Ppt ch 17

- 1. Chapter 17 Property Transactions: §1231 and Recapture Provisions Individual Income Taxes © 2013 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 1

- 2. The Big Picture (slide 1 of 2) • Hazel Brown owns and operates a retail arts and crafts store. – She is a sole proprietor and files a Form 1040, Schedule C. • In 2009, she remodeled the store and replaced the store equipment (counters, display racks, etc.) at a cost of $450,000. – All of the equipment was used (she bought it from a competitor that was going out of business). – The equipment is 7 year MACRS property. – She took $250,000 of § 179 expense on it and depreciated the balance. 2

- 3. The Big Picture (slide 2 of 2) • As of June 30, 2012, the equipment has an adjusted basis of $74,960. – $450,000 cost - $250,000 § 179 expense - $125,040 of MACRS depreciation. • Now, Hazel is again planning on replacing the store equipment. – She can sell all of the existing equipment for $128,000. • If Hazel completes this transaction, what will be the impact on her 2012 tax return? – Read the chapter and formulate your response. 3

- 4. §1231 Assets (slide 1 of 4) • §1231 assets defined – Depreciable and real property used in a business or for production of income and held >1 year – Includes timber, coal, iron, livestock, unharvested crops – Certain purchased intangibles 4

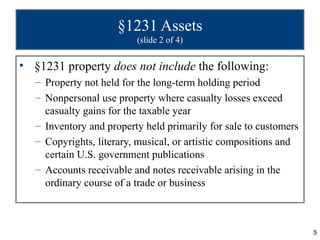

- 5. §1231 Assets (slide 2 of 4) • §1231 property does not include the following: – Property not held for the long-term holding period – Nonpersonal use property where casualty losses exceed casualty gains for the taxable year – Inventory and property held primarily for sale to customers – Copyrights, literary, musical, or artistic compositions and certain U.S. government publications – Accounts receivable and notes receivable arising in the ordinary course of a trade or business 5

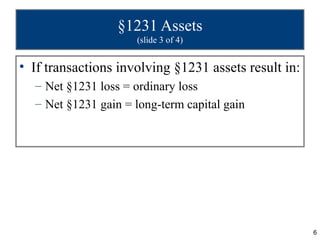

- 6. §1231 Assets (slide 3 of 4) • If transactions involving §1231 assets result in: – Net §1231 loss = ordinary loss – Net §1231 gain = long-term capital gain 6

- 7. §1231 Assets (slide 4 of 4) • Provides the best of potential results for the taxpayer – Ordinary loss that is fully deductible for AGI – Gains subject to the lower capital gains tax rates 7

- 8. The Big Picture - Example 1 § 1231 Assets • Return to the facts of The Big Picture on p. 17-1. • If Hazel sells the store equipment, she will have disposed of a § 1231 asset because it was depreciable property used in a trade or business and held for more than 12 months. • Her gain will be $53,040. – $128,000 selling price - $74,960 adjusted basis. – Part of the gain may be treated as a long-term capital gain under § 1231. • Recapture rules may apply (discussed later in this chapter). 8

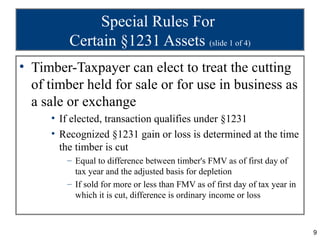

- 9. Special Rules For Certain §1231 Assets (slide 1 of 4) • Timber-Taxpayer can elect to treat the cutting of timber held for sale or for use in business as a sale or exchange • If elected, transaction qualifies under §1231 • Recognized §1231 gain or loss is determined at the time the timber is cut – Equal to difference between timber's FMV as of first day of tax year and the adjusted basis for depletion – If sold for more or less than FMV as of first day of tax year in which it is cut, difference is ordinary income or loss 9

- 10. Special Rules For Certain §1231 Assets (slide 2 of 4) • Livestock – Cattle and horses must be held 24 months or more and other livestock must be held 12 months or more to qualify under §1231 10

