Protective call

Download as pptx, pdf0 likes118 views

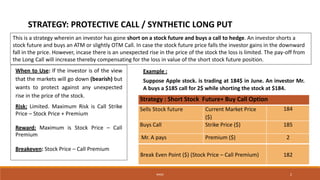

This strategy involves being short on a stock future to take advantage of downward price movements, while purchasing a call option to limit losses from an unexpected price rise. The investor shorts a stock future and buys an at-the-money or slightly out-of-the-money call option. If the stock price falls, the investor profits from the short future position. However, if the price rises unexpectedly, the call option limits losses. The maximum risk is limited to the call strike price minus the stock price plus the premium paid. The maximum reward occurs if the stock price falls to the call strike price minus the premium.

1 of 3

Download to read offline

Ad

Recommended

Chap 3

Chap 3guest897c2d

?

There are two main types of hedges using futures contracts: long hedges and short hedges. Long hedges lock in future purchase prices while short hedges lock in future sale prices. Companies should focus on hedging to minimize risks from market variables like interest rates and exchange rates. However, hedging also introduces basis risk and may not be optimal if competitors do not hedge. The optimal hedge ratio balances reducing risk from changes in the spot price with basis risk from changes in the futures price. Hedging an equity portfolio or individual stock using stock index futures contracts can protect against systematic market risks.Option strategies.

Option strategies.Prabir Deb

?

The document discusses various derivative strategies and their risk-reward profiles. It defines derivatives and options, and identifies the main types of option contracts. The rest of the document outlines bullish, bearish, and neutral option strategies, detailing the maximum risk and reward for each. These include strategies like bull call spreads, covered calls, collars, bear put spreads, and more complex strategies involving butterflies and condors. Overall, the document provides an overview of multiple derivative trading strategies and how their risk and profit potentials are determined.Protective put

Protective putPramod Kumar Sah

?

A protective put is a risk-management strategy where investors buy a put option to hedge against potential losses while remaining bullish on a stock. The protective put sets a floor price to limit losses, allowing the investor to sell the underlying asset at a predetermined strike price before expiration. This strategy can involve varying strike prices and premiums, and it can be fully or partially utilized alongside a long position in a stock.Market Strategies Using Options

Market Strategies Using OptionsNavin Bafna

?

The document summarizes various options strategies that can be used based on different market outlooks. It describes bullish, bearish, neutral, and volatile market strategies using calls, puts, spreads, and combinations. For example, it explains that buying a call is a bullish strategy that profits if the market rises above the strike price, while selling a put is also bullish but profits from premium received if the market stays flat or rises.Chap 8

Chap 8guest897c2d

?

A call option gives the holder the right to buy the underlying asset, while a put option gives the holder the right to sell. European options can only be exercised at expiration, while American options can be exercised at any time before expiration. The document then discusses long and short positions in call and put options and provides examples of profit diagrams for different option positions. It also reviews the key terms, underlying assets, and specifications of exchange-traded options. The document concludes by discussing dividends and stock splits, market makers, margins, warrants, executive stock options, and convertible bonds.Option Strategies - 1

Option Strategies - 1 EasyTradez

?

The document outlines various options trading strategies, including short call, long call, synthetic long call, and long put options. A short call involves selling a call option, which is considered risky due to unlimited potential losses, while a long call is a basic strategy for bullish investors. The synthetic long call combines stock purchase with a put option for downside protection, and long puts are used by bearish traders to profit from declining stock prices.Introduction To Trading And Order Types

Introduction To Trading And Order TypesPrashant Ram

?

This document serves as an introduction to basic trading concepts and order types for MBA candidates and finance students. It covers key topics such as market orders, limit orders, stop orders, and various trading strategies like going long and selling short. Additionally, it explains different types of orders and their implications in trading to help enhance understanding of the stock market mechanics.Types Of Order

Types Of OrderTooba Shafique

?

Types of orders include market orders, limit orders, stop orders, conditional orders, and good till cancel orders. A market order executes immediately at the best available price. A limit order can only be executed at or better than the specified price. A stop order automatically sells a stock if it drops to a certain price. Conditional orders are submitted or canceled if criteria are met. A good till cancel order remains in effect until canceled by the customer.The stock market investment rules

The stock market investment rulesMing

?

The document provides investment strategies for investing in the stock market. It recommends investing in large, well-established companies with price-earnings ratios below 10 that are leaders in high-growth industries. Additional tips include diversifying investments across different industries, using price-earnings ratios and earnings per share to evaluate companies, and following a "buy low and sell high" strategy of buying more shares when prices dip and holding investments for the long term rather than trying to time short-term market fluctuations. The strategies aim to capitalize on the long-term growth of well-managed companies while maintaining a margin of safety through diversification and ignoring daily price movements.Options Trading Strategies

Options Trading StrategiesMayank Bhatia

?

The document covers various options investment strategies, detailing the fundamental concepts of call and put options, as well as various trading strategies, including spreads, straddles, and protective puts. It explains how these strategies can be used based on the investor's expectations of stock price movements, outlining potential profits and risks associated with each. Additionally, it provides practical examples to illustrate the application of these strategies in real-world scenarios.options and their valuation

options and their valuationPANKAJ PANDEY

?

