Quantitative Modeling and Trading

Download as ppt, pdf1 like236 views

This document outlines objectives and critical success factors for a high frequency quantitative modeling and trading project in US stocks. The goals are to achieve optimal time frame modeling to generate revenue. Key factors are availability of tools, liquid stock tick data, and software. The approach is to establish an environment, explore models combining industry and academic approaches, and generate revenue. Examples include Engle models, Bayesian inference, particle filtering, and microstructure applications. Next steps are to set up the environment, explore promising models, and use Engle and other approaches.

1 of 7

Download to read offline

Ad

Recommended

Collaborative Filtering - MF, NCF, NGCF

Collaborative Filtering - MF, NCF, NGCFPark JunPyo

╠²

This document discusses neural graph collaborative filtering. It begins with an overview of recommender systems and collaborative filtering. It then discusses latent factor models, including matrix factorization and neural collaborative filtering (NCF). A key development was neural graph collaborative filtering (NGCF), which uses graph neural networks to model high-order connectivity in the user-item graph to address sparsity issues. NGCF aims to learn better embeddings by propagating user and item information through the graph.Session-based recommendations with recurrent neural networks

Session-based recommendations with recurrent neural networksZimin Park

╠²

This document summarizes a research paper on using recurrent neural networks for session-based recommendations. Some key points:

- RNNs were first used for session-based recommendations to address issues with previous methods that only considered the last item in a session. RNNs can capture how a session evolves over time.

- The model architecture uses GRU units in a recurrent layer. Sessions are handled independently in mini-batches to account for different session lengths.

- Sampling is used on model outputs since scoring all items is impractical. Ranking loss functions like Bayesian personalized ranking are used to optimize for ranking.

- Experiments on e-commerce and YouTube datasets show the RNN model outperforms baselines likeUniversity of Missouri-Columbia, Frequent Hierarchical Pattern (FHP) Tree

University of Missouri-Columbia, Frequent Hierarchical Pattern (FHP) Treekphodel

╠²

The document outlines a novel data mining methodology using a frequent hierarchical pattern (FHP) tree, developed by researchers at the University of Missouri-Columbia, to efficiently process dynamic datasets with large numbers of unique items. This persistent, dynamic data tree allows real-time data processing without full reprocessing, beneficial for applications such as electronic medical records. The technology is in the early stage of development, with a provisional patent filed and intentions to further refine the system with various auxiliary functions.Bpr bayesian personalized ranking from implicit feedback

Bpr bayesian personalized ranking from implicit feedbackPark JunPyo

╠²

This document discusses recommendation systems and the Bayesian Personalized Ranking (BPR) framework. It introduces the goal of recommendation systems to increase product sales through relevance, novelty, serendipity and diversity. It also discusses different recommendation approaches, including collaborative filtering, content-based filtering and knowledge-based filtering. A key part of the document is describing the BPR framework, which uses a Bayesian approach to learn a personalized ranking model from implicit feedback data. It formalizes the recommendation problem as optimizing a posterior distribution over the preferences of users through matrix factorization.Econ1 Objectives Test Questions

Econ1 Objectives Test Questionstutor2u

╠²

Objective test questions for AQA economics exams provide the following advice:

- Bring a calculator and draw diagrams as needed to complete 25 multiple choice questions in 20-22 minutes, with about 8 questions each on supply and demand and market failure/government intervention and 3-4 on elasticities.

- For supported multiple choice questions with EdExcel, select the correct option for 1 mark and provide explanations for up to 3 additional marks, using techniques like defining terms and drawing supply and demand diagrams.

- When answering supported multiple choice questions for EdExcel, candidates should define key terms, consider the underlying economic concept, apply information like tax effects, and be prepared to annotate diagrams, tables, and show workings for percentages or calculationsPredictive Analytics within the Analytics Value Chain

Predictive Analytics within the Analytics Value ChainJack Lampka

╠²

This document discusses predictive analytics and the role of leaders in interacting with data and analytics. It describes the analytics value chain from data to decisions, including descriptive analytics to understand what happened, predictive analytics to understand why things happened and what may happen in the future, and business decisions informed by analytics. It also discusses different predictive analytics methods appropriate for different stages of a product's life cycle and the importance of leaders understanding limitations and biases that can occur in analytics.A quantitative approach to tactical asset allocation (2014)

