Ras mrc

- 1. RAS Risk Management Market Risk Capital Amit Sinha, James Wang & Tolga Sezer August, 2012 1 / 21

- 2. Agenda Market Risk Capital: De’¼ünition and Requirements Backtesting Methodology RAS VaR Backtesting From VaR to MRC: The Tail-Loss Penalty RAS MRC Summary Conclusion 2 / 21

- 3. Part I Market Risk Capital: De’¼ünition and Requirements 3 / 21

- 4. MRC: De’¼ünition and Requirements Basel II & VaR-based Risk Capital Basel II sets the regulatory standard for risk-based capital requirements. Market Risk Capital is derived from the VaR (internal model approach) and tail-loss penalty. Internal Model Approach means that the institutions shall be able to use their in-house VaR models, but are required to conduct extensive backtesting to validate their performance. Tail-loss penalty are based on the losses of a portfolio historically beyond what the in-house VaR model would have predicted. 4 / 21

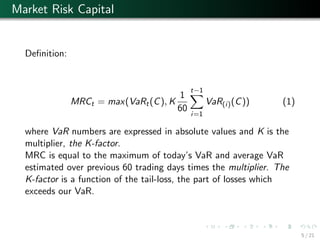

- 5. Market Risk Capital De’¼ünition: MRCt = max(VaRt(C), K 1 60 tŌłÆ1 i=1 VaR(i)(C)) (1) where VaR numbers are expressed in absolute values and K is the multiplier, the K-factor. MRC is equal to the maximum of todayŌĆÖs VaR and average VaR estimated over previous 60 trading days times the multiplier. The K-factor is a function of the tail-loss, the part of losses which exceeds our VaR. 5 / 21

- 6. Market Risk Capital Requirement: VaR and hypothetical PnL backtest in order to measure what the tail-losses for any portfolio would have been historically. A penalty-factor function, which incorporates the tail-losses identi’¼üed in the backtesting, which results in a K-factor. 6 / 21

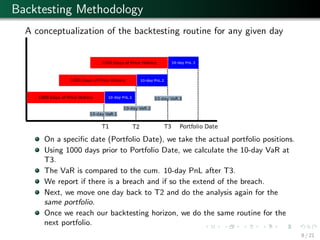

- 8. Backtesting Methodology A conceptualization of the backtesting routine for any given day On a speci’¼üc date (Portfolio Date), we take the actual portfolio positions. Using 1000 days prior to Portfolio Date, we calculate the 10-day VaR at T3. The VaR is compared to the cum. 10-day PnL after T3. We report if there is a breach and if so the extend of the breach. Next, we move one day back to T2 and do the analysis again for the same portfolio. Once we reach our backtesting horizon, we do the same routine for the next portfolio. 8 / 21

- 9. Part III RAS VaR Backtesting 9 / 21

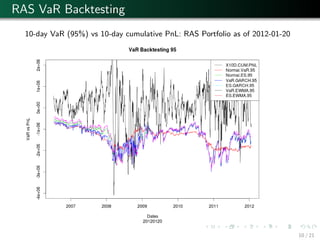

- 10. RAS VaR Backtesting 10-day VaR (95%) vs 10-day cumulative PnL: RAS Portfolio as of 2012-01-20 10 / 21

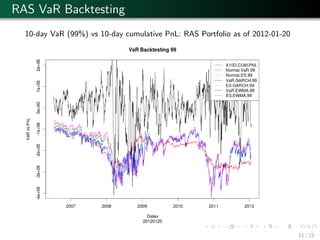

- 11. RAS VaR Backtesting 10-day VaR (99%) vs 10-day cumulative PnL: RAS Portfolio as of 2012-01-20 11 / 21

- 12. Part IV From VaR to MRC: The Tail-Loss Penalty 12 / 21

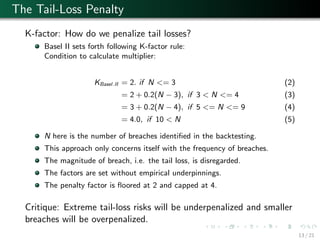

- 13. The Tail-Loss Penalty K-factor: How do we penalize tail losses? Basel II sets forth following K-factor rule: Condition to calculate multiplier: KBasel.II = 2. if N <= 3 (2) = 2 + 0.2(N ŌłÆ 3), if 3 < N <= 4 (3) = 3 + 0.2(N ŌłÆ 4), if 5 <= N <= 9 (4) = 4.0, if 10 < N (5) N here is the number of breaches identi’¼üed in the backtesting. This approach only concerns itself with the frequency of breaches. The magnitude of breach, i.e. the tail loss, is disregarded. The factors are set without empirical underpinnings. The penalty factor is ’¼éoored at 2 and capped at 4. Critique: Extreme tail-loss risks will be underpenalized and smaller breaches will be overpenalized. 13 / 21

