Purchase Money 2nd Trust

0 likes122 views

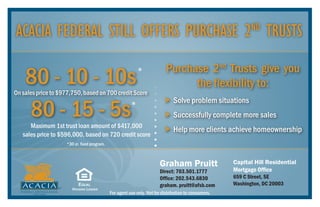

The document advertises that Acacia Federal Savings Bank offers purchase second trust loans, which provide borrowers flexible options with lower down payments of 80-10-10s or 80-15-5s and maximum first trust loan amounts of $417,000 or $596,000 depending on credit score. Purchase second trusts offer advantages for both clients, such as lower blended interest rates and no prepayment penalties, and realtors by providing a unique product and fast processing from a local lender.

1 of 2

Download to read offline

Ad

Recommended

Va Flyer

Va FlyerEffective Mortgage Company

╠²

This document summarizes the benefits of VA loans for veterans, reservists, active-duty personnel, and surviving spouses. Some key benefits include no down payment requirement, no cash reserves or application fees required, and no monthly mortgage insurance premiums. Borrowers may also qualify to finance closing costs or pay off some consumer debt. VA loans can be used to purchase a primary 1-4 unit home or refinance an existing loan, with some restrictions. The document provides contact information for a loan officer at Effective Mortgage Company to learn more about VA loan qualifications.Forfeiture of-deposit

Forfeiture of-depositsummitasegaran

╠²

The document discusses the concept of deposit and its forfeiture in contracts, emphasizing that a deposit serves as both a guarantee for performance and part payment towards the purchase price. It outlines the general rules regarding forfeiture, citing relevant legal cases that clarify when a deposit can be forfeited and the conditions under which courts may grant relief against forfeiture. Key points include the distinction between recoverable and non-recoverable deposits and the importance of explicit contractual language regarding deposits.Forfeiture of-deposit

Forfeiture of-depositsummitasegaran

╠²

The document discusses forfeiture of deposit in contracts. It defines what a deposit is and explains that deposits serve to guarantee performance and can be applied to the purchase price if the contract is completed. Forfeiture of a deposit occurs when a buyer breaches a contract. Generally, if a buyer does not go through with a purchase, their deposit will be forfeited to the seller as compensation for damages from the breach. The document also examines cases related to forfeiture of deposits and whether sellers must prove damages to forfeit deposits. It discusses issues around whether unpaid or unclear deposits can be forfeited and whether courts can provide equitable relief from forfeiture.CDO/ CDS: System Based on False Premises

CDO/ CDS: System Based on False PremisesDalila Benachenhou

╠²

The document discusses the flawed assumptions underlying collateralized debt obligations (CDOs) and credit default swaps (CDS) that contributed to the financial meltdown. It highlights the complexities of mortgage systems, the risks posed by fixed-rate contracts, and the reliance on faulty credit ratings. Key learnings emphasize that income should be a priority when purchasing homes, the reality of asset depreciation, and the inevitability of market corrections.HomePath Financing

HomePath Financing Michael Bon /NMLS #119781

╠²

HomePath is a Fannie Mae program that offers benefits to home buyers, including no mortgage insurance or appraisal costs. Through HomePath, buyers can find a variety of property types across the country, including condos, single family homes, and small multi-unit buildings. The program provides flexible financing options like fixed-rate and adjustable-rate mortgages. Buyers may qualify with less-than-perfect credit and as little as 10% down for investment or second homes. Maximum loan amounts and other restrictions apply.Bro Lorenzo Morgage

Bro Lorenzo Morgagegineva

╠²

Lorenzo Mortgage is a collection of lending professionals with 20 years of combined experience. They aim to satisfy client needs by getting loans approved quickly and closing them with kindness. Lorenzo understands that each client has individual needs and works to align financing solutions with those needs. They offer a variety of loan products from over 50 lenders to find clients the best rates and terms. Lorenzo prides itself on building lifelong relationships with clients through excellent customer service and loan products.All lenders not equal mni

All lenders not equal mniRichard Nabrzeski

╠²

This document discusses the benefits of choosing Mortgage Network, Inc. for financing a home. It states that Mortgage Network ensures customers receive honest answers, low rates, and excellent service. They pride themselves on creating a stress-free home financing experience. The document then lists several financing options Mortgage Network provides, such as programs for first-time home buyers, FHA/VA loans, jumbo loans, and more. It promotes Mortgage Network as the right lender to achieve home ownership.Todayhome mortgage

