Retirement Planning presentation

- 2. That┬Āis┬Āwhere┬Āwe┬Ācome┬ĀinŌĆ” ŌĆó Simplify the Complex Process of planning ŌĆó Offer one complete solution ŌĆÉ addressing your financial needs ŌĆó Deliver a Personalized plan ŌĆō tailor made to your needs ŌĆó Provide all services under one roof ŌĆÉ Analysis, Planning & Monitoring ŌĆó Partnering with you throughout your life span Help┬Āyou┬Āapproach┬Āyour┬Āgoals┬Āconfidently As part of The Principal Financial Group┬« (PFG), a global leader in retirement & financial services, we will

- 3. Spending┬ĀYears┬ĀŌĆō Youth Needy┬ĀYears┬ĀŌĆō Married Responsible┬ĀYears┬ĀŌĆō Married┬Āwith┬Ākids Settlement┬Ā┬ĀYears┬ĀŌĆō Married┬Āwith┬Āadult┬Ā children Peaceful┬ĀYears┬ĀŌĆÉ Retired Worried┬ĀYears┬ĀŌĆō Couples┬Ā with┬Ā marriageable┬Āchildren Retirement┬ĀPlanning covers┬Āall┬ĀLife┬ĀStages &┬ĀLife┬ĀEvents leading┬Āupto┬Āa┬Āpeaceful┬ĀRetired┬ĀLife┬Ā

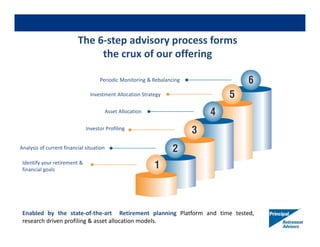

- 4. The┬Ā6ŌĆÉstep┬Āadvisory┬Āprocess┬Āforms┬Ā the┬Ācrux┬Āof┬Āour┬Āoffering Enabled by the stateŌĆÉofŌĆÉtheŌĆÉart Retirement planning Platform and time tested, research driven profiling & asset allocation models. Periodic┬ĀMonitoring┬Ā&┬ĀRebalancing Investment┬ĀAllocation┬ĀStrategy Asset┬ĀAllocation Investor┬ĀProfiling Analysis┬Āof┬Ācurrent┬Āfinancial┬Āsituation Identify┬Āyour┬Āretirement┬Ā&┬Ā financial┬Āgoals

- 7. A┬ĀName┬ĀYou┬Ācan┬ĀTrust We are part of the one of the leading financial services organization in the world ŌĆÉ The Principal Financial Group (PFG) Details┬Āas┬Āon┬ĀDec┬Ā31st,┬Ā2012,┬Āunless┬Āotherwise┬Āstated┬Ā┬ĀSource:┬Āwww.principal.com About PFG ŌĆó A leading global provider of retirement & investment services ŌĆó Largest 401(k) provider & 11th largest Life Insurance Company in the US ŌĆó Ranked 268th on Fortune magazineŌĆÖs Top 500 Corporation list (MayŌĆÖ2011) and 481st on the Forbes Global 2000 list(AprilŌĆÖ 2011) ŌĆó Listed on NYSE (Symbol PFG), constituent of S&P 500 since July 2002 ŌĆó $403 Billion in Assets Under Management, Operating Earnings $808 million ŌĆó 18.3 million customers, 13,500 employees worldwide, Offices in 18 countries across Asia, Australia, Europe, Latin America and America ŌĆó PFGŌĆÖs products includes Pension, Insurance, Asset Management, Mortgage & Banking ŌĆó Managing Assets for 10 of the Top 25 pension funds in the world(SeptemberŌĆÖ2011)

- 8. PRINCIPAL FINANCIAL GROUP Headquarters Des Moines, Iowa Mexico Principal AFORE Pensions Principal Seguros Life Insurance Principal Pensiones Annuities Principal Fondos de Inversi├│n, S.A. de C.V (PFI) Mutual Funds, IAM Chile Principal Vida Annuities / Pensions Principal Creditos Hipotecarios Residential Mortgages Principal AGF Mutual Funds, IAM Cuprum Pensions - Mandatory Brazil BrasilPrev - JV with Banco do Brasil Pensions, Annuities, IAM India Principal/AMC - JV with PNB/Vijaya Mutual Funds Principal PNB Asset Management Co. Asset Management PRA Malaysia CIMB-Principal AMC - JV with CIMB Group Mutual Funds, Asset Management CIMB Principal Islamic Asset Management (PGI JV with CIMB Group) Islamic Institutional Asset Management Hong Kong Principal Insurance Company Pensions, Mutual Funds, IAM Principal Global Investors (Asia) Ltd. Asset Management China CCB-Principal AMC ŌĆō JV with CCB Mutual Funds, IAM Representative Offices Pensions, Asset Management Germany Principal Global Investors (Europe) LTD Asset Management Ireland Principal Global Investors (Ireland) Ltd Mutual Funds UK Principal Global Investors(Europe) LTD Asset Management Japan Principal Global Investors (Japan) LTD Asset Management Australia Principal Global Investors (Australia) LTD Asset Management Singapore CIMB-Principal AMC Principal Global Investors (Singapore) Asset Management Thailand CIMB-Principal AMC Mutual Funds, Asset Management Indonesia CIMB-Principal AMC Mutual Funds, Asset Management Netherlands Principal Global Investors Representative Office Asset Management UAE Principal Global Investors Representative Office Asset Management PFG┬ĀŌĆō Global┬ĀPresence

- 9. PFG┬ĀŌĆō Some┬ĀAwards┬Ā&┬ĀRecognition ŌĆó Ranked as the No.1 investment brand in the 2011 Harris Poll EquiTrend Study ŌĆō May 2011 ŌĆó Named as one of the worlds most ethical companies for the fourth consecutive year by Ethisphere Magazine ŌĆÉ March 2010 ŌĆó Recognized by Pension & Investment magazine as one of the magazineŌĆÖs Eddy Award winners for excellence in investment education for defined contribution plan participants. ŌĆō March 2010 ŌĆó Principal Funds ranked as the fifth largest manager of lifeŌĆÉcycle mutual funds by Financial Research Corporation. ŌĆō December 2010 ŌĆó Principal Funds ranked no. 3 on BarronŌĆÖs annual ranking of top Mutual Fund companies ŌĆō February 2011 Source:┬Āwww.principal.com