Rectification of misclassification value field)

- 1. Rectification of Misclassification (Value Field) Presented by ŌĆō Sourabh Vijayvargeeya 1

- 2. Misclassification- A value that contains a incorrect qualifier details in its definition. 2

- 3. Why do misclassified accounts exist in Oracle ? A. When account value was added in value field form, an incorrect qualifier was chosen. B. After the code combination was created with particular account type, natural account was changed to another type of account using value field form. 3

- 4. At which stage we can find that an account is misclassified? ’üĄ A) Entry Time ’üĄ B) Account Inquiry ’üĄ C) Summary Accounts ’üĄ D) Via Reports (Trial Balance, FSG Reports) 4

- 5. Entry Time- 5 Here We can observe that System allow us to do entry with misclassified account i.e. Cash Account with account type ŌĆ£ExpensesŌĆØ (5101)

- 6. Account Inquiry- 6 Again In account inquiry form we are able to see the correct balance for cash account. (Refer example in notes)

- 7. Summary Account - 7 We also can see the correct balance of cash account in summary template as well. (Refer Previous Example)

- 8. Reports ŌĆō 1. Trial Balance 8 Trial balance is showing same balance as Summary Template. (Refer Previous Example)

- 9. Reports ŌĆō 2. FSG Reports 9

- 10. What if we take Different Behavior account type i.e. Assets to Liability or Revenue to Expenses A. Oracle doesnŌĆÖt make any difference between liability and assets at the time of transaction recording, Hence it will show the right amount in the account irrespective of account type in account qualifier (Value field form). B. In oracle some field have validation rule i.e. in that particular field if we are putting a account then its account type must be of that type as it have in validation rule. (E.g. account selection at the time of purchasing.) 10

- 11. What if we take Different Behavior account type i.e. Assets to Liability or Revenue to Expenses 11

- 12. So What is the first sign that one account is Misclassified? ’üĄ When opening a new fiscal year if the retained earnings account does not reflect the correct figures, there is a strong possibility one or more accounts could be misclassified. 12 Here we can observe that Cash account isnŌĆÖt have any closing balance and Retained earning is also not showing correct figure. Hence these type of error indicates that there might be a misclassified account.

- 13. How can we check Misclassified Value ŌĆō 1. Chart of Account- Segment Value Listing ’üĄ Navigation ŌĆō View>Request>Submit new Request > Chart of Account- Segment Value Listing 13 In this report itŌĆÖs clearly visible that a customer account type is liability that supposed to be assets, So we can say that this account was misclassified.

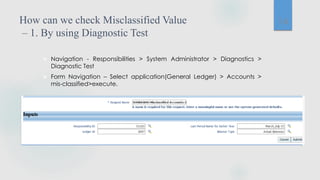

- 14. How can we check Misclassified Value ŌĆō 1. By using Diagnostic Test ’üĄ Navigation - Responsibilities > System Administrator > Diagnostics > Diagnostic Test ’üĄ Form Navigation ŌĆō Select application(General Ledger) > Accounts > mis-classified>execute. 14

- 15. Result By Diagnostic Test (Misclassified Req.) 15 In diagnostic test report we can see misclassified account detail as well as misclassified balances.

- 16. How to Correct Misclassified Account ’üĄ By Correction In Segment qualifier Account Type & Run the Program - Inherit Segment Value Attributes ? ’üĄ we canŌĆÖt update the earlier record by this request in oracle, for updating the code combination of mis-classified account in Gl_Account we have to run the database script using SQL table. ’üĄ Reason ŌĆōWhy we canŌĆÖt update the attribute by this request- ’üĄ This is to avoid the problems that would be caused If the Inheritance program was run against an Account that had been wrong in the previous year. The segment value attributes which can be propagated to the related account code combinations are: enabled/disabled flag, effective dates, allow posting and allow budgeting. 16

- 17. GL_Account code combination 17

- 18. Steps to correct balances for a misclassified account: ’āś Reopen the last period of your prior fiscal year, if it is closed. ’āś Create a journal entry that brings the misclassified account balance to zero for the last day of the last period of your prior fiscal year. Use a temporary account such as Suspense for the offsetting amount. ’āś Post the journal entry on the last day of the last period of your prior fiscal year. ’āś Verify that the misclassified account balance is zero by reviewing account balances online or in reports. ’āś Correct the account type of the misclassified account by changing the segment value qualifiers. General Ledger prevents you from changing the account type unless you first unfreeze all account structures that reference your account segment using the Key Flexfield Segments window. ’āś Ask your System Administrator to correct the account type of all accounts referencing the misclassified account by updating the ACCOUNT_TYPE column in the GL_CODE_COMBINATIONS table using SQL*Plus. ’āś Restore the misclassified account balance by reversing the journal entry you posted in Step 3 above. Reverse the journal entry into the last day of the same period that it was originally posted ’āś Review the corrected account balances online or in reports. 18

- 19. After Rectification Result 19 So we can see that after completing the all rectification steps we are able to see correct balance in next year reports

- 20. After Rectification Result (Gl_Code) 20 In same way GL code combination account type has also changed.

- 21. Thank You 21