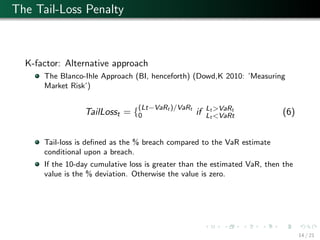

- 14. The Tail-Loss Penalty K-factor: Alternative approach The Blanco-Ihle Approach (BI, henceforth) (Dowd,K 2010: ŌĆÖMeasuring Market RiskŌĆÖ) TailLosst = { (LtŌłÆVaRt )/VaRt 0 if Lt >VaRt Lt <VaRt (6) Tail-loss is de’¼üned as the % breach compared to the VaR estimate conditional upon a breach. If the 10-day cumulative loss is greater than the estimated VaR, then the value is the % deviation. Otherwise the value is zero. 14 / 21

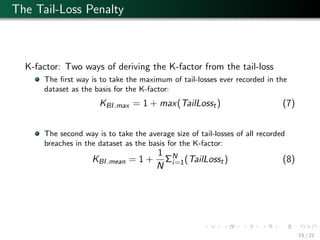

- 15. The Tail-Loss Penalty K-factor: Two ways of deriving the K-factor from the tail-loss The ’¼ürst way is to take the maximum of tail-losses ever recorded in the dataset as the basis for the K-factor: KBI.max = 1 + max(TailLosst) (7) The second way is to take the average size of tail-losses of all recorded breaches in the dataset as the basis for the K-factor: KBI.mean = 1 + 1 N ╬ŻN i=1(TailLosst) (8) 15 / 21

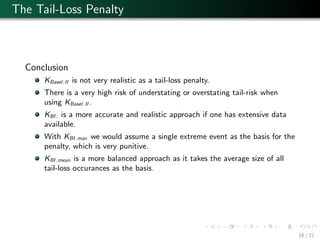

- 16. The Tail-Loss Penalty Conclusion KBasel.II is not very realistic as a tail-loss penalty. There is a very high risk of understating or overstating tail-risk when using KBasel.II . KBI. is a more accurate and realistic approach if one has extensive data available. With KBI.max we would assume a single extreme event as the basis for the penalty, which is very punitive. KBI.mean is a more balanced approach as it takes the average size of all tail-loss occurances as the basis. 16 / 21

- 17. Part V RAS MRC Summary 17 / 21

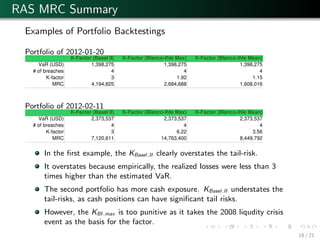

- 18. RAS MRC Summary Examples of Portfolio Backtestings Portfolio of 2012-01-20 K-Factor (Basel II) K-Factor (Blanco-Ihle Max) K-Factor (Blanco-Ihle Mean) VaR (USD) 1,398,275 1,398,275 1,398,275 # of breaches 4 4 4 K-factor 3 1.92 1.15 MRC 4,194,825 2,684,688 1,608,016 Portfolio of 2012-02-11 K-Factor (Basel II) K-Factor (Blanco-Ihle Max) K-Factor (Blanco-Ihle Mean) VaR (USD) 2,373,537 2,373,537 2,373,537 # of breaches 4 4 4 K-factor 3 6.22 3.56 MRC 7,120,611 14,763,400 8,449,792 In the ’¼ürst example, the KBasel.II clearly overstates the tail-risk. It overstates because empirically, the realized losses were less than 3 times higher than the estimated VaR. The second portfolio has more cash exposure. KBasel.II understates the tail-risks, as cash positions can have signi’¼ücant tail risks. However, the KBI.max is too punitive as it takes the 2008 liqudity crisis event as the basis for the factor. 18 / 21

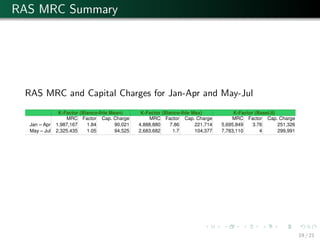

- 19. RAS MRC Summary RAS MRC and Capital Charges for Jan-Apr and May-Jul K-Factor (Blanco-Ihle Mean) K-Factor (Blanco-Ihle Max) K-Factor (Basel.II) MRC Factor Cap. Charge MRC Factor Cap. Charge MRC Factor Cap. Charge Jan ŌĆō Apr 1,987,167 1.84 90,021 4,888,880 7.86 221,714 5,695,849 3.76 251,326 May ŌĆō Jul 2,325,435 1.05 94,525 2,683,682 1.7 104,377 7,783,110 4 299,991 19 / 21

- 20. Part VI Conclusion 20 / 21

- 21. Conclusion Tail-losses are signi’¼ücant and need to be take account for on top of VaR. While VaR is lower in Q1, RAS has bigger tail-risks in Q1 ... ... relative to Q2 and ... relative to what KBasel.II would imply. The KBasel.II would be understating risk due to the cap on the factor. The Blanco-Ihle approach - together with extensive data mining - enables us to capture tail-risks more accurately. It would be very punitive if the KBI.Max approach was used, especially for cash positions. 21 / 21