This document provides an overview of options and their valuation. It defines key terms like calls, puts, exercise price, underlying asset, and premium. It describes the differences between European and American options and possibilities at expiration like in-the-money, out-of-the-money, and at-the-money. The document outlines the payoffs of call and put options at expiration. It also discusses options trading in India, index options, and combinations of options and shares. Finally, it introduces models for option valuation, including the binomial tree approach and the Black-Scholes model.put call parity

put call parity Krystal Skull

?

The document discusses properties of stock options, specifically put-call parity. It defines put-call parity as the relationship between the value of a European call option and put option with the same exercise price and date. Put-call parity can be used to identify arbitrage opportunities when it does not hold. The document also examines how put-call parity applies to American options and options on dividend paying stocks. Early exercise of American put options may be optimal unlike American call options.Equity Types of Orders

Equity Types of Ordersflame2011

?

Market orders execute immediately at the best available price, while limit orders only execute at or below a specified price to avoid losses. Stop loss orders trigger a sell when a stock reaches a predetermined price to limit downside risk. Good-till-cancelled orders only last for the trading day, while day orders expire at the end of the day if not filled. Understanding order types helps investors control investments and avoid unnecessary losses from unfavorable price movements.FPA Conference Presentation in Anaheim, Ca 10-11-2009

FPA Conference Presentation in Anaheim, Ca 10-11-2009seaneheron

?

This document summarizes a presentation on enhancing investment practices with equity option strategies. The presentation was given by Rutgers University in partnership with The Options Industry Council. It provides an overview of options basics including defining derivatives, why investors use options, and describing call and put options. It also reviews specific option strategies like covered calls, protective puts, straddles, and strangles. The presentation aims to educate investors on how to use options to generate income, reduce risk, and take advantage of different market conditions.Putnam Absolute Return Funds

Putnam Absolute Return FundsPutnam Investments

?

This document provides an overview and summary of Putnam Absolute Return Funds. It discusses how increased stock market volatility and low bond yields argue for alternative investment strategies. The Putnam Absolute Return Funds aim to generate positive returns regardless of market conditions with less volatility than traditional markets. Each fund seeks a different return target above inflation over a 3-year period using flexible portfolio management across global fixed income, stocks, and alternative assets.ITRADE Derivatives strategy guide

ITRADE Derivatives strategy guideItrade Capital Markets

?

This document provides summaries and payoff diagrams for various derivatives trading strategies including long calls, protective puts, call ratio back spreads, long futures, bull call spreads, short puts, long straddles, long strangles, long straps, long strips, long and short butterflies, long and short condors, and short butterflies. Each strategy is described in 1-3 sentences and includes information on market outlook, breakeven points, risk, and profit potential. Payoff diagrams visually depict strategy outcomes at different price levels.Strips and straps

Strips and strapssunil5111991

?

This document discusses two options trading strategies: strips and straps. Strips involve buying 1 at-the-money call and 2 at-the-money puts, betting that the underlying stock price will experience significant volatility and decrease. Straps involve buying 2 at-the-money calls and 1 at-the-money put, betting that the underlying stock price will experience significant volatility but increase. Both strategies have unlimited profit potential and limited risk, with the maximum loss being the net premium paid.OPTION-STRATEGIES-final

OPTION-STRATEGIES-finalMariam Latif

?

This document discusses different option trading strategies. It defines what an option is and explains bullish, bearish, and neutral strategies. Bullish strategies are used when traders expect prices to rise. Bearish strategies are employed when prices are expected to fall. Neutral strategies can profit from prices staying the same or moving in either direction. The document analyzes the advantages and disadvantages of each type of strategy and concludes that option strategies allow traders to reduce risk and increase profit potential regardless of the market direction.Straddle Options

Straddle OptionsInvestingTips

?

Straddle options are strategies used by traders to profit from market volatility by establishing positions for both rising and falling prices. A long straddle involves buying both a call and a put option with the same expiration, which limits losses to the premiums paid if the stock price remains unchanged, while offering unlimited potential for profit with significant price movement. Conversely, a short straddle involves selling both a put and a call, which can be profitable in stable markets but carries high risk in volatile ones.Margin buying PPT

Margin buying PPTTinku Kumar

?

Margin buying allows investors to purchase stocks with money borrowed from a broker, using the stocks themselves as collateral. By putting down only a small initial investment and borrowing the rest, margin buying enables investors to control a larger position in a stock and potentially earn higher returns. However, it also increases the risk of larger losses if the stock moves against the investor's position. An example shows how margin buying could allow tripling an initial $25 investment by purchasing $100 worth of stock, but it also increases the potential downside risk and interest owed to the broker.Option strategies part ii

Option strategies part iiAmeya Ranadive

?

The document describes two option strategies: a long combo and a protective call/synthetic long put.

A long combo is a bullish strategy that involves selling an out-of-the-money put and buying an out-of-the-money call on the same stock. This provides upside exposure similar to owning the stock but at a lower cost. Profits are made if the stock rises above the break-even point.

A protective call/synthetic long put involves shorting a stock and buying a call option to hedge against downside risk. If the stock falls, profits are made on the short position. The long call limits losses if the stock rises unexpectedly. This strategy hedges upside movement in theDerivatives in india

Derivatives in indiafinancialeducation

?

The document discusses financial derivatives in India. It begins by explaining the origin of derivatives in forward contracts related to agricultural commodities used for hedging. It then outlines the dominant types of derivatives in India including forwards, futures, options, and swaps. It notes that the Indian derivatives market started in 2000 and is now dominated by index derivatives and highly leveraged speculation. The document cautions that derivatives trading is a zero-sum game where most day traders lose money.Derivatives

DerivativesSajna Fathima

?