A quantitative approach to tactical asset allocation (2014)Park JunPyo

╠²

This document discusses quantitative tactical asset allocation strategies. It summarizes research on using simple moving average (SMA) crossovers to time exposure to various asset classes like stocks, bonds, commodities and real estate. Implementing a global tactical asset allocation (GTAA) approach based on 10-month SMA crossovers achieved equity-like returns with lower volatility and drawdowns compared to a static allocation. Adding alternative weighting schemes like relative strength could further improve risk-adjusted returns. While effective historically, momentum strategies struggled in the 2010s and require ongoing testing with different parameters and asset classes.Predictive Analytics and Strategic Enrolment Management

Predictive Analytics and Strategic Enrolment Managementsboyle69

╠²

The document discusses the strategic importance of forecasting enrolments in education through auto-regressive integrated moving average (ARIMA) models, detailing the forecasting process and model adequacy analysis. It presents methods for quantifying accuracy and uncertainty while applying forecasts in developing enrolment budgets and scheduling. Additionally, it outlines future enrolment planning initiatives and targets for academic and career advising, sales functions, and learner retention.Resume_Zhengbo_Zhu_two page

Resume_Zhengbo_Zhu_two pageZhengbo (Daniel) Zhu

╠²

Zhengbo Zhu is seeking a summer intern position in quantitative finance. He has a PhD in industrial engineering from Purdue University with a specialization in operations research, and a BS in automation from Tsinghua University. He has experience in equity research, trading, quantitative finance, and empirical finance. He is proficient in C++, MATLAB, R, and SAS.Stock Market Analysis

Stock Market AnalysisGabriel Policiuc

╠²

This document outlines an approach to using machine learning algorithms like hidden Markov models to predict stock prices. It discusses how technical analysis and increasing computational power allows algorithms to analyze large datasets. Human analysis is still important for interpretation. The document then provides an overview of using a hidden Markov model to account for different strategies in the stock market and modeling price data more accurately over time.Internship presentation

Internship presentationnikita kapil

╠²

This document discusses various data science problems in financial domains and the techniques used to solve them. It covers machine learning techniques like clustering for portfolio diversification analysis and regression for fundamental analysis. It also discusses libraries like Pandas for data exploration and Matplotlib/Seaborn for visualization. Modern portfolio theory and its use of efficient frontiers is also summarized. Finally, applications of machine learning like recommendations and predictions are mentioned.Trading Analytics

Trading AnalyticsRoryWinston1

╠²

The document discusses the evolution of the trading business, highlighting the transformation from manual processes to automated, analytics-driven operations. It emphasizes the importance of quantitative techniques, coding skills, and analytics infrastructure to manage enormous data volumes and improve trading strategies. Key case studies include pricing models, risk management, client analytics, and algorithmic trading, underscoring the necessity of domain knowledge and data integrity for successful trading outcomes.shailesh_resume

shailesh_resumeshailesh kumar

╠²

Shailesh Kumar has over 17 years of experience in quantitative modeling, statistical modeling, and statistical analysis using Python. He has a M.Sc. in Mathematics from IIT Delhi and has worked at BNP Paribas as an Associate on statistical arbitrage strategies and developing models. Some of his projects include developing stochastic volatility and correlation models, pair trading strategies, and analyzing the impact of news and trades on market returns. He also has 7 years of teaching experience in mathematics, statistics, and operations research.Building A Trading Desk On Analytics

Building A Trading Desk On AnalyticsRory Winston

╠²

This document discusses how analytics are used in modern electronic trading businesses. It provides an overview of how the trading business has evolved from manual to highly automated and analytics-driven. It describes the infrastructure needed to support analytics, including high-performance databases and quantitative modeling tools. It then gives examples of how analytics are applied to pricing, hedging, client analysis, and algorithmic trading through quantitative models trained on large datasets. Key challenges discussed include managing large data volumes and market volatility. The document emphasizes the importance of domain expertise, data quality, and simple yet effective quantitative models.Big Data, Machine Learning and Capital Markets

Big Data, Machine Learning and Capital MarketsPrabhat Vaish

╠²

This document discusses how big data and machine learning can be applied in capital markets. It provides an overview of capital markets and their data needs. It then discusses how the volume, velocity, and variety of data in capital markets poses big data challenges. A use case is presented on using big data and machine learning for trader surveillance to detect market manipulation. Another use case discusses using historical market data and machine learning for risk analytics like calculating Value at Risk. The document outlines some challenges in implementing big data and machine learning solutions and potential areas of implementation in capital markets.MLX 2018 - Marcos López de Prado, Lawrence Berkeley National Laboratory Comp...

