Profitability Ratio Analysis

- 2. Presented By Muhammad Rassel Hossain Id: 163-14-715 Rajib Sarker Id:163-14-710 Israt Jahan Nitu Id:121-11-338

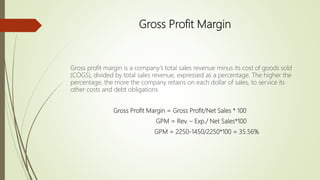

- 3. Gross Profit Margin Gross profit margin is a company's total sales revenue minus its cost of goods sold (COGS), divided by total sales revenue, expressed as a percentage. The higher the percentage, the more the company retains on each dollar of sales, to service its other costs and debt obligations Gross Profit Margin = Gross Profit/Net Sales * 100 GPM = Rev. – Exp./ Net Sales*100 GPM = 2250-1450/2250*100 = 35.56%

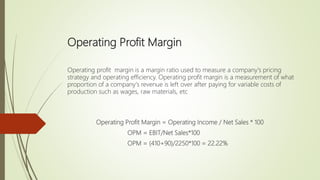

- 4. Operating Profit Margin Operating profit margin is a margin ratio used to measure a company's pricing strategy and operating efficiency. Operating profit margin is a measurement of what proportion of a company's revenue is left over after paying for variable costs of production such as wages, raw materials, etc Operating Profit Margin = Operating Income / Net Sales * 100 OPM = EBIT/Net Sales*100 OPM = (410+90)/2250*100 = 22.22%

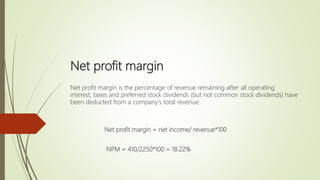

- 5. Net profit margin Net profit margin is the percentage of revenue remaining after all operating interest, taxes and preferred stock dividends (but not common stock dividends) have been deducted from a company's total revenue. Net profit margin = net income/ revenue*100 NPM = 410/2250*100 = 18.22%

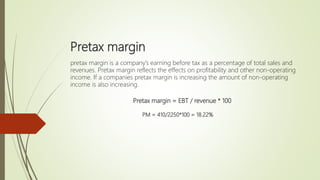

- 6. Pretax margin pretax margin is a company’s earning before tax as a percentage of total sales and revenues. Pretax margin reflects the effects on profitability and other non-operating income. If a companies pretax margin is increasing the amount of non-operating income is also increasing. Pretax margin = EBT / revenue * 100 PM = 410/2250*100 = 18.22%

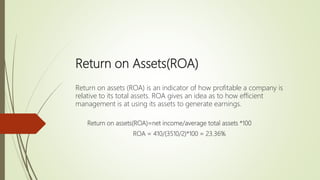

- 7. Return on Assets(ROA) Return on assets (ROA) is an indicator of how profitable a company is relative to its total assets. ROA gives an idea as to how efficient management is at using its assets to generate earnings. Return on assets(ROA)=net income/average total assets *100 ROA = 410/(3510/2)*100 = 23.36%

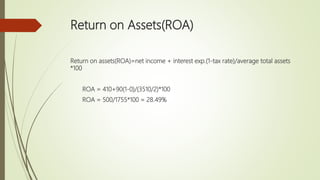

- 8. Return on Assets(ROA) Return on assets(ROA)=net income + interest exp.(1-tax rate)/average total assets *100 ROA = 410+90(1-0)/(3510/2)*100 ROA = 500/1755*100 = 28.49%

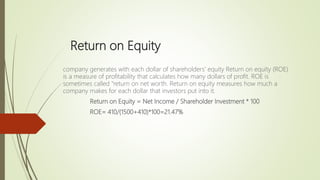

- 9. Return on Equity company generates with each dollar of shareholders' equity Return on equity (ROE) is a measure of profitability that calculates how many dollars of profit. ROE is sometimes called "return on net worth. Return on equity measures how much a company makes for each dollar that investors put into it. Return on Equity = Net Income / Shareholder Investment * 100 ROE= 410/(1500+410)*100=21.47%

- 10. Return on sales Return on sales (ROS) is a ratio used to evaluate a company's operational efficiency; ROS is also known as a firm's operating profit margin. This measure provides insight into how much profit is being produced per dollar of sales. Return on sales = Net Income / sales * 100 ROS = 410 / 2250 * 100=18.22%

- 11. THANK YOU