The document explains call and put options, which are derivative financial instruments allowing the buyer to buy or sell an underlying asset at a specified price. It details the rights and obligations of both buyers and sellers, as well as key terminologies like option premium, strike price, and expiration date. Additionally, the document discusses the strategic use of options to limit losses and manage risk.Derivatives in India

Derivatives in IndiaSrinivas Mittapelli

?

Derivatives emerged to help farmers and traders manage risks and have since become important risk management tools. The derivatives market in India has grown significantly since liberalization in the 1990s. Derivatives allow participants to hedge risks, speculate, and engage in arbitrage. Common derivatives contracts include forwards, futures, options, and swaps. Traders use various strategies like spreads and straddles to limit risks and maximize returns based on their market outlook. While still growing, India's derivatives market is becoming a major global exchange.Options Trading Strategies

Options Trading Strategiesluv_sharma

?

This document discusses various options trading strategies, including:

1. Long call - buyer is bullish on the underlying asset and pays a premium for the right to buy it at a set price.

2. Short call - writer is bearish and collects premium but has obligation to sell the asset if exercised.

3. Covered call - involves buying the asset and writing a call to generate income but limits upside.

4. Long put - buyer is bearish and pays premium for right to sell the asset at a set price.

5. Short put - writer is bullish and collects premium but has obligation to buy the asset if exercised.

It provides details on the risk and rewardWriting covered strangle

Writing covered stranglepkkothari

?

An investor sells both put and call options on the same stock with identical strike prices and expiration months, collecting premiums from buyers. This "writing a straddle" strategy profits if the stock price remains stable. The investor holds the underlying stock to cover calls sold and cash to buy stock if assigned puts. The strategy has break-even price ranges of $27.50-$32.50, above or below which the investor loses money. If the stock price is within this range at expiration, the investor keeps premiums; if below, assigned puts are covered; if above, assigned calls are covered for a profit.Options strategies

Options strategiesPavan Makhija

?

The document discusses various options trading strategies, including:

1) Buying call options to profit from an expected rise in the market. This strategy has unlimited upside potential but limited downside risk of the premium paid.

2) Buying put options to profit from an expected fall in the market. This also has unlimited upside potential and limited downside risk of the premium.

3) Holding stock and selling covered calls to generate income from the stock holding when a neutral market is expected. This caps upside potential in exchange for the option premium received.

The document explains the mechanics and risk-reward profiles of these and other options strategies through the use of diagrams and payoff tables.Options presentaion

Options presentaionrao9948281822

?

The document discusses 12 investment strategies using derivatives:

1) Long call

2) Short call

3) Synthetic long call by buying stock and put

4) Protective call/synthetic long put by shorting stock future and buying call

5) Long put

6) Short put

7) Long combo by selling put and buying call

8) Long strangle

9) Short strangle

10) Covered call

11) Covered put

12) Long strangle

Each strategy is explained briefly with an example to illustrate how it works and the potential risks and rewards.Options presentaion ppt

Options presentaion pptrao9948281822

?

The document discusses 12 investment strategies using derivatives:

1) Long call

2) Short call

3) Synthetic long call by buying stock and put

4) Protective call/synthetic long put by shorting stock future and buying call

5) Long put

6) Short put

7) Long combo by selling put and buying call

8) Long strangle

9) Short strangle

10) Covered call

11) Covered put

12) Long strangle

Each strategy is explained briefly with an example and payoff analysis. The strategies range from bullish to bearish positions using options.Derivatives - Option strategies.

Derivatives - Option strategies.Ameya Ranadive

?

The document discusses various option strategies including long call, long put, short call, synthetic long call, and short put.

A long call strategy involves buying call options and profits if the underlying stock or index price rises above the strike price plus premium paid. A long put strategy involves buying put options and profits if the price falls below the strike price minus premium paid.

A short call strategy involves selling call options and profits if the price remains below or at the strike price, collecting premium as maximum profit. A synthetic long call strategy involves buying stock and buying protective put options to limit downside risk while retaining upside potential.

A short put strategy involves selling put options and profits as long as the underlying price remains aboveMore Related Content

What's hot (19)

The stock market investment rules

The stock market investment rulesMing

?

The document provides investment strategies for investing in the stock market. It recommends investing in large, well-established companies with price-earnings ratios below 10 that are leaders in high-growth industries. Additional tips include diversifying investments across different industries, using price-earnings ratios and earnings per share to evaluate companies, and following a "buy low and sell high" strategy of buying more shares when prices dip and holding investments for the long term rather than trying to time short-term market fluctuations. The strategies aim to capitalize on the long-term growth of well-managed companies while maintaining a margin of safety through diversification and ignoring daily price movements.Options Trading Strategies

Options Trading StrategiesMayank Bhatia

?

The document covers various options investment strategies, detailing the fundamental concepts of call and put options, as well as various trading strategies, including spreads, straddles, and protective puts. It explains how these strategies can be used based on the investor's expectations of stock price movements, outlining potential profits and risks associated with each. Additionally, it provides practical examples to illustrate the application of these strategies in real-world scenarios.options and their valuation

options and their valuationPANKAJ PANDEY

?