Todayhome mortgagejlcwritingservices

╠²

This document provides information about home loan and mortgage services from Today Home Solutions. It offers various mortgage products like home loans, private lending, refinancing, and loan modifications. It provides the contact information and a form to request free quotes. Interest rates on various mortgage products like 30-year fixed rate, 15-year fixed rate, FHA loans, and adjustable rate mortgages are also listed.The iServe Difference

The iServe DifferenceAllen Friedman

╠²

iServe offers clients many options for home financing including conventional, FHA, VA, USDA, jumbo, and fixed and ARM loans. They provide financing for credit scores down to 560, expanded debt-to-income ratios, investors with up to 10 properties, non-traditional credit, asset depletion, and portfolio underwriting. iServe also offers the ability to broker loans and a 2-week financing guarantee.FHA Loan Overview

FHA Loan Overviewam054433

╠²

The document provides an overview of the Federal Housing Administration (FHA) mortgage loan program. It discusses that FHA provides mortgage insurance for loans made by approved lenders to help first-time and low-income borrowers get homes. It notes that FHA loans have lower down payment and credit score requirements, making it easier for buyers to qualify and for lenders to sell more homes. The document also outlines some of the key advantages and options of FHA loans compared to other types of loans.Mortgage Allies

Mortgage AlliesJacques du Preez

╠²

Jacques du Preez is an independent mortgage broker with 25 years of experience. He is licensed with Mortgage Edge and registered with the Financial Services Commission of Ontario. He specializes in residential, commercial, construction, and asset financing mortgages. As a broker, he has access to over 30 lenders and can provide the best rates, credit protection, and personalized service. His goal is to empower clients and help them achieve financial freedom and debt freedom based on their unique needs and future plans.Mortgage allies

Mortgage alliesJacques du Preez

╠²

Jacques du Preez is an independent mortgage broker with 25 years of experience. He is licensed with Mortgage Edge and registered with the Financial Services Commission of Ontario. He specializes in residential, commercial, construction, and asset financing mortgages. As a broker, he has access to over 30 lenders and can provide the best rates, credit protection, and personalized service. His goal is to empower clients and help them achieve financial freedom and debt freedom based on their unique needs and future plans.2 eric billock blank_fast fha

2 eric billock blank_fast fhaImortgage

╠²

This document summarizes the benefits of an FHA loan from imortgage, including down payments as low as 3.5%, low minimum credit scores, financing for 1-4 unit owner-occupied residences, allowed gifts and non-occupant co-signors, 6% seller concessions, and loans not lowered in declining markets. It states that imortgage can close FHA loans within 30 days and offers contact information for Justin Sorsabal and Eric Billock to get more information or help finding an appropriate loan program.Realtors Recent Industry Changes 0909 B Kelly

Realtors Recent Industry Changes 0909 B KellyBill Kelly

╠²

The document summarizes recent changes to the mortgage industry, including the Home Valuation Code of Conduct (HVCC) which prevents loan officers from selecting appraisers, the Mortgage Disclosure Improvement Act (MDIA) which requires new Truth-in-Lending disclosures if loan terms change, updated condo financing guidelines, and the impact of credit scores on interest rates and costs. It promotes using Mortgage Network for their expertise navigating these changes and providing financing solutions.Reverse Mortgage Seminar

Reverse Mortgage SeminarTerry Cronin

╠²

The document summarizes a Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage, which allows senior homeowners to convert home equity into tax-free cash without having to make monthly mortgage payments. Key points covered include: who qualifies for a HECM, how the loan amount is calculated, interest rates, flexible payment options, and the application process. The summary emphasizes that a HECM allows seniors to access home equity for retirement needs while continuing to live in their home.Homepath Financing

Homepath FinancingMichael Bon /NMLS #119781

╠²

Fannie Mae's HomePath program offers affordable home loans for purchasing REO properties with minimum down payments as low as 3-5% and flexible terms. Borrowers may qualify for fixed-rate or adjustable-rate mortgages within conforming or high-balance loan limits even with less than perfect credit. The program provides homes with no mortgage insurance or appraisal requirements. Contact a HomePath authorized lender like Mortgage Advisory Group for current special incentives from Fannie Mae.Types Of Loans Flyer