- 11. Special Rules For Certain §1231 Assets (slide 3 of 4) • Casualty gains and losses from §1231 assets and from long-term nonpersonal use capital assets are determined and netted together • If a net loss, items are treated separately – §1231 casualty gains and nonpersonal use capital asset casualty gains are treated as ordinary gains – §1231 casualty losses are deductible for AGI – Nonpersonal use capital asset casualty losses are deductible from AGI subject to the 2% of AGI limitation • If a net gain, treat as §1231 gain 11

- 12. Special Rules For Certain §1231 Assets (slide 4 of 4) • The special netting process for casualties & thefts does not include condemnation gains and losses – A § 1231 asset disposed of by condemnation receives § 1231 treatment • Personal use property condemnation gains and losses are not subject to the § 1231 rules – Gains are capital gains • Personal use property is a capital asset – Losses are nondeductible • They arise from the disposition of personal use property 12

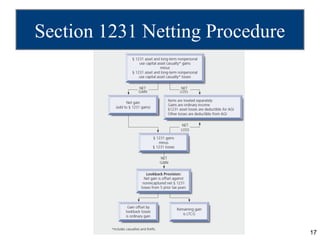

- 13. General Procedure for § 1231 Computation (slide 1 of 3) • Step 1: Casualty Netting – Net all recognized long-term gains & losses from casualties of § 1231 assets and nonpersonal use capital assets • If casualty gains exceed casualty losses, add the excess to the other § 1231 gains for the taxable year • If casualty losses exceed casualty gains, exclude all casualty losses and gains from further § 1231 computation – All casualty gains are ordinary income – Section 1231 asset casualty losses are deductible for AGI – Other casualty losses are deductible from AGI 13

- 14. General Procedure for § 1231 Computation (slide 2 of 3) • Step 2: § 1231 Netting – After adding any net casualty gain from previous step to the other § 1231 gains and losses, net all § 1231 gains and losses • If gains exceed the losses, net gain is offset by the ‘‘lookback’’ nonrecaptured § 1231 losses from the 5 prior tax years – To the extent of this offset, the net § 1231 gain is classified as ordinary gain – Any remaining gain is long-term capital gain • If the losses exceed the gains, all gains are ordinary income – Section 1231 asset losses are deductible for AGI – Other casualty losses are deductible from AGI 14

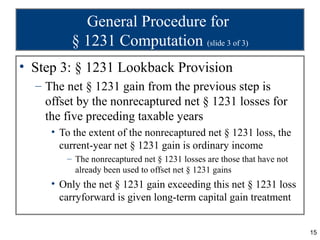

- 15. General Procedure for § 1231 Computation (slide 3 of 3) • Step 3: § 1231 Lookback Provision – The net § 1231 gain from the previous step is offset by the nonrecaptured net § 1231 losses for the five preceding taxable years • To the extent of the nonrecaptured net § 1231 loss, the current-year net § 1231 gain is ordinary income – The nonrecaptured net § 1231 losses are those that have not already been used to offset net § 1231 gains • Only the net § 1231 gain exceeding this net § 1231 loss carryforward is given long-term capital gain treatment 15

- 16. Lookback Provision Example • Taxpayer had the following net §1231 gains and losses: 2010 $ 4,000 loss 2011 $10,000 loss 2012 $16,000 gain – In 2012, taxpayer’s net §1231 gain of $16,000 will be treated as $14,000 of ordinary income and $2,000 of long-term capital gain 16

- 17. Section 1231 Netting Procedure 17

- 18. Depreciation Recapture (slide 1 of 3) • Assets subject to depreciation or cost recovery may be subject to depreciation recapture when disposed of at a gain – Losses on depreciable assets receive §1231 treatment • No recapture occurs in loss situations 18

- 19. Depreciation Recapture (slide 2 of 3) • Depreciation recapture characterizes gains that would appear to be §1231 as ordinary gain – The Code contains two major recapture provisions • §1245 • §1250 19

- 20. Depreciation Recapture (slide 3 of 3) • Depreciation recapture provisions generally override all other Code Sections – There are exceptions to depreciation recapture rules, for example: • In dispositions where all gain is not recognized – e.g., like-kind exchanges, involuntary conversions • Where gain is not recognized at all – e.g., gifts and inheritances 20