MLX 2018 - Marcos López de Prado, Lawrence Berkeley National Laboratory Comp...Mehdi Merai Ph.D.(c)

╠²

This document discusses the common failures in machine learning funds, highlighting seven key pitfalls that contribute to their high failure rate. It emphasizes the need for collaborative teamwork in developing investment strategies, as opposed to siloed efforts by individual quantitative portfolio managers. The author advocates for a meta-strategy paradigm wherein tasks are divided and specialized to enhance strategy development and success.Stock-market-prediction.pptx

Stock-market-prediction.pptxrikritiKoirala1

╠²

This document presents a project that aims to predict stock market prices using multiple linear regression. It introduces the topic, defines the objective, reviews relevant literature on stock market prediction techniques, and outlines the system architecture, data collection process, and algorithm used. The project implements a linear regression model to predict closing stock prices based on historical data on opening, high, low, and closing prices and trading volumes. It evaluates the model using mean absolute error and tests the system through unit, integration, and system testing. The conclusion states that the predicted data can help analyze company stock performance in the market.RETRIEVING FUNDAMENTAL VALUES OF EQUITY

RETRIEVING FUNDAMENTAL VALUES OF EQUITYIRJET Journal

╠²

The document describes a system that retrieves and analyzes fundamental values of equity for companies to help users make informed investment decisions. It uses machine learning, specifically an LSTM model, to gather data on market cap, earnings, stock prices and other metrics from financial websites via APIs. This information is displayed to users who search for a company. The system also predicts future stock price movements based on historical data to guide investors. It was implemented using APIs, JSON, Node.js, and an LSTM neural network trained on stock market data from Yahoo Finance.Research aspects in high frequency trading

Research aspects in high frequency tradingGaurav Chakravorty

╠²

This document discusses some of the challenging aspects of high frequency trading (HFT) and potential areas for academic or industrial research. It notes that the essence of HFT is to react quickly to incoming market data in order to make markets more efficient. However, this requires dealing with an infinite number of possible inputs, hidden inputs from other participants, and the need for extreme speed. The document then outlines some specific modular research aspects, including automated feature learning from market data, using deep learning to identify patterns in price and time movements, developing optimal loss functions, quantifying the value of speed, optimizing computer architectures for speed, and applying signal processing methods to clean noisy market data.How to design quant trading strategies using ŌĆ£RŌĆØ?

How to design quant trading strategies using ŌĆ£RŌĆØ?QuantInsti

╠²

This document outlines a comprehensive guide on designing quantitative trading strategies using the R programming language and its associated packages, particularly 'quantstrat'. It details the steps involved in strategy development, including hypothesis formation, testing, refining, and implementing in a live trading environment. Additionally, it introduces an educational program on algorithmic trading offered by QuantInsti, designed for professionals looking to enhance their knowledge and skills in financial technology.Stock Price Prediction Using Sentiment Analysis and Historic Data of Stock

Stock Price Prediction Using Sentiment Analysis and Historic Data of StockIRJET Journal

╠²

This document discusses using sentiment analysis and historical stock data to predict stock prices. It proposes analyzing sentiments expressed on Twitter about companies and correlating that with stock price movements. It also discusses using machine learning techniques like naive Bayes classification, time series analysis, and ARIMA models on historical stock data to predict future prices. The proposed system aims to help novice investors make decisions by collectively analyzing news and market sentiments using machine learning algorithms. Accurately predicting stock prices could help investors realize more profits.Intro to Quant Trading Strategies (Lecture 1 of 10)

Intro to Quant Trading Strategies (Lecture 1 of 10)Adrian Aley

╠²

This document provides an overview of a lecture on quantitative trading strategies given by Dr. Haksun Li. It discusses technical analysis from a scientific perspective and outlines Numerical Method's quantitative trading research process. This includes translating trading intuitions into mathematical models, coding the strategies, evaluating their properties through simulation, and live trading. Moving average crossover is presented as an example strategy and approaches to model it quantitatively are described.Predictive data mining

Predictive data miningvenkatramana104

╠²

This document discusses data mining methods and implementation of predictive data mining architecture for stock market prediction. It describes predicting unknown data values using classification, regression, and time series analysis. Two types of predictions discussed are stock market and environmental predictions. Stock market prediction aims to determine future company stock prices, while various parameters like return on investment are analyzed. The document also covers data mining techniques like descriptive and predictive mining, algorithms, and performance evaluation metrics like correct profitable trade signals and annual return on investment.Analysis of Trends in Stock Market.pdf

Analysis of Trends in Stock Market.pdfValerie Felton

╠²

1) The document analyzes trends in the stock market using machine learning techniques like XGBoost, random forests and regression.