Types Of Loans FlyerMaggie Adymin

╠²

This document provides information about the various home loan programs offered by Mortgage Advisory Group. It summarizes their conventional, high balance, USDA, VA, reverse mortgage, FHA Streamline 203(k), and FHA loan options. The document encourages readers who are thinking about a home loan or refinancing to contact their mortgage advisor for a free consultation to find a program that fits their needs.Types of loans flyer

Types of loans flyerMaggie Adymin

╠²

This document provides information about the various home loan programs offered by Mortgage Advisory Group. It summarizes their conventional, high balance, USDA, VA, reverse mortgage, FHA Streamline 203(k), and FHA loan options. The document encourages readers who are thinking about a home loan or refinancing to contact their mortgage advisor for a free consultation to find a program that fits their needs.Realtor conventional vs government comparison flyer

Realtor conventional vs government comparison flyerRichard Nabrzeski

╠²

This document summarizes different mortgage options that provide choices for home buyers. It outlines key features of conventional, FHA, VA, and USDA Rural Housing loans including down payment amounts, loan-to-value ratios, credit score and debt-to-income requirements. It encourages contacting the author for more details on how these programs can help clients.Spring training 20 years flyer

Spring training 20 years flyerRichard Nabrzeski

╠²

This document is an advertisement for mortgage services from a company called Mortgage Network. It summarizes that they offer:

1) Local decision making to streamline the mortgage process from application to closing.

2) Competitive low rates.

3) A variety of mortgage programs including those for first time home buyers, low down payment options, VA loans, refinancing, jumbo loans, second homes, reverse mortgages, commercial loans, and specialized programs.FHA VA Loans What Agents Need To Know

FHA VA Loans What Agents Need To KnowJTtheCoach.com

╠²

The document outlines educational courses approved for credit by the California Department of Real Estate, emphasizing that such approval does not endorse the course sponsors' views. It provides historical context about the Federal Housing Administration (FHA), its goals, and the differences between FHA and conventional loans, including credit guidelines and loan requirements. Additionally, it includes refinancing options and resources for distressed homeowners and mentions the application of FHA loans for buying and rehabilitating homes.regions Citigroup Napa_20080521

regions Citigroup Napa_20080521finance25

╠²

This document summarizes Citigroup's presentation on housing market trends, challenges in the financial industry, and Regions Bank's strategies to mitigate risks. It shows declining home sales and rising median home prices. Regions has avoided risky mortgages and investments. It focuses on commercial and consumer real estate loans, especially loans to homebuilders, condominiums, and home equity which require active management due to market conditions.regions Citigroup Napa_20080521

regions Citigroup Napa_20080521finance25

╠²

This document summarizes Citigroup's presentation on housing market trends, challenges in the financial industry, and Regions Bank's strategies to mitigate risks. It shows that while housing sales and prices declined, Regions has avoided risky mortgages and investments. The presentation outlines Regions' plans to actively manage problem areas like its residential homebuilder, condo, and home equity portfolios through tightened underwriting, collections efforts, and focused resources.Personalized Mortgage Plan Benefits

Personalized Mortgage Plan BenefitsPeter Boyle

╠²

The document provides a total cost analysis for Donny Osmond comparing multiple mortgage options. It includes:

1) A summary table comparing up to four mortgage programs on key data points like loan amounts, interest rates, and monthly payments.

2) An analysis of the total cost of each program over time, including fees, to help select the lowest cost option rather than just the lowest monthly payment.

3) A mortgage plan to help understand how each option impacts goals like paying off the loan early or increasing equity and savings over time. It also estimates potential tax benefits to factor into the decision.

The analysis is meant to help the homeowner make an informed choice by understanding the true long-termIt Pays to Buy Now!

