Presentation-March30

- 1. Paddy Processing: An Introduction

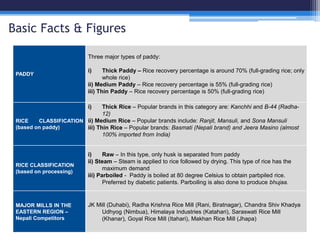

- 2. PADDY Three major types of paddy: i) Thick Paddy â Rice recovery percentage is around 70% (full-grading rice; only whole rice) ii) Medium Paddy â Rice recovery percentage is 55% (full-grading rice) iii) Thin Paddy â Rice recovery percentage is 50% (full-grading rice) RICE CLASSIFICATION (based on paddy) i) Thick Rice â Popular brands in this category are: Kanchhi and B-44 (Radha- 12) ii) Medium Rice â Popular brands include: Ranjit, Mansuli, and Sona Mansuli iii) Thin Rice â Popular brands: Basmati (Nepali brand) and Jeera Masino (almost 100% imported from India) RICE CLASSIFICATION (based on processing) i) Raw â In this type, only husk is separated from paddy ii) Steam â Steam is applied to rice followed by drying. This type of rice has the maximum demand iii) Parboiled - Paddy is boiled at 80 degree Celsius to obtain parbpiled rice. Preferred by diabetic patients. Parboiling is also done to produce bhujaa. MAJOR MILLS IN THE EASTERN REGION â Nepali Competitors JK Mill (Duhabi), Radha Krishna Rice Mill (Rani, Biratnagar), Chandra Shiv Khadya Udhyog (Nimbua), Himalaya Industries (Katahari), Saraswati Rice Mill (Khanar), Goyal Rice Mill (Itahari), Makhan Rice Mill (Jhapa) Basic Facts & Figures

- 3. ï§ Data for the price(s) of rice and paddy were collected for the last 6 years from various government agencies (data for wholesale price, retail price, and price at the Indian border were collected and tabulated) ï§ From the data, only the wholesale price was taken into account in the financial model (calculation of gross sales profit) ï§ Official price figures for bran only available for the last couple of months ï§ Interviews with wholesalers and mills - â Both current price(s) and the price range(s) for this year collected from wholesalers and mills for: rice, paddy, bran, and husk â Gathered market information on the market for bran and husk â Gained an understanding on the milling processes and key challenges faced by Nepali rice mills in the Terai region Collection of historical price(s) of paddy, rice, and bran 1 Verification of price(s) by interviewing wholesale suppliers in Biratnagar and rice mills in: Morang, Jhapa, and Sunsari 2 Adjustment of official data 3 ï§ Reconciliation of the data from government agencies and the data collected from wholesalers and mills ï§ Current price(s) used in the data analysis (financial model) for the purpose of calculating gross profit for the three different paddy/rice types. Historical price variations are recorded and the average annual growth rate of prices calculated, which will serve as inputs for future calculations. Methodology: Data Collection & Analysis

- 4. Annual Gross Profit from Thick Rice Processing (15,872,000) â Gross Loss of NRs. 1.5 Crore Annual Gross Profit from Medium Rice Processing 38,304,000 â Gross Profit of NRs. 3.8 Crore Annual Gross Profit from Thin Rice Processing 458,752,000 â Gross Profit of NRs. 45.8 Crore (Since most of Jeera Masino seems to be imported from India, the calculations for thin rice were primarily based on Basmati) Financial Model: Key Takeaways The processing of thin rice appears to have the highest gross margin and, thus, the highest gross profit. However, the demand for thin rice (especially Basmati) may not be high in our target market

- 5. Key Factors Affecting Profitability Price of Paddy Price of Rice Demand & Price of By- Products Husk Requirement for Source of Energy Rice processing mills can only be a âprice takerâ in the market for rice; price of rice controlled because of subsidized mills on the Indian side The husk produced from processing may not be adequate to produce the estimated required energy through boiler steam turbine ï§ Most of the paddy for Nepali mills supplied from India because of production constraint in Nepal. The subsidized paddy from India means that Indian farmers/middlemen benefit while Nepali farmers struggle to compete ï§ Both paddy and rice prices generally have an average annual growth rate of 10%. Other than that, price of rice in Nepal is dictated less by local demand and more by the large mills (subsidized) in India near the border ï§ Market of Bran and Broken Rice â The gross profit mostly depends on the sale of bran and broken rice (and husk, if husk is not burned for boiler/gasifier), which explains the higher margin on thin rice processing (the by-products from thin paddy add up to 50% of paddy) Price of paddy (cost of goods sold) from Nepali farms controlled through market mechanism by the price of Indian paddy (which enjoys subsidy) Mills appear to have no margin on paddy-rice conversion; profit mostly derived from the sale of by-products ï§ Estimated husk requirement for 500-600 kW steam turbine appears to be around 4 ton/hour. To put things in perspective, husk accounts for 18-20% of paddy. There might be additional costs associated with buying husk to meet the gap (needs to be further calculated and verified)

- 6. REASON/EFFECT ï§ The subsidized Indian mills established across the border get an unfair advantage and can produce rice at a lower price compared to Nepali rice ï§ Nepali mills confirm that the Indian rice brands are usually in the market at a slightly lower price Subsidy to Indian Processing Mills ï§ Most mills in Morang, Jhapa, and Sunsari rely on NEA- supplied energy, and have generator as backup ï§ Few larger mills (J.K. Mill, for instance) run many hours on diesel-powered generators with an operational cost of almost NRs. 8,000 per hour (est. 80 liters per hour). How they are still profitable remains a mystery. Unreliable Energy Supply ï§ Due to inadequate paddy production in Nepal, most of the Nepali mills currently import paddy from India ï§ One major reason discouraging Nepali farmers from producing is the subsidy given to Indian farmers, thereby reducing cost of paddy production in India Inadequate Paddy Production in Nepal 2 31 Key Challenges Faced by Nepali Processing Mills