2) It collects stock market data using Python APIs and performs feature engineering and sentiment analysis on tweets to predict stock price patterns.

3) It finds that XGBoost achieves good accuracy without overfitting due to feature engineering and evaluation of parameter settings like term lengths.Serene Zawaydeh - Big Data -Investment -Wavelets

Serene Zawaydeh - Big Data -Investment -WaveletsSerene Zawaydeh

╠²

The document discusses the role of big data in investment management, emphasizing its volume, velocity, and variety as crucial attributes. It highlights various applications, challenges, and technologies employed by capital market firms, including the integration of real-time data and wavelet analysis for forecasting and decision-making. Furthermore, it outlines the increasing investment in big data technologies aimed at enhancing analytical capabilities and addressing regulatory compliance.Mall MM_MSFE 09_Columbia University

Mall MM_MSFE 09_Columbia Universityguest2432bf1

╠²

Man Mohan Mall is pursuing a Master of Science in Financial Engineering at Columbia University with a 3.7 GPA. He holds a Bachelor of Technology in Biotechnology and Biochemical Engineering from Indian Institute of Technology Kharagpur with an 8.2 GPA. His professional experience includes quantitative analysis and trading internships at Jamison Capital Partners and derivatives trading at Futures First in India. He has skills in C/C++, Excel-VBA, MATLAB and financial modeling and has developed various pricing and portfolio optimization models.Case sas 2

Case sas 2Siva Koti Reddy

╠²

This document describes the use of data mining techniques for fraud detection. It outlines the typical steps in a data mining process, including problem definition, data collection/enhancement, modeling strategies, model training/validation/testing, analyzing results, and linking techniques to business problems. It then provides two case studies as examples: one uses health care data to detect fraud, the other uses purchase card data. Both cases illustrate how the data mining process can be applied to solve real-world fraud detection problems.Fundamentals of Quantitative Analysis

Fundamentals of Quantitative AnalysisJubayer Alam Shoikat

╠²

The document provides an overview of quantitative analysis. It discusses that quantitative analysis is the systematic study of an organization's structure, characteristics, functions, and relationships to provide executives with a quantitative basis for decision making. The characteristics of quantitative analysis include a focus on decision making, applying a scientific approach, using an interdisciplinary team, and applying formal mathematical models. The quantitative analysis process involves defining the problem, developing a model, acquiring data, developing a solution, testing the solution, and validating the model. Common tools used in quantitative analysis include linear programming, statistical techniques, decision tables, decision trees, game theory, forecasting, and mathematical programming.More Related Content

Similar to Quantitative Modeling and Trading (20)

Resume_Zhengbo_Zhu_two page

Resume_Zhengbo_Zhu_two pageZhengbo (Daniel) Zhu

╠²

Zhengbo Zhu is seeking a summer intern position in quantitative finance. He has a PhD in industrial engineering from Purdue University with a specialization in operations research, and a BS in automation from Tsinghua University. He has experience in equity research, trading, quantitative finance, and empirical finance. He is proficient in C++, MATLAB, R, and SAS.Stock Market Analysis

Stock Market AnalysisGabriel Policiuc

╠²

This document outlines an approach to using machine learning algorithms like hidden Markov models to predict stock prices. It discusses how technical analysis and increasing computational power allows algorithms to analyze large datasets. Human analysis is still important for interpretation. The document then provides an overview of using a hidden Markov model to account for different strategies in the stock market and modeling price data more accurately over time.Internship presentation

Internship presentationnikita kapil

╠²

This document discusses various data science problems in financial domains and the techniques used to solve them. It covers machine learning techniques like clustering for portfolio diversification analysis and regression for fundamental analysis. It also discusses libraries like Pandas for data exploration and Matplotlib/Seaborn for visualization. Modern portfolio theory and its use of efficient frontiers is also summarized. Finally, applications of machine learning like recommendations and predictions are mentioned.Trading Analytics