It Pays to Buy Now!Tom Cryer

╠²

The document discusses the Federal Home Buyer Tax Credit and encourages readers to take advantage of it before it expires. It provides details on tax credits of up to $8,000 for first-time buyers and $6,500 for repeat buyers. It notes that contracts must be in effect by April 30th and close by June 30th, 2010 to qualify. It also mentions that housing affordability is high and interest rates are low, making it a good time to buy or sell a home.Rural housing affordable loan flyer

Rural housing affordable loan flyerRichard Nabrzeski

╠²

This document summarizes the benefits of the Rural Housing Program, which provides financing options for moderate, low, and very low income borrowers who may not otherwise qualify for conventional or FHA loans. The program offers 30-year fixed rate financing with no down payment or monthly mortgage insurance required. It allows for 100% gift funds and financing of closing costs. Borrowers must meet county income limits and the property must be in an eligible rural area intended for primary residence use only.Rural housing affordable loan flyer

Rural housing affordable loan flyerRichard Nabrzeski

╠²

This document summarizes the benefits of the Rural Housing Program, which provides financing options for moderate, low, and very low income borrowers who may not otherwise qualify for conventional or FHA loans. The program offers 30-year fixed rate financing with no down payment or monthly mortgage insurance required. It allows for 100% gift funds and financing of closing costs. Borrowers must meet county income limits and the property must be in an eligible rural area intended for primary residence use only.Market Monitor 04 01 11

Market Monitor 04 01 11John Cranstoun

╠²

The document summarizes a CNN article that outlines how refinancing a mortgage into a 15-year term at a lower interest rate can save $50,000 over 9 years compared to a 30-year term. It provides an example of how refinancing a $280,000 loan with 25 years remaining into a 15-year term at 4.375% interest could save $175,000 in interest versus keeping the 30-year term at 5.125% interest. It notes that while this strategy is effective, borrowers must be able to qualify and have sufficient equity. For those who cannot afford higher monthly payments, refinancing into a 20-year term could still save $44,000 over 10 yearsMore Related Content

Similar to Purchase Money 2nd Trust (20)

The iServe Difference

The iServe DifferenceAllen Friedman

╠²

iServe offers clients many options for home financing including conventional, FHA, VA, USDA, jumbo, and fixed and ARM loans. They provide financing for credit scores down to 560, expanded debt-to-income ratios, investors with up to 10 properties, non-traditional credit, asset depletion, and portfolio underwriting. iServe also offers the ability to broker loans and a 2-week financing guarantee.FHA Loan Overview

FHA Loan Overviewam054433

╠²

The document provides an overview of the Federal Housing Administration (FHA) mortgage loan program. It discusses that FHA provides mortgage insurance for loans made by approved lenders to help first-time and low-income borrowers get homes. It notes that FHA loans have lower down payment and credit score requirements, making it easier for buyers to qualify and for lenders to sell more homes. The document also outlines some of the key advantages and options of FHA loans compared to other types of loans.Mortgage Allies

Mortgage AlliesJacques du Preez

╠²

Jacques du Preez is an independent mortgage broker with 25 years of experience. He is licensed with Mortgage Edge and registered with the Financial Services Commission of Ontario. He specializes in residential, commercial, construction, and asset financing mortgages. As a broker, he has access to over 30 lenders and can provide the best rates, credit protection, and personalized service. His goal is to empower clients and help them achieve financial freedom and debt freedom based on their unique needs and future plans.Mortgage allies

Mortgage alliesJacques du Preez

╠²

Jacques du Preez is an independent mortgage broker with 25 years of experience. He is licensed with Mortgage Edge and registered with the Financial Services Commission of Ontario. He specializes in residential, commercial, construction, and asset financing mortgages. As a broker, he has access to over 30 lenders and can provide the best rates, credit protection, and personalized service. His goal is to empower clients and help them achieve financial freedom and debt freedom based on their unique needs and future plans.2 eric billock blank_fast fha

2 eric billock blank_fast fhaImortgage

╠²

This document summarizes the benefits of an FHA loan from imortgage, including down payments as low as 3.5%, low minimum credit scores, financing for 1-4 unit owner-occupied residences, allowed gifts and non-occupant co-signors, 6% seller concessions, and loans not lowered in declining markets. It states that imortgage can close FHA loans within 30 days and offers contact information for Justin Sorsabal and Eric Billock to get more information or help finding an appropriate loan program.Realtors Recent Industry Changes 0909 B Kelly