This document provides an overview of options and their valuation. It defines key terms like calls, puts, exercise price, underlying asset, and premium. It describes the differences between European and American options and possibilities at expiration like in-the-money, out-of-the-money, and at-the-money. The document outlines the payoffs of call and put options at expiration. It also discusses options trading in India, index options, and combinations of options and shares. Finally, it introduces models for option valuation, including the binomial tree approach and the Black-Scholes model.put call parity

put call parity Krystal Skull

?

The document discusses properties of stock options, specifically put-call parity. It defines put-call parity as the relationship between the value of a European call option and put option with the same exercise price and date. Put-call parity can be used to identify arbitrage opportunities when it does not hold. The document also examines how put-call parity applies to American options and options on dividend paying stocks. Early exercise of American put options may be optimal unlike American call options.Equity Types of Orders

Equity Types of Ordersflame2011

?

Market orders execute immediately at the best available price, while limit orders only execute at or below a specified price to avoid losses. Stop loss orders trigger a sell when a stock reaches a predetermined price to limit downside risk. Good-till-cancelled orders only last for the trading day, while day orders expire at the end of the day if not filled. Understanding order types helps investors control investments and avoid unnecessary losses from unfavorable price movements.FPA Conference Presentation in Anaheim, Ca 10-11-2009

FPA Conference Presentation in Anaheim, Ca 10-11-2009seaneheron

?

This document summarizes a presentation on enhancing investment practices with equity option strategies. The presentation was given by Rutgers University in partnership with The Options Industry Council. It provides an overview of options basics including defining derivatives, why investors use options, and describing call and put options. It also reviews specific option strategies like covered calls, protective puts, straddles, and strangles. The presentation aims to educate investors on how to use options to generate income, reduce risk, and take advantage of different market conditions.Putnam Absolute Return Funds

Putnam Absolute Return FundsPutnam Investments

?

This document provides an overview and summary of Putnam Absolute Return Funds. It discusses how increased stock market volatility and low bond yields argue for alternative investment strategies. The Putnam Absolute Return Funds aim to generate positive returns regardless of market conditions with less volatility than traditional markets. Each fund seeks a different return target above inflation over a 3-year period using flexible portfolio management across global fixed income, stocks, and alternative assets.ITRADE Derivatives strategy guide

ITRADE Derivatives strategy guideItrade Capital Markets

?

This document provides summaries and payoff diagrams for various derivatives trading strategies including long calls, protective puts, call ratio back spreads, long futures, bull call spreads, short puts, long straddles, long strangles, long straps, long strips, long and short butterflies, long and short condors, and short butterflies. Each strategy is described in 1-3 sentences and includes information on market outlook, breakeven points, risk, and profit potential. Payoff diagrams visually depict strategy outcomes at different price levels.Strips and straps

Strips and strapssunil5111991

?

This document discusses two options trading strategies: strips and straps. Strips involve buying 1 at-the-money call and 2 at-the-money puts, betting that the underlying stock price will experience significant volatility and decrease. Straps involve buying 2 at-the-money calls and 1 at-the-money put, betting that the underlying stock price will experience significant volatility but increase. Both strategies have unlimited profit potential and limited risk, with the maximum loss being the net premium paid.OPTION-STRATEGIES-final

OPTION-STRATEGIES-finalMariam Latif

?

This document discusses different option trading strategies. It defines what an option is and explains bullish, bearish, and neutral strategies. Bullish strategies are used when traders expect prices to rise. Bearish strategies are employed when prices are expected to fall. Neutral strategies can profit from prices staying the same or moving in either direction. The document analyzes the advantages and disadvantages of each type of strategy and concludes that option strategies allow traders to reduce risk and increase profit potential regardless of the market direction.Straddle Options

Straddle OptionsInvestingTips

?

Straddle options are strategies used by traders to profit from market volatility by establishing positions for both rising and falling prices. A long straddle involves buying both a call and a put option with the same expiration, which limits losses to the premiums paid if the stock price remains unchanged, while offering unlimited potential for profit with significant price movement. Conversely, a short straddle involves selling both a put and a call, which can be profitable in stable markets but carries high risk in volatile ones.Margin buying PPT

Margin buying PPTTinku Kumar

?

Margin buying allows investors to purchase stocks with money borrowed from a broker, using the stocks themselves as collateral. By putting down only a small initial investment and borrowing the rest, margin buying enables investors to control a larger position in a stock and potentially earn higher returns. However, it also increases the risk of larger losses if the stock moves against the investor's position. An example shows how margin buying could allow tripling an initial $25 investment by purchasing $100 worth of stock, but it also increases the potential downside risk and interest owed to the broker.Option strategies part ii

Option strategies part iiAmeya Ranadive

?

The document describes two option strategies: a long combo and a protective call/synthetic long put.

A long combo is a bullish strategy that involves selling an out-of-the-money put and buying an out-of-the-money call on the same stock. This provides upside exposure similar to owning the stock but at a lower cost. Profits are made if the stock rises above the break-even point.

A protective call/synthetic long put involves shorting a stock and buying a call option to hedge against downside risk. If the stock falls, profits are made on the short position. The long call limits losses if the stock rises unexpectedly. This strategy hedges upside movement in theDerivatives in india

Derivatives in indiafinancialeducation

?

The document discusses financial derivatives in India. It begins by explaining the origin of derivatives in forward contracts related to agricultural commodities used for hedging. It then outlines the dominant types of derivatives in India including forwards, futures, options, and swaps. It notes that the Indian derivatives market started in 2000 and is now dominated by index derivatives and highly leveraged speculation. The document cautions that derivatives trading is a zero-sum game where most day traders lose money.Derivatives

DerivativesSajna Fathima

?