Trading AnalyticsRoryWinston1

╠²

The document discusses the evolution of the trading business, highlighting the transformation from manual processes to automated, analytics-driven operations. It emphasizes the importance of quantitative techniques, coding skills, and analytics infrastructure to manage enormous data volumes and improve trading strategies. Key case studies include pricing models, risk management, client analytics, and algorithmic trading, underscoring the necessity of domain knowledge and data integrity for successful trading outcomes.shailesh_resume

shailesh_resumeshailesh kumar

╠²

Shailesh Kumar has over 17 years of experience in quantitative modeling, statistical modeling, and statistical analysis using Python. He has a M.Sc. in Mathematics from IIT Delhi and has worked at BNP Paribas as an Associate on statistical arbitrage strategies and developing models. Some of his projects include developing stochastic volatility and correlation models, pair trading strategies, and analyzing the impact of news and trades on market returns. He also has 7 years of teaching experience in mathematics, statistics, and operations research.Building A Trading Desk On Analytics

Building A Trading Desk On AnalyticsRory Winston

╠²

This document discusses how analytics are used in modern electronic trading businesses. It provides an overview of how the trading business has evolved from manual to highly automated and analytics-driven. It describes the infrastructure needed to support analytics, including high-performance databases and quantitative modeling tools. It then gives examples of how analytics are applied to pricing, hedging, client analysis, and algorithmic trading through quantitative models trained on large datasets. Key challenges discussed include managing large data volumes and market volatility. The document emphasizes the importance of domain expertise, data quality, and simple yet effective quantitative models.Big Data, Machine Learning and Capital Markets

Big Data, Machine Learning and Capital MarketsPrabhat Vaish

╠²

This document discusses how big data and machine learning can be applied in capital markets. It provides an overview of capital markets and their data needs. It then discusses how the volume, velocity, and variety of data in capital markets poses big data challenges. A use case is presented on using big data and machine learning for trader surveillance to detect market manipulation. Another use case discusses using historical market data and machine learning for risk analytics like calculating Value at Risk. The document outlines some challenges in implementing big data and machine learning solutions and potential areas of implementation in capital markets.MLX 2018 - Marcos López de Prado, Lawrence Berkeley National Laboratory Comp...

MLX 2018 - Marcos López de Prado, Lawrence Berkeley National Laboratory Comp...Mehdi Merai Ph.D.(c)

╠²

This document discusses the common failures in machine learning funds, highlighting seven key pitfalls that contribute to their high failure rate. It emphasizes the need for collaborative teamwork in developing investment strategies, as opposed to siloed efforts by individual quantitative portfolio managers. The author advocates for a meta-strategy paradigm wherein tasks are divided and specialized to enhance strategy development and success.Stock-market-prediction.pptx

Stock-market-prediction.pptxrikritiKoirala1

╠²

This document presents a project that aims to predict stock market prices using multiple linear regression. It introduces the topic, defines the objective, reviews relevant literature on stock market prediction techniques, and outlines the system architecture, data collection process, and algorithm used. The project implements a linear regression model to predict closing stock prices based on historical data on opening, high, low, and closing prices and trading volumes. It evaluates the model using mean absolute error and tests the system through unit, integration, and system testing. The conclusion states that the predicted data can help analyze company stock performance in the market.RETRIEVING FUNDAMENTAL VALUES OF EQUITY

RETRIEVING FUNDAMENTAL VALUES OF EQUITYIRJET Journal

╠²

The document describes a system that retrieves and analyzes fundamental values of equity for companies to help users make informed investment decisions. It uses machine learning, specifically an LSTM model, to gather data on market cap, earnings, stock prices and other metrics from financial websites via APIs. This information is displayed to users who search for a company. The system also predicts future stock price movements based on historical data to guide investors. It was implemented using APIs, JSON, Node.js, and an LSTM neural network trained on stock market data from Yahoo Finance.Research aspects in high frequency trading

Research aspects in high frequency tradingGaurav Chakravorty

╠²

This document discusses some of the challenging aspects of high frequency trading (HFT) and potential areas for academic or industrial research. It notes that the essence of HFT is to react quickly to incoming market data in order to make markets more efficient. However, this requires dealing with an infinite number of possible inputs, hidden inputs from other participants, and the need for extreme speed. The document then outlines some specific modular research aspects, including automated feature learning from market data, using deep learning to identify patterns in price and time movements, developing optimal loss functions, quantifying the value of speed, optimizing computer architectures for speed, and applying signal processing methods to clean noisy market data.How to design quant trading strategies using ŌĆ£RŌĆØ?

