Red Sea Disruptive Impact and Container Shipping Market - Mahmood Sakhi Albalushi - Sep 2024.pdf

- 1. Red Sea Disruptive Impact and Container Shipping Market Dr. Mahmood Sakhi Albalushi Board Member of the Omani Economic Association September 2024 Maritime Shipping Overview Logistics encompasses all activities related to the movement of goods and services. As an essential component of supply chain operations, logistics plays a crucial role in enhancing the efficiency of businesses worldwide. Maritime shipping, handling nearly 90% of global trade, is particularly significant to the global supply chain. Consequently, any disruption to this essential mode of transportation can have a substantial impact on global trade and business operations. Recently, several geopolitical issues have emerged, with the situation in the Red Sea being one of the most disruptive to global trade. This paper seeks to explore the effects of the Red Sea disruptions on both regional and international shipping industries. Oman's strategic location near the Bab El-Mandab Strait, along with its deep-sea ports and well- equipped state-of-the-art handling facilities, positions it as a vital logistics hub for the region. Oman plays a key role in managing transshipment containers, particularly at Salalah Port. Red Sea Disruptive Impacts on Supply Chain The recent disruptions in the Red Sea are significantly affecting global shipping traffic and costs. The strategic importance of this maritime route lies in the substantial volume of cargo that traverses it, with more than 30% of global container traffic and over 12% of worldwide trade relying on this passage. As a result of the disruptions, many vessels have been compelled to take the longer route around the Cape of Good Hope to connect Asia with Europe and America. This detour adds over 4,000 nautical miles and more than 14 days to transit times, resulting in increased insurance and operational expenses. Source: UN Global Platform, IMF PortWatch

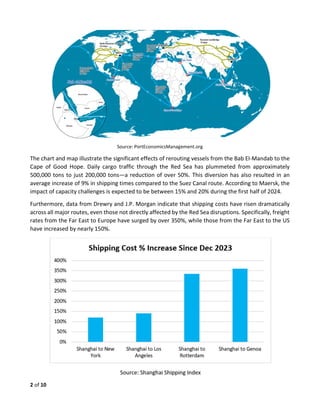

- 2. 2 of 10 Source: PortEconomicsManagement.org The chart and map illustrate the significant effects of rerouting vessels from the Bab El-Mandab to the Cape of Good Hope. Daily cargo traffic through the Red Sea has plummeted from approximately 500,000 tons to just 200,000 tons—a reduction of over 50%. This diversion has also resulted in an average increase of 9% in shipping times compared to the Suez Canal route. According to Maersk, the impact of capacity challenges is expected to be between 15% and 20% during the first half of 2024. Furthermore, data from Drewry and J.P. Morgan indicate that shipping costs have risen dramatically across all major routes, even those not directly affected by the Red Sea disruptions. Specifically, freight rates from the Far East to Europe have surged by over 350%, while those from the Far East to the US have increased by nearly 150%.

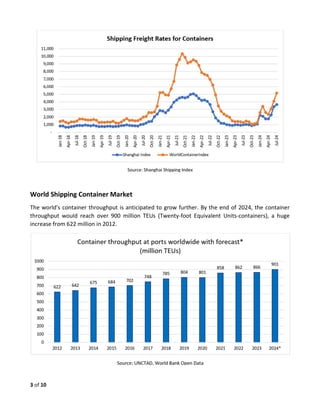

- 3. 3 of 10 World Shipping Container Market The world's container throughput is anticipated to grow further. By the end of 2024, the container throughput would reach over 900 million TEUs (Twenty-foot Equivalent Units-containers), a huge increase from 622 million in 2012.

- 4. 4 of 10 The anticipated growth has led major shipping lines to order more mega-ships, further emphasizing the growing size of container vessels and demand. While these larger ships offer cost efficiencies, they also present challenges, such as increased insurance risks, higher port infrastructure costs, and heightened congestion. As trading volumes and operating costs increase, container ship sizes are getting bigger for economies of scale. The chart below shows how the size of ships has been increasing exponentially over the last 60 years from just 800 container ship capacity to over 24,000 container ship capacity. The chart illustrates the container ships' evolution. Source: Transport Geography, Alphaliner This trend in vessel sizes has put pressure on seaports to invest in systems and infrastructure upgrades to accommodate handling these mega vessels. The top seven global port operators handle about 40% of the world's total containers. These seven include PSA Int’l, China Merchants Ports, China COSCO Shipping, APM Terminals, DP World, Hutchison Ports, and MSC Group.

- 5. 5 of 10 The chart below illustrates the percentages of each major global port operator's share of world total throughput, ranging from 5% to 7%. Omani, Regional, and Global Ports Performance Containerized cargo has gained immense popularity for playing a vital role in facilitating international trade. As a result, the significance of seaports and the size of ships has increased. The design and

- 6. 6 of 10 operational systems of ports are becoming increasingly complex and efficient. Therefore, key attributes of successful ports include having more berths, deeper waters, and advanced systems for enhanced efficiency. Many ports started to upgrade their capacity and efficiency so they could handle the new mega- container ships. The largest container ship can have a capacity of over 24,000 TEUs. The current Omani ports enjoy world-class infrastructure. They are all deep-water ports and equipped to handle the largest container ships.