The document explains call and put options, which are derivative financial instruments allowing the buyer to buy or sell an underlying asset at a specified price. It details the rights and obligations of both buyers and sellers, as well as key terminologies like option premium, strike price, and expiration date. Additionally, the document discusses the strategic use of options to limit losses and manage risk.Derivatives in India

Derivatives in IndiaSrinivas Mittapelli

?

Derivatives emerged to help farmers and traders manage risks and have since become important risk management tools. The derivatives market in India has grown significantly since liberalization in the 1990s. Derivatives allow participants to hedge risks, speculate, and engage in arbitrage. Common derivatives contracts include forwards, futures, options, and swaps. Traders use various strategies like spreads and straddles to limit risks and maximize returns based on their market outlook. While still growing, India's derivatives market is becoming a major global exchange.Options Trading Strategies

Options Trading Strategiesluv_sharma

?

This document discusses various options trading strategies, including:

1. Long call - buyer is bullish on the underlying asset and pays a premium for the right to buy it at a set price.

2. Short call - writer is bearish and collects premium but has obligation to sell the asset if exercised.

3. Covered call - involves buying the asset and writing a call to generate income but limits upside.

4. Long put - buyer is bearish and pays premium for right to sell the asset at a set price.

5. Short put - writer is bullish and collects premium but has obligation to buy the asset if exercised.

It provides details on the risk and rewardWriting covered strangle

Writing covered stranglepkkothari

?

An investor sells both put and call options on the same stock with identical strike prices and expiration months, collecting premiums from buyers. This "writing a straddle" strategy profits if the stock price remains stable. The investor holds the underlying stock to cover calls sold and cash to buy stock if assigned puts. The strategy has break-even price ranges of $27.50-$32.50, above or below which the investor loses money. If the stock price is within this range at expiration, the investor keeps premiums; if below, assigned puts are covered; if above, assigned calls are covered for a profit.Options strategies

Options strategiesPavan Makhija

?

The document discusses various options trading strategies, including:

1) Buying call options to profit from an expected rise in the market. This strategy has unlimited upside potential but limited downside risk of the premium paid.

2) Buying put options to profit from an expected fall in the market. This also has unlimited upside potential and limited downside risk of the premium.

3) Holding stock and selling covered calls to generate income from the stock holding when a neutral market is expected. This caps upside potential in exchange for the option premium received.

The document explains the mechanics and risk-reward profiles of these and other options strategies through the use of diagrams and payoff tables.Similar to Protective call (20)

Options presentaion

Options presentaionrao9948281822

?

The document discusses 12 investment strategies using derivatives:

1) Long call

2) Short call

3) Synthetic long call by buying stock and put

4) Protective call/synthetic long put by shorting stock future and buying call

5) Long put

6) Short put

7) Long combo by selling put and buying call

8) Long strangle

9) Short strangle

10) Covered call

11) Covered put

12) Long strangle

Each strategy is explained briefly with an example to illustrate how it works and the potential risks and rewards.Options presentaion ppt

Options presentaion pptrao9948281822

?

The document discusses 12 investment strategies using derivatives:

1) Long call

2) Short call

3) Synthetic long call by buying stock and put

4) Protective call/synthetic long put by shorting stock future and buying call

5) Long put

6) Short put

7) Long combo by selling put and buying call

8) Long strangle

9) Short strangle

10) Covered call

11) Covered put

12) Long strangle

Each strategy is explained briefly with an example and payoff analysis. The strategies range from bullish to bearish positions using options.Derivatives - Option strategies.

Derivatives - Option strategies.Ameya Ranadive

?

The document discusses various option strategies including long call, long put, short call, synthetic long call, and short put.

A long call strategy involves buying call options and profits if the underlying stock or index price rises above the strike price plus premium paid. A long put strategy involves buying put options and profits if the price falls below the strike price minus premium paid.

A short call strategy involves selling call options and profits if the price remains below or at the strike price, collecting premium as maximum profit. A synthetic long call strategy involves buying stock and buying protective put options to limit downside risk while retaining upside potential.

A short put strategy involves selling put options and profits as long as the underlying price remains aboveLecture no 61 short synthetic future

Lecture no 61 short synthetic futureProfessional Training Academy

?

The document provides an overview of the short synthetic future trading strategy, which involves buying ATM put options and selling ATM call options to simulate shorting a stock. It outlines the steps to enter and exit a position, highlights advantages such as uncapped profit potential, and emphasizes the risks associated with unlimited losses if the stock price rises. The strategy is best used in conjunction with other trades and is suitable for a bearish market outlook.Option strategies

Option strategiesNilay Mishra

?

The document outlines various options trading strategies, including long and short calls, long puts, covered calls, and combinations of these strategies. Each strategy includes details such as when to use it, associated risks and rewards, and breakeven points, aiming to help investors make informed decisions based on their market outlook. The strategies cater to different market conditions, from aggressive bullish or bearish positions to neutral views with limited risks.Option trading strategies

Option trading strategiessivaram12321

?

This document provides an overview of various bullish, neutral, and bearish options trading strategies. It begins with a table of contents listing 27 bullish strategies, 25 neutral strategies, and 9 bearish strategies. It then provides a brief introduction to options, defining call options, put options, and describing option duration and moneyness. The document proceeds to explain 15 specific strategies in more detail, including long call, synthetic long call, short put, covered call, long combo, and others. Each strategy section defines the strategy, risks, rewards, construction, and provides an example to illustrate how it works.Lecture no 6 covered call

Lecture no 6 covered callProfessional Training Academy

?

