Presentation On Badla System

- 1. Presentation on BADLA SYSTEMBYVIDYADHAR PANDEY

- 2. The "carry forward" activities are mixed together with the spot marketBadla is a mechanism to avoid the discipline of a spot market; to do trades on the spot market but not actually do settlementEXAMPLESuppose you buy 1,000 shares of Infosys at Rs 3,500, your cash outflow is Rs 35 lakh. Instead of paying cash, you can ask your broker to find a borrower to finance your trade. This process of buying stocks with borrowed money is badla trading.

- 3. WORKING OF BADLA SYSTEMThe stock exchange acts as an intermediary between you and the actual lender.You will be charged an interest rate for borrowing, which will be determined by the demand for that stock under badla trading

- 4. Thus, higher the demand for Infosys under badla trading higher will be the interest rate. You can keep your borrowing unpaid for a maximum of 70 days, after which you will have to repay the badla financier through the exchange

- 5. HISTORY OF BADLA TRADINGThe Joint Parliamentary Committee on Irregularities in Securities and Banking Transactions, 1992 (JPC of 1992) discussed the irregularities of badlaSEBI issued a directive in December 1993 prohibiting the carry forward of transactions.

- 6. However it was recommended by the G.S PATEL COMMITTIE in the year 1995 and the carry forward transaction in the security market were permittedIt was further modified by the J.R VARMA COMMITTIE in the year 1997a daily margin of 10 % was to be paid

- 7. 50 % of which was to be paid in advance

- 8. forward trading limit was fixed for 20 croresThe NSE introduced futures contracts on the Nifty in the year 2000Finally badla was banned in the year 2000-01

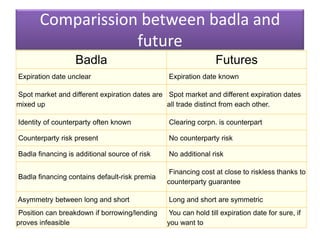

- 9. Comparission between badla and future