- 21. §1245 Recapture (slide 1 of 3) • Depreciation recapture for §1245 property – Applies to tangible and intangible personalty, and nonresidential realty using accelerated methods of ACRS (placed in service 1981-86) • Recapture potential is entire amount of accumulated depreciation for asset • Method of depreciation does not matter 21

- 22. §1245 Recapture (slide 2 of 3) • When gain on the disposition of a §1245 asset is less than the total amount of accumulated depreciation: – The total gain will be treated as depreciation recapture (i.e., ordinary income) 22

- 23. §1245 Recapture (slide 3 of 3) • When the gain on the disposition of a §1245 asset is greater than the total amount of accumulated depreciation: – Total accumulated depreciation will be recaptured (as ordinary income), and – The gain in excess of depreciation recapture will be §1231 gain or capital gain 23

- 24. The Big Picture - Example 8 §1245 Recapture (slide 1 of 3) • Return to the facts of The Big Picture on p. 17-1. • Hazel purchased the equipment for $450,000 – She has taken $375,040 of depreciation on it. • $250,000 § 179 expense + $125,040 regular MACRS depreciation – The equipment’s adjusted basis is $74,960. • If Hazel sells the equipment for $128,000, she will have a gain of $53,040. – $128,000 − $74,960 24

- 25. The Big Picture - Example 8 §1245 Recapture (slide 2 of 3) • Return to the facts of The Big Picture on p. 17-1. • If it were not for § 1245, the $53,040 gain would be § 1231 gain. – Section 1245 prevents this potentially favorable result by treating as ordinary income (not as § 1231 gain) any gain to the extent of depreciation taken. • In this example, the entire $53,040 gain would be ordinary income. 25

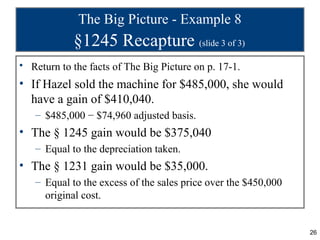

- 26. The Big Picture - Example 8 §1245 Recapture (slide 3 of 3) • Return to the facts of The Big Picture on p. 17-1. • If Hazel sold the machine for $485,000, she would have a gain of $410,040. – $485,000 − $74,960 adjusted basis. • The § 1245 gain would be $375,040 – Equal to the depreciation taken. • The § 1231 gain would be $35,000. – Equal to the excess of the sales price over the $450,000 original cost. 26

- 27. Observations on § 1245 (slide 1 of 3) • Usually total depreciation taken will exceed the recognized gain – Therefore, disposition of § 1245 property usually results in ordinary income rather than § 1231 gain – Thus, generally, no § 1231 gain will occur unless the § 1245 property is disposed of for more than its original cost 27

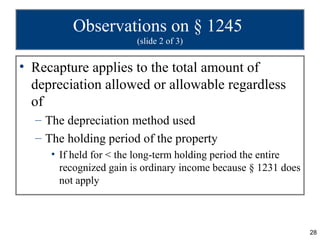

- 28. Observations on § 1245 (slide 2 of 3) • Recapture applies to the total amount of depreciation allowed or allowable regardless of – The depreciation method used – The holding period of the property • If held for < the long-term holding period the entire recognized gain is ordinary income because § 1231 does not apply 28

- 29. Observations on § 1245 (slide 3 of 3) • Section 1245 does not apply to losses which receive § 1231 treatment • Gains from the disposition of § 1245 assets may also be treated as passive activity gains 29

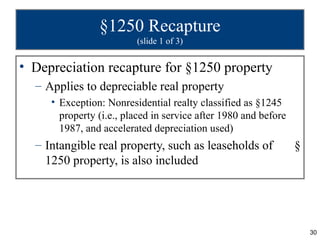

- 30. §1250 Recapture (slide 1 of 3) • Depreciation recapture for §1250 property – Applies to depreciable real property • Exception: Nonresidential realty classified as §1245 property (i.e., placed in service after 1980 and before 1987, and accelerated depreciation used) – Intangible real property, such as leaseholds of § 1250 property, is also included 30