Lecture no 6 discusses the covered call strategy, emphasizing that it is a straightforward yet effective way to generate income while holding stocks, with limited risk and reward profiles. The strategy involves owning a stock and selling call options monthly, generating premium income and employing time decay to benefit. Key points include managing positions according to market trends and the implications of stock movements relative to the strike price.Synthetic Position 2018

Synthetic Position 2018Riewphira Dohtdong

?

This document discusses synthetic put options, which are created by combining a short stock position with a long call option on the same stock. This combination mimics the payoff of a long put option. The document defines synthetic puts and outlines their characteristics, including their profit/loss potential and breakeven points. It also provides historical price data for a synthetic put on ADA/USD from December 2017 to February 2018, showing the monthly opening, high, and low prices.Lecture no 15 diagonal call

Lecture no 15 diagonal callProfessional Training Academy

?

The document outlines the concepts and strategies related to diagonal call options, a variation of covered calls, focusing on generating income through selling higher strike short-term calls against long-term deep in-the-money calls. It covers the bullish outlook, risk and reward profiles, effects of time decay, trading steps, and the process for exiting and managing positions. Additionally, it includes advantages and disadvantages of the strategy along with a real-time example of a covered short strangle market behavior.Options trading strategies

Options trading strategiesankursaraf92

?

The document discusses various options trading strategies including bull call spread, bear put spread, straddle, strangle, covered call, protective put, and calendar spread. For each strategy, it provides details on when to use it, the associated risks and rewards, and break-even points. Worked examples with numerical values are given to illustrate how to implement the strategies and analyze their potential payoffs.Saim ppt

Saim pptamitnanglu

?

This document summarizes the key concepts of options markets, including:

- There are two main types of options: calls, which give the right to buy, and puts, which give the right to sell. Options can be European or American in terms of when they can be exercised.

- The four main option positions are long call, long put, short call, and short put. The payoffs of these positions depend on whether the underlying asset price is above or below the strike price at expiration.

- For call options, long positions profit when the price is above the strike price, while short positions profit when it is below. For put options, long positions profit when the price is below the strike priceOptions Stratigies

Options Stratigiessurinder verma

?

The document provides an in-depth overview of various option strategies in international finance, covering call and put options, their pricing mechanisms, and market expectations. It explains different trading strategies such as long calls, short calls, protective puts, and bull/bear spreads, detailing the risks, rewards, and examples for each strategy. The content also outlines option terminology and moneyness, enhancing understanding of trading dynamics in options markets.Lecture no 62 long combo

Lecture no 62 long comboProfessional Training Academy

?

The document discusses the long combo trading strategy, which combines selling out-of-the-money (OTM) puts and buying OTM calls to simulate long stock positions with reduced capital requirements. It highlights the bullish outlook of this strategy, its risk management approach, and the effects of time decay on options. The document also outlines the advantages and disadvantages of the long combo, such as uncapped profit potential and minimal capital outlay but no dividend entitlement.Options

Optionsmuratcoskun

?

The document provides an introduction to corporate finance options, including:

- A brief history of options and their use in ancient Greece.

- Current options markets and regulators.

- Key terminology related to options contracts.

- The main types of options - calls and puts.

- Common valuation methods and strategies for options positions, including bullish, bearish, and neutral strategies.DRM Ch 1-Introduction.pptx

DRM Ch 1-Introduction.pptxBharatiya Vidya Bhavan's Usha and Lakshmi Mittal Institute of Management

?

A derivative is a financial instrument whose value is based on an underlying asset such as a stock, currency, or commodity. Derivatives include forwards, futures, swaps, and options. Forwards and swaps are traded over-the-counter (OTC) while futures and options are traded on exchanges. Options provide the right but not the obligation to buy or sell the underlying asset, while futures/forwards obligate the parties to fulfill the contract. Derivatives allow risk transfer and provide leverage to market participants.Options Trading

Options TradingAlfred Rodrigues

?

This document discusses various options trading strategies including:

1. Covered calls which involve buying a stock and selling a call option to generate income from the call premium. This is appropriate when a sharp rise in stock prices is expected.

2. Protective puts which involve buying a stock and purchasing a put option to establish a floor and limit potential losses. This provides downside protection similar to insurance.

3. Bull and bear spreads which involve buying and selling options of the same type but with different strike prices to limit risk and profit from the expected direction of the stock price.

4. Butterfly spreads and straddles which establish positions that can profit from volatility in the stock price regardless of direction throughDerivatives & Risk Management

Derivatives & Risk Management Ashish Sadavarti

?

Mr. Sadavarti presented on the short call option strategy. A call option gives the holder the right to buy the underlying asset at a set price. For a short call option strategy, the seller of the call option expects the underlying price to fall. As an example, Mr. Nelson sold a call option on Nifty with a strike price of Rs. 2600 and received a premium of Rs. 154. If the Nifty closes at or below Rs. 2600 at expiration, Mr. Nelson keeps the full premium. His maximum profit is Rs. 154 with unlimited risk if the Nifty rises above the strike price plus the premium received.Option strategies part iii

Option strategies part iiiAmeya Ranadive

?