Realtors Recent Industry Changes 0909 B KellyBill Kelly

╠²

The document summarizes recent changes to the mortgage industry, including the Home Valuation Code of Conduct (HVCC) which prevents loan officers from selecting appraisers, the Mortgage Disclosure Improvement Act (MDIA) which requires new Truth-in-Lending disclosures if loan terms change, updated condo financing guidelines, and the impact of credit scores on interest rates and costs. It promotes using Mortgage Network for their expertise navigating these changes and providing financing solutions.Reverse Mortgage Seminar

Reverse Mortgage SeminarTerry Cronin

╠²

The document summarizes a Home Equity Conversion Mortgage (HECM), also known as a reverse mortgage, which allows senior homeowners to convert home equity into tax-free cash without having to make monthly mortgage payments. Key points covered include: who qualifies for a HECM, how the loan amount is calculated, interest rates, flexible payment options, and the application process. The summary emphasizes that a HECM allows seniors to access home equity for retirement needs while continuing to live in their home.Homepath Financing

Homepath FinancingMichael Bon /NMLS #119781

╠²

Fannie Mae's HomePath program offers affordable home loans for purchasing REO properties with minimum down payments as low as 3-5% and flexible terms. Borrowers may qualify for fixed-rate or adjustable-rate mortgages within conforming or high-balance loan limits even with less than perfect credit. The program provides homes with no mortgage insurance or appraisal requirements. Contact a HomePath authorized lender like Mortgage Advisory Group for current special incentives from Fannie Mae.Types Of Loans Flyer

Types Of Loans FlyerMaggie Adymin

╠²

This document provides information about the various home loan programs offered by Mortgage Advisory Group. It summarizes their conventional, high balance, USDA, VA, reverse mortgage, FHA Streamline 203(k), and FHA loan options. The document encourages readers who are thinking about a home loan or refinancing to contact their mortgage advisor for a free consultation to find a program that fits their needs.Types of loans flyer

Types of loans flyerMaggie Adymin

╠²

This document provides information about the various home loan programs offered by Mortgage Advisory Group. It summarizes their conventional, high balance, USDA, VA, reverse mortgage, FHA Streamline 203(k), and FHA loan options. The document encourages readers who are thinking about a home loan or refinancing to contact their mortgage advisor for a free consultation to find a program that fits their needs.Realtor conventional vs government comparison flyer

Realtor conventional vs government comparison flyerRichard Nabrzeski

╠²

This document summarizes different mortgage options that provide choices for home buyers. It outlines key features of conventional, FHA, VA, and USDA Rural Housing loans including down payment amounts, loan-to-value ratios, credit score and debt-to-income requirements. It encourages contacting the author for more details on how these programs can help clients.Spring training 20 years flyer

Spring training 20 years flyerRichard Nabrzeski

╠²

This document is an advertisement for mortgage services from a company called Mortgage Network. It summarizes that they offer:

1) Local decision making to streamline the mortgage process from application to closing.

2) Competitive low rates.

3) A variety of mortgage programs including those for first time home buyers, low down payment options, VA loans, refinancing, jumbo loans, second homes, reverse mortgages, commercial loans, and specialized programs.FHA VA Loans What Agents Need To Know

FHA VA Loans What Agents Need To KnowJTtheCoach.com

╠²

The document outlines educational courses approved for credit by the California Department of Real Estate, emphasizing that such approval does not endorse the course sponsors' views. It provides historical context about the Federal Housing Administration (FHA), its goals, and the differences between FHA and conventional loans, including credit guidelines and loan requirements. Additionally, it includes refinancing options and resources for distressed homeowners and mentions the application of FHA loans for buying and rehabilitating homes.regions Citigroup Napa_20080521

regions Citigroup Napa_20080521finance25

╠²

This document summarizes Citigroup's presentation on housing market trends, challenges in the financial industry, and Regions Bank's strategies to mitigate risks. It shows declining home sales and rising median home prices. Regions has avoided risky mortgages and investments. It focuses on commercial and consumer real estate loans, especially loans to homebuilders, condominiums, and home equity which require active management due to market conditions.regions Citigroup Napa_20080521

regions Citigroup Napa_20080521finance25

╠²

This document summarizes Citigroup's presentation on housing market trends, challenges in the financial industry, and Regions Bank's strategies to mitigate risks. It shows that while housing sales and prices declined, Regions has avoided risky mortgages and investments. The presentation outlines Regions' plans to actively manage problem areas like its residential homebuilder, condo, and home equity portfolios through tightened underwriting, collections efforts, and focused resources.Personalized Mortgage Plan Benefits

Personalized Mortgage Plan BenefitsPeter Boyle

╠²

The document provides a total cost analysis for Donny Osmond comparing multiple mortgage options. It includes:

1) A summary table comparing up to four mortgage programs on key data points like loan amounts, interest rates, and monthly payments.