- 7. 7 of 10 A closer examination of the annual container throughput (measured in TEUs) at major regional ports reveals a trend of growth for most, despite disruptions affecting the Red Sea passage. Unfortunately, the Red Sea ports, particularly Jeddah port, are experiencing negative implications from these issues. Jebel Ali Port in Dubai, UAE, remains the leading regional port, handling over 14.46 million TEUs in 2023 and 7.34 million TEUs in the first half of 2024, compared to 7.24 million TEUs for the same period of 2023. Oman's key ports, Salalah and Sohar, recorded throughput of 3.79 million TEUs and 0.82 million TEUs, respectively. In the first half of 2024, Salalah handled 1.6 million TEUs (down from 1.8 million TEUs in 2023), while Sohar processed 0.48 million TEUs, an increase from 0.38 million TEUs in the previous year. Salalah Port Salalah Port is one of the major transshipment ports in the region. The below chart shows the volume of containers handled by the port. Overall, Salalah Port has enjoyed growth since it commenced operations in 1998. However, the growth has not been consistent, as fluctuations are very clear. The main reason is that most containers (over 90%) are transshipment. The COVID-19 had little impact on the port’s operations and volume handling. Years 2020, 2021, and 2022 had the highest container volumes, reaching about 4.5 million TEUs. However, 2023 experienced a significant decline which is also expected in 2024. The drop in 2023 was 15%, and it is forecast to drop a further 15% in 2024. The Red Sea disruptions have further exacerbated this trend.

- 8. 8 of 10 The chart above illustrates the distribution of TEUs (Twenty-foot Equivalent Units) processed at the port, categorized into Exports, Imports, and Transshipment TEUs. Notably, transshipment accounts for over 90% of the total containers handled, while both exports and imports represent only about 4% each. The port experienced its highest volume in 2020, managing more than 4.3 million TEUs. However, despite its strategic location, deep berths, and efficient handling performance, cargo volume began to decline in 2023, with expectations of further decreases in 2024, primarily due to the additional pressures arising from the situation in the Red Sea. The decline in 2023 was recorded at 15%, and a similar decrease is anticipated in 2024. Sohar Port Sohar Port experienced remarkable growth beginning in the second half of 2014, following the closure of Sultan Qaboos Port in Muscat on August 1, 2014. However, from 2018 to 2022, the total TEUs handled by the container terminal showed a declining trend. In 2023, the port witnessed a recovery, achieving a 13% increase in volume, with expectations of further growth of 19% in 2024.

- 9. 9 of 10 In 2023, Sohar Port handled a total of 818,110 TEUs, equivalent to 571,351 containers. The upward trend continued into the first quarter of 2024, with the port processing 221,241 TEUs, an 18% increase compared to the same period in the previous year. In the second quarter, there was an even more significant growth, reaching 259,987 TEUs, which represents a 33% increase. If this momentum continues, the port will be on track to handle 19% more TEUs in 2024 than in 2023. Future Outlook The COVID-19 pandemic significantly impacted shipping and supply chain operations. As it started to recover, another geopolitical issue arose and created another supply chain disruption in the Red Sea that is causing further global trade challenges, increasing both costs and delivery times. Heightened geopolitical risks in the Middle East are intensifying pressure on maritime supply chain routes. The disruptions stemming from events in the Red Sea have rendered maritime shipping higher costs and more challenging time to come. Despite these geopolitical risks and challenges, demand for maritime shipping services continues to rise. The container shipping sector is projected to grow steadily, with an average annual growth rate of 5%, and is expected to sustain this trajectory until 2027 (see chart below). Omani ports are well-established deep-sea facilities and are strategically positioned. Omani mega ports, Sohar, Salalah, and Duqm, are all located along the Indian Ocean and outside the Strait of Hormuz and Red Sea. Sohar Port serves as a vital link between the Gulf and broader global markets. To enhance its competitiveness, Sohar Port needs to proactively attract more international direct routes and accommodate larger mother vessels—the port benefits from strong connectivity to the hinterland and neighboring GCC countries. Salalah Port is the largest port in Oman, with a capacity of 5 million TEUs, and is ranked as one of the most efficient ports in the world. Over 90% of containers handled by Salalah Port are transshipment containers. The port needs to be more competitive to attract more shipping lines for transshipment services and support local exports and imports with competitive rates and services. The disruption at

- 10. 10 of 10 the Red Sea should make Salalah Port the major relief port in the region because of its infrastructure and efficiency. Duqm Port, Oman, is the newest deep-sea facility, joining the Sohar and Salalah ports. Duqm Port is part of a mega economic city, the Special Economic Zone at Duqm, which houses substantial projects, including the Duqm refinery and crude oil storage facilities. All in all, despite the current challenges facing the global shipping industry, Omani ports remain well- prepared to adapt to the evolving demands of maritime trade and play a vital role in mitigating regional and global supply chain challenges and disruptions.