How to design quant trading strategies using ŌĆ£RŌĆØ?QuantInsti

╠²

This document outlines a comprehensive guide on designing quantitative trading strategies using the R programming language and its associated packages, particularly 'quantstrat'. It details the steps involved in strategy development, including hypothesis formation, testing, refining, and implementing in a live trading environment. Additionally, it introduces an educational program on algorithmic trading offered by QuantInsti, designed for professionals looking to enhance their knowledge and skills in financial technology.Stock Price Prediction Using Sentiment Analysis and Historic Data of Stock

Stock Price Prediction Using Sentiment Analysis and Historic Data of StockIRJET Journal

╠²

This document discusses using sentiment analysis and historical stock data to predict stock prices. It proposes analyzing sentiments expressed on Twitter about companies and correlating that with stock price movements. It also discusses using machine learning techniques like naive Bayes classification, time series analysis, and ARIMA models on historical stock data to predict future prices. The proposed system aims to help novice investors make decisions by collectively analyzing news and market sentiments using machine learning algorithms. Accurately predicting stock prices could help investors realize more profits.Intro to Quant Trading Strategies (Lecture 1 of 10)

Intro to Quant Trading Strategies (Lecture 1 of 10)Adrian Aley

╠²

This document provides an overview of a lecture on quantitative trading strategies given by Dr. Haksun Li. It discusses technical analysis from a scientific perspective and outlines Numerical Method's quantitative trading research process. This includes translating trading intuitions into mathematical models, coding the strategies, evaluating their properties through simulation, and live trading. Moving average crossover is presented as an example strategy and approaches to model it quantitatively are described.Predictive data mining

Predictive data miningvenkatramana104

╠²

This document discusses data mining methods and implementation of predictive data mining architecture for stock market prediction. It describes predicting unknown data values using classification, regression, and time series analysis. Two types of predictions discussed are stock market and environmental predictions. Stock market prediction aims to determine future company stock prices, while various parameters like return on investment are analyzed. The document also covers data mining techniques like descriptive and predictive mining, algorithms, and performance evaluation metrics like correct profitable trade signals and annual return on investment.Analysis of Trends in Stock Market.pdf

Analysis of Trends in Stock Market.pdfValerie Felton

╠²

1) The document analyzes trends in the stock market using machine learning techniques like XGBoost, random forests and regression.

2) It collects stock market data using Python APIs and performs feature engineering and sentiment analysis on tweets to predict stock price patterns.

3) It finds that XGBoost achieves good accuracy without overfitting due to feature engineering and evaluation of parameter settings like term lengths.Serene Zawaydeh - Big Data -Investment -Wavelets

Serene Zawaydeh - Big Data -Investment -WaveletsSerene Zawaydeh

╠²

The document discusses the role of big data in investment management, emphasizing its volume, velocity, and variety as crucial attributes. It highlights various applications, challenges, and technologies employed by capital market firms, including the integration of real-time data and wavelet analysis for forecasting and decision-making. Furthermore, it outlines the increasing investment in big data technologies aimed at enhancing analytical capabilities and addressing regulatory compliance.Mall MM_MSFE 09_Columbia University

Mall MM_MSFE 09_Columbia Universityguest2432bf1

╠²

Man Mohan Mall is pursuing a Master of Science in Financial Engineering at Columbia University with a 3.7 GPA. He holds a Bachelor of Technology in Biotechnology and Biochemical Engineering from Indian Institute of Technology Kharagpur with an 8.2 GPA. His professional experience includes quantitative analysis and trading internships at Jamison Capital Partners and derivatives trading at Futures First in India. He has skills in C/C++, Excel-VBA, MATLAB and financial modeling and has developed various pricing and portfolio optimization models.Case sas 2

