Terms of a GP/LP Fund Structure

- 1. Terms of a GP-LP Fund by Robert Carroll

- 2. All ideas are stolen from: "If you read only one guide to becoming a successful VC, this is the one" –Paul Maeder, Former Chairman, National Venture Capital Association (NVCA) “When we formed Kleiner Perkins Caufield and Byers (KPCB) in the ’70s, the golden age of VC had just begun. For VC 2.0, this book packs the insights and wisdom of those who have done it, not once but multiple times.” –Frank Caufield, cofounder, Kleiner Perkins Caufield and Byers (2011)

- 3. Two Documents • The Fund is governed by two important documents: 1. The PPM (Private Placement Memorandum) 2. LPA (Limited Partnership Agreement)

- 4. PPM • A typical PPM will include – The fund’s investment strategy – The GP’s background and expertise – The market opportunity

- 5. Fund Investment Strategy • Market opportunity, drivers of growth • Competitive advantage in this market opportunity • Fund managers’ background and relevant expertise • Capital efficiency, investment cycle, and target fund returns (able to generate 25% IRR?) • Competition from other venture funds • Risks…and plan for mitigating these risks

- 6. How LPs Evaluate GPs

- 7. LPA • An LPA is a legal document that contains legal terms that describe the control, management, financial investments, and distribution of returns

- 8. Terms of the Limited Partnership Agreement (LPA)

- 9. General Partner • Language: Oasis Ventures 2, a Cayman Islands limited partnership (the “General Partner”), whose General Partner will be ABC Management, LLC. • Comments: Delaware is a standard choice for domestic funds. For funds investing outside the United States, the Cayman Islands, Channel Islands, and Luxembourg are popular jurisdictions of formation.

- 10. Investment Objective • Language: To achieve superior investment returns from investments in equity and equity-related securities in companies in the [sector] and [sector]-related companies. • Comments: Typical language

- 11. The Offering • Language: The partnership is seeking $100 million of capital commitments from limited partners (“Capital Commitments”), with a maximum of $150 million in Capital Commitments. The General Partner will invest an amount equal to at least 5 percent of the total Capital Commitments of all partners on the same schedule as the limited partners of the Fund (the “Limited Partners”). • Comments: Industry norm has been 1%, but LPs are expecting more these days

- 12. Minimum Investment • Language: The minimum investment is $3,000,000 from institutions and $500,000 from individuals, provided that the General Partner may accept subscriptions for smaller amounts at its sole discretion. • Comments: GPs usually like to cap any one LP at 10-15% to ensure LP diversity

- 13. Initial Closing • Language: An initial closing will be held as soon as practicable. Thereafter, the Fund may accept additional subscriptions until the one-year anniversary of the initial closing date (the “Final Closing Date”). • Comments: A one-year fund-raising period is typical, although recently many GPs have gone back to the LPs seeking extension of this period in any challenging fund-raising environment.

- 14. Drawdowns • Language: Drawdowns may occur on an as- needed basis with a minimum of 10 days’ notice, provided that the initial drawdown may be required upon five business days’ notice. No more than 35 percent of the capital may be called in any 12-month period. • Comments: On average, a GP projects to invest about 15 to 20 percent of the total committed capital each year over an investment period that lasts for three to five years.

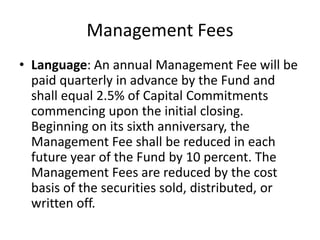

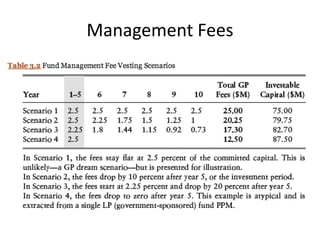

- 15. Management Fees • Language: An annual Management Fee will be paid quarterly in advance by the Fund and shall equal 2.5% of Capital Commitments commencing upon the initial closing. Beginning on its sixth anniversary, the Management Fee shall be reduced in each future year of the Fund by 10 percent. The Management Fees are reduced by the cost basis of the securities sold, distributed, or written off.

- 16. Management Fees

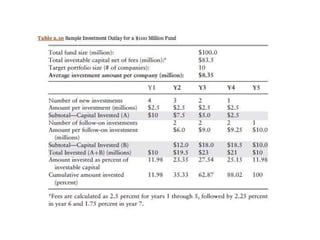

- 17. Investment Period • Language: The Fund may call capital to fund new investments from the Initial Closing Date until the fifth anniversary of the Final Closing Date (the “Investment Period”). • Comments: LPs expect that investments will be made during a reasonable investment period (typically five to six years), after which follow-on investments are typically permitted. After the investment period, GPs are expected to harvest investments and work toward liquidity exits.

- 18. Term of the Fund • Language: Ten years from the Final Closing Date, subject to up to two one-year extensions at the General Partner's discretion to effect an orderly liquidation of the Fund's investments. • Comments: Ten years is the standard for a VC fund. Most funds are extended if investments are still in the portfolio.

- 20. Allocations • Language: The cumulative net income and gains of the partnership will be allocated 80 percent to all partners in proportion to their contributed capital and 20 percent to the General Partner. • Comments: Industry standards have established that 80 percent of profits will be paid to LPs and 20 percent to GPs.

- 21. How to calculate carry

![Investment Objective

• Language: To achieve superior investment

returns from investments in equity and

equity-related securities in companies in the

[sector] and [sector]-related companies.

• Comments: Typical language](https://image.slidesharecdn.com/raisingafund-140609010349-phpapp01/85/Terms-of-a-GP-LP-Fund-Structure-10-320.jpg)