Refund in gst

- 2. GST will help to remove tax barriers between states, creating a single market. GST would enable goods to be taxed at the point of utilization rather than production thus avoiding double taxation. It is urgent to make the process of refund much smoother under GST. A delay in refund would cause problem for the exporters in maintaining the working capital and cash flow.

- 3. It is imperative to make the process of refund much smoother under GST. A delay in refund would cause problem for the exporters/manufacturerâs in maintaining the working capital and cash flow.

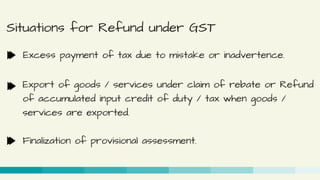

- 4. Situations for Refund under GST Finalization of provisional assessment. Export of goods / services under claim of rebate or Refund of accumulated input credit of duty / tax when goods / services are exported. Excess payment of tax due to mistake or inadvertence.

- 5. Refund of tax payment on purchases made by Embassies or UN bodies. Payment of duty / tax during investigation but no/ less liability arises at the time of finalization of investigation / adjudication. Refund of Pre â deposit for filing appeal including refund arising in pursuance of an appellate authorityâs order (when the appeal is decided in favor of the appellant).

- 6. Tax Refund for International Tourists. Credit accumulation due to inverted duty structure i.e. due to tax rate differential between output and inputs. Credit accumulation due to inverted duty structure i.e. due to tax rate differential between output and inputs. Credit accumulation due to output being tax exempt or nil- rated.

- 7. GST Centre give you an opportunity to learn more about GST through our Online Courses. We are giving the best Training on GST in India. We are focusing, Self employed and small business owners Persons looking to start business in India All Business Owners doing business in India

- 8. Connect with us.. VISIT : https://gstcentre.in