2) An analysis of the total cost of each program over time, including fees, to help select the lowest cost option rather than just the lowest monthly payment.

3) A mortgage plan to help understand how each option impacts goals like paying off the loan early or increasing equity and savings over time. It also estimates potential tax benefits to factor into the decision.

The analysis is meant to help the homeowner make an informed choice by understanding the true long-termIt Pays to Buy Now!

It Pays to Buy Now!Tom Cryer

╠²

The document discusses the Federal Home Buyer Tax Credit and encourages readers to take advantage of it before it expires. It provides details on tax credits of up to $8,000 for first-time buyers and $6,500 for repeat buyers. It notes that contracts must be in effect by April 30th and close by June 30th, 2010 to qualify. It also mentions that housing affordability is high and interest rates are low, making it a good time to buy or sell a home.Rural housing affordable loan flyer

Rural housing affordable loan flyerRichard Nabrzeski

╠²

This document summarizes the benefits of the Rural Housing Program, which provides financing options for moderate, low, and very low income borrowers who may not otherwise qualify for conventional or FHA loans. The program offers 30-year fixed rate financing with no down payment or monthly mortgage insurance required. It allows for 100% gift funds and financing of closing costs. Borrowers must meet county income limits and the property must be in an eligible rural area intended for primary residence use only.Rural housing affordable loan flyer

Rural housing affordable loan flyerRichard Nabrzeski

╠²

This document summarizes the benefits of the Rural Housing Program, which provides financing options for moderate, low, and very low income borrowers who may not otherwise qualify for conventional or FHA loans. The program offers 30-year fixed rate financing with no down payment or monthly mortgage insurance required. It allows for 100% gift funds and financing of closing costs. Borrowers must meet county income limits and the property must be in an eligible rural area intended for primary residence use only.Market Monitor 04 01 11

Market Monitor 04 01 11John Cranstoun

╠²

The document summarizes a CNN article that outlines how refinancing a mortgage into a 15-year term at a lower interest rate can save $50,000 over 9 years compared to a 30-year term. It provides an example of how refinancing a $280,000 loan with 25 years remaining into a 15-year term at 4.375% interest could save $175,000 in interest versus keeping the 30-year term at 5.125% interest. It notes that while this strategy is effective, borrowers must be able to qualify and have sufficient equity. For those who cannot afford higher monthly payments, refinancing into a 20-year term could still save $44,000 over 10 yearsPurchase Money 2nd Trust

- 1. ACACIA FEDERAL STILL OFFERS PURCHASE 2ND TRUSTS Purchase 2nd Trusts give you 80 - 10 - 10s On sales price to $977,750, based on 700 credit Score * the flexibility to: 80 - 15 - 5s h Solve problem situations * h Successfully complete more sales Maximum 1st trust loan amount of $417,000 h Help more clients achieve homeownership sales price to $596,000, based on 720 credit score *30-yr. fixed program. Graham Pruitt Capital Hill Residential Direct: 703.501.1777 Mortgage Office Office: 202.543.6830 659 C Street, SE Equal graham. pruitt@afsb.com Washington, DC 20003 SM Housing lEndEr FEDERAL SAVINGS BANK A UNIFI Company For agent use only. Not for distribution to consumers.

- 2. Advantages of Purchase 2nd Trust Loans For the Client: h Lower down payment option h Ability to write off interest in many cases  Avoid Private Mortage Insurance h No prepayment penalty -- 2nd can be paid off at any time  Avoid FHA up-front and monthly fees h Lower blended interest rate For YOU, the realtor: h A unique product to add to your offerings h Work with a local lender with in-house processing and underwriting h Flexible option for borrowers with good credit and more cash h Great service and fast turnaround on purchase transactions h Option for non-FHA approved condos