Portfolio management

- 2. What is a portfolio?  Portfolio is a group of financial assets such as shares, stocks, bonds, debt instrument, mutual funds, cash equivalents etc. A portfolio is planned to stabilize the risk of non-performance of various pools of investment  Portfolio refers to invest in a group of securities rather to invest in a single security  “Don’t put your all eggs in one basket”  Portfolio help in reducing risk without sacrificing return

- 3. What is management? ÔÇó Management is the organization and coordination of activities of an enterprise in accordance with well- defined policies and in achievement of its predefined objectives

- 4. Portfolio management ÔÇó Portfolio management is the process of creation and maintenance of investment portfolio ÔÇó Portfolio management is a complex process which tries to make investment activity more rewarding and less risky

- 5. Types of portfolio management ÔÇó Active portfolio management: The portfolio manager are actively involved in buying and selling of securities to ensure maximum profit to individual ÔÇó Passive portfolio management: The portfolio manager deals with a fixed portfolio designed to match the current market scenario ÔÇó Discretionary portfolio management service: An individual authorizes a portfolio manager to take care of his financial needs on his behalf ÔÇó Non-discretionary portfolio management: The portfolio manager can merely advice the client what is good and bad for him but the client reserve full right to take his own

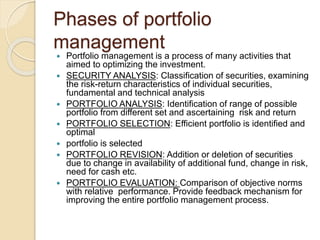

- 6. Phases of portfolio management ÔÇó Portfolio management is a process of many activities that aimed to optimizing the investment. ÔÇó SECURITY ANALYSIS: Classification of securities, examining the risk-return characteristics of individual securities, fundamental and technical analysis ÔÇó PORTFOLIO ANALYSIS: Identification of range of possible portfolio from different set and ascertaining risk and return ÔÇó PORTFOLIO SELECTION: Efficient portfolio is identified and optimal ÔÇó portfolio is selected ÔÇó PORTFOLIO REVISION: Addition or deletion of securities due to change in availability of additional fund, change in risk, need for cash etc. ÔÇó PORTFOLIO EVALUATION: Comparison of objective norms with relative performance. Provide feedback mechanism for improving the entire portfolio management process.

- 7. Capital asset pricing model(CAPM) ÔÇó CAPM is the tool used by finance professionals in order to calculate the return that an investment should bring ÔÇó Developed by Harry Markowitz in 1952 ÔÇó Mathematically, ÔÇó The securities market as a whole has a beta coefficient of 1.0 ÔÇó If beta is greater than 1.0 it implies a higher risk than the market average ÔÇó If beta is less than 1.0 it implies a less risk than the market average

- 8. Capital market line(CML)  CML is the tangent line drawn from the point of risk-free assets to the feasible region for risky assets  The portfolio will lie on the efficient frontier which is the market portfolio ‘M’  It provides a linear relation between expected return and the risk that describes the proportion of a risk-free asset and an efficient portfolio of assets that an investor can hold

- 9. Security market line(SML)  SML is the representation of CAPM  The SML is the line that reflects an investment’s risk versus its return. A line that graphs the systematic or market ,risk versus return of the whole market at a certain time and shows all risky marketable securities  It is also known as the “characteristic line”  Individual securities are plotted on SML graph

- 10. THANK YOU