Q & a income from other sources

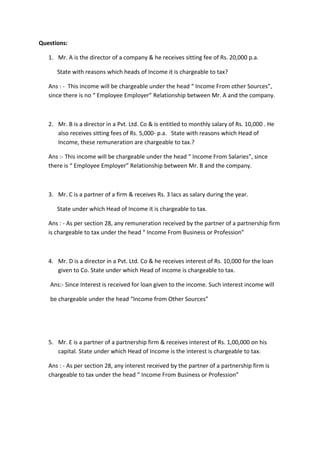

- 1. Questions: 1. Mr. A is the director of a company & he receives sitting fee of Rs. 20,000 p.a. State with reasons which heads of Income it is chargeable to tax? Ans : - This income will be chargeable under the head ŌĆ£ Income From other SourcesŌĆØ, since there is no ŌĆ£ Employee EmployerŌĆØ Relationship between Mr. A and the company. 2. Mr. B is a director in a Pvt. Ltd. Co & is entitled to monthly salary of Rs. 10,000 . He also receives sitting fees of Rs. 5,000- p.a. State with reasons which Head of Income, these remuneration are chargeable to tax.? Ans :- This income will be chargeable under the head ŌĆ£ Income From SalariesŌĆØ, since there is ŌĆ£ Employee EmployerŌĆØ Relationship between Mr. B and the company. 3. Mr. C is a partner of a firm & receives Rs. 3 lacs as salary during the year. State under which Head of Income it is chargeable to tax. Ans : - As per section 28, any remuneration received by the partner of a partnership firm is chargeable to tax under the head ŌĆ£ Income From Business or ProfessionŌĆØ 4. Mr. D is a director in a Pvt. Ltd. Co & he receives interest of Rs. 10,000 for the loan given to Co. State under which Head of income is chargeable to tax. Ans:- Since Interest is received for loan given to the income. Such interest income will be chargeable under the head ŌĆ£Income from Other SourcesŌĆØ 5. Mr. E is a partner of a partnership firm & receives interest of Rs. 1,00,000 on his capital. State under which Head of Income is the interest is chargeable to tax. Ans : - As per section 28, any interest received by the partner of a partnership firm is chargeable to tax under the head ŌĆ£ Income From Business or ProfessionŌĆØ

- 2. 6. Ms. F an actress receives Rs. 1 crore as a prize money for winning Big Boss. State under which Head of income is this chargeable to tax. Ans:- Winning of any TV show is in nature of any chance game, lottery, puzzles etc. Therefore it is chargeable to tax under the head ŌĆ£Income From other SourcesŌĆØ 7. Ms. G, an actress participated in Big Boss she didnŌĆÖt win the event but received Rs. 12 lakhs for 45 days participating in the program. State under which Head of income is this chargeable to tax. Ans:- Income received in present case is for acting in the show and earned in the professional capacity. Thus, it will be chargeable under the head ŌĆ£Income From Business or ProfessionŌĆØ. 8. Mr. H receives family pension of Rs. 42,000. State under which Head of Income is this income chargeable to tax & amt of deduction available. Ans:- Family pension is chargeable to tax under the head ŌĆ£ Income From Other SourcesŌĆØ. 9. Mr. I receives the following interest & Divided income. 1. Dividend from Indian co. Rs. 10,000 2. Divided from Foreign co. Rs. 20,000 3. Divided from Co.-operative Bank Rs. 25,000 4. Interest on PPF A/c Rs. 50,000 State the taxable amt under the income from other source Ans:- 1. Dividend received from an Indian Company is exempted under the section 10(34) 2. Dividend from Foreign Company is taxable 3. Dividend from the Co-operative Bank is taxable

- 3. 4. Interest on PPF is exempted under the Sec 10 (50) Therefore, the total amount taxable is Rs. 45,000 10. Mr. I is a part- time author of various books on management principles the receives Royalty of Rs. 3 Lakhs. State the head under which the same will be taxable. Ans:- Mr. I is a part time author, so income received from her as a part of royalty for writing of book will be taxable under the head ŌĆ£ Income From Other SourcesŌĆØ. 11. Mr. K receives 3 gifts Rs. 15,000 each on the occasion of his BŌĆÖday from his friends. State the taxable amt of gift. Ans:- The Total Amount of gifts received by him is Rs 45,000 which is less than the amount eligible for gift tax i.e. Rs. 50,000. Hence, the entire amount will be exempted from tax. 12. Mr. L receives 3 gifts of Rs. 18,000 each from his friends on the occasion of marriage anniversary. State the taxable amount of Gift Ans:- The Total Amount of gifts received by him is Rs 54,000 which is more than the amount eligible for gift tax i.e. Rs. 50,000. Hence, the entire amount will be taxable under the head ŌĆ£Income from Other SourcesŌĆØ. 13. Mr. M receives 5 gifts of Rs. 18,000 each on the occasion of purchase of new house. Out of which 3 are from relatives. State the Taxable Amount of Gift Ans :- Gifts received from Relatives is not chargeable to tax. The other gifts total only Rs. 36,000. This is less than Rs. 50,000. Therefore, the entire amount is taxable. 14. Mr. N receives 10 gifts of Rs. 15,000 each on marriage. Out of which 4 are from relatives. State the Taxable Amount of Gift Ans:- Entire Amount Received on the occasion of Marriage is not Chargeable to Tax. 15. Mr. O receives laptop as a gift from his friend on the occasion of New Year. Laptop is worth Rs. 60,000 State the taxable amount of gift.

- 4. Ans:- The entire amount is taxable under the head ŌĆ£ Income From other SourcesŌĆØ as the gift received is of the higher amount than the limit specified. 16. Mr. P receives the following gifts, 1. Rs. 40,000 from his friends 2. Rs. 30,000 from his daughter 3. Rs. 25,000 from his sister 4. Rs. 15,000 from his sisterŌĆÖs son. Calculate taxable amt of gift. Ans:- ŌĆ£ Gifts Received From RelativesŌĆØ is not chargeable to tax. As per the definition of income Tax Act, daughter and sister are relatives. However, sisterŌĆÖs son is not a relative. Therefore, total taxable gift received during the year is Rs. 55,000 which exceeds Rs. 50,000. Therefore, the entire amount of Rs. 55,000 is chargeable to tax.