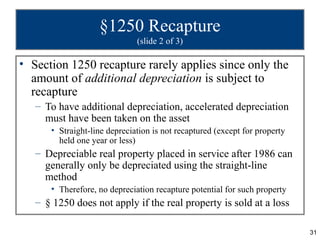

- 31. §1250 Recapture (slide 2 of 3) • Section 1250 recapture rarely applies since only the amount of additional depreciation is subject to recapture – To have additional depreciation, accelerated depreciation must have been taken on the asset • Straight-line depreciation is not recaptured (except for property held one year or less) – Depreciable real property placed in service after 1986 can generally only be depreciated using the straight-line method • Therefore, no depreciation recapture potential for such property – § 1250 does not apply if the real property is sold at a loss 31

- 32. §1250 Recapture (slide 3 of 3) • The § 1250 recapture rules also apply to the following property for which accelerated depreciation was used: – Additional first-year depreciation [§ 168(k)] exceeding straight-line depreciation taken on leasehold improvements, qualified restaurant property, and qualified retail improvement property. – Immediate expense deduction [§ 179(f)] exceeding straight- line depreciation taken on leasehold improvements, qualified restaurant property, and qualified retail improvement property. 32

- 33. Real Estate 25% Gain (slide 1 of 4) • Also called unrecaptured §1250 gain or 25% gain – 25% gain is some or all of the §1231 gain treated as long-term capital gain – Used in the alternative tax computation for net capital gain 33

- 34. Real Estate 25% Gain (slide 2 of 4) • Maximum amount of 25% gain is depreciation taken on real property sold at a recognized gain reduced by: – Certain §1250 and §1245 depreciation recapture – Losses from other §1231 assets – §1231 lookback losses • Limited to recognized gain when total gain is less than depreciation taken 34

- 35. Real Estate 25% Gain (slide 3 of 4) • Special 25% Gain Netting Rules – Where there is a § 1231 gain from real estate and that gain includes both potential 25% gain and potential 0%/15% gain, any § 1231 loss from disposition of other § 1231 assets • First offsets the 0%/15% portion of the § 1231 gain • Then offsets the 25% portion of the § 1231 gain – Also, any § 1231 lookback loss • First recharacterizes the 25% portion of the § 1231 gain • Then recharacterizes the 0%/15% portion of the § 1231 gain as ordinary income 35

- 36. Real Estate 25% Gain (slide 4 of 4) • Net § 1231 Gain Limitation – The amount of unrecaptured § 1250 gain may not exceed the net § 1231 gain that is eligible to be treated as long- term capital gain – The unrecaptured § 1250 gain is the lesser of • The unrecaptured § 1250 gain, or • The net § 1231 gain that is treated as capital gain – Thus, if there is a net § 1231 gain, but it is all recaptured by the 5 year § 1231 lookback loss provision, there is no surviving § 1231 gain or unrecaptured § 1250 gain 36

- 37. Related Effects of Recapture (slide 1 of 8) • Gifts – The carryover basis of gifts, from donor to donee, also carries over depreciation recapture potential associated with asset – That is, donee steps into shoes of donor with regard to depreciation recapture potential 37

- 38. Related Effects of Recapture (slide 2 of 8) • Inheritance – Death is only way to eliminate recapture potential – That is, depreciation recapture potential does not carry over from decedent to heir 38

- 39. Related Effects of Recapture (slide 3 of 8) • Charitable contributions – Recapture potential reduces the amount of charitable contribution deductions that are based on FMV 39

- 40. The Big Picture - Example 20 Depreciation Recapture and Charitable Transfers • Return to the facts of The Big Picture on p. 17-1. • If instead of selling the old equipment Hazel gives it to a charity, her charitable contribution is limited to zero. – The potential § 1245 recapture on the equipment is $375,040 (the depreciation taken). – When that amount is subtracted from the equipment’s $128,000 fair market value, the result is zero. 40

- 41. Related Effects of Recapture (slide 4 of 8) • Nontaxable transactions – When the transferee carries over the basis of the transferor, the recapture potential also carries over • Included in this category are transfers of property pursuant to the following: – Nontaxable incorporations under § 351 – Certain liquidations of subsidiary companies under § 332 – Nontaxable contributions to a partnership under § 721 – Nontaxable reorganizations – Gain may be recognized in these transactions if boot is received • If gain is recognized, it is treated as ordinary income to the extent of the recapture potential or recognized gain, whichever is lower 41