The document discusses bull put spread and bear call spread strategies. A bull put spread involves selling a put option and buying a further out-of-the-money put. This strategy profits if the underlying asset stays above the higher strike price or rises. A bear call spread involves selling an in-the-money call and buying a further out-of-the-money call. This strategy profits if the underlying stays below the higher strike price or falls. The document also provides an example of each strategy, including the net premium, break-even price, and potential payoffs.Lecture no 53 collar

Lecture no 53 collarProfessional Training Academy

?

The document discusses the collar trading strategy, which combines buying a stock, purchasing put options for protection against declines, and selling call options to finance the insurance. This low-risk strategy is suitable for conservatively bullish outlooks, aiming for long-term positions with limited maximum risk and reward. Successful execution involves careful selection of strike prices and managing the position according to pre-defined trading rules.dokumen.tips_1-finc4101-investment-analysis-instructor-dr-leng-ling-topic-int...

dokumen.tips_1-finc4101-investment-analysis-instructor-dr-leng-ling-topic-int...MbongeniShongwe1

?

1. The document provides an introduction to options, covering key concepts like call and put options, exercise price, premium, and payoffs for option holders and writers.

2. Key option features discussed include the right to buy/sell the underlying asset, expiration date, American vs. European style, and calculating profit/loss at expiration.

3. Examples are provided to illustrate payoffs and profits for long and short positions in call and put options when the underlying stock price is above, below, or at the exercise price.Ad

Recently uploaded (11)

仿制础础鲍尝别迟迟别谤美国旧金山艺术大学毕业证明,础础鲍成绩单

仿制础础鲍尝别迟迟别谤美国旧金山艺术大学毕业证明,础础鲍成绩单taqyed

?

2025年极速办旧金山艺术大学毕业证【q薇1954292140】学历认证流程旧金山艺术大学毕业证美国本科成绩单制作【q薇1954292140】海外各大学Diploma版本,因为疫情学校推迟发放证书、证书原件丢失补办、没有正常毕业未能认证学历面临就业提供解决办法。当遭遇挂科、旷课导致无法修满学分,或者直接被学校退学,最后无法毕业拿不到毕业证。此时的你一定手足无措,因为留学一场,没有获得毕业证以及学历证明肯定是无法给自己和父母一个交代的。

【复刻旧金山艺术大学成绩单信封,Buy Academy of Art University Transcripts】

购买日韩成绩单、英国大学成绩单、美国大学成绩单、澳洲大学成绩单、加拿大大学成绩单(q微1954292140)新加坡大学成绩单、新西兰大学成绩单、爱尔兰成绩单、西班牙成绩单、德国成绩单。成绩单的意义主要体现在证明学习能力、评估学术背景、展示综合素质、提高录取率,以及是作为留信认证申请材料的一部分。

旧金山艺术大学成绩单能够体现您的的学习能力,包括旧金山艺术大学课程成绩、专业能力、研究能力。(q微1954292140)具体来说,成绩报告单通常包含学生的学习技能与习惯、各科成绩以及老师评语等部分,因此,成绩单不仅是学生学术能力的证明,也是评估学生是否适合某个教育项目的重要依据!

我们承诺采用的是学校原版纸张(原版纸质、底色、纹路)我们工厂拥有全套进口原装设备,特殊工艺都是采用不同机器制作,仿真度基本可以达到100%,所有成品以及工艺效果都可提前给客户展示,不满意可以根据客户要求进行调整,直到满意为止!

【主营项目】

一.旧金山艺术大学毕业证【q微1954292140】旧金山艺术大学成绩单、留信认证、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理国外各大学文凭(一对一专业服务,可全程监控跟踪进度)Collective Mining | Corporate Presentation - June 2025

Collective Mining | Corporate Presentation - June 2025Collective Mining

?

Collective Mining | Corporate Presentation - June 2025

To learn more, please visit our website: www.collectivemining.com OR Royalties Inc. - Major Asset Overview, June 2025

OR Royalties Inc. - Major Asset Overview, June 2025OR Royalties Inc.

?

OR Royalties Inc. - Major Asset Overview, June 2025网上可查学历Uni SiegenOffer德国锡根大学学历认证查询,Uni Siegen文凭

网上可查学历Uni SiegenOffer德国锡根大学学历认证查询,Uni Siegen文凭taqyed

?

鉴于此,办理Uni Siegen大学毕业证锡根大学毕业证书【q薇1954292140】留学一站式办理学历文凭直通车(锡根大学毕业证Uni Siegen成绩单原版锡根大学学位证假文凭)未能正常毕业?【q薇1954292140】办理锡根大学毕业证成绩单/留信学历认证/学历文凭/使馆认证/留学回国人员证明/录取通知书/Offer/在读证明/成绩单/网上存档永久可查!

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

【办理锡根大学成绩单Buy Universit?t Siegen Transcripts】

购买日韩成绩单、英国大学成绩单、美国大学成绩单、澳洲大学成绩单、加拿大大学成绩单(q微1954292140)新加坡大学成绩单、新西兰大学成绩单、爱尔兰成绩单、西班牙成绩单、德国成绩单。成绩单的意义主要体现在证明学习能力、评估学术背景、展示综合素质、提高录取率,以及是作为留信认证申请材料的一部分。

锡根大学成绩单能够体现您的的学习能力,包括锡根大学课程成绩、专业能力、研究能力。(q微1954292140)具体来说,成绩报告单通常包含学生的学习技能与习惯、各科成绩以及老师评语等部分,因此,成绩单不仅是学生学术能力的证明,也是评估学生是否适合某个教育项目的重要依据!LLense, Shad light on media content value

LLense, Shad light on media content valueNicolas Lee

?

