, web-delivered, reporting platform !ŌĆ»Scalable solution !ŌĆ»Fast implementation !ŌĆ»Cross-asset coverage !ŌĆ»Reduces Operational Risk, Cost and Time !ŌĆ»On hand operations professionals for managed solutions

- 6. Point Nine 6 Circle - Solution for all market participants w w w . p 9 f t . c o m 6 Equity FX Indices Commodity Credit Fixed Income Depository Custodians Prime Brokers Execution Brokers Fund Administrators ŌĆ£CircleŌĆØ Fund/Asset Manager Buy Side Banks Corporates Retail FX Cash Regulators Trade Repositories Alternative Assets Real Assets

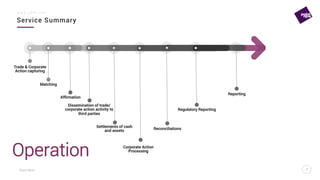

- 7. Point Nine Service Summary 7 w w w . p 9 f t . c o m 7 Trade & Corporate Action capturing Settlements of cash and assets Matching Af’¼ürmation Corporate Action Processing Dissemination of trade/ corporate action activity to third parties Reconciliations Reporting Operation Regulatory Reporting

- 8. Point Nine Service Summary 8 w w w . p 9 f t . c o m 8 Proprietary Technology Web Based Centralized Solution Full Audit Trail Customized User Access Circle Connectivity Range Fast Implementation Technology

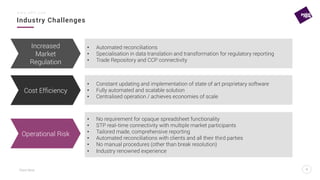

- 9. Point Nine Industry Challenges 9 w w w . p 9 f t . c o m 9 ŌĆóŌĆ» Automated reconciliations ŌĆóŌĆ» Specialisation in data translation and transformation for regulatory reporting ŌĆóŌĆ» Trade Repository and CCP connectivity ŌĆóŌĆ» Constant updating and implementation of state of art proprietary software ŌĆóŌĆ» Fully automated and scalable solution ŌĆóŌĆ» Centralised operation / achieves economies of scale ŌĆóŌĆ» No requirement for opaque spreadsheet functionality ŌĆóŌĆ» STP real-time connectivity with multiple market participants ŌĆóŌĆ» Tailored made, comprehensive reporting ŌĆóŌĆ» Automated reconciliations with clients and all their third parties ŌĆóŌĆ» No manual procedures (other than break resolution) ŌĆóŌĆ» Industry renowned experience Increased Market Regulation Cost Ef’¼üciency Operational Risk

- 10. Point Nine Customer Circle Platform 10 w w w . p 9 f t . c o m 10 Depository Custodians Prime Brokers Execution Brokers Fund Administrators ŌĆóŌĆ» Real-time ŌĆóŌĆ» Full lifecycle post-trade processing ŌĆóŌĆ» Low operational cost ŌĆóŌĆ» Full audit trail ŌĆóŌĆ» Managed services ŌĆóŌĆ» In built reconciliation tool identifying trade breaks and differences facilitating immediate resolution

- 11. Point Nine Customer Circle Platform 11 w w w . p 9 f t . c o m 11 Fund/Asset Manager Buy Side Banks Corporates Retail FX ŌĆóŌĆ» Real-time connectivity to all market participants ŌĆóŌĆ» Seamless setup and integration ŌĆóŌĆ» Reduction of operational risk ŌĆóŌĆ» Full life cycle trade support ŌĆóŌĆ» Customer view access ŌĆóŌĆ» Full audit trail

- 12. Point Nine Circle Dashboard 12 w w w . p 9 f t . c o m 12

- 13. Point Nine Get In Touch 13 w w w . p 9 f t . c o m 13 E info@p9ft.com +44 20 7193 5298 We are here to help you Working days 9am to 7pm BSG Valentine, Lynton House 7-12 Tavistock Square, WC1H 9BQ UK, London Chrysorrogiatissis 11, 3032 Cyprus, Limassol Sedyh 38-14, 220103 Belarus, Minsk Sales Of’¼üce Head Of’¼üce R&D Of’¼üce P