- 42. Related Effects of Recapture (slide 5 of 8) • Like-kind exchanges and involuntary conversions – Property received in these transactions have a substituted basis • Basis of former property and its recapture potential is substituted for basis of new property – Any gain recognized on the transaction will first be treated as depreciation recapture, then as §1231 or capital gain • Any remaining recapture potential carries over 42

- 43. The Big Picture - Example 21 Depreciation Recapture and Like-Kind Exchanges • Return to the facts of The Big Picture on p. 17-1. • Rather than sell the equipment, Hazel could exchange it for equipment worth $150,000. – Hazel would have to pay $22,000 and would have a § 1031 like-kind exchange. • $150,000 FMV of equip. rec’d – $128,000 FMV of the equip. given up – Because boot was given (the $22,000 cash) and not received, her realized gain of $53,040 is not recognized • $128,000 FMV of equip. given up − $74,960 adjusted basis of the equip. given up. – The $375,040 of depreciation recapture potential under § 1245 carries over to the replacement equipment. 43

- 44. Related Effects of Recapture (slide 6 of 8) • Installment sales – Recapture gain is recognized in year of sale regardless of whether gain is otherwise recognized under the installment method 44

- 45. The Big Picture - Example 22 Depreciation Recapture and Installment Sales • Return to the facts of The Big Picture on p. 17-1. • Assume Hazel could sell the used equipment for $28,000 down and the balance in five yearly installments of $20,000 plus interest. • She would have to recognize her entire $53,040 gain ($128,000 sale price - $74,960 adjusted basis) in 2012. – All of the gain is § 1245 depreciation recapture gain because the $375,040 depreciation taken exceeds the $53,040 recognized gain. 45

- 46. Related Effects of Recapture (slide 7 of 8) • Property Dividends – A corporation generally recognizes gain on the distribution of appreciated property to shareholders – Recapture applies to the extent of the lower of the recapture potential or the excess of the property’s FMV over its adjusted basis 46

- 47. Related Effects of Recapture (slide 8 of 8) • Sales between related parties – Sales of depreciable assets between related parties can cause the total gain to be recognized as ordinary income • Applies to related party sales or exchanges of property that is depreciable in hands of transferee 47

- 48. Refocus On The Big Picture (slide 1 of 2) • Hazel maximized her depreciation deductions when she acquired the store equipment in 2009. • When she sells the equipment in 2012, however, she has a gain because of the low adjusted basis resulting from the § 179 immediate expensing and the rapid seven-year MACRS depreciation. – Section 1245 ‘‘recaptures’’ this gain as ordinary income. 48

- 49. Refocus On The Big Picture (slide 2 of 2) • One way Hazel could avoid recognizing the $53,040 ($128,000 - $74,960) gain would be to do a like-kind exchange. – Trade the 2009 equipment for the new equipment. – She would likely have to give up the 2009 equipment plus cash to acquire the replacement equipment. – Thus, there would be no ‘‘boot received’’ and, therefore, no current gain recognized. • However, the depreciation recapture potential on the 2009 equipment would carry over to the replacement equipment. 49

- 50. If you have any comments or suggestions concerning this PowerPoint Presentation for South-Western Federal Taxation, please contact: Dr. Donald R. Trippeer, CPA trippedr@oneonta.edu SUNY Oneonta © 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part. 50

![§1250 Recapture

(slide 3 of 3)

• The § 1250 recapture rules also apply to the

following property for which accelerated depreciation

was used:

– Additional first-year depreciation [§ 168(k)] exceeding

straight-line depreciation taken on leasehold

improvements, qualified restaurant property, and qualified

retail improvement property.

– Immediate expense deduction [§ 179(f)] exceeding straight-

line depreciation taken on leasehold improvements,

qualified restaurant property, and qualified retail

improvement property.

32](https://image.slidesharecdn.com/pptch17-130308122032-phpapp02/85/Ppt-ch-17-32-320.jpg)