PowerPoint Presentation on Goods and Services Tax

- 2. Goods and Services Tax-GST ? GST is a tax that levies on supply of goods or services, or both. It is a comprehensive tax that levies on Manufacture, sale and consumption of goods and services at level. The proposed GST will be levied on all transactions involving supply of goods and services, except those which are kept out of its purview. The main purpose of GST is to Bring ŌĆśSingle Umbrella Tax RateŌĆÖ and ŌĆśRemoval of Cascading EffectŌĆÖ.

- 3. Why GST for India? Tax Mechanism Issues in Existing law Administration Needs of India Increases the tax revenues Ensure competitive pricing Ensure boost to exports Demand of Indian economy

- 4. Types of GST:- Note:- In case of U.T.ŌĆÖs (Union Territories) like Chandigarh, Pondicherry etc., CGST will be applied. CGST ŌĆó CGST(Central Goods and services Tax), that will be charged and collected by central government SGST ŌĆó SGST(State Goods and Services Tax), that will be charged and collected by Respective state governments IGST ŌĆó IGST (Integrated Goods and Services Tax), that will be charged and collected by both central as well as state governments

- 5. Salient Features of GST Subsuming of Various Central Taxes Subsuming of various state taxes Distribution of GST No Surcharge Levy on GST Scope of GST Working of GST Council Compensation to State Governments.

- 6. Expected Scheme of GST Dual Model Cross Utilization Carry Forward of CENVAT and VAT credit Common Threshold limit GST Registration GST Invoice Tax Return GST Rate Other Miscellaneous Functions

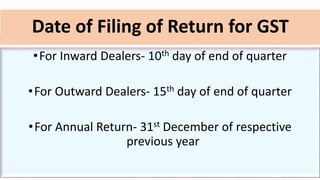

- 7. Date of Filing of Return for GST ŌĆóFor Inward Dealers- 10th day of end of quarter ŌĆóFor Outward Dealers- 15th day of end of quarter ŌĆóFor Annual Return- 31st December of respective previous year

- 8. For any Query Feel free to Contact Me:- ’āśE-Mail:- investuru@gmail.com ’āśWebsite:- www.investuru.com ’āśGoogle Search:- Investuru ’āśLinkedIn:- www.linkedin.com/investuru