Case sas 2Siva Koti Reddy

╠²

This document describes the use of data mining techniques for fraud detection. It outlines the typical steps in a data mining process, including problem definition, data collection/enhancement, modeling strategies, model training/validation/testing, analyzing results, and linking techniques to business problems. It then provides two case studies as examples: one uses health care data to detect fraud, the other uses purchase card data. Both cases illustrate how the data mining process can be applied to solve real-world fraud detection problems.Fundamentals of Quantitative Analysis

Fundamentals of Quantitative AnalysisJubayer Alam Shoikat

╠²

The document provides an overview of quantitative analysis. It discusses that quantitative analysis is the systematic study of an organization's structure, characteristics, functions, and relationships to provide executives with a quantitative basis for decision making. The characteristics of quantitative analysis include a focus on decision making, applying a scientific approach, using an interdisciplinary team, and applying formal mathematical models. The quantitative analysis process involves defining the problem, developing a model, acquiring data, developing a solution, testing the solution, and validating the model. Common tools used in quantitative analysis include linear programming, statistical techniques, decision tables, decision trees, game theory, forecasting, and mathematical programming.MLX 2018 - Marcos López de Prado, Lawrence Berkeley National Laboratory Comp...

MLX 2018 - Marcos López de Prado, Lawrence Berkeley National Laboratory Comp...Mehdi Merai Ph.D.(c)

╠²

Quantitative Modeling and Trading

- 2. Objectives ’éŚHigh frequency quantitative modeling and trading in US stocks(NYSE and NASDAQ Markets) ’éŚAchieve this in an optimal time frame and generate revenue stream for the firm 2

- 3. Critical Success Factors ’éŚAvailability of tools and information in proper format ’éŚThe most liquid stocks tick information would be available initially as a snapshot ’éŚSufficient infrastructure and Statistical software (S- plus /Matlab) are available to perform quant. Analysis. ’éŚMy goal initially would be to focus on establishing a basic environment ’éŚMinimal amount of time to be spent on pure IT allied endeavors although they are important for overall success of the project 3

- 4. Facts & Advantages’éŚThere are other Hi-frequency hedge funds who have been in operation for 8+ years and are ahead in terms of experience and models for quant analysis and trading strategies ’éŚThere are no standard textbooks for this areas that provide a guide to success How to take advantage and address gaps? ’éŚDevelop High Frequency model that utilizes ’éŚrecent developments in stock market ’éŚExisting time tested quant principles and recent academic developments ŌĆ£Get the right mix of industry models and academic models and generate revenue within optimal time frameŌĆØ 4

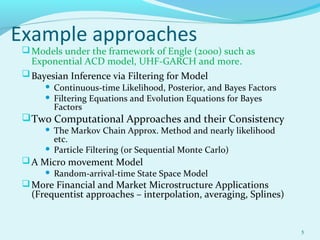

- 5. Example approaches ’ü▒Models under the framework of Engle (2000) such as Exponential ACD model, UHF-GARCH and more. ’ü▒Bayesian Inference via Filtering for Model ’éŚ Continuous-time Likelihood, Posterior, and Bayes Factors ’éŚ Filtering Equations and Evolution Equations for Bayes Factors ’ü▒Two Computational Approaches and their Consistency ’éŚ The Markov Chain Approx. Method and nearly likelihood etc. ’éŚ Particle Filtering (or Sequential Monte Carlo) ’ü▒A Micro movement Model ’éŚ Random-arrival-time State Space Model ’ü▒More Financial and Market Microstructure Applications (Frequentist approaches ŌĆō interpolation, averaging, Splines) 5

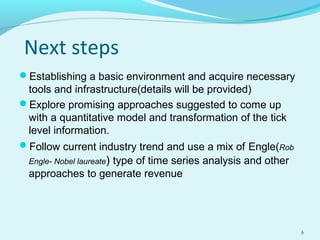

- 6. Next steps ’éŚEstablishing a basic environment and acquire necessary tools and infrastructure(details will be provided) ’éŚExplore promising approaches suggested to come up with a quantitative model and transformation of the tick level information. ’éŚFollow current industry trend and use a mix of Engle(Rob Engle- Nobel laureate) type of time series analysis and other approaches to generate revenue 6

- 7. Next steps ’éŚEstablishing a basic environment and acquire necessary tools and infrastructure(details will be provided) ’éŚExplore promising approaches suggested to come up with a quantitative model and transformation of the tick level information. ’éŚFollow current industry trend and use a mix of Engle(Rob Engle- Nobel laureate) type of time series analysis and other approaches to generate revenue 6