Llense is an AI-powered platform that analyzes video content frame by frame to automatically identify characters, actions, emotions, and context. It transforms media catalogs into searchable, discoverable, and monetizable assets — enabling broadcasters, streamers, educators, and archives to unlock the hidden value of every scene.OR Royalties Inc. - Corporate Presentation, June 16, 2025

OR Royalties Inc. - Corporate Presentation, June 16, 2025OR Royalties Inc.

?

OR Royalties Inc. - Corporate Presentation, June 16, 2025最新版美国田纳西理工大学毕业证(罢罢鲍毕业证书)原版定制

最新版美国田纳西理工大学毕业证(罢罢鲍毕业证书)原版定制taqyea

?

2025原版田纳西理工大学毕业证书pdf电子版【q薇1954292140】美国毕业证办理TTU田纳西理工大学毕业证书多少钱?【q薇1954292140】海外各大学Diploma版本,因为疫情学校推迟发放证书、证书原件丢失补办、没有正常毕业未能认证学历面临就业提供解决办法。当遭遇挂科、旷课导致无法修满学分,或者直接被学校退学,最后无法毕业拿不到毕业证。此时的你一定手足无措,因为留学一场,没有获得毕业证以及学历证明肯定是无法给自己和父母一个交代的。

【复刻田纳西理工大学成绩单信封,Buy Tennessee Technological University Transcripts】

购买日韩成绩单、英国大学成绩单、美国大学成绩单、澳洲大学成绩单、加拿大大学成绩单(q微1954292140)新加坡大学成绩单、新西兰大学成绩单、爱尔兰成绩单、西班牙成绩单、德国成绩单。成绩单的意义主要体现在证明学习能力、评估学术背景、展示综合素质、提高录取率,以及是作为留信认证申请材料的一部分。

田纳西理工大学成绩单能够体现您的的学习能力,包括田纳西理工大学课程成绩、专业能力、研究能力。(q微1954292140)具体来说,成绩报告单通常包含学生的学习技能与习惯、各科成绩以及老师评语等部分,因此,成绩单不仅是学生学术能力的证明,也是评估学生是否适合某个教育项目的重要依据!

我们承诺采用的是学校原版纸张(原版纸质、底色、纹路)我们工厂拥有全套进口原装设备,特殊工艺都是采用不同机器制作,仿真度基本可以达到100%,所有成品以及工艺效果都可提前给客户展示,不满意可以根据客户要求进行调整,直到满意为止!

【主营项目】

一、工作未确定,回国需先给父母、亲戚朋友看下文凭的情况,办理毕业证|办理文凭: 买大学毕业证|买大学文凭【q薇1954292140】田纳西理工大学学位证明书如何办理申请?

二、回国进私企、外企、自己做生意的情况,这些单位是不查询毕业证真伪的,而且国内没有渠道去查询国外文凭的真假,也不需要提供真实教育部认证。鉴于此,办理美国成绩单田纳西理工大学毕业证【q薇1954292140】国外大学毕业证, 文凭办理, 国外文凭办理, 留信网认证Ad

Protective call

- 1. STRATEGY:PROTECTIVE CALL / SYNTHETIC LONG PUT R.NAGA SRINIVASARAO NAGA 1

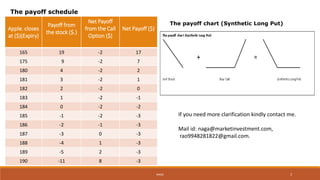

- 2. STRATEGY: PROTECTIVE CALL / SYNTHETIC LONG PUT This is a strategy wherein an investor has gone short on a stock future and buys a call to hedge. An investor shorts a stock future and buys an ATM or slightly OTM Call. In case the stock future price falls the investor gains in the downward fall in the price. However, incase there is an unexpected rise in the price of the stock the loss is limited. The pay-off from the Long Call will increase thereby compensating for the loss in value of the short stock future position. When to Use: If the investor is of the view that the markets will go down (bearish) but wants to protect against any unexpected rise in the price of the stock. Risk: Limited. Maximum Risk is Call Strike Price – Stock Price + Premium Reward: Maximum is Stock Price – Call Premium Breakeven: Stock Price – Call Premium Example : Suppose Apple stock. is trading at 184$ in June. An investor Mr. A buys a $185 call for 2$ while shorting the stock at $184. Strategy : Short Stock Future+ Buy Call Option Sells Stock future Current Market Price ($) 184 Buys Call Strike Price ($) 185 Mr. A pays Premium ($) 2 Break Even Point ($) (Stock Price – Call Premium) 182 NAGA 2

- 3. Apple. closes at ($)(Expiry) Payoff from the stock ($.) Net Payoff from the Call Option ($) Net Payoff ($) 165 19 -2 17 175 9 -2 7 180 4 -2 2 181 3 -2 1 182 2 -2 0 183 1 -2 -1 184 0 -2 -2 185 -1 -2 -3 186 -2 -1 -3 187 -3 0 -3 188 -4 1 -3 189 -5 2 -3 190 -11 8 -3 The payoff schedule The payoff chart (Synthetic Long Put) If you need more clarification kindly contact me. Mail id: naga@marketinvestment.com, rao9948281822@gmail.com. NAGA 3